SolStock/E+ via Getty Images

Repsol, S.A. (OTCQX:REPYY, OTCQX:REPYF) is benefiting from the recent increase in oil prices. In my view, the recent industrial transformation initiated in 2020 works as a catalyst for net income growth. If Repsol continues to accelerate digital initiatives and investments in decarbonized models, free cash flow will likely grow up. Even taking into consideration political risks and shortages of raw materials, I believe that Repsol is undervalued by the market.

Repsol: The Industrial Transformation Is Already Contributing To Significant Net Income Growth

Multinational energy and petrochemical company Repsol engages in worldwide upstream and downstream activities.

I believe that the company is quite interesting because management, in 2020-2021, initiated an ambitious strategy to enlarge its industrial activities as well as to reduce its exposition to carbon fuels:

The Chairman advocated designing the paths to reach a decarbonized model in 2050 based on technological neutrality without dogmas and guaranteeing that there will be no “shortages” or “unacceptable increases in energy prices. Source: Antonio Brufau calls for the design of a “realistic” energy mix for a strong Europe.

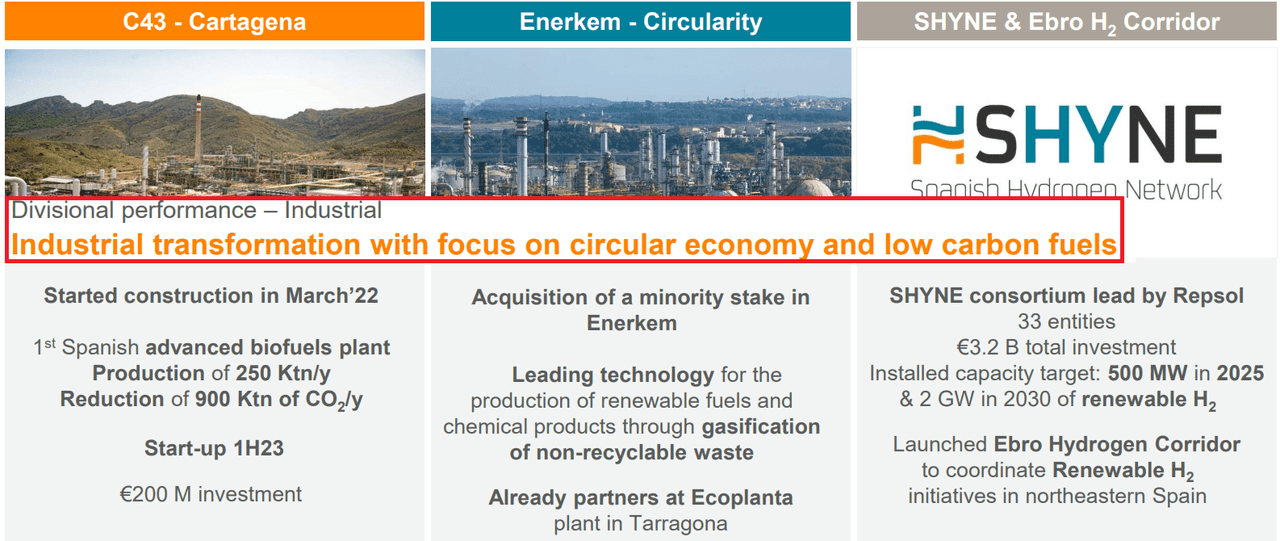

In this regard, in the last quarterly report, management noted an acquisition of a minority stake in Enerkem, investments in Renewable H2 initiatives, and biofuels plant production.

