Andrii Sedykh/iStock via Getty Images

Typically, blue-chip growth companies trade at materially higher valuations than the rest of the market.

This is well justified given that they’re safer and enjoy faster growth prospects.

But this year, we have seen something quite unusual happen in the REIT sector.

The blue-chip growth REITs in many cases dropped even more than the average of the sector (VNQ) and it has led to some quite exceptional opportunities.

They dropped so heavily because they combine “growth” and “REITs“, both of which are today out of favor due to rising interest rates.

But despite the low market sentiment, many of these companies are doing very well. They use little leverage and continue to grow their cash flow at a rapid pace.

In what follows, we highlight two of our largest blue-chip REIT investments at High Yield Landlord:

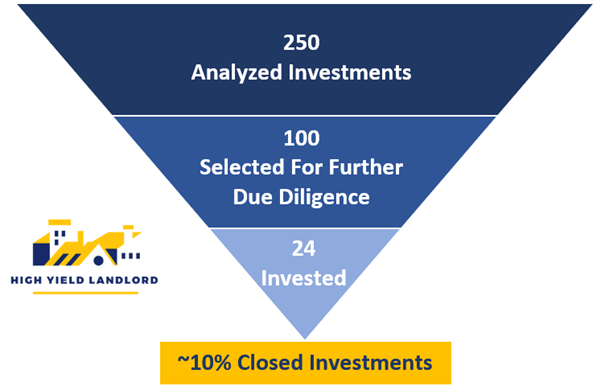

High Yield Landlord

Alexandria Real Estate Equities (ARE)

ARE is the undisputed leader in life science and pharmaceutical laboratory real estate across the nation. Often, the REIT gets lumped in with biotech companies and/or the office real estate sector, which may partially explain its steep price drop this year, but its cash flow is very consistent and its properties are far more specialized than your average office building.

Moreover, a large share of the work done in these laboratory/research facilities cannot be done from home or remotely, which insulates ARE from the work-from-home trend that’s disrupting office REITs. These are mission-critical assets for ARE’s tenants, which are generally the largest and strongest pharmaceutical companies in the world.

There are at least three major reasons why ARE is a blue-chip REIT:

1. High Rent Growth

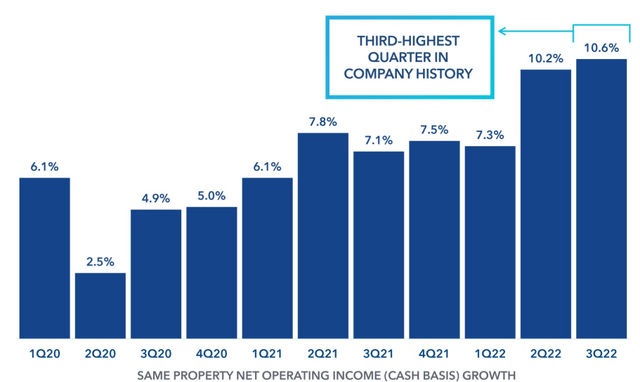

Occupancy sits at 95%, which indicates that demand for ARE’s properties is high. That’s borne out in the rent growth numbers. In the third quarter of 2022, ARE enjoyed the third highest same property NOI growth in its 30-year history:

Alexandria Real Estate Equities

Aging demographics ensure that life science companies will continue to spend heavily on research and development of new products, which means that demand for ARE’s lab properties should continue for the foreseeable future.

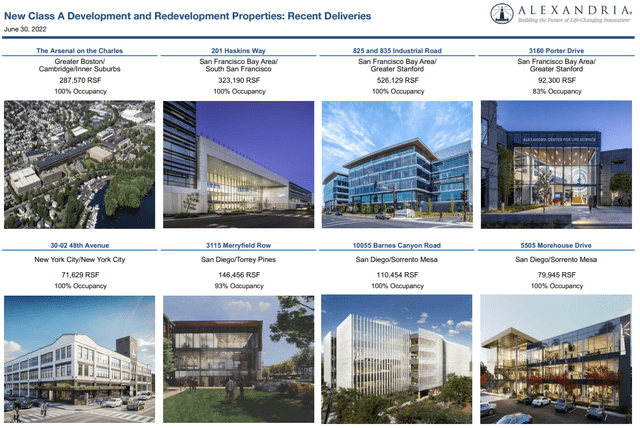

2. In-House Development Platform

Class A life science buildings in unbeatable locations, such as the properties ARE owns, typically trade at cap rates of around 4%. But ARE has an in-house development platform that builds new buildings from the ground up (or redevelops existing properties to have all the newest features) at stabilized cap rates averaging 6.2% on a cash basis.

