Frazer Harrison/Getty Images Entertainment

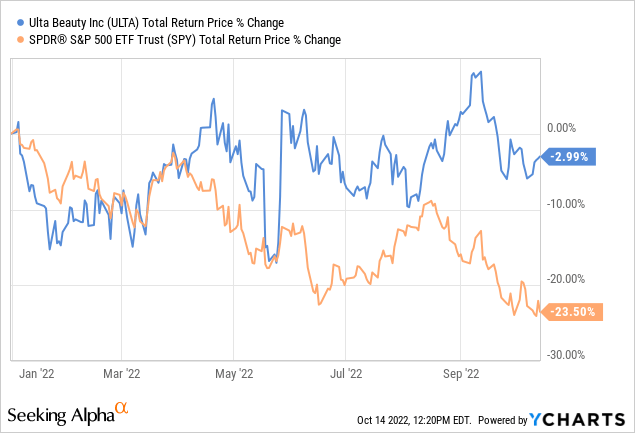

Ulta Beauty (NASDAQ:ULTA) has proven that it has a strong brand, loyal customers, and significant competitive advantages. It has managed to survive and thrive after the Covid crisis, and it has performed well recently despite the weakening macro-economic conditions. Year to date it has outperformed the market, as judged by the S&P 500 index, by a significant margin, and it is barely down a few percentage points.

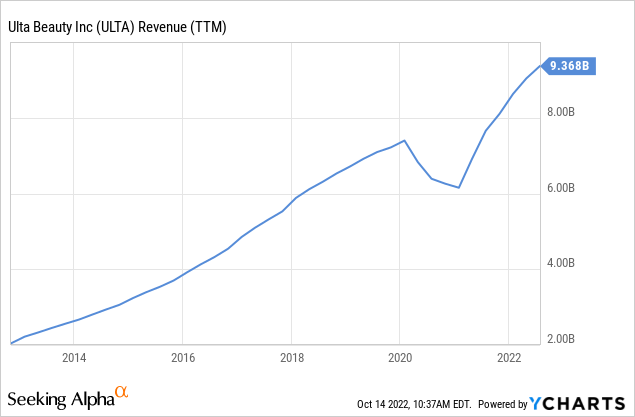

In the last few years ULTA has become the largest specialty beauty retailer in the US, and has one of the most successful loyalty programs with over 38 million members. Sales and earnings have been increasing at an impressive rate. For instance, sales have increased almost by a factor of ten from 2007 to 2021, thanks to significant store openings and higher store productivity. The fact that many of its customers enjoy sampling products in person, and appreciate the personalized attention they receive at the stores, has helped the company successfully compete with e-commerce, including Amazon (AMZN).

Growth

We don’t expect ULTA to match its incredible historical growth, since it already has stores in most major US markets, but we do believe it still can grow sales and earnings at a healthy rate. The company has continued opening stores, so far around 50 this year, and its e-commerce operation is getting bigger too. ULTA is also opening some stores within stores at some Target (TGT) locations.

We find ULTA’s financial target achievable, and they seek compounded growth in net sales of 5% to 7%, and diluted earnings per share growth in the low double digits.

Ulta Beauty Investor Presentation

Looking at its historical revenue, other than the drop cause by the Covid crisis, the company seems to be incredibly consistent in how it has been growing its sales.

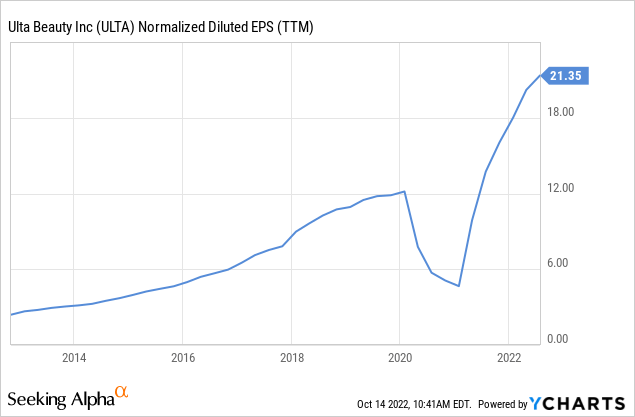

The same thing can be said about its earnings per share, which incredibly are now almost twice as high as the peak before the Covid crisis.