Corporate Presentation

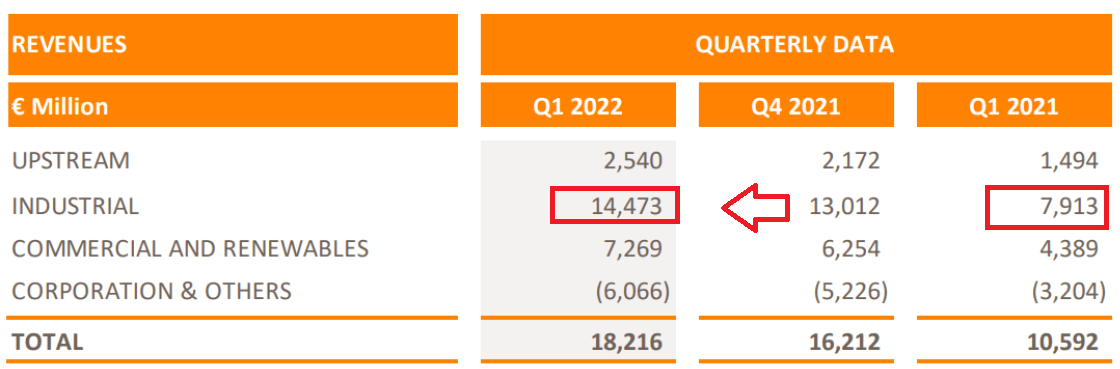

We could see the results of the recent investments in 2022. Industrial revenue increased from €7 billion in Q1 2021 to €14 billion in 2022. The other business segment also reports revenue growth, but not that significant as industrial sales growth.

Corporate Presentation

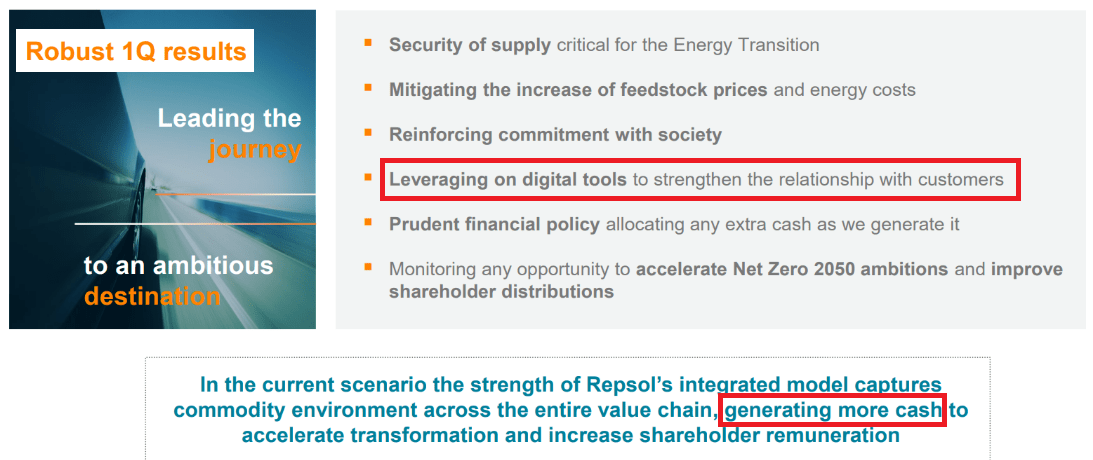

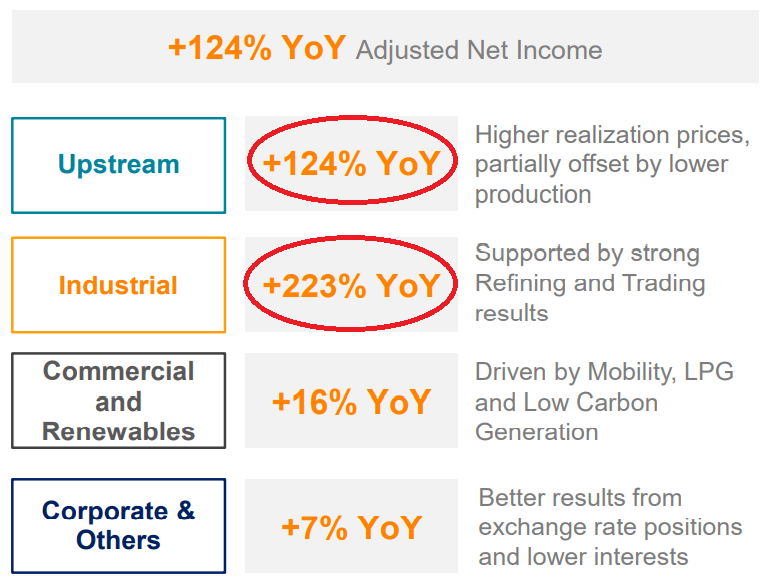

Finally, in the last quarterly report, Repsol announced more digital tools to develop new relationships with customers and more cash generation. The net income growth appears simply quite impressive. Have a look at the details in the images below.

