Maxxa_Satori/iStock via Getty Images

My last article about FactSet Research Systems Inc. (NYSE:NYSE:FDS) was published a year ago when the stock was trading around $370. Back then, I already did not see FactSet as a good investment, but in the meantime the stock clearly outperformed the S&P 500 (SPY). While the index declined about 7.5%, FactSet could gain about 23.5% in value (not including dividends).

But while the stock price increase might be good for those invested in FactSet, I don’t think the increase is justified. The stock is now trading at an even higher valuation multiple than in September 2021 when my last article was published and, in my opinion, we will see a multiple contraction during the next bear market.

Quarterly Results

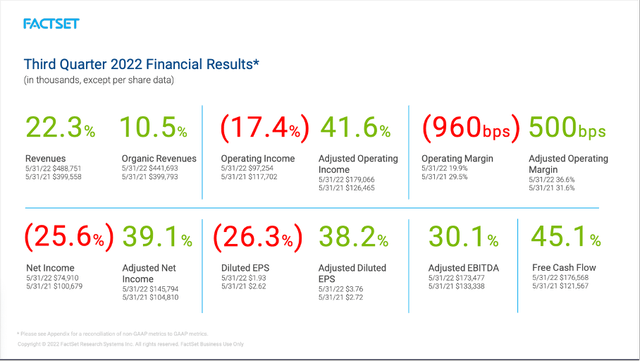

When looking at third quarter results for fiscal 2022, FactSet is still reporting solid results. Especially the top line increased 22.3% year-over-year from $399.6 million in the same quarter last year to $488.8 million this quarter. However, operating income declined from $117.7 million in Q3/21 to $97.3 million in Q3/22 – resulting in 17.3% year-over-year decline. And diluted earnings per share also declined from $2.62 in Q3/21 to $1.93 in Q3/22 – resulting in a decline of 26.3% year-over-year. However, free cash flow – one of the most important metrics in my opinion – increased from $121.7 million in the same quarter last year to $176.6 million in Q3/22.

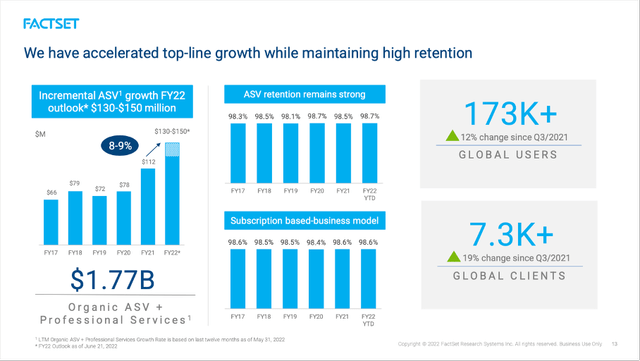

FactSet Q3/22 Earnings Presentation

FactSet could also increase the number of its clients (more than $10,000 annual subscription value) by 147 during the last three months to 7,319 and the number of users increased by 2,357 in the same timeframe to 173,698.

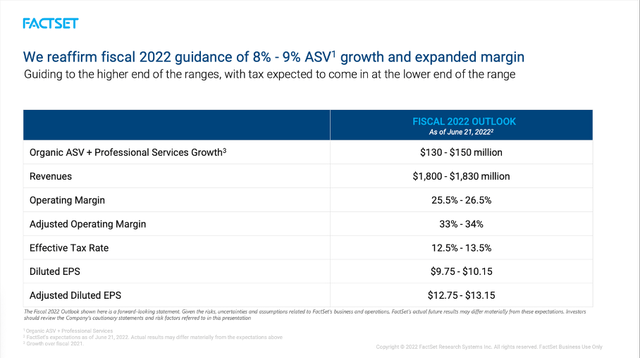

When looking at the guidance for fiscal 2022, FactSet is expecting revenue to be between $1,800 million and 1,830 million (resulting in 13% to 15% year-over-year increase) and adjusted earnings per share are expected to be between $12.75 and $13.15.

