PercyAlban/iStock Unreleased via Getty Images

Introduction

RiverNorth/DoubleLine Strategic Opportunity Fund (NYSE:OPP) (hereafter just ‘OPP’ for simplicity sake) is a closed-end fund focusing on creating value by zooming in on a tactical income strategy and (up to 35% of the managed assets) and the opportunistic income strategy (up to 90% of the manage assets).

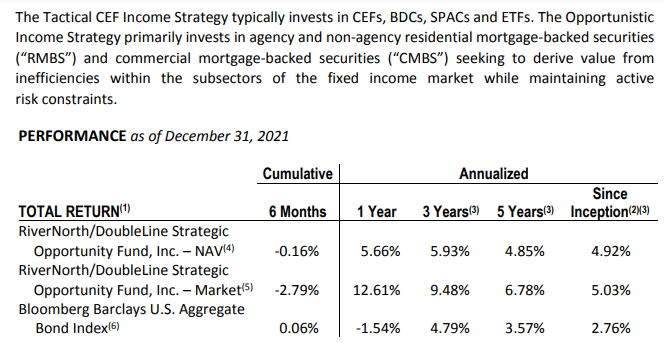

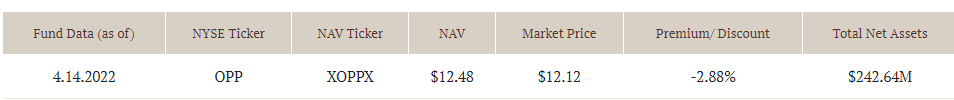

OPP Investor Relations

With an annualized return of about 5% since inception, the CEF isn’t doing too bad, especially when compared to the bond index which it uses as its benchmark. In this article, I will focus on OPP’s preferred shares as I am mainly interested in generating a consistent income While OPP’s common units currently yield approximately 12.5% based on the current annualized distribution rate, I like the additional layer of safety the preferred shares are offering.

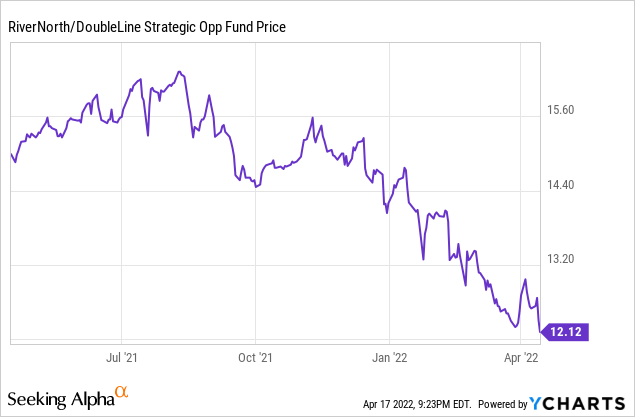

What’s in the portfolio?

The portfolio mainly consists of bonds, closed end funds and mortgage backed securities. As you can see below, common shares and preferred shares make up less than 16% of the total assets.

OPP Investor Relations

The agency MBS position represents almost 35% of the portfolio while non-agency CMOs represent an additional 31%. For a complete breakdown of the assets, I’d like to refer you to the semi-annual report published by OPP which provides a very detailed breakdown of every single position.

