ryasick

Article Thesis

Brookfield Infrastructure Partners (NYSE:BIP)(NYSE:BIPC) is a high-quality real asset investment that is well-managed and that has a compelling long-term track record. Due to several macro trends, the long-term growth outlook is compelling as well. And yet, Brookfield Infrastructure has experienced a major pullback in recent months, which has made shares pretty inexpensive relative to the average valuation over the last couple of years. For investors, this provides a buying opportunity, I believe.

Recent Results And Outlook

Brookfield Infrastructure is a real asset player that owns pipelines, terminals, electric grid assets, communications towers and data centers, and so on. In short, Brookfield Infrastructure is active across many of the backbones of a modern society, as these assets help with the transportation and distribution of energy, data, and so on.

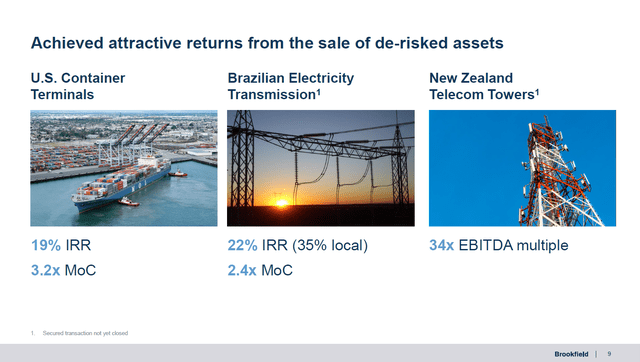

Some of these assets are held on a buy-and-hold basis, while Brookfield also recycles money from time to time. Sometimes, the company acquires underperforming assets with potential for better profits. Brookfield will then improve operations as much as possible, and can then sell the asset at a higher price. The proceeds can then be deployed into new projects. Brookfield Infrastructure has done this very successfully in the past, including during the current year:

Internal rates of return of 19% and 22% on two of the company’s asset sales this year are highly attractive. If the company is able to do such deals in the future, too, then significant shareholder value will be created. Since Brookfield has done similar deals in the past, prior to 2022, I believe that there is a good chance that investors will benefit from such returns on some of the assets BIP buys and sells in the future, too.

Brookfield Infrastructure’s most recent quarterly results were announced in November. The company reported a highly attractive revenue increase of 24% versus the previous year’s period, driven by new investments. Those resulted in a larger asset base, which is why Brookfield’s expenses rose as well. Due to rising interest rates and a higher debt load (due to asset acquisitions being partially financed with debt) BIP’s interest expenses rose as well.

But on a funds from operations basis, which seems like the best way to value BIP as this metric accounts for non-cash charges such as depreciation, Brookfield Infrastructure still enjoyed compelling growth. The company was able to grow its funds from operations per share by 15% year over year. Company-wide funds from operations growth was higher, but FFO per share growth is most important for investors.

