nadla/iStock via Getty Images

Co-produced with Treading Softly

It doesn’t take living a long time to notice that life is filled with cycles.

We have lunar cycles, years, seasons, billing cycles, and the list goes on.

So it makes sense we’d also need income that comes to our account on a recurring basis. It has to be recurring simply because life’s demands are exactly like that. Your living expenses will keep recurring – and growing!

When we take a birds eye view of the market, we see that many companies which pay dividends, do so on various recurring cycles. Some pay once a year, others twice, others 4 times, and some others monthly.

I try to not let how often a dividend is paid to govern if I invest in the company, but I will say that I naturally gravitate to those that pay more frequently versus less frequently.

Why is that the case? Let’s take a look.

Monthly Income vs. Monthly Bills

Remember the idea of life being filled with recurring cycles? One of the big ones that adults have to deal with is expenses. Your monthly assortment of bills is like a crowd of angry people demanding their cut of your paycheck, but unlike that crowd, you actually benefit from using their services.

Power bills, trash collection, water, sewer, internet, phone, etc. are frequently bills that must be paid on a monthly basis. It is entirely possible to budget an annual dividend over 12 months’ worth of bills, but it is significantly easier to match monthly income to monthly bills.

Some newer income investors will find it encouraging to watch their monthly dividend income start being able to cover specific bills and expand that coverage over time. I’d start small, your phone bill, or your water bill for example, and as you grow your portfolio, eventually it’ll cover both.

I remember one member of our High Dividend Opportunities community celebrating that their monthly dividend income had become large enough to cover their mortgage payment – a long-time goal of theirs. It was not much longer before their monthly dividend income was able to cover all of their monthly expenses. This gave them massive peace of mind; it meant if their employer let them go in a recession or downturn, they wouldn’t be left destitute.

Allow Rapid Reinvestment or Redeployment

When dividends arrive in one’s account. It opens the door to countless opportunities on how to use them. You get to decide what the best use is. For many who are not retired, the entire amount will be plowed back into their portfolio to grow its size and income output.

This is another quiet benefit of monthly dividends. They allow that income being received to start compounding more quickly.

Consider this, if you had $20,000 and it earned 10% yields. After 5 years, if it was paying interest annually and reinvested, it would turn into $32,210.20. Yet when interest is paid monthly and reinvested, it would turn into $32,906.18. That is a $695 difference or over $100 a year in loss from getting paid less frequently.

Likewise, when it comes to growing income for decades upon decades, that small difference can balloon. If we expand our timeframe to 40 years, the difference reaches over $168,000 in difference, nothing to scoff at!

So when I find a solid monthly income stream, I’m not looking to turn it away without a good reason.

Two Excellent Monthly Payers

That all being said, I want to take a moment to highlight two funds I feel are at dirt-cheap prices and pay monthly income to their shareholders.

Not only are they at excellent price points currently, but they are also at historical discounts to their normal discount/premium values.

So what are these two opportunities?

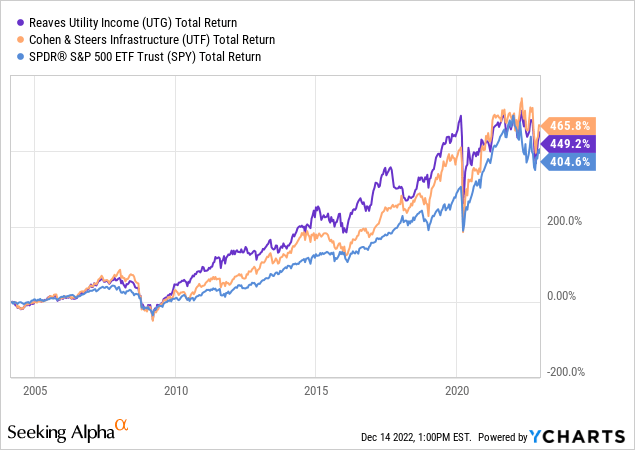

Reaves Utility Income Fund (UTG) which currently yields 7.8% and Cohen & Steers Infrastructure Fund (UTF) which currently yields 7.7%. Both of these funds pay strong monthly income and have outperformed the market over the long haul and this year.

How do these two monthly paying CEFs do this? They invest in highly defensive, essential, and dividend-paying securities. UTF’s top holdings are well-known income names – NextEra Energy (NEE), Enbridge (ENB), and American Tower Corp. (AMT). Likewise, UTG’s top holdings are equally impressive – BCE Inc. (BCE), Ameren (AEE), and Duke Energy (DUK).

So by holding strong dividend-paying securities for long periods, both UTG and UTF have been able to provide NAV stability and recurring income which you can see above has allowed them to outperform the S&P 500 (SPY) over a multi-decade span.

Furthermore, as we look forward to a recessionary environment, their defensive holdings with long histories of raising their dividends allow holders to have comfort in knowing that UTF and UTG will be able to continue paying strong income to their accounts.

Conclusion

The market moves in cycles along with the economy and most things in our lives.

So when you discover two monthly income-paying securities on-sale at dirt-cheap prices. You begin the adding or buying cycle and then enter into the DRIPing and holding cycle all while enjoying performance that historically has outperformed the overall market – with massive income being paid to you to boot!

This way when your life enters the retirement cycle, you’ll have plenty of income pouring in from reliable sources and you have one less thing to worry about each month. Monthly income continues to meet monthly expenses head on and your budget remains in a surplus.

With longer, cooler nights, I have entered into my favorite winter pass time, enjoying a fire in the evening, whether it be in my fireplace or fire pit. Watching the flame rise and hearing the crackling of the wood gives me great opportunity to reminisce and think over the day’s events, while planning for tomorrow. There’s a peace of mind that I’m able to have because I know my income stream is strong and coming back soon to drop off more dollars into my accounts.

Be the first to comment