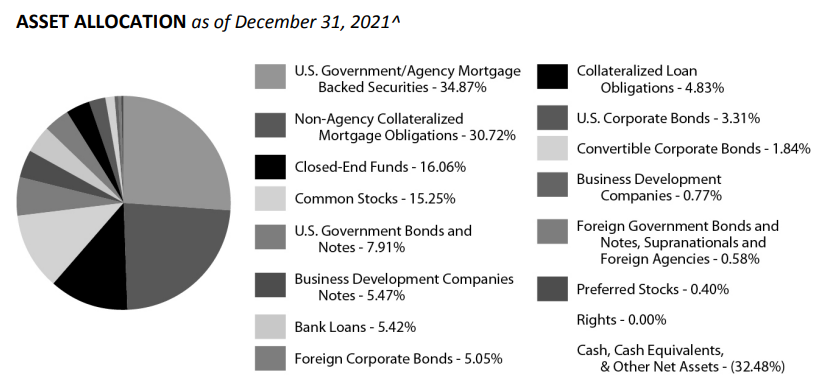

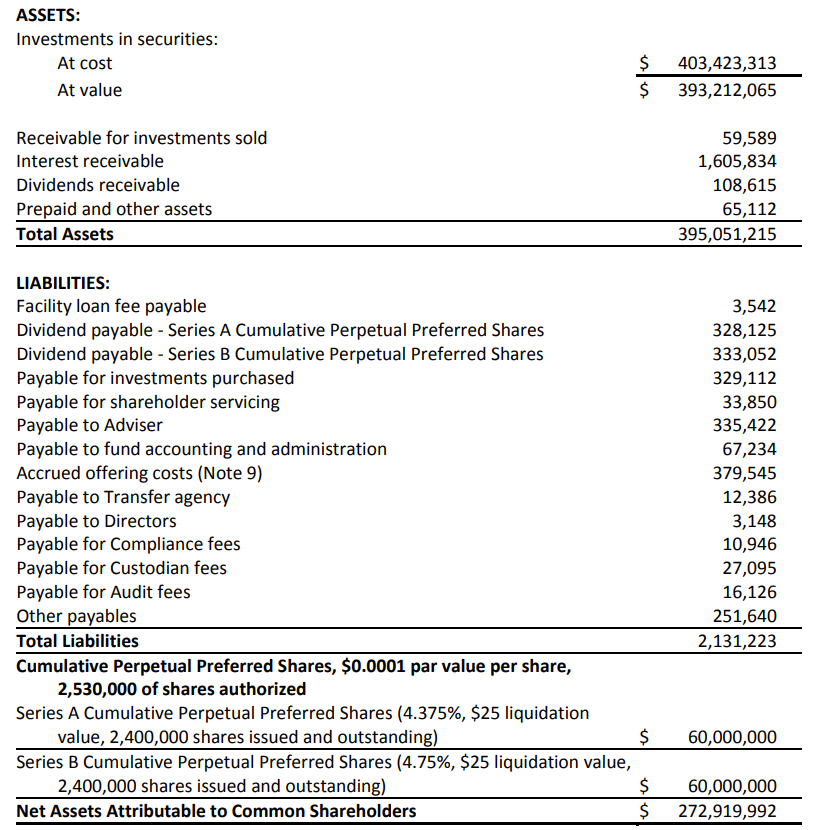

What I really appreciate about OPP is the fact that its balance sheet is very clean. Forget about adding too much leverage on the balance sheet which puts the entire business model at risk. As you can see below, the total amount of liabilities is less than 1% of the total asset base, and a large portion is related to the dividend payable on the preferred shares.

OPP Investor Relations

The only leverage on the balance sheet is the preferred shares. So as a preferred shareholder, you are in a very privileged position as there are hardly any creditors ahead of you if the fund would have to unwind. The NAV attributable to the common unitholders is just under $273M. As of the end of the reporting period, OPP had 19.22M units outstanding which mean the NAV/share at that moment was $14.20. As interest rates have been increasing, investors in OPP should expect a lower asset value and a lower net asset value as well, and the fund website indicates the NAV per share was $12.48 as of last Thursday. With a total net asset base of $242.6M, this indicates the net share count increased to just over 19.4M units.

OPP Investor Relations

OPP continues to issue new shares every once in a while and is putting the proceeds to work. A portion of the capital raised in the first half of the financial year was used to repay the $21M loan. That loan was actually very cheap as the annual report for FY2021 indicated the cost of debt was 1.04% as the loan was based on the one-month LIBOR + 0.95%. By removing the loan, the preferred shares now rank first in line in case the fund goes belly-up.

Why are the preferred shares relevant, and why do I like them?

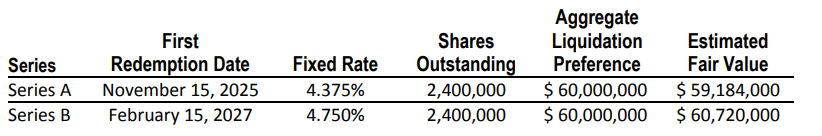

OPP now has two series of preferred shares outstanding.

The Series A preferred shares are trading with (NYSE:OPP.PA) as ticker symbol and offer a cumulative dividend of $1.09375 per share per year, which works out to a preferred dividend yield of 4.375% based on the par value of $25/share. These securities can be called from November 15th, 2025 on. And to be clear, the preferred dividend does not have a reset function: the $1.09375 remains unchanged until OPP decides to call the preferred shares.

The Series B preferred shares are trading with (NYSE:OPP.PB) as ticker symbol and are also cumulative in nature. This series was issued in Q1 2022 and OPP had to offer a higher preferred dividend to get the deal done and these preferred shares are paying a preferred dividend of $1.1875 per share and can be called from February 15, 2027 on.

