Angel Di Bilio

Southwest Airlines (NYSE:LUV) recently held its Investor Day and I followed the event for Seeking Alpha. The general impression I had also supports my bullish view on Southwest Airlines. In this report, I will highlight what stood out for me during the event, how that fits in the company’s path and I will address one item that was announced before the event.

Southwest Airlines Is A Dividend Stock Again

So, the item that was announced before the start of the Investor Day was the reinstatement of the dividend. Southwest Airlines is the first of the big airlines that reinstated shareholder returns. Partially this was driven by government support schemes not allowing shareholder returns until recently.

The fact that Southwest Airlines announces shareholder returns now is firmly supported by the strength of off-peak unit revenues into next year despite the expectation that a mild recession will hit in 2023 and the company’s methodological approach toward continuously identifying value-generating opportunities as well as ways to mitigate risks. Southwest Airlines is the only airline with an investment grade rate and a net cash position, so the company really knows what is doing and that makes it easier to discuss or contemplate shareholder returns.

The low-cost carrier has re-instated the dividend of $0.18 per share, which provided a higher annualized dividend yield at the time it was announced than during pre-pandemic levels. That already can be seen as a sign that the company managed the pandemic disruptions quite well and more importantly reflects confidence for the future. Certainly, the 1.8% yield is not juicy by any means but I would say the underlying confidence in the business is key.

Capacity To Recover Beyond Pre-Pandemic Levels

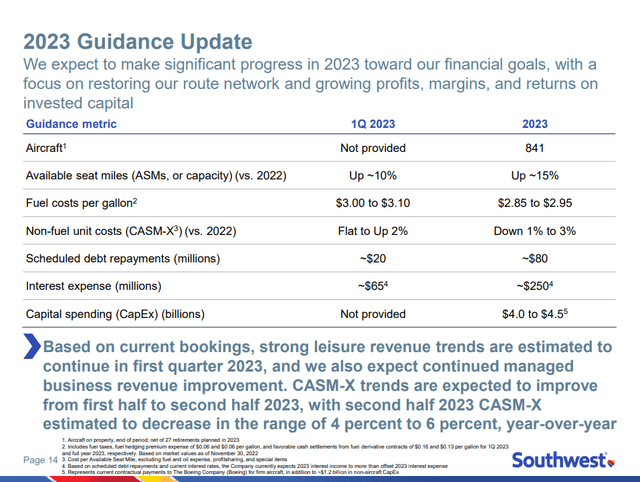

For this year, Southwest Airlines has guided for capacity to be down 4.5% compared to pre-pandemic levels, and from there in 2023, the company will grow capacity by 15 % indicating a capacity of 10% above pre-pandemic levels. Southwest Airlines is certainly not the first airline to operate capacity above pre-pandemic levels, but from what I have seen the operational capacity exceeding pre-pandemic levels was the signature of ultra-low cost carriers and not so much for low-cost carriers and legacy carriers. So, an important move from Southwest Airlines to aim for higher capacity next year.

Capacity is not created from one day to the other, but it’s where available resources and expectations for demand come together. The capacity being up 10% compared from pre-pandemic levels shows the underlying assumption that demand will continue to be robust and while things in the airline industry can change rather quickly I do think much of 2023 will be strong from the demand side with off-peak unit revenues.

Focusing on available resources, that consists of various components but the most important ones at this points are flight deck crews and aircraft. You need crews to fly the aircraft and you need new technology aircraft to do this cost-efficiently over the longer term. So, the past year driven by a combination of pilot shortages as well as building reliability into the schedule assets has been underutilized. However, at the moment most airline executives started discussing shortages, Southwest Airlines was already working on building training capacity. As a preferred airline for pilots, they have no problem in hiring staff, but training would be the bottleneck. Southwest Airlines was the first airline that detailed a plan ranging from how many instructors they needed to how many simulators they needed to hire and train 1,200 pilots this year and over 2,000 next year. So, all of those steps taken last year lead to the capacity of 110% of pre-pandemic levels. Likely there’s some buffer built into that capacity projection as well as the reality that whatever crew they train is not going to be fully efficient. Not this year and not next year. Southwest Airlines has been most clear on pointing that out.