Corporate Presentation Corporate Presentation

Repsol Looks Undervalued: It Could Trade At €31 Per Share

In my view, further development of digital applications like Vivit will likely improve awareness about Repsol. With the oil price at its maximum level in decades, consumers will likely appreciate the digital tools offered to make a more efficient use of energy. More satisfied clients will likely lead to sales growth.

Repsol launched Vivit, a mobile app for customers in the home that aims to personalize the relationship with our customers through individualized management of energy consumption, thus providing users with simple tools to help them make more efficient use of energy. Source: 10-k

Repsol is also investing a significant amount of money in new projects in the United States and countries in the OECD. Developed countries are investing in energy storage and alternative sources of energy, so I believe that Repsol’s initiatives will be enhanced by subsidies or public investment. The acquisition of Hecate Energy Group, LLC, and the creation of the SHYNE multi-sector consortium are good examples:

Boost to international expansion in the United States with the acquisition of 100% of Jicarilla 2 and 40% of Hecate Energy Group, LLC, a US company specializing in the development of photovoltaic and battery projects for energy storage. Hecate Energy Group has a portfolio of over 40 GW of renewable and storage projects under development. Of this number, 16.8 GW relate to advanced photovoltaic projects and 4.3 GW to battery projects. The vast majority of Hecate Energy Group’s assets are located in US electricity markets.

Repsol has created the SHYNE multi-sector consortium with the participation of 30 Spanish companies (Iberia, Talgo, Enagás, Alsa, Bosch, Scania, among others) to promote the use of renewable hydrogen across all segments of transport. This will be achieved by producing fuels and creating a broad infrastructure of at least 12 hydrogen plants. The project, which aims to reach an installed capacity of 500 megawatts by 2025 and 2,000 megawatts by 2030, will entail an investment of 3.23 billion euros. Source: 10-k

According to researchers, the global Oil & Gas EPC market size is expected to grow at a CAGR of 5.4% until 2028. Under this case scenario, I assumed that this figure is correct.

The global Oil & Gas EPC market size is projected to reach US$ 252560 million by 2028, from US$ 173290 million in 2021, at a CAGR of 5.4% during 2022-2028. Source: Industry Research

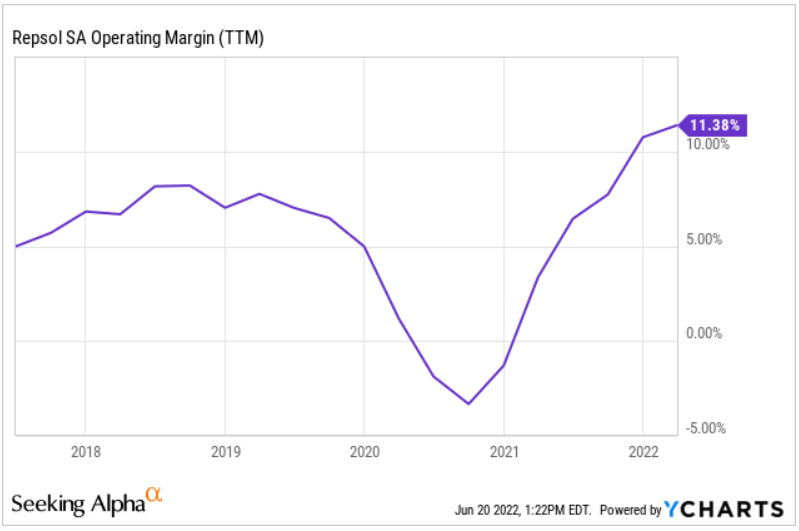

I assumed an operating margin close to 11%, which Repsol reported in the past. In my view, my figures are not far from the figures reported by management in the last four years.

