MichaelGSedlak/iStock via Getty Images

Verastem (NASDAQ:VSTM) recently reported their Q4 and full-year 2021 earnings that revealed substantial headway since my previous VSTM article. Verastem has put the pedal to the floor in their attempts to progress their RAS pathway assets, which are set for numerous catalysts throughout 2022. The company has also been working hard on their financials and has added a $150M debt facility with Oxford Finance, which will help support the advancement of VS-6766. The market has responded positively with VSTM trading up over 50% over the past month. These developments have encouraged me to revisit Verastem and decide what I am going to do with my dormant VSTM position.

I intend to review the company’s recent earnings report and will highlight some bullish points for investors. In addition, I will point out some potent upcoming catalysts that investors should be aware of. Finally, I will reveal my plans for my dormant VSTM position.

Q4 and Full-Year 2021 Results

Verastem recently reported their Q4 earnings with total revenue for Q4 was $0.5M. The company’s OpEx came in at $17.1M, which resulted in a $16.5M net loss for the quarter. For the full year of 2021, total revenue came in at $2.1M, which comprised of $1.4M in milestones and royalties from COPIKTRA, and $0.6M of transition services to Secura Bio. OpEx for 2021 was $63.5M, which was down significantly from the $104.1M in 2020. Overall, the company reported a $71.2M net loss during 2021.

Verastem ended 2021 with $100.3M in cash, cash equivalents, and investments and $125.3M on a pro forma basis.

Bullish Highlights

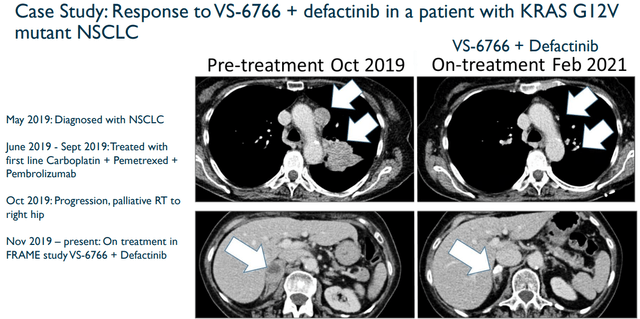

At this point in time, most of Verastem’s activities are centered on their RAS pathway inhibitor candidate, VS-6766. By prompting MEK with ARAF, BRAF, and CRAF, VS-6766 is projected to generate a “more complete and durable anti-tumor response.” VS-6766 has the potential to be a best-in-class product thanks to it being a unique dual RAF/MEK mechanism of action with the potential to have impressive safety and tolerability. Moreover, VS-6766 is an oral drug that is expected to have intermittent dosing.

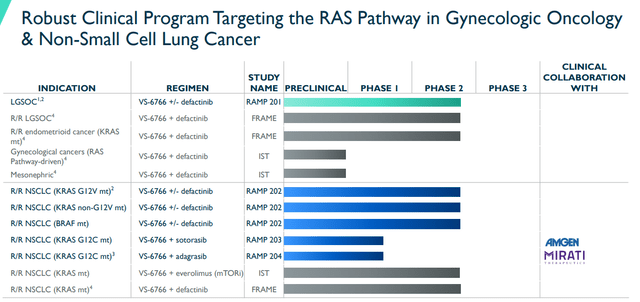

VS-6766 is being aimed at RAS Pathway-dependent cancers including gynecological and NSCLC.

Verastem’s Gynecological and NSCLC Programs (Verastem)

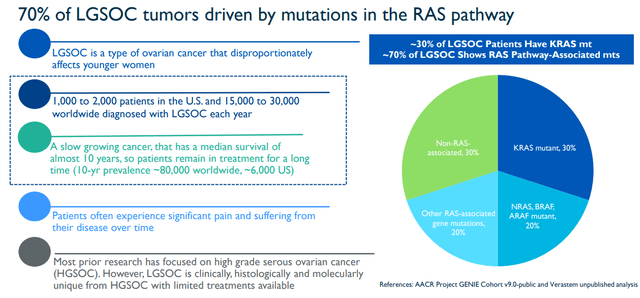

The highest priority program is the low-grade serous ovarian cancer “LGSOC” program of VS-6766 +/- defactinib. According to Verastem, a large portion of the industry’s research efforts are directed at high-grade serous ovarian cancer “HGSOC”. Yet, LGSOC is distinctive from HGSOC with inadequate treatment options available. VS-6766 could be a critical option for LGSOC patients considering roughly 30% of LGSOC patients are KRAS mutations and about 70% of LGSOC display RAS Pathway-Associated mutations. As a result, the FDA granted Breakthrough Therapy designation for VS-6766 with defactinib for the treatment of all patients with recurrent LGSOC irrespective of KRAS status following one or more lines of therapy, including platinum-based chemotherapy.

