onurdongel

(Note: This article was in the newsletter October 6, 2022.)

Simon Property Group, Inc. (NYSE:SPG) is one of those excellent companies that I always looked at from “afar” because it just seemed expensive or too expensive. You can always pay for quality knowing that your investment is probably not at-risk long term if you do not have to sell. On the other hand, most stocks sooner or later get caught in a downdraft that can scare long term holders even though the company itself is just fine. Being a contrarian, I happen to love investigating a good “scare.”

In fact, that is usually what I wait for. A company like Simon rarely goes on sale. When it does, there are all kinds of scary stories about “this time it is different.” But the reality is that it is rarely different. Times change and industries face challenges. But the best usually outperform through all that and more.

Then again Mr. Market has other ideas:

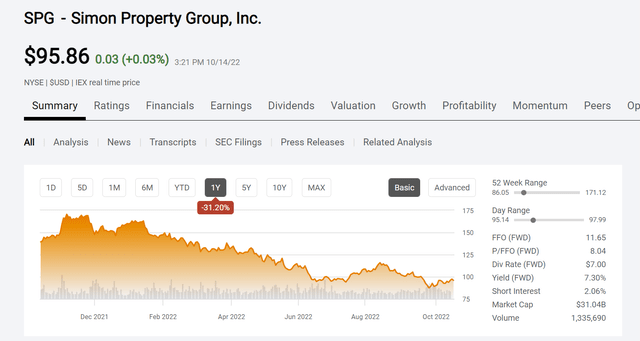

Simon Property Group Common Stock History And Key Valuation Measures (Seeking Alpha Website October 14, 2022)

The stock price is going down because of guilt by association. This stock has earned the website warning several times about “High Risk Of Performing Badly” thought that warning is clearly not there now. However, with the chart shown above, that warning could happen again really throughout the industry.

There is a market assumption that retail is in for a tough time as the Federal Reserve continues to take steps to reduce an overheated economy to something that can be maintained.

What is less understood is that continuing to inflate an already overheated economy happened once before in 2008. We really do not need that a second time. Generally, things like inflation and asset bubbles take years of economic mismanagement. In this case, the easy money supply of several years combined with increasing deficits was aided by the bottlenecks that formed with an unexpectedly rapid recovery. Some of us warned this day was coming unless the execution changed. Again, this is straightforward mainstream economics. The difference is this time it had less time before the Federal Reserve corrected its action. That should make for a less devastating downturn than was the case in 2008 (References here would be the standard Samuelson textbook “Economics” many of us had in college or nearly any money and banking textbook).

The Company Situation

The company itself is not a retailer. Instead, the company basically leases space to others. There is a world of difference between a retailer having a down year and that same retailer either unable to pay the rent or going out of business.

Right now, it looks like the economic asset bubbles and inflation that were building were caught in time to prevent another 2008. However, the whole thing does have to unfold, and we have to get to the other side.

Should the current situation prove to be a likely recession. Then the retail industry will likely have a down year but there will not be mass bankruptcies and lots of open spaces.

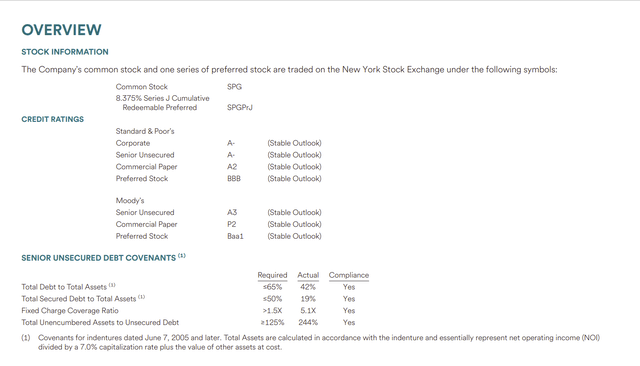

Simon Property Group Financial Strength Overview Second Quarter 2022 (Simon Property Group Second Quarter 2022, Supplemental Earnings Materials)

The company itself, as shown above, has one of the highest financial ratings for its debt in the industry. The same goes for the preferred stock. Management also reported that leased space had increased in the current fiscal year.

Even the presentation of a summary of non-paying tenants does not appear to show an issue. But sometimes facts do not matter because the market is worried about the future. This is where the investor view of the current steps taken by the Federal Reserve are extremely important. Often times, the market overestimates risk during times of contraction and uncertainty.