Ycharts

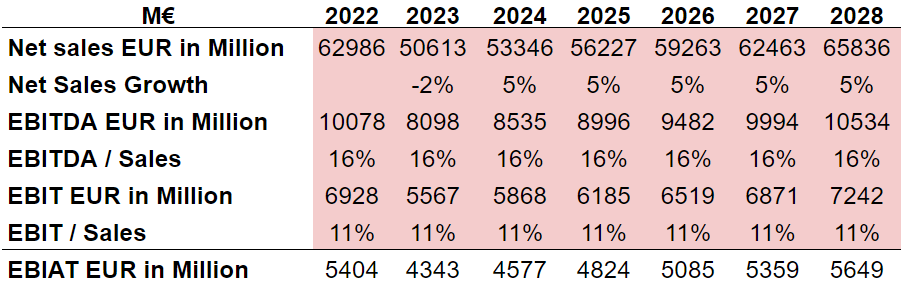

Putting the previous assumptions all together, I obtained 2028 sales of €65.8 billion, 2028 EBIT of €7.2 billion, and 2028 EBIAT of €5.6 billion. Also note that with an EBITDA margin around 16%, 2028 EBITDA stands at €10 billion.

Arie Investment Management

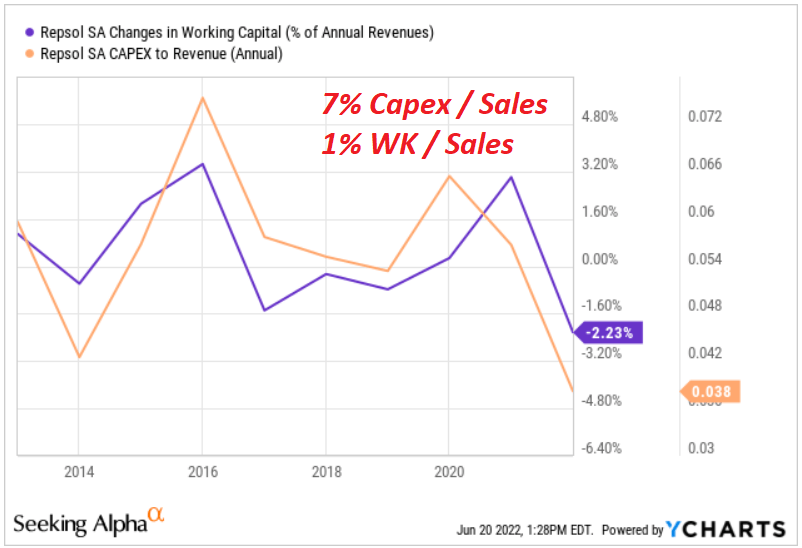

In the light of the results reported by Repsol, in my view, capex/sales of 7% and working/capital/sales of 1% appear conservative.

Ycharts And Arie

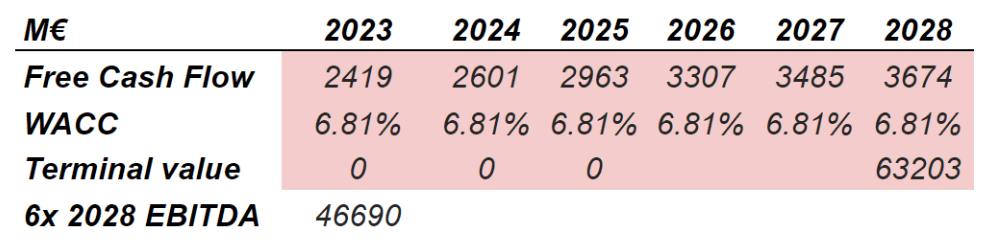

If we add back D&A and subtract changes in working capital and capital expenditures, 2028 free cash flow stands at €3.6 billion. I used a discount close to 6%-7%, like other investment analysts, and an exit multiple of 6x, which is lower than the median in the industry. The results include a net present value of the terminal value of €46 billion.

