kokkai

Thesis

Sea Limited (NYSE:SE) stunned investors during its Q2 earnings card when it pulled its usual guidance for its e-commerce unit Shopee. We had anticipated SE’s May lows to hold. Instead, we believe the market set up a remarkable bull trap heading into its Q2 earnings, which we had failed to pay close attention to.

As such, SE has fallen markedly from its August highs, down nearly 50%. Therefore, the market has set up SE with much more pessimism baked in as Sea Limited heads into its upcoming Q3 earnings release on November 15.

We postulate that the market is likely anticipating a weak FQ3 performance for Sea Limited, despite its efforts to continue improving on “self-sufficiency” as its growth moderated significantly.

Hence, we believe there’s no question that SE was a pandemic boom-and-bust story that ensnared investors caught up with its massive growth thesis. Even ARK Invest (ARKK) (ARKW) CEO/CIO Cathie Wood has lost conviction in Sea Limited’s turnaround as she exited the firm’s positions in SE in late October.

Despite that, we discuss why the gloomy setup heading into its Q3 release forebodes well for investors willing to bet on the company’s turnaround under CEO Forrest Li & team.

Maintain Speculative Buy with a medium-term price target (PT) of $60.

Wall Street Slashed Sea Limited’s Projections

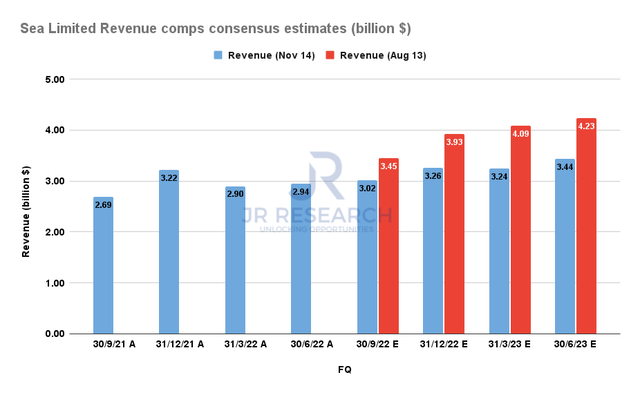

Sea Limited Revenue comps consensus estimates (S&P Cap IQ)

As a reminder, management pulled its full-year guidance for Shopee as it saw significant growth normalization headwinds compounded by worsening macroeconomic and inflation challenges. CEO Forrest Li articulated:

I would like to discuss our decision to suspend the full-year revenue guidance for Shopee driven by the highly volatile and unpredictable macro environment. As shared earlier, while we think the right thing to do during the pandemic lockdown was to prioritize growth with improving efficiency, we think the right thing to do in this time of continuing heightened macro volatility is to prioritize efficiency and self-sufficiency. (Sea Limited FQ2’22 earnings call)

Furthermore, management was reticent on whether it would provide guidance in future earnings commentary, which likely led to significant uncertainties.

Hence, we aren’t surprised that Street analysts have slashed Sea Limited’s revenue and profitability estimates through FY24. As seen above, Sea is projected to post revenue of $3.02B for FQ3, down nearly 13% from its August projections.

We postulate that Street analysts have likely modeled their bear case assumptions on SE’s projections over the medium term, given the negative surprise by management in its Q2 call.

Therefore, the critical question that investors need to consider is whether SE’s valuations have assumed the Street’s pessimism.

SE Last Traded At 1.9x NTM Sales

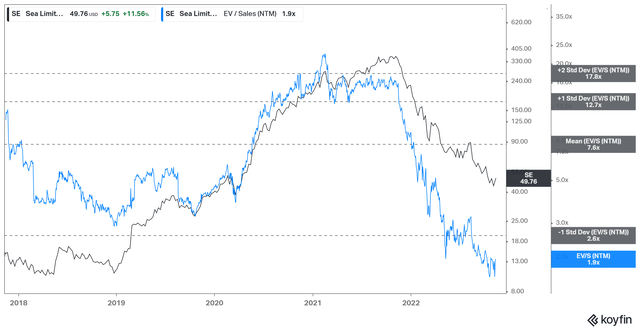

SE NTM Revenue multiples valuation trend (koyfin)

We gleaned that SE last traded at a NTM Revenue multiple of 1.9x. Therefore, we postulate that significant pessimism has already been baked into its valuation as Sea Limited remains in a growth phase.

