Daniel Balakov

Introduction

As a dividend growth investor, I am constantly looking for new dividend growth opportunities. My diversified portfolio aims to deliver a reliable stream of dividends, and I am continually looking for additions. Sometimes I add to existing positions that are attractive. Other times, I start new positions to diversify myself further.

As the stock market is somewhat volatile in 2022, I believe there are opportunities to find additional investments. Cyclical sectors like consumer discretionary and industrials can offer even more significant opportunities as investors seek refuge in safer, less volatile stocks. I will analyze Cummins (NYSE:CMI), a leading industrial company, in this article.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows Cummins designs, manufactures, distributes, and services diesel and natural gas engines, electric and hybrid powertrains, and related components worldwide. It operates through five segments: Engine, Distribution, Components, Power Systems, and New Power. The company offers diesel and natural gas-powered engines under the Cummins and other customer brands for heavy and medium-duty trucks, buses, recreational vehicles, light-duty automotive, construction, mining, marine, rail, oil and gas, defense, and agricultural markets.

Fundamentals

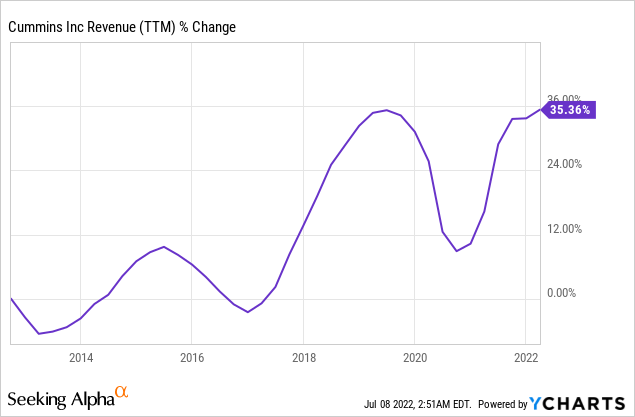

The graph below shows how cyclical the sales of Cummins are. The engine demand is growing when the economy is booming and declining when it slows. Over the last decade, sales have increased by 35%. The company mainly achieved growth as it expanded its manufacturing capacity. The company’s activity in the M&A arena is primarily to improve its tech leadership. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Cummins to keep growing sales at an annual rate of ~5% in the medium term.

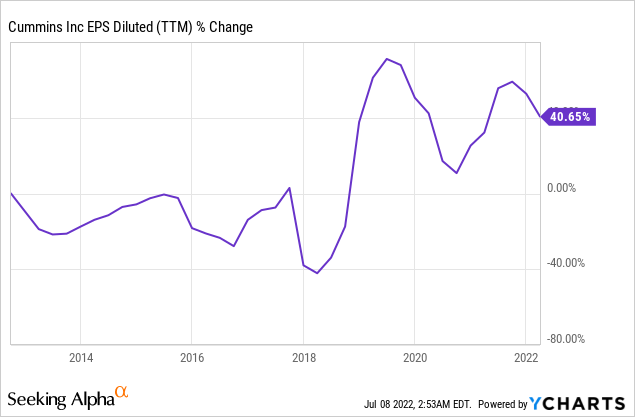

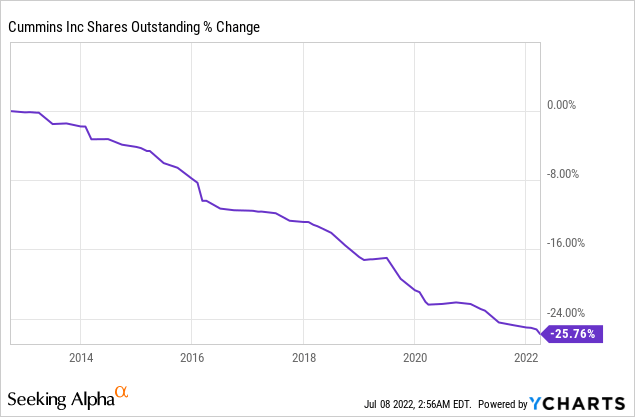

The EPS (earnings per share) has been growing faster. Over the last decade, the EPS has grown by more than 40%. The EPS is also cyclical as the demand changes affect the top and bottom line. The company maintained a stable operating margin over the decade. The EPS increase is attributed to the combination of sales increase and significant buyback activity. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Cummins to keep growing EPS at an annual rate of ~11% in the medium term.

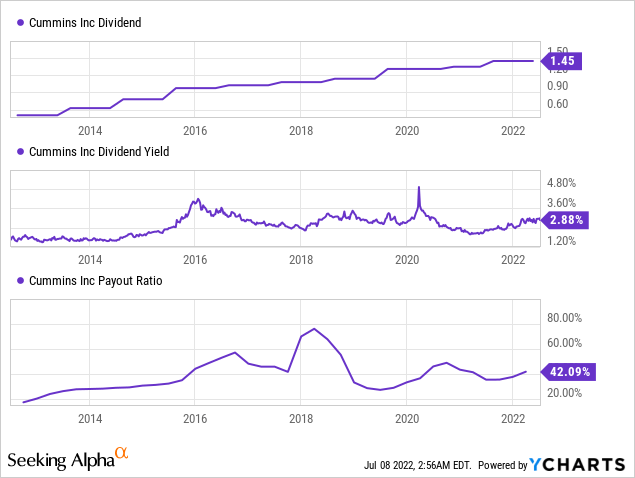

The company is a consistent dividend grower. The company has not decreased its dividend for more than 25 years and has consistently increased it for more than 15 years. The dividend is safe with a payout ratio of 42%, as it leaves enough margin of safety for future cyclicality. The current 2.9% dividend yield is a comfortable entry point for long-term investors. Investors should expect another high single-digits dividend increase this month.