Arie Investment Management

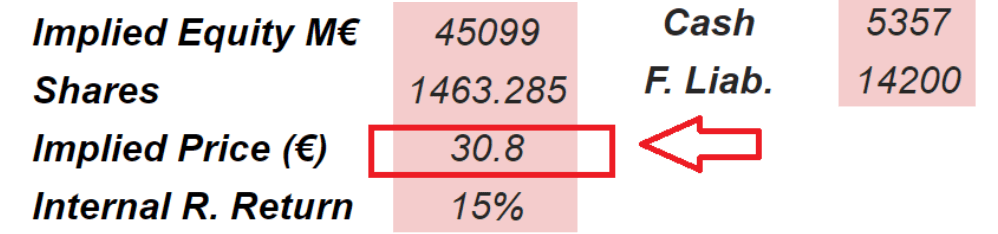

Summing the total amount of cash and subtracting the debt, I obtained an implied valuation of almost €31. It is significantly higher than the current market price.

Arie Investment Management

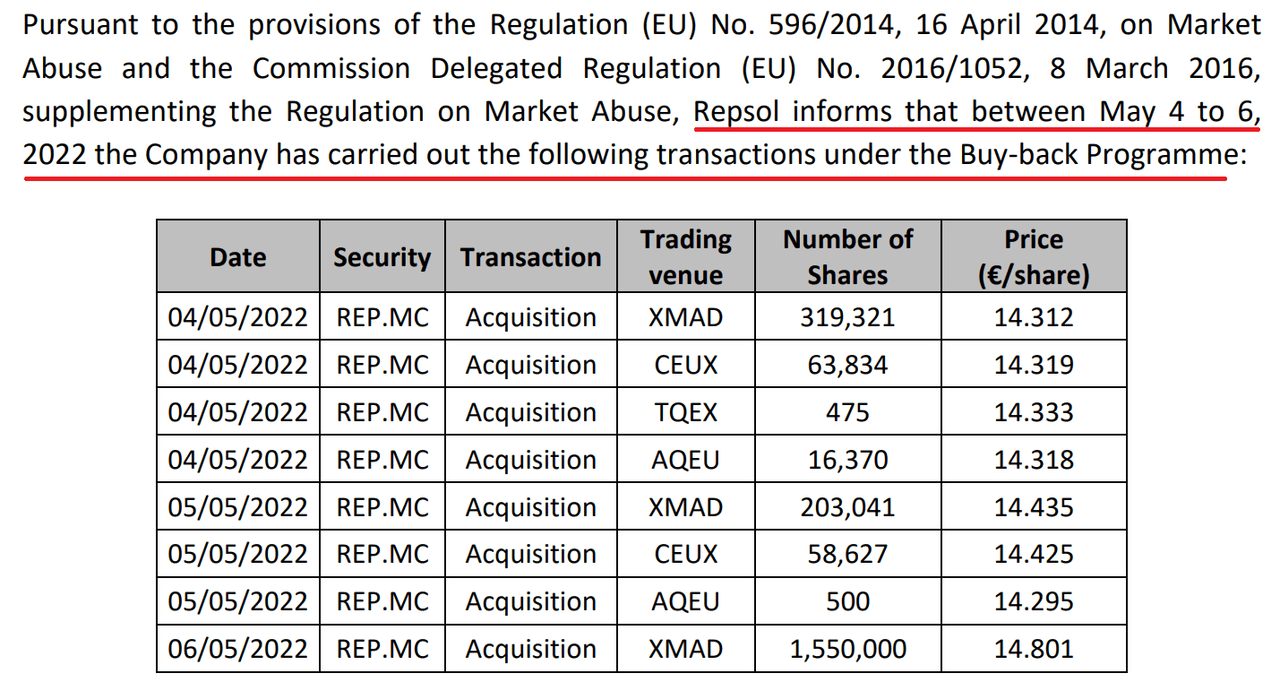

In my view, the fact that Repsol is acquiring its own shares is very meaningful. The Board of Directors appears to think that shares are undervalued. In the light of this case scenario, the Board would be correct.

