Fabian Gysel/iStock Unreleased via Getty Images

Embraer S.A. (NYSE:ERJ) hasn’t opened particularly well, with free cash flow guidance seeming to fall below forecasts. The culprit continues to be supply chain difficulties that are hampering deliveries and revenue. Nonetheless, Eve Holding (EVEX) continues to hold value, and deleveraging is substantial over the last couple of quarters, with risks therefore being substantially diminished and the profile notably improved. Moreover, there are positive regulatory developments in the commercial segment, and the KC-390 is garnering interest after its recent debut in the market.

Where many of Embraer’s businesses looked like discount counterparts to other aviation players, it is beginning to look more like an aviation staple and a real contender in the markets. We believe there is a fair bit to come from Embraer as give and take from macro pressures ease some markets and harshen others. Overall, their scale and marginality is likely to hold.

Embraer Q3 Earnings Breakdown

The Q3 report was not particularly loaded, but we focus on a few salient points that are key in understanding the evolution of the Embraer proposition, and why it is being managed well for an improvement in profile and markets that deserve a graduation from the crud-bucket into something more respectable:

- Deleveraging has been substantial. Debt fell by about $800 million YTD, or around 25%, and this has not come exclusively from the Eve IPO, where Embraer still holds 90% of the company. Leverage was a big concern in prior years, as cost improvement programmes were in their infancy, margins were bad, and the only line of products in defense was the Tucanos, which are not a threatening modern plane. That leverage has been substantially reduced and doesn’t dominate the claims on the assets anymore. Leverage is closer to being a third of EV nowadays. You can’t lose all your money if leverage isn’t an issue – for Embraer, it is now less of an issue. It’s a key evolution in its financial profile.

- The KC-390 heavy-lift aircraft was debuting on the market not long ago, more or less last year. The only deal it had was with the Brazilian government, which committed to the plane, but then actually tried backing out of the deal. While the deal shrank, there has been a new agreement, and it defends Embraer’s position with more compensatory clauses and other elements. What matters is that Brazil is now not the only interested client. A deal has been signed with South Korea, and there are planes on the line for Brazil, Hungary, and Portugal. It is still working through NATO tests. What’s more is that ERJ has signed a deal with L3Harris (LHX) to work on developing an agile tanker version of the 390. This could turn into a major deal with the massive USAF, and L3 bothering to get involved is impressive. India may get involved with the 390 at some point, and the markets could grow if this still nascent platform meets expectations of militaries. The Portugal client ordering two planes could be an important stepping stone into more NATO contracts. Things are looking promising here.

- Executive aviation remains a strong market, and this is something we’ve appreciated since the depths of the pandemic. Deliveries of both small and medium-sized cabin executive jets are higher.

- China has approved the line of ERJ commercial jets. China is still in lockdown, and this is a dead market at this moment, but it could come online from nothing with regional operators picking up ERJ’s regional jet lineup in commercial. With the rest of the world at earlier stages in their downcycle, China could be the first among major wallet shares to recover as the impacts of supply chain issues and global rate hikes pass through the global economy.

Bottom Line

The opening today was weak because of weak cash flow guidance, but management has made it clear that they are undershooting meaningfully because they may not close some transactions due to supply chain issues before closure of the balances for the full year. Interiors and avionics are apparently keeping things up.

If you complete the guidance what you are seeing today, it’s being much higher than the $150 million, but in the order to not, I would say, give a false information, perfecting to say $150 million, it’s just a matter to get the aircraft out of burden probably is going to be much better, and you are totally right in comparison to the previous year.

Antonio Carlos Garcia, ERJ CFO

Serious working capital bloat has similarly made things structurally worse this year naturally on account of the supply chain issues, which are likely to become resolved as we see inflation decline.

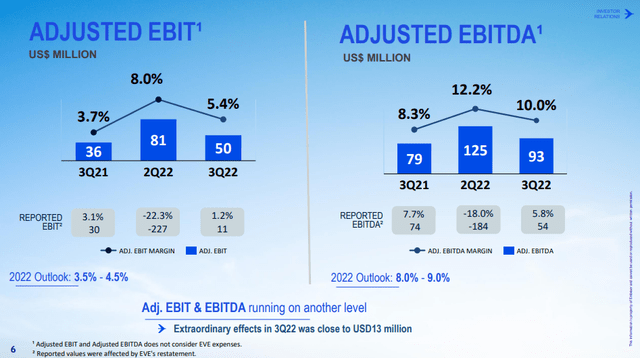

From a valuation point of view, we point out that scale is keeping up despite supply chain struggles, and EBIT is growing with decent margins.

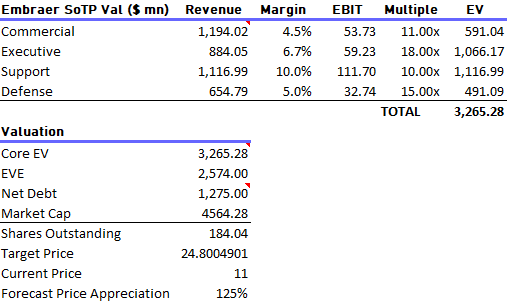

We continue to maintain the following valuation, updating for the market cap of EVEX as of today. Deleveraging should have improved the share price, and therefore upside on a stalled price has grown.

Valuation (VTS)

All the EBIT margins are conservative, theoretical figures based on comps but discounted into less profitable territory, but with comprehensive margins not being far away from our theoretical average, things look pretty good in terms of margin achievement.

While macro conditions may put particular pressure on the commercial segment, with executive and defense likely being uncorrelated, there is the benefit that regional travel is less affected by demand destruction. China is a latent market that may be poised for rebound once it emerges from lockdowns and fiscal injection proceeds.

Overall, the problems of ERJ seem temporary, and in broad strokes, the company has been managed into a more premium category. Exposures are rather resilient, and platforms that were blind bets before like the 390 have turned into potentially interesting market items. Eve is a VC play, but it is more latent value and bolsters the margin of safety. We see no major issue with Embraer S.A. today.

Be the first to comment