FactSet Q3/22 Earnings Presentation

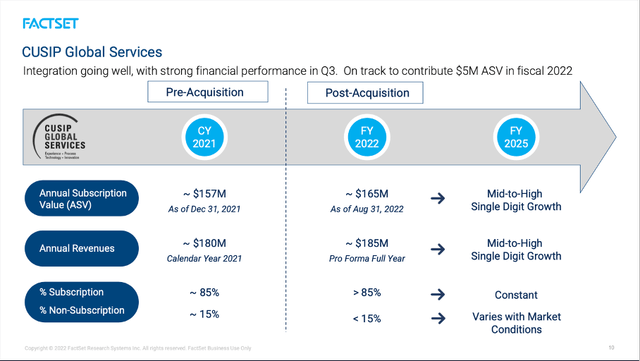

While revenue growth might look impressive, the increase was mostly due to the acquisition of CUSIP Global Services as the acquisition led to $49.4 million in additional revenue in the third quarter. Nevertheless, organic revenue still grew 10.5% year-over-year. And the acquisition led not only to higher revenue but is in parts also responsible for the declining operating income and declining earnings per share. The increased costs for “selling, general and administrative” which increased 56.5% year-over-year to $119.9 million due to the acquisition are part of the reason. And interest expenses also increased to $12.1 million. Another reason for the declining operating income was the $49.0 million “long-lived asset impairment” during the third quarter.

Acquisition of CUSIP Global Services

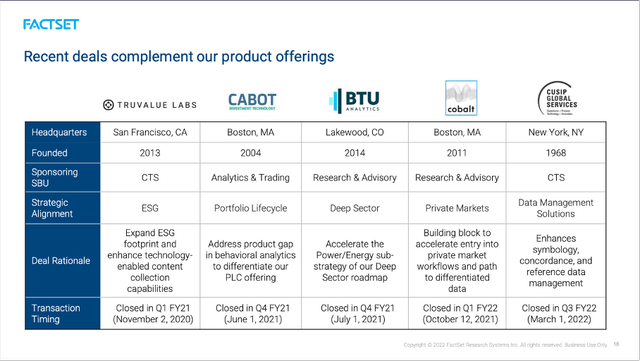

In the last few quarters, FactSet made several acquisitions. Among others, FactSet acquired Truvalue Labs, BTU Analytics as well as Cobalt. But one acquisition was clearly the most important in the last few years – the acquisition of CUSIP Global Services.

In March 2022, FactSet announced the successful completion of the acquisition of CUSIP Global Services from its competitor S&P Global Inc. (SPGI) for $1,925 million. The business is generating about $175 million in annual revenue and is expected to grow revenue in the mid-to-high single-digit range.

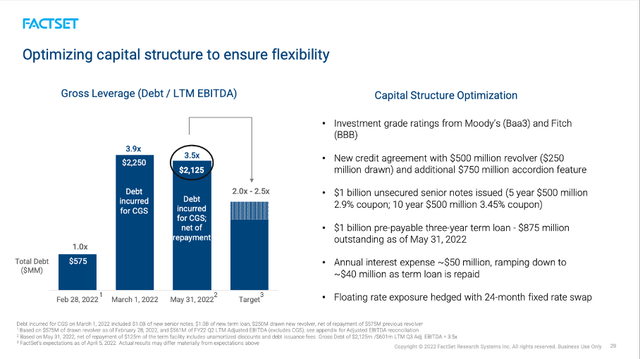

FactSet Q3/22 Earnings Presentation

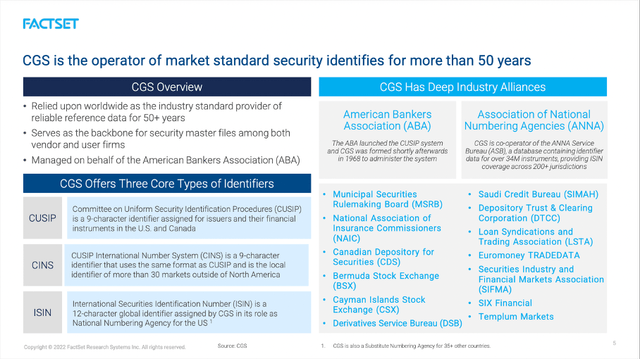

CGS is managed on behalf of the American Bankers Association and is relied upon worldwide as the industry standard provider of reliable reference data for more than 50 years. The company serves as the backbone for security master files among both vendor and user firms and offers three core types of identifiers – CUSIP (a 9-character identifier assigned for issuers and their financial instruments in the United States and Canada), CINS (a 9-character identifier for more than 30 markets outside of North America) and ISIN (a 12-character global identifier assigned by CGS in its role as National Numbering Agency for the US).