Looking at aircraft, there obviously is a problem. Boeing and Airbus cannot build planes fast enough due to shortages in the aerospace supply chain. For Southwest Airlines there’s another complicating factor, namely the Boeing 737 MAX 7. Southwest Airlines is one of the few customers for the type, but Boeing is running into problems getting that aircraft certified. So, to de-risk the capacity plan for next year Southwest Airlines has flexibility for aircraft retirements and the company has started scheduling more deliveries of the MAX 8. Compared to the previous quarter’s fleet plan, the company now expects to take 10 fewer MAX 7 aircraft and has converted options bringing the net increase for the MAX 8 to plus 21. In the short term, the MAX 8 provides a bit of a headwind to the number of FTEs per aircraft, but ultimately, the MAX 8 aircraft offer higher revenue potential and on a unit cost basis are more efficient than the aircraft they will replace in the fleet and the aircraft they replace in the order book. The deliveries from 2022 sliding into 2023 also have led to some elevated capex, but that is merely a timing issue. The $1 billion in capex reduction from 2022 will basically be carried over into 2022.

Fuel costs are expected to come down, and in the same way, the airline is de-risking its capacity plan, the company also is de-risking some of the fuel costs components. One obvious de-risk is adopting fuel-efficient aircraft and the other de-risk that the company applies is fuel price hedging with 50% of the fuel consumption for 2023 hedged.

Cost per available seat-mile excluding fuel (CASM-X) is expected to come down 1% to 3%. So, looking into 2023, there’s some uncertainty regarding the development of unit revenues, but what we do see is that the elements that Southwest Airlines can control are managed well with a de-risk to the capacity plan and fuel hedges.

So 2023 looks like a year for the cost to come down while the workforce gains experience and Southwest Airlines keeps identifying opportunities in the field and that will benefit the company beyond 2023.

We do know that from the 2022 guidance provided at least year’s Investor Day, not a lot has materialized. Realistically we also shouldn’t expect that to be the case. A year ago, no airline or company could have expected an invasion of Ukraine to happen and the far-reaching implications it would have on energy prices, inflation and supply chains. So, fuel costs were higher by $1 per gallon than what Southwest Airlines expected while a CASM-X of 14% to 15% higher than 2019 levels was above the 10% to 14% that was initially guided for while the company’s capacity will be down 4.5% compared to guidance of down 3% or up 2% all while the number of new-technology aircraft deliveries will be roughly 50 units lower than anticipated. So, big miss on last year’s guidance but it was another year filled with exceptional events beyond the control of Southwest Airlines. Southwest Airlines did use the opportunity to lower capex and strong unit revenues provided by making dept repayments of $2.6 billion rather than the $455 million that the company had guided for and that will help the company going forward by having lower interest expenses and lower debt repayments in upcoming years.

