z1b

What I like about the stock market is that it gives investors lots of second chances. For example, there have been many times in which I’ve regretted not buying more of a stock when it was cheap after it rockets higher out of my buy range.

When a stock is flying high, it seems nothing can bring it down, but let’s remind ourselves that the market is prone to periods of over-exuberance and deep pessimism, and the latter is when it’s time to buy.

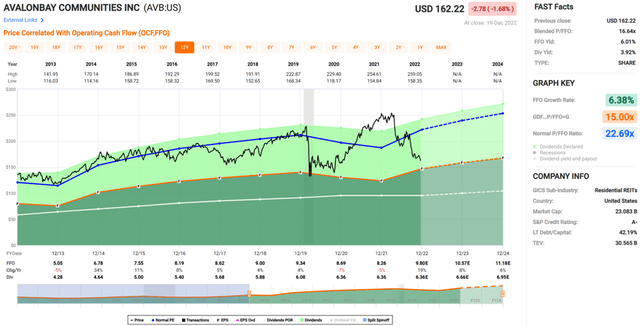

These cycles happen regularly with frequency, and such I find the case to be AvalonBay Communities (NYSE:AVB), which again is trading in value territory since taking off last year. As shown below, AVB is now sitting just shy of its 52-week low of $158. This article highlights why the recent downturn presents an excellent opportunity for value investors to layer into this dividend stock.

AVB Stock (Seeking Alpha)

Why AVB?

AvalonBay Communities is one of the largest Apartment REITs in the U.S., with an ownership interest in 293 apartment communities, consisting of 88K housing units. Its portfolio is diversified across major metropolitan markets 12 states from coast to coast and the District of Columbia.

One of the key strengths of AvalonBay is its focus on quality properties in high-demand locations. The company has a strong track record of acquiring and developing properties in prime urban and suburban areas, which has allowed it to consistently achieve strong occupancy rates and rental premiums. This focus on quality has also helped AvalonBay to attract and retain high income tenants, which has contributed to the company’s steady revenue and earnings growth over the years.

AVB is living up to its track record, with Core FFO per share growing by an impressive 21% YoY to $2.50 during the third quarter. This was driven by strong same store revenue growth of 12% YoY and 2.2% sequentially due to higher rental rates. Also encouraging, management is expecting positive operating leverage, guiding for operating expense growth of 5.8% for the full year 2022. This, of course, results in higher margins, with net operating income growth guidance of 13.4% for the full year.

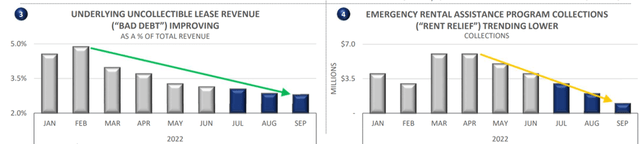

Moreover, it appears that tenant health is trending in the right direction. As shown below, both uncollectible lease revenue (otherwise known as bad debt) has improved every month since February, and emergency rental assistance program collections have improved every month since April of this year.

AVB Tenant Health (Investor Presentation)

Looking forward, AVB is set to see meaningful incremental $130 million in NOI growth over the next few years with its sizeable development pipeline. this includes $2.6 billion in development currently underway that’s still in the early stages of construction. Management hinted at the possibility of even higher potential NOI growth from these projects due to conservative estimates, as noted during the recent conference call:

It’s also worth noting that this future [NOI] growth is based on our conservative underwriting with un-trended rents that are set when construction starts as we typically do not mark rents on these projects to current market levels until we’ve achieved roughly 20% lease status. And again, with only four of these assets currently at that level of leasing, the vast majority of our development underway should benefit from a further lift in NOI when they do open for business.

Property development is in AVB’s backyard, as it has a history of taking advantage of healthy spreads between yields on newly developed properties and asset dispositions. This is reflected by the 7% yield on cost that management expects on the development pipeline, while it was able to sell five wholly-owned properties during the third quarter at an attractive cap rate of 4.1%, implying a potential 3% investment spread between asset dispositions and new developments.

Meanwhile, AVB is just one of a handful of REITs to have an A- credit rating, with a net debt to core EBITDAre ratio of just 4.6x. Furthermore, 95% of AVB’s properties are unencumbered by mortgages, giving it financial flexibility. AVB also maintains plenty of liquidity, recently increasing its credit line by $500 million to $2.25 billion and extended the maturity date to 2026. The bulk of its development funding is secured through the end of next year.

Meanwhile, AVB now pays an attractive 3.9% dividend yield that’s well covered by a 64% payout ratio, based on Q3 Core FFO per share of $2.50. While dividend growth has been muted since 2020, I would expect for growth to ramp up again with a clearer economic picture and as the development pipeline comes online.

Turning to valuation, AVB is attractive at the current price of $162 with a forward P/FFO of 16.6, sitting well below its normal P/FFO of 22.7. I believe AVB deserves to trade at a valuation in the 18 to 20x range considering its track record and outlook. Analysts have an average price target of $195.70, implying potential for double digit total returns.

AVB Valuation (FAST Graphs)

Investor Takeaway

AVB is an attractive option for investors seeking exposure to a very high quality multifamily player. It’s seeing strong revenue growth and is expecting positive operating leverage with its full year outlook, and tenant health appears to be trending in the right direction.

Furthermore, management’s sizeable development pipeline should help drive NOI growth over the next few years. Lastly, AVB carries a strong balance sheet and pays a well-covered dividend yielding nearly 4%. As such, I view the recent market downturn as presenting an excellent opportunity to layer into the stock.

Be the first to comment