ARE Q2 Supplemental

This ability to build or redevelop properties gives ARE the ability to create a massive amount of value. Upon completing and stabilizing new projects, ARE has the ability to sell complete or partial stakes in projects for gains in the tens or hundreds of millions of dollars.

For the most part, though, ARE would rather hold on to these brand-new Class A properties and simply enjoy the long-term upside of owning them.

3. Fortress Balance Sheet

ARE’s BBB+ rated balance sheet acts as a wide moat insulating the REIT from much of the damage wrought in commercial real estate by rising interest rates. Consider these points:

- ARE has no debt maturities until 2025

- The weighted average debt maturity sits at 13.6 years

- The balance sheet boasts massive liquidity totaling $5.5 billion (equal to 25% of market cap)

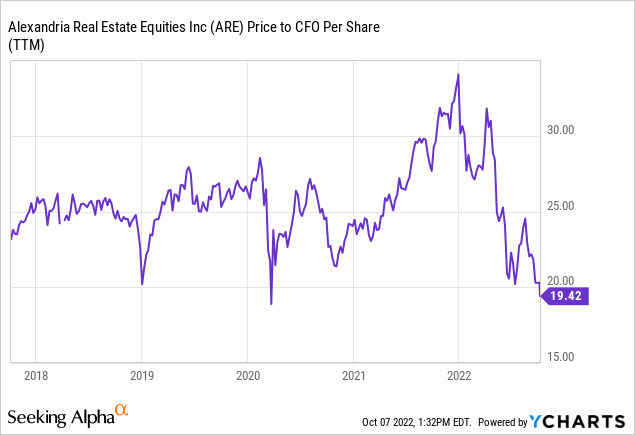

ARE’s biggest “sin” this year has been having a high valuation to match its high-quality characteristics. It’s a growth REIT, and growth stocks are being punished. That has pushed ARE to its lowest valuation at any time in the last five years.

We would conservatively estimate that ARE has 40% upside to fair value, and while you wait to realize that upside, you can enjoy ARE’s steady dividend growth. ARE’s dividend has risen at an average pace of 6.8% per year over the last decade, and that growth isn’t likely to slow anytime soon.

Essential Properties Realty Trust (EPRT)

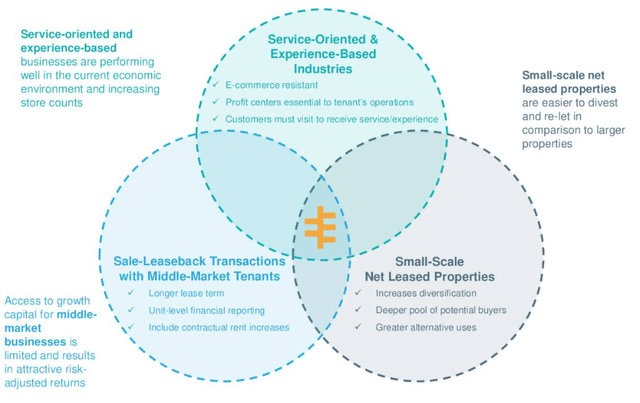

After the take-private of STORE Capital (STOR) is completed, EPRT will be the new leader in middle-market sale leasebacks. That is, the REIT specializes in engaging in transactions with private, middle-market businesses wherein EPRT purchases owner-occupied real estate while simultaneously executing a long-term net lease that puts the tenant in charge of all property maintenance, insurance, and taxes.