Such an overestimate provides the investor with a contrarian opportunity. Fresh in the mind of Mr. Market is all the bad news prior to the pandemic challenges because this industry had a cyclical downturn in the years before 2020. But fiscal year 2020 was extreme enough to doom a lot of reasonable turnaround stores and other less risky plays.

That is where the property locations of this company (that generate good financial strength ratings and above average profitability) are so important. In the good times, many investors were willing to pay a premium for good management because “what was the risk?” Now that the risk became apparent, those same investors are seriously considering cutting their losses.

It was so much easier to convince investors of the quality of management when the good times were prevalent. Now the stock price indicates considerable doubt about the company’s future.

A large consideration is the funds flow based upon book value of assets. The ratings shown above assure the customer of an industry outperformance in both good times and downturns. It is part of the ratings. Simon will have faster paybacks than many in the industry which also implies more discretionary cash flow. Such properties are readily saleable because they generate cash flow that is above average (as a group). Simon rarely is stuck with a lemon.

As one of the largest real estate investment trusts (“REITs”) in the business, the geographic diversification has in the past shielded this REIT from the worst effects of retail washouts than has affected the industry in the past. The revised acquisition of Taubman Centers accelerated a recovery (led by an increased dividend) that left the rest of the industry way behind.

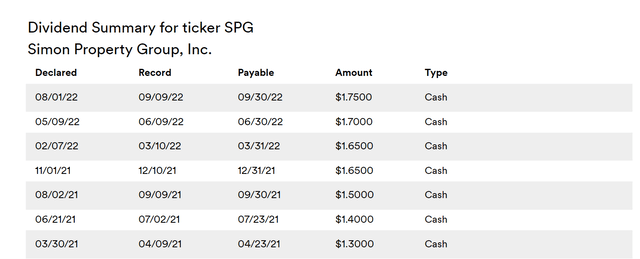

Simon raised the dividend several times since the recovery (and acquisition) started.

Simon Property Group Recent Dividend History (Simon Property Group Website October 14, 2022)

One of the advantages of a financially strong company is the bargaining power inherent in that strength. That bargaining power with the resulting acquisition and the accompanying industry recovery has led to a market unexpected rapid increase in the dividend.

Despite this outstanding performance for such a large company, the market is all worries about the future. It is almost like Simon has to demonstrate again and again that the company performance did not materially deteriorate since the last dividend raise.

The idea that the stock price would decline while the dividend is going up is really mind boggling. The stock price performance is more about institutional fears of not meeting performance benchmarks than anything fundamentally wrong with the company.

Performance So Far

The company has really shown improvement going into the current economic headwinds.

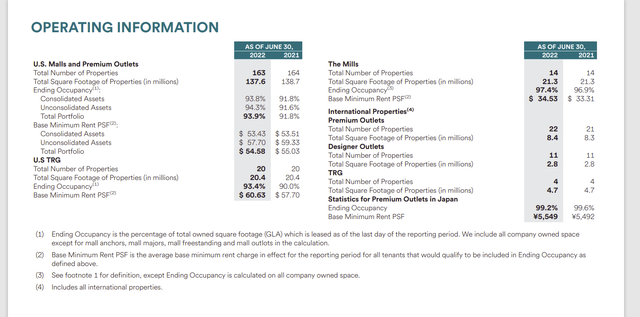

Simon Property Group Key Business Statistics Second Quarter 2022 (Simon Property Group Second Quarter 2022, Supplemental Earnings Materials)

This does not mean that Simon would not suffer a few negative comparisons in the future. The key is whatever Simon goes through will probably be far worse for a lot of competitors.

Then again, recessions typically do not last that long. So far economic activity remains at a very high level even if we meet the book definition of a recession.

For retailers, that is likely to mean that consumers will keep spending. Economic activity is likely to continue to decline as the Federal Reserve continues to correct the excesses of the last several years. On the government side, the deficit for the year ending in September is going to show the first large drop really since the Obama administration. That means the elements leading to an overheated economy and corresponding asset bubbles are being dealt with (however painful that may be). That is very good news for a company like this one.