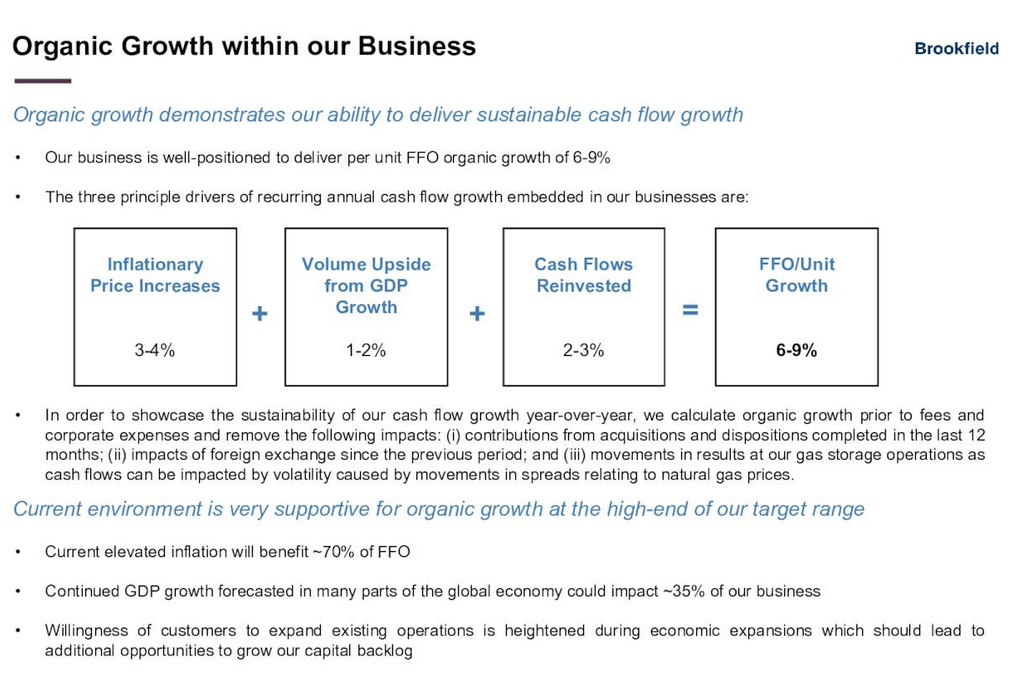

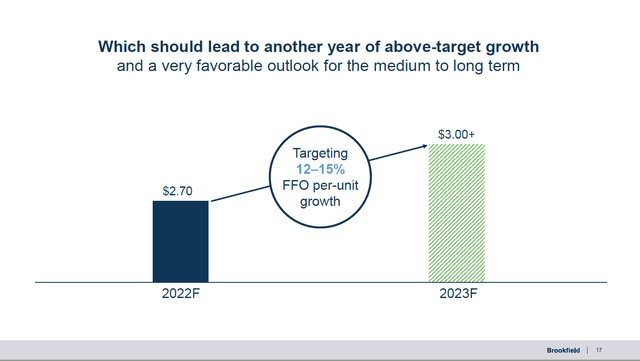

With a 15% growth rate for the quarter, relative to the previous year’s period, Brookfield Infrastructure performed slightly better than during the first half of the year, when FFO per share growth was 11% — but even that was very solid. Overall, the company has grown its FFO per share by 12% so far this year, which is slightly north of the company’s long-term target as can be seen in the following presentation slide that shows BIP’s growth goals:

BIP

Between price increases for existing assets, some volume upside, and reinvested cash flows that allow BIP to add new assets, the company plans to generate 6%-9% annual FFO per share growth. When BIP beats those goals, as is the case in 2022, that’s even better, of course, but it’s not really needed. Even if Brookfield Infrastructure were to grow its FFO per share by just 6% per year going forward, in line with the lower end of the long-term guidance, that could be sufficient to generate a 10% annual return, thanks to a high starting dividend yield that adds meaningfully to the company’s total return forecast.

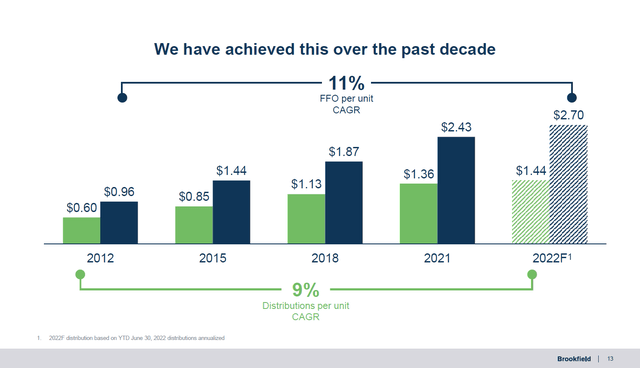

Despite the fact that Brookfield Infrastructure is aiming for a high single digit FFO per share growth rate, its historic performance has been better, not only during 2022, but also during previous years:

The company managed to generate 11% annual FFO per share growth over the last decade, thus 2022 was not a major outlier. It’s great when a company is executing better than its own forecasts, of course. The fact that BIP has managed to outperform management’s own long-term guidance meaningfully over a prolonged period of time could mean that future outperformance of said guidance is more likely than not, too. But investors should remember that past returns do not guarantee future returns, thus FFO per share growth could be lower than what we have seen over the last decade going forward.