Essential Properties Realty Trust

Essential Properties Realty Trust

Since tenants are midsized, privately held businesses, EPRT is able to secure landlord-friendly lease terms such as above-average cap rates of ~ 7.5%, long lease terms surpassing 15 years, rent escalations averaging 1.5% annually, master lease protection, and unit-level financial reporting. This financial reporting shows that EPRT’s portfolio currently enjoys a rent coverage of >4.0x, which leaves significant margin of safety even if we go into a recession:

EPRT September Presentation

Moreover, EPRT also targets smaller properties averaging $2.3 million in value with fungible buildings. The smaller size of its properties widens the potential buyer pool, and more fungible buildings minimize the downside in the case of a tenant default or non-renewal.

This unique strategy has historically resulted in above returns and EPRT is today still just getting started.

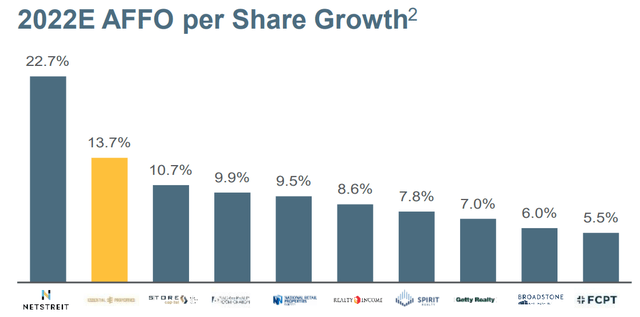

Due to its smaller portfolio size, EPRT has been enjoying some of the fastest growth in the net lease REIT space. In 2021, AFFO per share surged 21% and this year, it is again leading the pack in its peer group, growing far faster than REITs like Realty Income (O):

Essential Properties Realty Trust

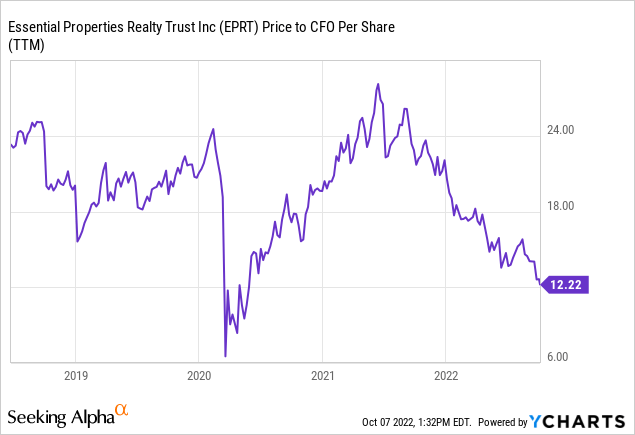

This year, the midpoint of AFFO per share guidance represents nearly 14% YoY growth. Despite this impressive growth, the market has turned greatly negative on EPRT, driving its valuation to near pandemic-era lows.

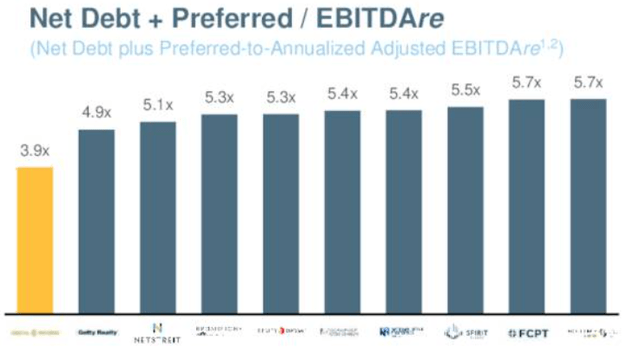

If EPRT was heavily leveraged, this might make sense. But the opposite is the case. EPRT enjoys the lowest level of leverage in its peer group.

Essential Properties Realty Trust

EPRT trades at a price to AFFO of ~13x, but we think it’s worth at least an 18x multiple, giving it ~40% upside to fair value. In the meantime, sit back and enjoy the 5% dividend yield.

Bottom Line

Growth stocks have taken a beating so far this year, and the two REITs discussed above have been part of that.

We think that they should be significantly outperforming the average rather than performing the same or worse than it. That’s because they boast higher quality portfolios, management teams, and balance sheets than the average REIT.

We’re taking advantage of seller panic and buying up more shares in these blue-chip REITs. We believe we will be richly rewarded in the long run because of it.

Be the first to comment