David Taljat

We Are All In This Together

The more I am getting involved in shipping stocks, the more I realize why many investors avoid them. The overall industry (including containerships, dry bulkers, tankers, etc.) is so cyclical that there is a myriad of factors, especially macroeconomic ones, that can easily make or break your investment case.

And even then, the market can still react in an irrational manner that doesn’t necessarily reflect these factors, leaving investors puzzled. For me, this has definitely been the case with Danaos Corporation (NYSE:DAC).

On the one hand, and as I have mentioned in my previous articles covering the stock, Danaos’ investment case is set in a way that is too convincing to ignore. Being a containership lessor, Danaos has managed to secure tremendous cash flows over the next several quarters, thus shedding much of the inherent uncertainty attached to shipping companies regarding medium-term profit prospects. Combined with an ever-improving balance sheet and accelerating capital returns, Danaos offers (in theory) one of the most predictable total return outcomes I have encountered in a shipping company.

On the other hand, shares of Danaos have been gradually declining lower. Is this due to the market being ignorant of the benefits attached to Danaos’ fleet employment? Is the market scared of Danaos’ ZIM Integrated Shipping Services (NYSE:ZIM) equity stake, which has been plummeting lately? You can never really know what the market is ultimately (if that’s even the case) trying to price in. The situation is truly frustrating and demands patience.

I just wanted to share this introduction because, as an investor in Danaos over the past several months, I have been asking myself, “Did I miss something before investing?” and “Does the market know something I don’t?” These are all valid questions. Truthfully, based on what I have concluded by following all the relevant news, analyses, and discussions about Danaos and its peers on a daily basis, I can tell you that most, if not all, investors are equally confused and baffled and are asking the same questions, more or less.

What Does ZIM’s Nosedive Mean For Danaos?

I have already gone over Danaos’ fleet employment more than once. You can read my latest article, including more on that, here. In this one, I think it’s more interesting to go over ZIM and how Danaos’ stake in the company is going to affect its future performance.

In its Q2 filings, Danaos reported that it didn’t make any changes to its shareholding in ZIM. The company held 5,686,950 shares at the end of the quarter, the same as in Q1. The stake in ZIM can affect Danaos in two ways: Through the change of its value based on movements in ZIM stock and the dividends received from ZIM.

For Danaos to retain its interest in ZIM, management’s rationale must have been that shares remain cheap and that their future value and/or dividend potential is worth more than selling. Yet, the market has been dumping ZIM stock with passion lately.

ZIM stock price (Google Finance)

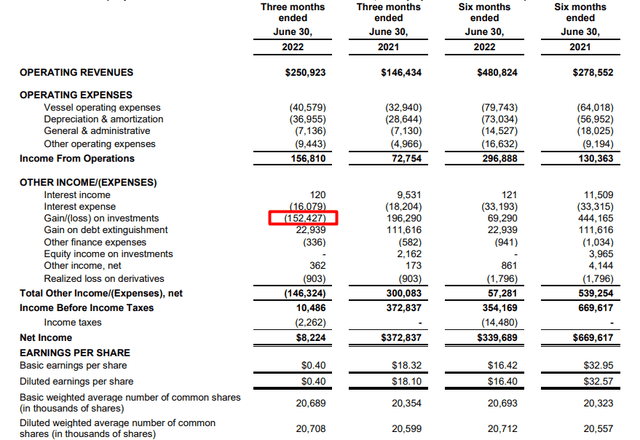

In Q2, the decline of ZIM stock cost the company $168.8 million. Combined with the $16.2 million in dividends received from ZIM, Danaos recorded a loss of $152.4 million on investments.

Danaos’ Income Statement (Danaos Q2 report)

On June 30th, ZIM closed at $42.58. It is now trading at $34.33. Assuming the company hasn’t sold any shares (which is most likely the case at current levels), the change in the value of ZIM stock has cost Danaos ($42.58-$34.33)*5,686,950=$46.9 million “so far” this quarter.

In the meantime, the company should record a dividend income of 5,686,950*$4.85*0.9 (to include the 10% withholding tax Danaos pays via its Singapore SPV) = $24.8 million. Considering that the company should post over $160 million in adjusted net income in Q3 (they reported $157.1 in Q2, and more vessels are rolling into higher rates), the ZIM’s performance ($24.8 – $46.9 = a loss of $22.1 million) should not have a material effect on Danaos’ book value growth prospects, even if ZIM were to stay at its current depressed levels.