In addition to the dividends that are the most important mean to return capital to shareholders, the company is also buying back its shares. Over the last decade, Cummins has repurchased more than one-quarter of its outstanding shares. When used by a growing company, buybacks supplement the EPS growth, and it is wise for cyclical companies with a long track record to repurchase shares when the valuation is attractive, like today. The company has a $2B buyback plan in progress, which equates to 7% of the company.

Valuation

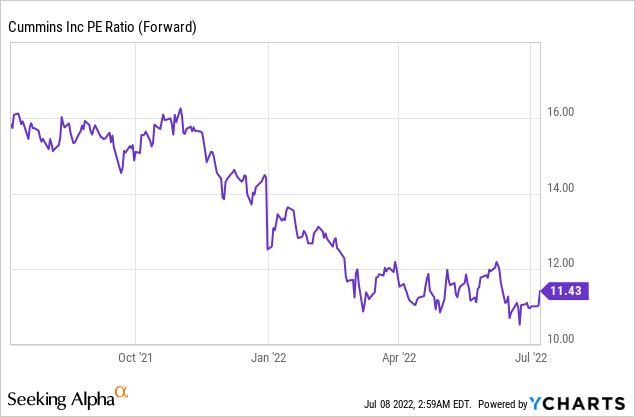

The current P/E (price to earnings) ratio is 11.43 when using the forecasted earnings for 2022. As the graph below shows, this is the lowest valuation we have seen for Cummins in the last twelve months. Paying 11 times earnings for a company that is forecasted to show healthy growth over the medium term makes a lot of sense to me.

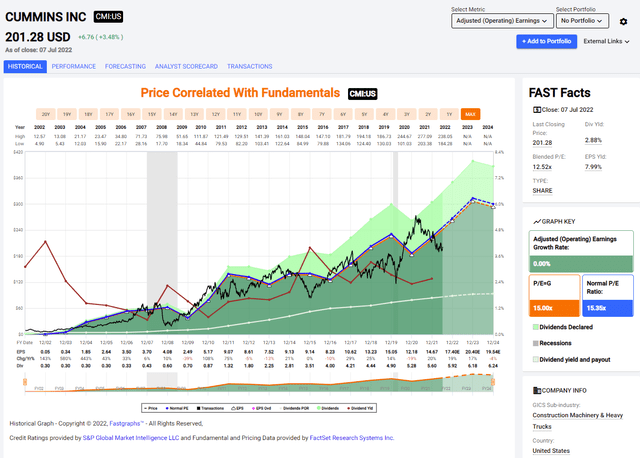

The graph below from Fastgraphs emphasizes how attractively valued the company is a the moment. In the last two decades, the shares have been trading for an average P/E of 15. Therefore, buying the shares at the current valuation is attractive. It is even more promising as the company is forecasted to keep growing in the coming several years.

To conclude, Cummins is a reliable company when it comes to fundamentals. It grows sales and EPS, and in turn, they drive dividend growth and buybacks. The company is trading for what I believe to be an attractive valuation with a P/E ratio at its lowest point over the last twelve months. This P/E ratio is also significantly lower than the average valuation.

Opportunities

North American supply chain challenges are catalyzing Cummins. The increased demand for logistics and the need to transfer goods increase the demand for truck and rail engines. This macro trend is positively pressing on Cummins in the U.S to produce more units. The North American demand is strong as companies must deal with the supply chain’s bottlenecks.

Another macro trend that fuels the demand for Cummins’ products is the increase in prices of commodities. It increases the need for engines in the mining sector. Moreover, there is also a surge in demand for power generation equipment. The macro trends with higher prices of energy force countries to diversify, and they need more power generation.

Cummins also enjoys more opportunities that are related to its size. The company diversifies itself with several business segments that allow it to lower the cyclicality. In addition, it also enjoys geographical diversification as it sells its products in over 190 countries and territories. Diversification reduces the risk and allows the company to capitalize on growth opportunities in different markets and products.

Risks

Weakness in China is a significant risk for Cummins. The company sells to China as the country is constantly growing its industrial capacity. Moreover, China also requires more power to power its growing economy. Cummins suffered in the last quarter from lower demand due to the lockdowns in China that led to slower economic growth and lowered the demand.

Inflation is another risk for Cummins as it increases the labor cost and the cost of materials needed to produce engines. The company maintained a 10% operating margin over the last decade. Significant inflationary pressures may press the company margins and hurt profitability. Higher prices may result in lower market share and demand.

The recession is the third risk for Cummins. While it is a significant risk in the short term, it is not an effective long-term risk. A recession will surpass demand and will probably pressure EPS and share price. However, the company has dealt with plenty of recessions in the last several decades, and this volatility in this kind of company is not a bug. It’s a feature.

Conclusions

Cummins is an excellent company with a long track record of solid execution. The company enjoys remarkable long-term growth despite the cyclical nature of its business. Therefore, investors can feel comfortable with its dividend growth and buybacks. The company has several growth opportunities that will propel its development in the years to come.

There are, of course, risks to the investment thesis. In the short term, it’s inflation and the risk of recession. Investors may also be concerned with the slower growth of the Chinese economy. However, the current valuation leaves investors with plenty of margin of safety. Therefore, I believe that investors can feel comfortable buying Cummins for the long term.

Be the first to comment