Jean-Luc Ichard/iStock Editorial via Getty Images

Investment Thesis

Microsoft Corporation (NASDAQ:MSFT) stock has continued to languish near its recent March bottom, despite suffering its most significant decline since the COVID bear market. Notably, MSFT stock remained almost 20% below its November highs, even as the King of SaaS fell into a bear market recently.

However, we think the value compression over the last five months has normalized MSFT stock multiples significantly. Consequently, its stock has reverted to its 5Y P/E and FCF multiples mean.

Microsoft also had to deal with recent headwinds relating to weak consumer end demand in the PC market and antitrust concerns relating to Azure’s business practices. However, we think these are transitory and surmountable challenges for the company.

As such, we consider MSFT stock delicately balanced as CEO Satya Nadella & Team head into its CQ1 (Microsoft’s FQ3’22) earnings report on April 26.

Therefore, we maintain our Buy rating on MSFT stock.

MSFT Stock Decline Fell Into A Bear Market

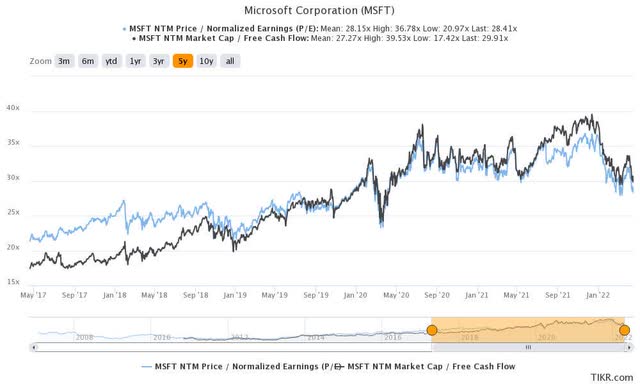

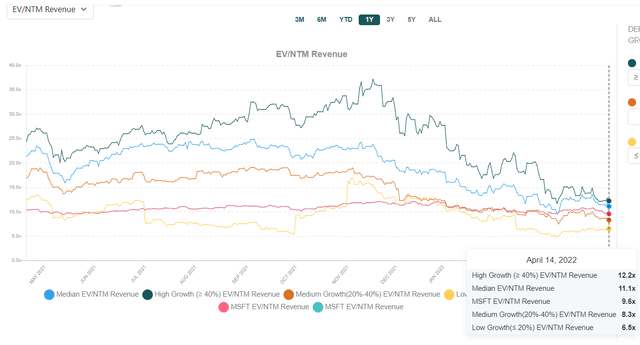

MSFT stock valuation multiples (TIKR) MSFT stock NTM revenue multiples Vs. high-growth SaaS peers (Public Comps)

Despite the massive collapse in SaaS stocks over the past five months, the market continues to accord these stocks a substantial growth premium. For instance, the SaaS median P/E of 41.6x is significantly higher than the tech industry’s median P/E of 24.2x. Hence, we think investors remain confident in software companies’ secular growth themes and business models.

Nevertheless, the normalization of the growth premium in high-growth SaaS has been astounding, as seen above. The median NTM revenue multiple (23.8x) was substantially above MSFT stock’s multiple of 12x in November. But, the gap has closed significantly as the high-growth SaaS median has reverted to 11.1x against MSFT stock’s 9.6x.

Notably, MSFT stock’s recent decline of 23% (November-March) saw it go into a bear market momentarily. Nevertheless, the plunge also brought down MSFT stock valuation to more reasonable levels. Its NTM FCF multiple (29.9x) and NTM normalized P/E multiple (28.4x) have reverted broadly in line with their respective 5Y mean. While we don’t consider MSFT stock undervalued, we think its valuation looks reasonable, given its highly profitable and well-diversified business model.

PC Headwinds Exacerbated Near-Term Challenges

Tech stocks have continued to come under pressure given the surging inflation and interest rate hike challenges. As a result, Microsoft stock was also impacted. In addition, the recent headwinds relating to normalization in consumer demand in the PC market also impacted Microsoft stock.