Value Generation Is A Continued Process At Southwest Airlines

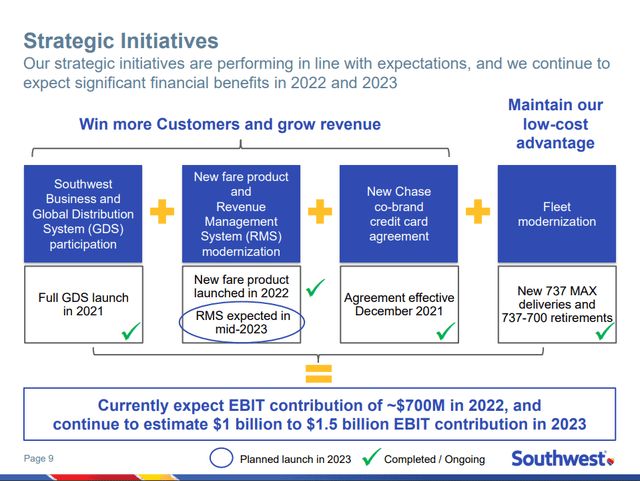

One thing I can really appreciate about Southwest Airlines is their disciplined approach toward managing costs, risks and identifying new opportunities. Last year the company came up with strategic initiatives to create $1 billion to $1.5 billion in added EBIT by 2023. Around $700 million of that has already materialized this year. The company is more focused on business and system business revenues, which we already saw this year when the company elected to fly shorter trips providing a headwind to the unit costs but harvesting strong business revenues in those sectors. Southwest Airlines showed that since 2019, its share from business travel GDS grew from 1% to 10% So, we’re seeing strong progress there and this is likely a permanent addition to the business revenue stream. The airline also saw strength in its new fare product but declined to provide a breakdown per fare class. However, the new fare product launched in May this year is built on evolving demands from air travelers where more flexibility is desired than before.

Going into 2023, the revenue management system will be modernized which gives Southwest Airlines the opportunity to optimize fares and the company will further restore its network by increasing frequencies and also connecting or reconnecting destinations.

In 2023, the company also plans to optimize turnaround times and optimize maintenance planning which will allow for better utilization of aircraft which would allow for adding flights at lower incremental costs better utilizing existing ground staff and facilities. Other opportunities exist in modernizing systems to allow for passenger self-service and overnight flying. So, we see that there are some 2023 items planned that will add value not necessarily in 2023 but definitely in the years after.

Southwest Airlines has mastered value generation quite well. From 2015 to 2019, the company focused on modernizing its fleet with the phase-out of the Boeing 737 Classic and phasing in the Boeing 737-800, and acquiring Air Tran and focusing on a new reservation system and at a new rewards program. This previous set of strategic initiatives had a 19% return on invested capital annually from 2015 to 2019. So, we see that in the same way last year’s initiatives were outlined before that the company already had success with generating value and during the Investor Day we already saw elements that will add value in future years with last year’s initiatives still having some room to increase EBIT further.

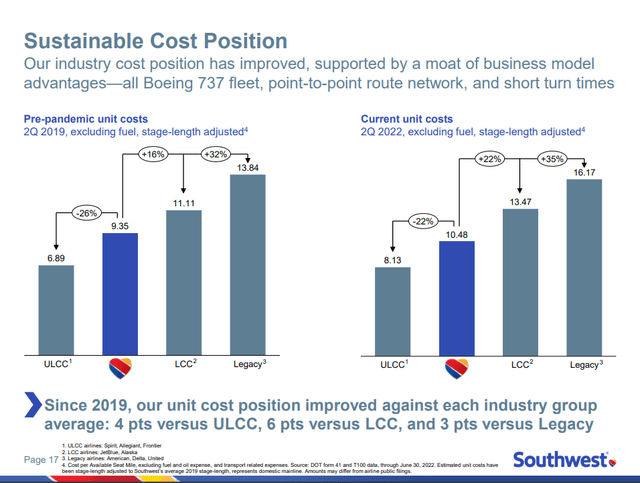

Southwest Airlines Improved The Cost Gap

One concern during last year’s expectations of cost increases was that as a low-cost carrier, Southwest Airlines did not have many levers to cut costs, and in some way, analysts with those concerns were absolutely right. However, at the end of the day, we do see that compared to pre-pandemic carriers the airline narrowed the gap with ultra-low-cost carriers and the cost gap between other low-cost carriers and legacy carriers further widened. So, this is a strong indication that in a tough cost environment Southwest Airlines had a superior positioning when it comes to controlling costs.

Conclusion: Southwest Airlines Stock Is A Strong Buy

While next year definitely will have a big unknown in terms of where unit revenues will head. I do see significant strategic strength and confidence in where Southwest Airlines is heading. The company is extremely well positioned with new initiatives to generate value on top and bottom line while also implementing cost-reduction initiatives.

More importantly, the company has also identified new opportunities for further value generation. At a time when airline executives of other airlines were concerned about stock prices, Southwest Airlines used the challenging times for the airline from operational perspective and share price perspective to set up new strategies and strengthen its business which ultimately has aided the company in reinstating dividends and create long-term rewards that could flow toward investors.

Be the first to comment