A High-quality Business

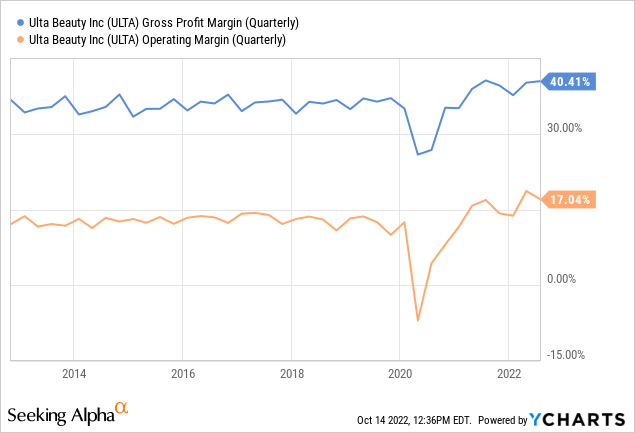

While it is rare for a retailer to have strong competitive advantages, we believe ULTA does indeed have a strong business moat given its high operating margins. It is extremely rare to see a retailer with such high and stable margins, and they are now above what they were pre-Covid crisis.

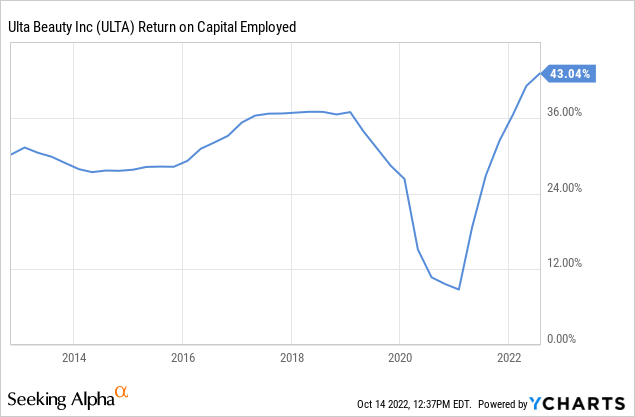

Similarly the return on capital employed is much higher than that of your average business, in fact it is at levels we generally only see with some technology companies or other companies with extremely strong competitive advantages.

Balance Sheet

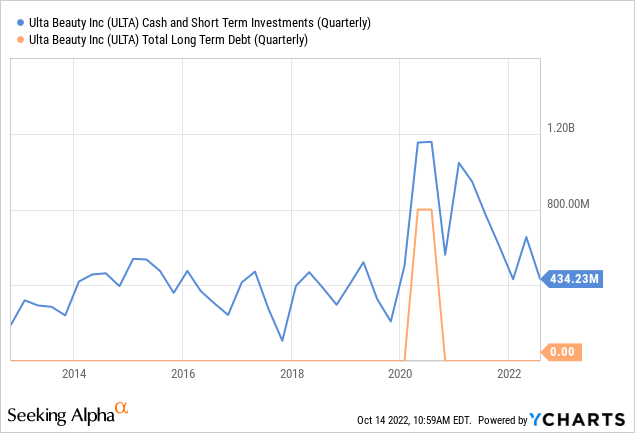

ULTA has an extremely clean balance sheet, with basically no long-term debt, and a healthy amount of cash and short-term investments.