LGSOC RAS Pathway Overview (Verastem)

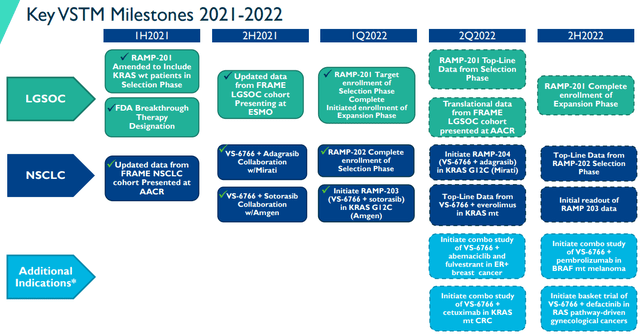

The company has completed enrollment in Part A of the registration-directed Phase II RAMP 201 study. Verastem expects to report topline results from Part A this quarter. The company has also started enrolling in Part B, which is projected to be completed in the second half of this year.

The company is also taking aim at KRAS mutant non-small cell lung cancer “NSCLC”. Part A of the registration-directed RAMP 202 study enrollment is now complete. The company is exploring VS-6766 alone and in combination with defactinib in patients with KRAS G12V mutant NSCLC.

Verastem added BRAF mutant cohorts to evaluate the combination in patients with V600E or non-V600E BRAF mutations. Verastem anticipates reporting topline data from Part A in the second half of this year. In addition, they expect to initiate Part B of the study in the second half of this year.

Moreover, Verastem has entered into two collaborations for VS-6766 in NSCLC. The company expects to provide initial results of VS-6766 in combination with Amgen’s (AMGN) LUMAKRAS “sotorasib” from the Phase I/II RAMP 203 study in the second half of this year. Plus, the company is expected to start their Phase I/II RAMP 204 study of VS-6766 in combination with Mirati’s (MRTX) adagrasib this quarter.

Outside the clinic, the company has made some significant progress in terms of their finances. Verastem secured a debt facility with Oxford Finance LLC for up to $150M. Verastem pulled an initial $25M term loan at closing and has the ability to access a supplementary $125M in tranches. The funds from this credit facility in conjunction with expected COPIKTRA milestones have extended their cash runway through 2025 and to the potential commercial launches of VS-6766 and Defactinib.

2022 Milestones and Catalysts

Verastem has several potent milestones and catalysts on the docket for the remainder of 2022. First and foremost, is top-line data from the selection phase of the RAMP-201 study for LGSOC. In addition, the company is expecting top-line data for VS-6266 with everolimus in KRAS mutants in NSCLC.

2021-2022 Milestones and Catalysts (Verastem)

In the second half, the company is expecting to report the RAMP-202 selection phase for NSCLC and the initial readout for RAMP-203.

As you can see, Verastem has numerous catalysts that could reveal VS-6766’s potential to be a best-in-class drug including data from LGSOC and NSCLC by the end of this year. It is possible that Verastem will leave 2022 with enough evidence to be a serious contender in the KRAS space and will be valued as such.

My Plan

I must admit that I put VSTM in the back of a sock drawer and haven’t looked at it seriously since my last article. I was able to obtain a “house money” position a while back and I’ve been trying to maintain that status by avoiding a potential reload. However, now that the company has secured enough funding to get them to a potential approval, I am willing to take my VSTM position out of mothball and restart my accumulation efforts. To be clear, I’m not looking to amass an upsized position at this time because of the overall market conditions, which are crushing speculative tickers with a high cash burn. Therefore, I’m going to take a dollar-cost average “DCA” approach by making periodic Investments over the course of 2022 in order to slowly build a position and mitigate risk. Indeed, I plan on booking profits on spikes in the share price with the goal to regain “house money” status and will reapply those profits to grow a larger position ahead of a possible approval.

Long-term, I plan on scaling up my position based on the company’s clinical performance and cash runway. If all goes well, I intend to keep VSTM in the Compounding Healthcare “Bio Boom” speculative portfolio for at least another five years in anticipation that the company can get VS-6766 through the FDA and onto the market.

Be the first to comment