Buy Back Program

Problems In The Supply Of Raw Materials, Negotiations With Transportation Suppliers, Or Political Risks Could Bring The Stock Price Down To $10

Repsol operates in countries where change of governments could lead to changes in taxes and royalties payable. It is a bit risky because we cannot really say when changes in the oil and gas regulation may happen. Under this case scenario, I assumed certain detrimental changes in some regions, which may lead to a decrease in the free cash flow growth:

Part of Repsol’s activities are carried out in countries that are prone to social, political or economic instability that could lead to unlawful conduct by the Group’s counterparties or unilateral changes imposed by governments or institutions. Examples here include increases in taxes and royalties payable, limits on production or exports, mandatory renegotiations or annulment of contracts, regulation of product prices, nationalization, eminent domain or seizure of assets, loss of concessions, changes in government policies, changes in commercial customs and practices, or delayed payments. Source: 10-k

Repsol could be affected by inflation, increase in salaries, or problems with supply of raw materials. In particular, the company collaborates with third parties that offer infrastructure and transportation services. If these third parties decide to negotiate their agreements, management may soon suffer a decline in the free cash flow margin. As a result, the stock price may decline:

The Repsol Group is exposed to negative impacts associated with the unavailability or scarcity of market goods and services, price and cost fluctuations, as well as interruptions and deviations in time and form in the supply of goods or the provision of services, including the supply of raw materials, which may eventually force the interruption of the affected business activities. Specifically, part of the processing, transportation and marketing of crude oil and gas production from Upstream assets is carried out through infrastructure (pipelines, processing and purification units or liquefaction terminals) operated by third parties. Source: 10-k

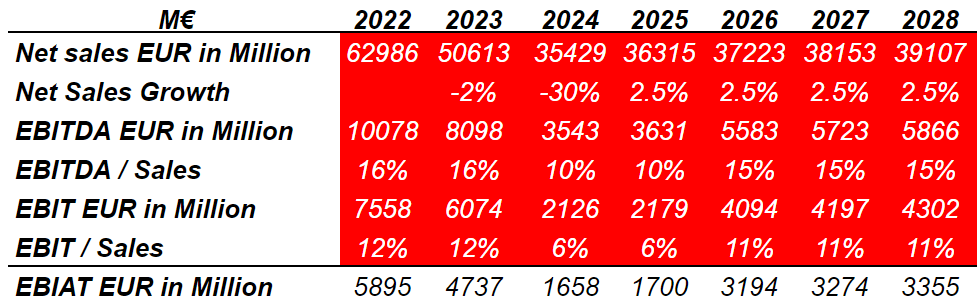

Under my bearish case scenario, I used sales growth of -30% in 2024 and around 2.5% from 2025 to 2028. If we also assume an EBITDA margin between 10% and 15%, 2028 EBITDA stands at close to €3.35 billion.

Arie Investment Management

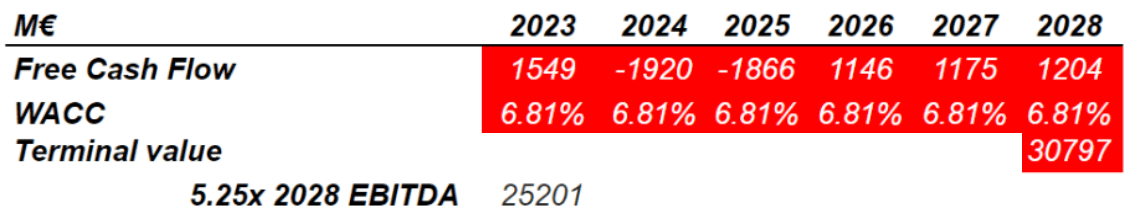

Under this scenario, I considered it reasonable using an exit multiple of 5.25x, which implied a NPV of the terminal value of €25 billion.

Arie Investment Management

Adjusting the cash in hand and the debt, I obtained an implied equity of €14 billion and a fair price of €10. The internal rate of return is negative.