FactSet CGS Acquisition Presentation

The acquisition also influenced the balance sheet. On May 31, 2022, FactSet had $43 million of short-term debt as well as $2,062 million on its balance sheet. When comparing the total debt of $2,105 million to a total equity of $1,268 million, we get a D/E ratio of 1.66 which seems rather high but might be still acceptable. We can also compare the total debt to the operating income FactSet can generate annually ($525 million in the last four quarters) and it would take four years to repay the outstanding debt. This also seems to be acceptable – especially as FactSet is able to grow its business with a rather high pace. And we should also not forget $527 million in cash and cash equivalents.

FactSet Q3/22 Earnings Presentation

All in all, the balance sheet is not perfect, and ratings of Baa3 from Moody’s Corporation and BBB from Fitch are still “investment grade” but rather at the low end of the spectrum. On the other hand, FactSet’s target is to decrease its gross leverage (debt / LTM EBITDA) from 3.5x to about 2.0x – 2.5x and will probably earn a better rating again in the coming years.

Recession

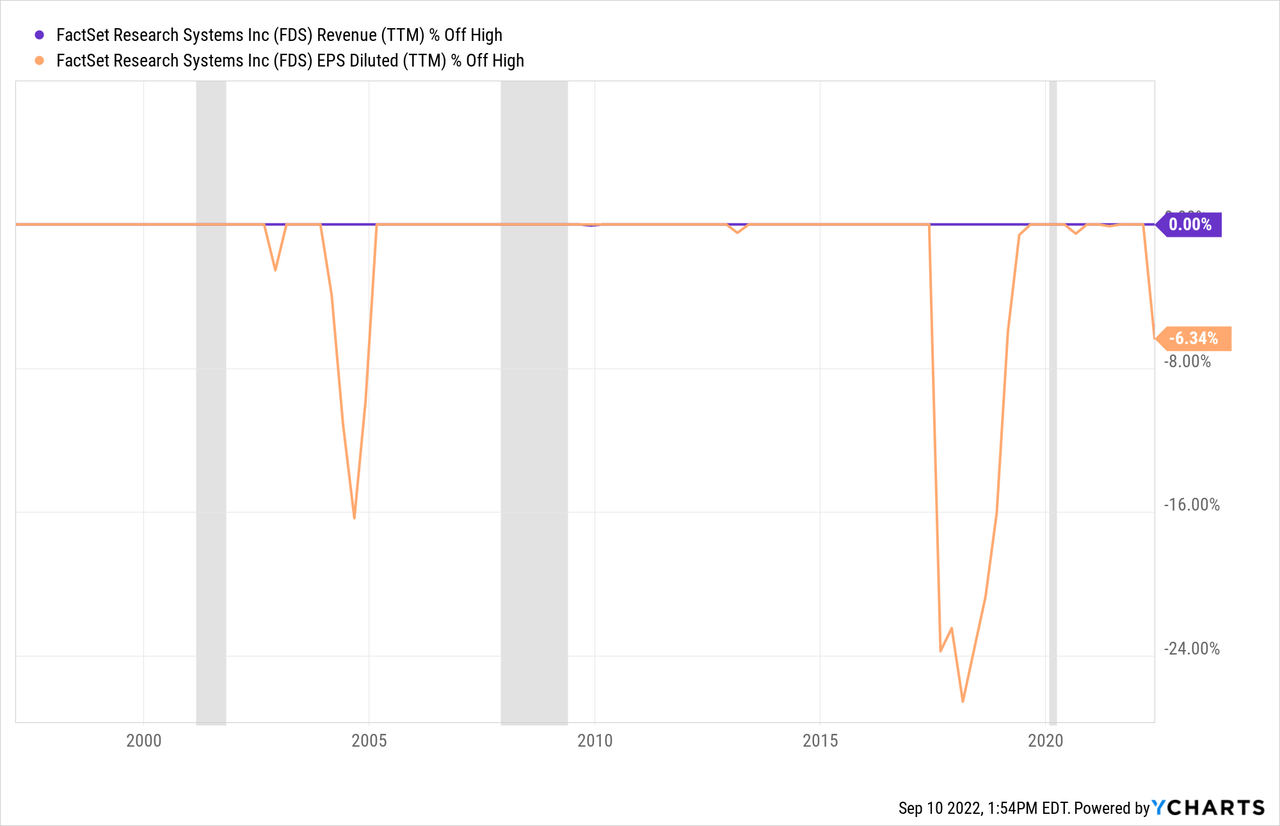

But when talking about FactSet’s performance during the last 25 years, we see trailing twelve-month revenue numbers that never declined – not even during a recession. When looking at earnings per share, we see two declines during these 25 years, but these two declines cannot really be associated with a recession. Just by looking at the numbers, we must assume FactSet being extremely recession-proof.

And while I don’t want to dispute evidence from the past, we still must assume FactSet being affected by the next potential recession. In case of a bear market – and the 2020 bear market doesn’t count as it was quickly replaced by euphoria once again – the number of clients and users will probably decline. When asset prices are declining quarter over quarter, many people are suddenly not interested in financial markets anymore and often sell assets. This will lead to a lower number of users and institutional investors might cut staff (which will also lower demand for subscriptions).

And FactSet is getting more and more mature over time, and this is also increasing the risk for a declining revenue during recessions. For young businesses, it is much simpler to achieve (high) growth even during recessions – revenue growth might slow down during recessions, but revenue is most likely not declining. While there is the chance of FactSet performing quite well during the next recession, we should also keep the scenario of financial service companies being negatively affected by a brutal and long-lasting bear market in mind.