This is quite important as one of the core elements in Danaos’ investment case is that it features a very predictable NAV growth roadmap amid its multi-year flee employment profile, towards which we expect the stock to eventually converge.

Is There A Chance For Danaos To Actually Trade Towards $100 and Even $150?

In my latest update, I supported the case that Danaos could trade towards $150 and beyond based on its upcoming contracted earnings, further aided by its recent share repurchase program.

This may sound like an aggressive price target, and it is, but it’s certainly not impossible or unreasonable. Considering shares are currently hovering close to $67, this seems like a long and difficult cliff to climb. However, it’s not uncommon for shipping stocks to suddenly start adjusting toward their “fair” value, including massive rallies. A great example is Danaos’ own ascending from $2.50 in March 2020 to over $100 in March 2022. The stock rallied 40X in just two years.

We continue to estimate that Danaos’ own fleet should produce EPS close to $26 this year. We also estimate this figure to be $30 next year amid higher leasing rates year-over-year. Based on ZIM’s own guidance and current charter rates, the company should achieve an EPS of at least $40 this year. This number prices in the ongoing decline rates, as the company already achieved EPS of $25.26 during the first half of the year.

Assuming the company pays out $20 per share (50% of its net income in line with its dividend policy), then Danaos should receive: 5,686,950 shares*$20*0.9 = $102 million in ZIM dividends.

Thus, Danaos should record approximately $4.98 in net income per share from ZIM’s dividends this year (assumes 20.53M shares outstanding, likely to be higher following DAC’s buybacks).

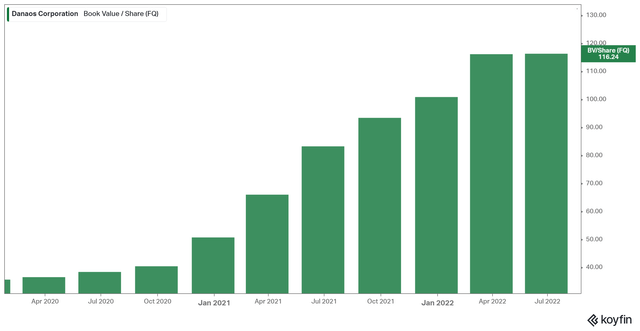

Now let’s break down what this means for the company’s book value. Danaos featured $116.24 per share worth of equity value as of its latest results. This implies that the stock trades at around 58% of its NAV now.

However, as we have mentioned before, this is not quite accurate. This is because Danaos’ vessels should be valued notably higher than their balance sheet figure due to each ship coming attached to long-term charter contracts whose discounted future cash flows are not displayed on the balance sheet.

Our estimates that account for these charters indicate that Danaos’ NAV is conservatively close to $150. There is room for speculation here, but even if you come out with a lower number (e.g., due to a higher discount rate), say $140, the steep discount in Danaos’ current stock price is undoubtedly there.

Wrapping Up Danaos’ Investment Case

Danaos’ book value keeps going up by the quarter, while shares have been moving lower and lower. This is indeed frustrating, but the stock’s investment case seems to be approaching a tipping point. The discount has become too cheap to keep ignoring, while stock repurchases have already started taking place rather aggressively.

By the end of July, Danaos’ management had already repurchased 409,200 shares of its common stock for $25.1 million, completing just over 1/4 of the $100 million share repurchase program announced in June. Impressively, this implies an average price paid per share of $61.3, which means that Danaos literally snatched shares at their bottom and at an even greater discount than the stock is currently trading at.

So let’s summarise:

- Danaos is trading at a 42% discount against its NAV (at least – this is the balance sheet figure),

- NAV is going to increase by at least $30/share in 2023, assuming $0 in ZIM dividends and no recovery in ZIM’s stock price,

- The company’s remaining buyback program accounts for roughly 10% of the stock’s public float,

- The dividend yield is not tremendous at 4.4% (considering that GSL and ESEA offer a higher margin of safety here), but DPS should easily grow 50%+ in the coming quarters (payout ratio is under 10% of earnings).

Overall, I believe that Danaos’ investment case has not changed too much from the previous quarter. The core case that leans on Danaos’ steep discount to NAV, great earnings visibility, and accelerating capital returns remains intact. The recent decline in ZIM stock should not have a material impact on Danaos’ prospects to trade higher, as dividends received should mitigate a decent chunk of the unrealized marked-to-market losses. Further, our case also assumes that Danaos receives $0 in dividends from ZIM next year.

In that regard, I continue to support that the journey upward seems to be a waiting game, so patience remains our best friend here.

Be the first to comment