Those rents that are shown above, are very likely to continue to hold up and even improve a little. The recession fears make the market assume a repeat of the latest retail washout or cyclical decline. But much of the weakest part of the business is gone. The rest will likely slug through the current challenges successfully despite market worries. That means they will likely pay the rent which is different from having a down year.

Occupancy has continued to improve along with the improvement in the per square foot cost for retail clients. The market had worried for a while about weak leasing rates (which is about normal for a cyclical recovery). But the superior locations of many of the properties limit that downside risk and often allow this company to lead participation in an industry recovery.

As those occupancy rates continue to increase, the cost of space will likely increase. That is what makes for some good recovery potential as this company with superior locations is likely to “fill up first” along with premium prices that go with “filling up first”. Clearly the market is not anticipating that with recession fears dominating the news.

The Money

Any company with the financial strength of Simon has little worries about meeting dividend requirements or financing issues. That should go without saying. But nothing is “off the table” when it comes to the market worrying about a recession.

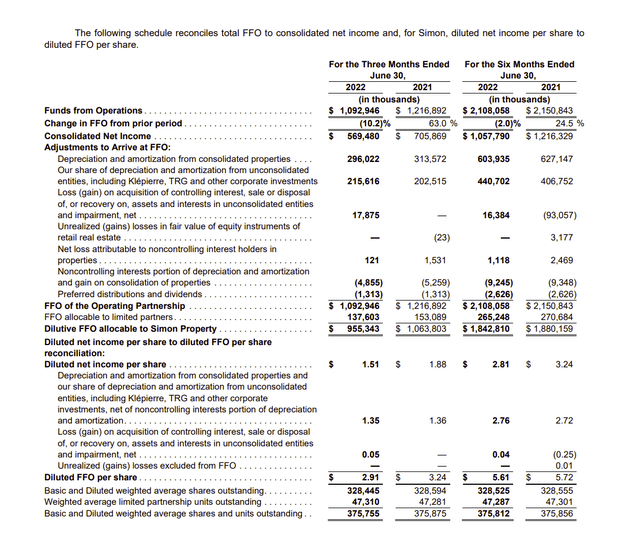

Simon Property Group Funds Flow From Operating Activities (Simon Property Group Second Quarter 2022, Earnings Release)

Management strategy keeps the dividend from ever being an investor worry. The dividend rate was just raised (a few months back), and the numbers above demonstrate there is plenty of room to raise it more should management choose to do that.

The dividend rate is $1.75 per quarter. That is roughly the earnings before cash flow from the depreciation charge. The coverage on this dividend is similar to a lot of other highly-rated stocks such as W. P. Carey Inc. (WPC), or even stocks in other industries like Exxon Mobil (XOM) with highly rated debt.

If the coverage gets too tight for the market, these companies can borrow to maintain that dividend if management chooses, or the dividend can be cut in an unusually severe downturn only to quickly return. But when the rating gets as high as it is for Simon and the debt ratios are that conservative, then usually the management strategy precludes a dividend cut for all practical terms.

An investor rarely sees the margin of safety for this distribution because of the management strategy and high financial strength. It is far more likely that this management will opportunistically consider distressed acquisitions that will be immediately accretive while keeping debt levels conservative. That makes the current yield an inappropriately pessimistic signal. Then again Mr. Market often goes to extremes.

The Future

Simon has a very well covered dividend that has the backing of tremendous financial strength. That dividend alone is what most investors report as a long-term average investment result.

When you consider investing in an industry leader, there is often a margin of safety that is absent from many other industry possibilities. In this case there is considerable recovery potential for the stock that once traded higher than $150 during the good times.

Simon has about a $30 billion market cap. That is about 5 times the size of most of the companies I follow in this area. The kind of management depth and very good execution that accompanies a sky-high debt rating is very hard to match. This company has the resources to out-bid competitors for good properties along with a reputation that is advantageous in any competitive bidding situation.

Stocks often return to historical levels once the current challenges pass. But many times, the contrarian opportunity is missed by investors that want a still lower price that may or may not happen. Others will not invest until the stock goes up (often quite a bit). The psychological challenges of buying a bargain when the market is having a lot of doom and gloom predictions are considerable.

But then again, that is what makes contrarian investing so profitable. If it was easy to do, then a lot of investors would do it and the above average returns would not be there. This is a market leader in profitability and financial strength. They do not go on sale often. So once this opportunity is gone, it is likely to not happen again for a very long time.

Be the first to comment