Wide Economic Moat and Growth Potential

Of course, the subscription model might lead to a lower number of clients and users cancelling the subscription. FactSet has a wide economic moat around its business, which will protect the company from declining revenue to some degree. The economic moat mostly stems from switching costs, which I described in my first article about the company:

These switching costs mostly stem from steep learning costs, that most companies and clients are trying to avoid. A company might have to train its staff to use another platform and the knowledge how to use FactSet’s tools and programs that many employees might have gained over the years suddenly is lost. To understand the whole functionality of a platform takes a lot of time. Especially smaller companies don’t have the time and/or financial resources to double these investments they already made (considering money as well as time).

Additionally, these systems and the provided data might also be embedded in other applications or software the company uses and this embeddedness is creating high switching costs as it would take a lot of time to “fix” this. So even if another company comes along with a slightly better or cheaper product many customers won’t switch as the process of switching costs a lot more than the company would save and this is creating pricing power for FactSet.

These switching costs also become obvious when looking at the high retention rates FactSet had in the past due to its subscription-based business model.

FactSet Q3/22 Earnings Presentation

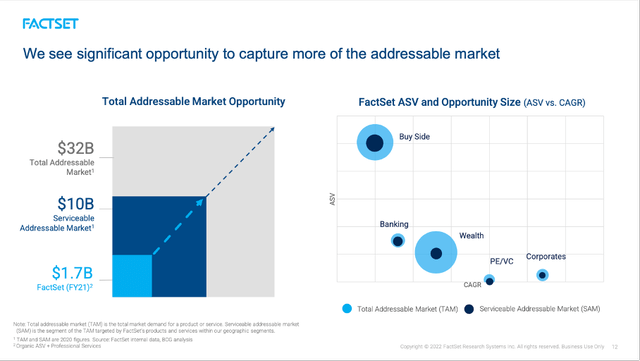

And FactSet does not only have high switching costs leading to a wide economic moat. According to the company, the total addressable market is $32 billion, and management is seeing significant opportunity to capture more of the addressable market. Of course, we should not get carried away by – in many cases – overly optimistic expectations what the total addressable market could be. FactSet is not the only player in the market and competitors are trying to take market share as well. Instead, we can look at the more reasonable serviceable addressable market of $10 billion, and compared to $1.7 billion in annual subscription value for FactSet, there still remains plenty room for growth.

FactSet Q3/22 Earnings Presentation

But despite the growth potential, FactSet remains a bit overvalued in my opinion and is still not a good investment right now.