No matter what, it seems highly likely that BIP will generate meaningful cash flow growth in the long run, even if it is not able to maintain a double-digit growth rate. Brookfield’s assets are needed, and since regulation makes it ever more complicated to build large and expensive assets such as pipelines, there is very little risk that BIP’s assets will not be needed in the future. In fact, I believe that those assets will become harder to replace going forward, making them more valuable. This, in turn, should also give BIP an improving negotiating position, which is why I believe that the organic growth potential from existing assets is meaningful via volume growth and pricing.

In the very near term, Brookfield Infrastructure is forecasting a highly compelling growth rate as well:

For the upcoming year that starts in two weeks, BIP is forecasting a low-teens FFO per share growth rate, using the midpoint of the guidance range. Since inflation is currently higher than the long-term average, price increases should have a more meaningful impact relative to an average year, especially since some contracts are CPI-linked. This will give a nice boost to BIP’s results next year, which is why above-average growth isn’t surprising.

Shares Are One Of The Best Values In Years

With BIP likely generating more than $3 per share in funds from operations next year — at a 13.5% increase versus 2022, the precise result would be $3.06 per share — BIP looks quite inexpensive. 2023 will be the best year in the company’s history by far when it comes to generating cash flows, and yet, shares have pulled back very meaningfully over the last couple of months.

From a 52-week high of $46, shares of BIP have fallen all the way back to $31, meaning BIP is currently trading at just 10x forward FFO. That’s a solid valuation for a company generating no growth or very modest growth. But for a company like Brookfield Infrastructure, that has grown its FFO per share at a double-digit rate over the last decade and that will grow very meaningfully over the coming years as well, that looks like a pretty attractive valuation, I believe.

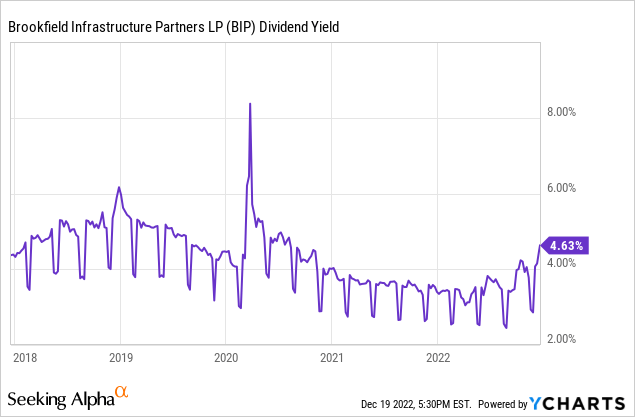

We can also look at BIP’s dividend yield in order to gauge the attractiveness of shares at current prices:

Today, the yield is the highest it has been over the last two years. During the COVID panic in early 2020, its yield was way higher for a very short period of time. In 2018 and 2019, shares also offered a higher yield for a while, but it should be noted that the dividend payout ratio was higher back then. Today, with a lower payout ratio, the dividend is safer. And yet, the yield is at a multi-year high today.

When a company generates a dividend yield of 4.6%, not a lot of growth is needed for a solid return in the 8% range. In fact, BIP could achieve this by growing its FFO per share and its dividend by just 3%-4% a year going forward. Based on management’s guidance and the past track record, I do believe that it is highly likely that actual growth will be better than that. This should, in turn, result in total returns of more than 8% going forward. If, for example, BIP grows its FFO per share and its dividend by 7% a year going forward, total returns could be in the 11%-12% range at constant valuation multiples.

When we add the potential for BIP’s shares to benefit from multiple expansion — shares are currently cheap, after all — then returns could be even better. In short, this stock currently looks like an investment where high-single-digit returns seem achievable even if some things go wrong. When everything goes right, returns deep in the double-digit range are realistic.

Takeaway

Brookfield Infrastructure is a high-quality real asset investment with a strong track record that has generated compelling results in recent quarters. The near-term outlook for the remainder of 2022 and for 2023 is attractive as well. I do believe that there is a high likelihood that BIP will generate attractive returns of 8% or potentially much more than that going forward. With shares trading at a 52-week low and with the dividend yield standing at a multi-year high, BIP looks attractive.

Be the first to comment