OPP Investor Relations

The Series B also contains an interesting feature. If the company fails to maintain an asset coverage level of at least 200% at the end of every quarter and if this issue is not solved within a 30-day period, OPP will be forced to redeem these preferred shares. This does not mean OPP will have to buy back all of the Series B preferred shares, but only the amount needed to bring the asset coverage level up to 200% again while there also is a maximum of preferred shares that can be retired under the charter of the fund and the potential credit agreements at that date. To be clear: only the B-series of the preferred shares have this feature.

The A-shares closed at $19.62 while the B-shares closed at $21.49 per share resulting in preferred yields of 5.57% and 5.53%. Given the small difference between both preferred shares, I’d prefer the B-series and give up a 4 bp yield in return for the slightly better asset coverage ratio protection and the higher quarterly income.

Considering the total balance sheet size was approximately $395M as of the end of December, and the total face value of the outstanding preferred shares was $120M, the asset coverage level as of the end of December was 329%. Considering the NAV has decreased based on the April 14th NAV/share, the balance sheet has lost about $30M in assets which means the asset coverage value will be around 300-310% using the current NAV. This means that even if the value of the assets drops by another 60%, the preferred shares are still fully covered by assets (with an anticipated coverage ratio of 120%) but this is of course a theoretical example.

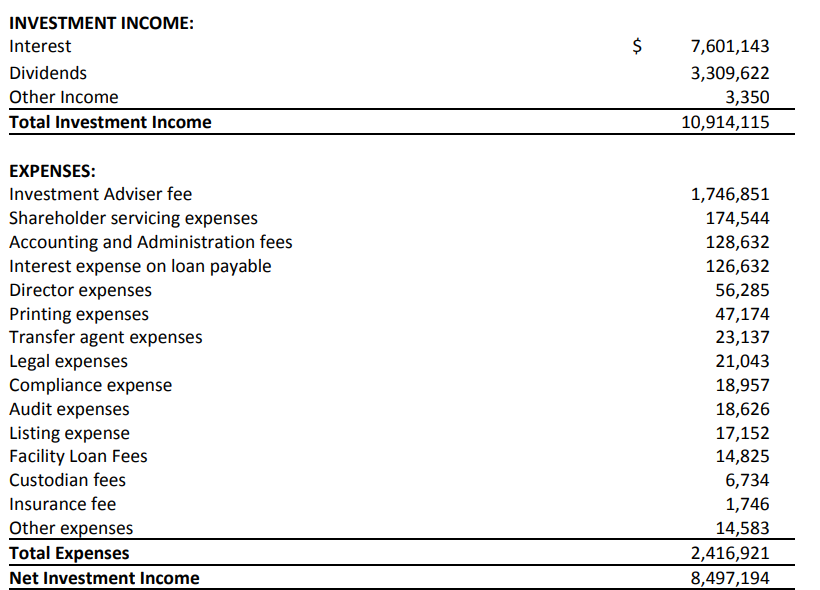

We also know the preferred shares will cost approximately $5.5M per year, so the normalized preferred dividend cost is $2.75M per semester. Looking at the H1 results, we see OPP generated $10.9M in investment income (excluding capital gains and capital losses, so these really are the interest and dividend income results!) while the total expenses were approximately $2.4M. Including in this $2.4M was a residual $127,000 interest payment on the loan and as that loan has now been fully paid off, this expense will disappear and the normalized operating expenses would be around $2.3M per semester.

OPP Investor Relations

This means the normalized net investment income will be approximately $8.6M. Which means the preferred dividends are very well covered as the payout ratio based on the net investment income is less than 35%.

I’m satisfied with both the asset coverage ratio as well as the preferred dividend coverage ratio level.

Investment thesis

If there would be debt on the OPP balance sheet I likely would not be as interested in the preferred securities as I am now. But seeing the relatively strong balance sheet and seeing how the preferred shares are first in line in case of a liquidation, I am getting quite interested in the preferred shares.

While a preferred dividend yield of just over 5.5% is not something to be extremely enthusiastic about, I think the risk/reward ratio of the preferred shares is attractive as even if the portfolio loses an additional 60% of its value, the preferred shareholders can still be made whole. On top of that, OPP continues to issue common shares which means the fund is adding more equity junior to the preferred shares and this also makes the preferred shares safer.

I currently have no position in OPP’s common shares and also have no intention to go long. But I am adding both series of the preferred shares to my watch list with the intention to go long in the near future.

Be the first to comment