Intrinsic Value Calculation

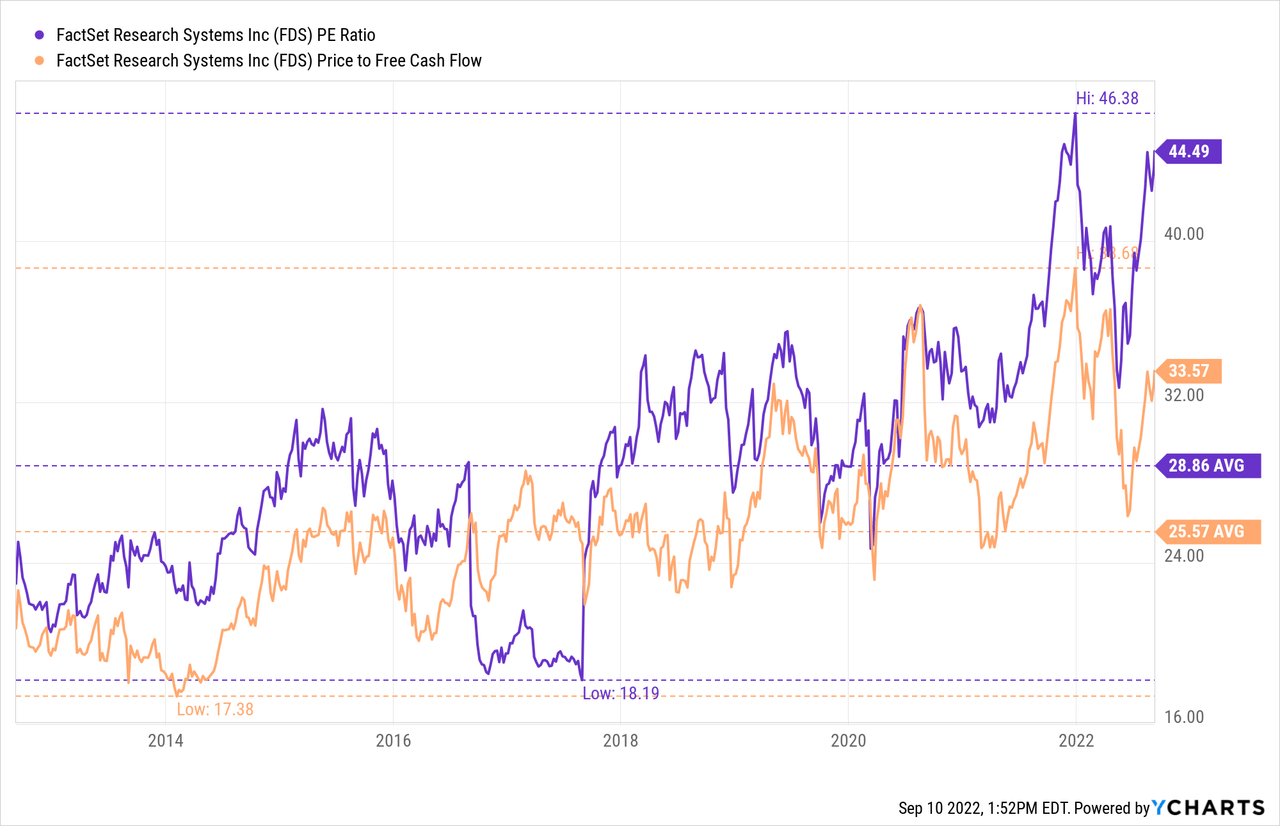

The main problem of FactSet is mostly the rather high valuation multiples. In the last few quarters, valuation multiples already contracted for several stocks. FactSet, however, is still trading close to the highest P/E ratio it has been trading in almost 15 years. When my last article was published (and the stock was already too expensive in my opinion) FactSet was trading for 37 times earnings and now it is trading for a P/E ratio of 45. This is not only above the 10-year average P/E ratio of 28.86 but posing a high risk for multiple contraction in my opinion. Valuation multiples close to 50 are rather seldom during a recession and I consider it highly unlikely FactSet will be able to remain at such high multiples. We should be prepared for valuation multiples to contract, and the stock price being cut in half just by lower valuation multiples investors are ascribing FactSet seems like a realistic possibility.