A recent IDC report showed that PC shipments declined 5.1% YoY worldwide in CQ1. But, the difficult comps were not unexpected, given the pandemic boom driving remote working and classes. Furthermore, shipments remain robust, as IDC accentuated (edited):

The focus shouldn’t be on the YoY decline in PC volumes because that was to be expected. The focus should be on the PC industry managing to ship more than 80M PCs at a time when logistics and supply chain are still a mess, accompanied by numerous geopolitical and pandemic-related challenges. – Barron’s

Still, the impact concerned the Street, as UBS highlighted (edited): “Office 365’s ‘high penetration’ and benefits from the pandemic and work-from-home boom are starting to fade, and could also impact Windows. Our estimates are trimmed to reflect a higher risk of a PC growth slowdown. Management’s guidance for the June quarter could be lower than the Street’s estimates.”

Cloud Business Should Mitigate Impact

Therefore, the impact on MSFT stock seems to be justified as the market attempts to price in these near-term concerns. However, investors should also consider the higher level of corporate IT spending, and the continued shift to the cloud should mitigate weaker consumer spending.

A recent Bloomberg survey demonstrated that CTOs expect to spend more in 2022, mainly on cybersecurity and cloud computing. Notably, “61% of respondents say they expect to increase their tech spending. Of those, 72% will likely increase their budgets by 9% or more this year.” Furthermore, 62% of the respondents indicated that they intend to increase spending with Microsoft, just below AWS’ (AMZN) 64%.

Furthermore, Synergy Research Group also accentuated it expects global hyperscale data centers to surpass 1K in 2024, from 500 in 2018. It added (edited): “The future looks bright for hyperscale operators, with double-digit annual growth in total revenues supported in large part by cloud revenues that will be growing in the 20% to 30% per year range.”

Therefore, we believe that Microsoft’s enterprise and hyperscale business should continue to drive growth and mitigate the potential impact of weaker end consumer demand.

Nevertheless, we also shifted our attention to antitrust concerns on Azure’s business practices that were flagged recently. Bloomberg reported that Microsoft has been using its clout and leadership in its Windows and Office suite to lock in customers to Azure or risked paying more.

Notably, these concerns have also drawn the attention of the EU regulators (where we think Microsoft could have lesser political clout). We believe these concerns seem valid, and thus investors need to continue monitoring the developments closely moving forward. Bloomberg reported (edited):

The impact has been felt in companies and organizations both large and small. Microsoft’s rules don’t allow running its existing Office software on Amazon’s cloud, and require it to pay more to run the Windows operating system on its rival’s servers.

“The excrement is about to hit the fan,” said Wes Miller, an analyst at Directions on Microsoft, a research firm that advises customers on Microsoft licensing. He said that using the company’s software on a competing cloud service is “significantly more expensive than it used to be, and more expensive than it costs you to do the same thing on Azure.” – Bloomberg

However, we have not noticed similar attention emanating from the US regulators yet. Interestingly, a WSJ report in early April discussed how Microsoft has “adroitly” maneuvered and “endeared” itself with US lawmakers. Still, it’s still too early to determine whether the attention on Microsoft’s Azure business could attract the attention of the US antitrust regulators. But, Microsoft’s ability to navigate itself in the US has been pretty “impressive.” WSJ added (edited):

Microsoft President Brad Smith, a Microsoft veteran of almost 30 years and president for seven, has maneuvered his company to an enviable position in a regulatory environment that is increasingly hostile toward tech titans.

Once an antitrust pariah itself, Microsoft is now widely seen by regulators as the friendly party among today’s top tech companies, a status government officials and Microsoft insiders say flows largely from Mr. Smith’s cultivation of friends in Washington. Rivals say he is also skilled at directing negative attention toward competitors-to Microsoft’s benefit. – WSJ

Is MSFT Stock A Buy, Sell, Or Hold?

MSFT stock remains a Buy. We are confident that the recent bottom in Microsoft stock should hold. Moreover, given the pretty steep compression in its stock, its valuation looks more reasonable, even though it’s not undervalued. But, we think a fairly-valued MSFT stock is a solid long-term proposition for most tech investors.

Be the first to comment