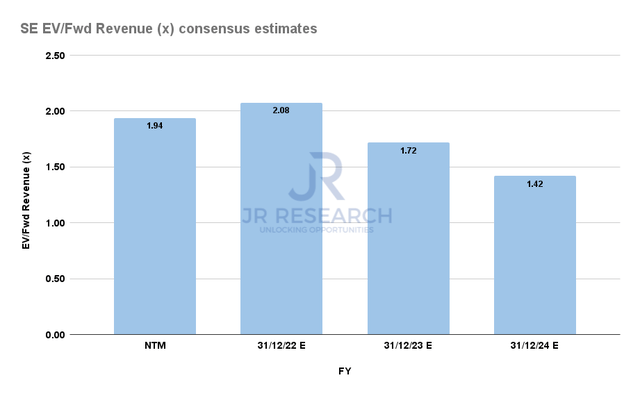

SE EV/Fwd Revenue multiples valuation trend (S&P Cap IQ)

As such, Sea Limited is expected to recover its growth through FY24, improving its valuation to a FY24 revenue multiple of 1.42x.

However, as the company had pulled its guidance, investors do not have a viable guidepost to assess its path toward profitability against management’s forecasts.

Hence, we believe the de-rating is justified, and SE could remain range bound for some time unless market risk-on sentiments return to spur a broad re-rating of well-battered speculative stocks.

Is SE Stock A Buy, Sell, Or Hold?

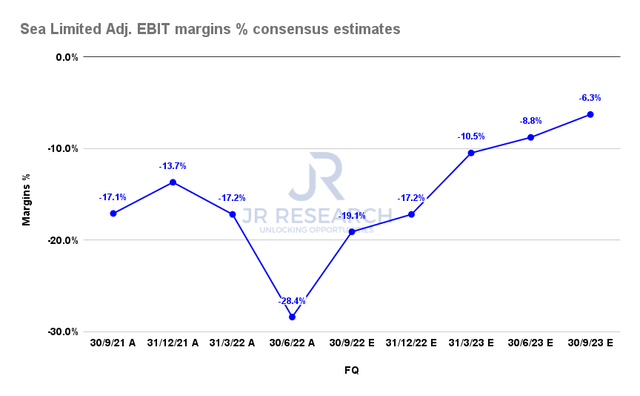

SE Adjusted EBIT margins % consensus estimates (S&P Cap IQ)

SE is still expected to remain unprofitable on adjusted EBIT terms through FY24. Therefore, investors betting on a turnaround of its fortunes are reminded to consider SE a speculative bet and nothing more.

If the market anticipates its path to profitability to extend further, given the macro headwinds, investors need to expect further downside. As such, we urge investors to set up appropriate risk management strategies to protect their capital accordingly.

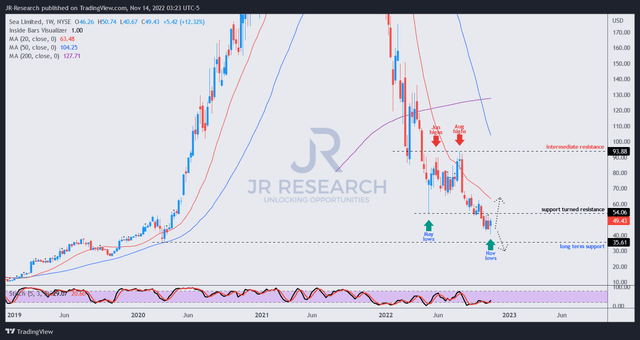

SE price chart (weekly) (TradingView)

At the current levels, the setup for SE heading into its Q3 earnings release is markedly different from its Q2 setup in August.

As seen above, the market drew buyers rapidly into its August highs, which turned out to be an astute bull trap, digesting its momentum significantly.

However, with SE down nearly 50% from its August highs, the market has likely baked in a downbeat FQ3 release on November 15.

Notwithstanding, we must highlight that we do not see highly constructive Buy signals suggesting that investors need to capitalize on the current consolidation.

However, we assess that the reward/risk remains skewed for a mean-reversion opportunity toward the $60+ region from the current levels.

Maintain Speculative Buy.

Be the first to comment