Aside from looking at valuation multiples, we can also use a discounted cash flow calculation to determine an intrinsic value for FactSet. As basis we can use the free cash flow of the last four quarters, which was $522 million. And even in a very optimistic scenario, we must assume a stagnating free cash flow in fiscal 2023 (the acquisition might lead to a higher free cash flow, but the recession will have a negative effect and offset this increase. For the following years until fiscal 2032, I assume 11% growth (which was the average growth rate of the last 10 years) and till perpetuity we assume a growth rate of 6%. Even when calculating with these rather optimistic assumptions, we get an intrinsic value of $433.90 for FactSet and the stock remains a bit overvalued.

Conclusion

FactSet also belongs to the category of great businesses with a wide economic moat that are just not available for the right price. While the business model is great, the stock is simply not a good investment as it is too expensive in my opinion.

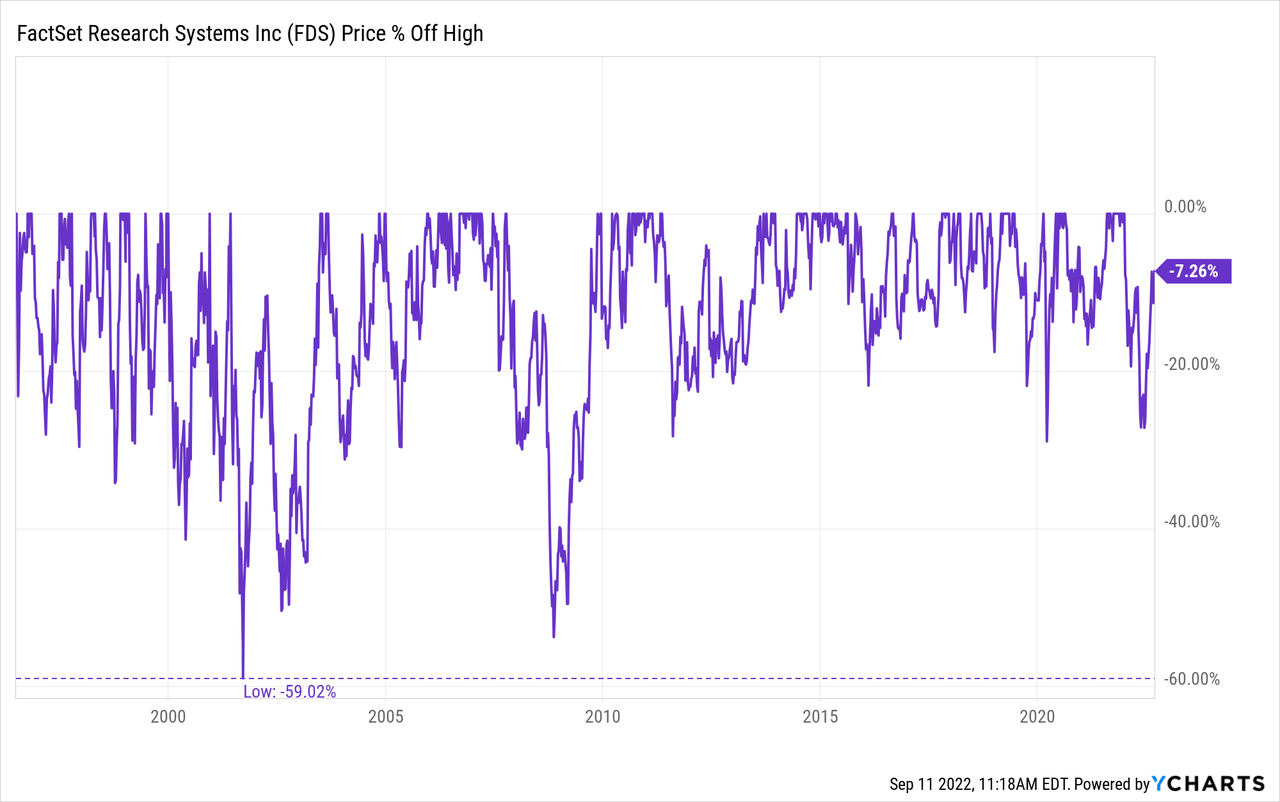

Due to the extremely high valuation multiples, FactSet is faced with a high risk of multiple contraction in the next few quarters. And in combination with possibly lower earnings per share, FactSet’s stock could easily be cut in half – like it has been following the Dotcom bubble and the Great Financial Crisis.

Be the first to comment