Arie Investment Management

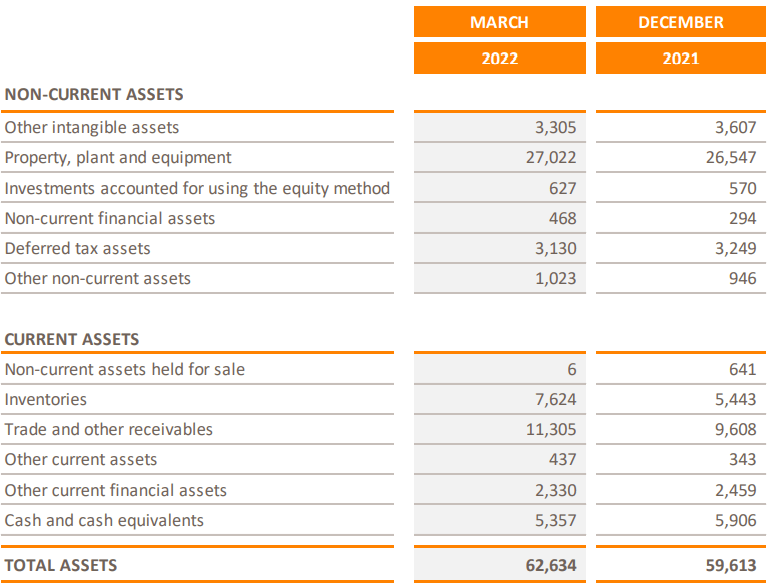

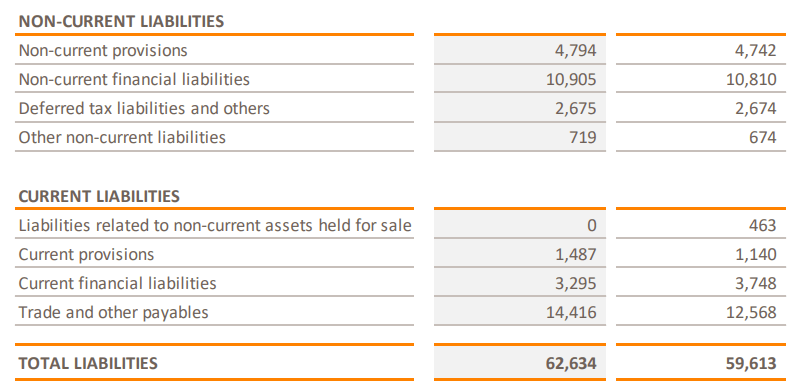

Balance Sheet: Good Amount Of Cash And New Money From The Sale Of 25% of Its Renewable Energy Business

As of March 31, 2022, Repsol reported €5.3 million in cash and an asset/liability ratio close to 1x. Considering the current oil price and the balance sheet, in my view, the financial situation appears quite healthy.

Investor Presentation

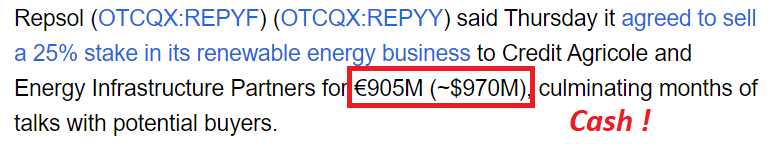

In my view, Repsol’s total amount of cash will likely increase as the company has signed an agreement to sell a large asset for €905 million. More liquidity could lead to an increase in the company’s valuation as soon as more traders see the cash increase:

SA

Repsol also reports non-current financial liabilities worth €10.9 billion, and current financial liabilities of €3.2 billion. If we assume forward EBITDA of €10 billion, I don’t believe that the total amount of debt is that worrying.

Investor Presentation

Takeaway

Repsol’s last quarterly report included significant net income growth, and market estimates appear quite beneficial. In my view, more investments in industrial transformation and new digital initiatives could bring even more free cash flow than expected. Even considering political risks associated with the exploration of oil and gas, shortages of supply of raw materials, and inflation risks, I see upside potential in the stock price. With the Board Of Directors acquiring its own shares, Repsol appears an interesting stock to follow carefully.

Be the first to comment