ESG

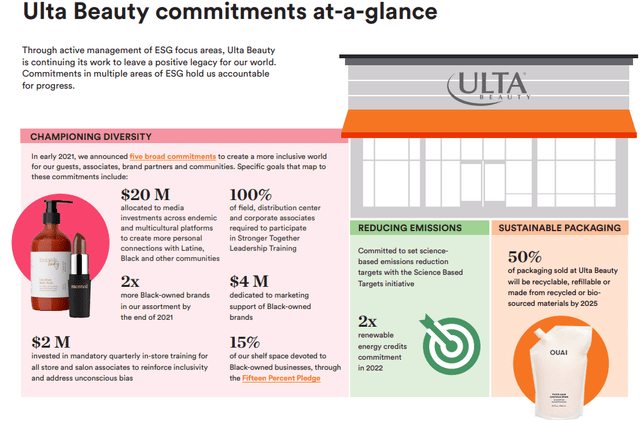

We like that ULTA has been increasing its commitment to good ESG practices on multiple fronts. It is championing diversity, reducing emissions, and incorporating sustainable packaging. For example, 16% of the company’s annual electricity usage was met through renewable energy credits in 2021, double the percentage in 2020. ULTA expects usage of renewable energy credits to double again in 2022.

Valuation

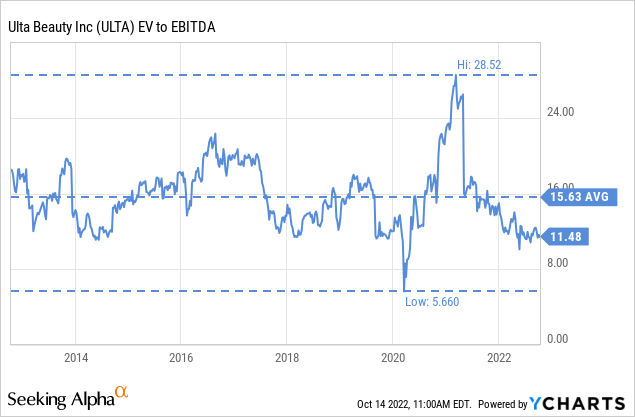

We believe this is a great time to buy the shares given the wide discount to the historical valuation based on EV/EBITDA multiples. While some discount to the historical valuation is probably reasonable given the lower expected growth rate, we believe an EV/EBITDA of ~11.5x to be attractive given the expected low double digit EPS growth rate and the quality of the business.

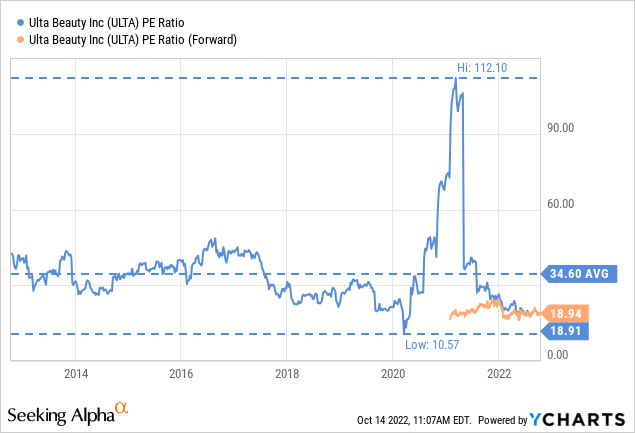

The price/earnings ratio does not scream “bargain” either, but it is significantly below the historical average. We find a ~19x multiple to be very reasonable for this business.

Risks

The biggest risk we see is the potential change in customer habits. If people increasingly buy their beauty products directly from the manufacturers by placing online orders, this could dis-intermediate retailers like ULTA. So far customers have shown they appreciate being able to try products at the stores and the personalized touch that is only possible at stores, but there is no guarantee customer preferences won’t change in the future.

Conclusion

We are impressed with how resilient of a brick-and-mortar retailer ULTA has proven to be. It is delivering record sales and earnings after a massive shock from Covid, and with a difficult economic environment of high inflation and massive competition from e-commerce rivals. We believe this is a company worthy of consideration for investment, and the current valuation is quite reasonable, especially considering the extraordinary results the company has delivered in the past.

Be the first to comment