Diego Thomazini

Equities are having a tough 2022 so far. As central banks with the Fed and the BoE at the forefront began raising interest rates in order to tackle inflation, the market has entered into risk-off mode and valuations have suffered as a result. Geopolitical tensions and the energy crisis in Europe are also weighing on the downside.

Consequently, Vanguard Total World Stock ETF (NYSEARCA:VT), representing the performance of global stocks, has tumbled more than 25% YTD, dipping below the pre-pandemic highs from the beginning of 2020. Although inflation is still high, the central banks may soon see mounting political pressure not to raise rates, as government debts are at record levels and pension savings are evaporating. Since history has shown that trying to time the market and catch the exact bottom fails the majority of the time, I see the current VT levels as a good entry point for long-term passive equity investors, who seek global exposure at a low cost.

Note, while unraveling my thesis on the macro environment, I’ll mainly focus on the U.S. economy, as it is the largest, has the largest financial sector by far, and the dollar is the world’s reserve currency. This makes the FED the tone-setter for the rest of the central banks.

The rate hike bonanza

After record low rates in conjunction with quantitative easing and fiscal stimulus in 2020, the inflation genie got out of the bottle at the beginning of 2021, but was initially dismissed as transitory by the Fed. Towards the end of the year, as reality became harsher, officials were forced to admit that there was indeed a problem that had to be tackled.

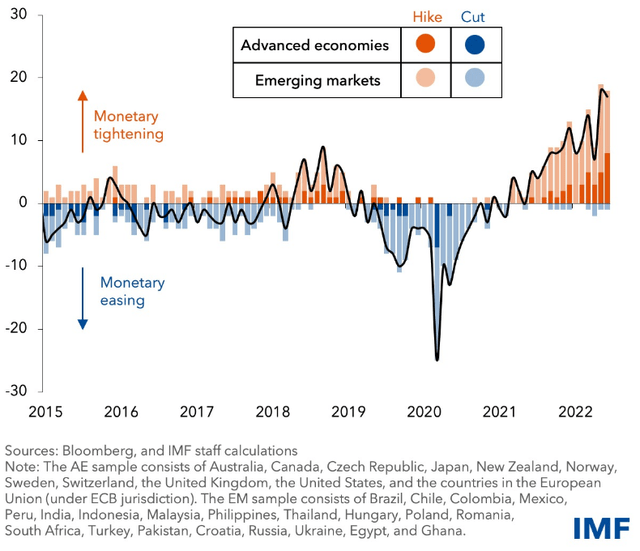

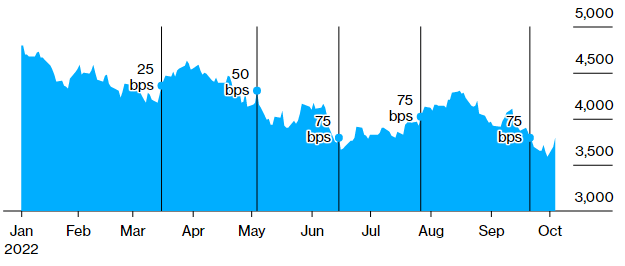

Central bank’s rate cuts/hikes (Bloomberg, IMF)

The tone was set by the BoE, which hiked rates in December 2021 with the Bank of Canada, and the Fed following suit. Fast forward to the summer of 2022, pretty much every central bank has started raising rates. As of now, there are no official signs of a pivot, and central banks are sticking to their main objective of price stability.

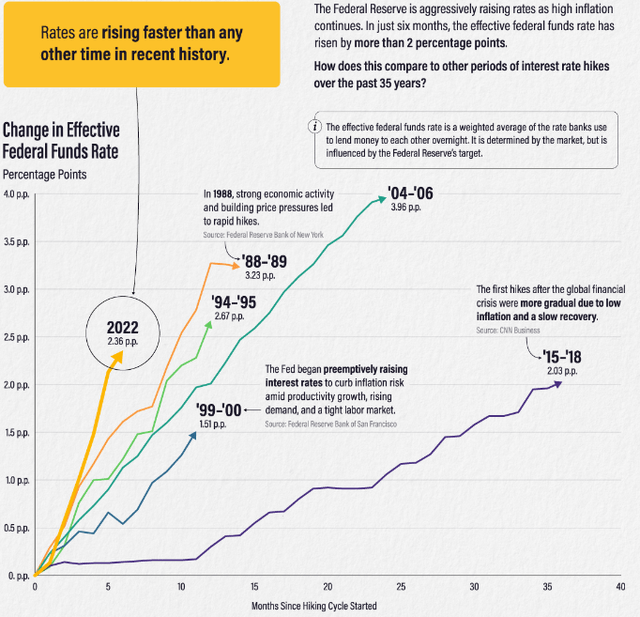

Speed of US interest rate hikes (Visual Capitalist)

The Fed has been raising rates at the fastest speed since 1988. The recent inflation data for September have strengthened the market-wide consensus for another 75 bps hike in November. But as rates are raising, the economy is slowing down, and although unemployment is yet to rise, questions about the potential for the practical sustainability of higher rates must be raised.

Potential implication of the rate hikes and the public opinion

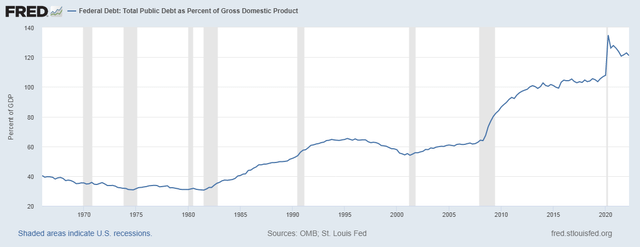

The national debt of the U.S. surpassed US$31B in 2022, and there are no signs of a reduction in the foreseeable future. In terms of a share of GDP, the figure stands above 120% – almost twice as high as in 2008 when the Great Recession was raging.

US public debt/GDP (Federal Reserve Bank of St. Louis)

To put things in perspective, if the weighted average interest rate on U.S. debt was at 4% today, this will imply interest payments of over US$1.24B, which would be almost 30% of projected government revenue. Currently the weighted average interest rate on the debt is much lower, but if rate hikes continue and the higher levels persist, it will climb fast as most of the debt has to be rolled over in a few years. And the U.S. is not unique in that sense. Some European countries like Greece and Italy are far worse in terms of debt/GDP levels.

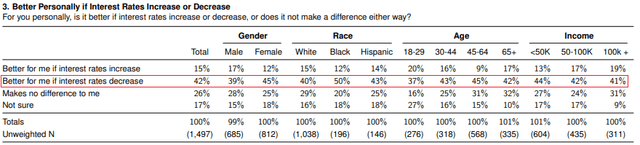

This is the main reason why I’m very skeptical whether interest rates will continue to be increased and even remain elevated for long. In addition, supranational organizations, like the UN, are beginning to voice a concern about the effects of tighter monetary on the global economy. Public opinion in the U.S. already is overwhelmingly in favor of lower interest rates, according to a poll by the Economist/YouGov from the beginning of October.

Public perception in the US about interest rates (The Economist/YouGov)

Such public opinion is very telling, especially that unemployment is still low and economic pain is yet to be experienced by the wider public. In such an event, the preference for interest rate decreases will increase even more. At the same time, serious turmoil is likely as the number of so called “zombie” companies is above the pre-pandemic levels and rising interest rates could trigger a bankruptcy chain. And in a democracy, where there are election cycles every two years, any government that wants to retain its power will risk to get obliterated in the elections if there’s a deep recession. Inflation is also not pleasant for the ruling parties, but it can easily be blamed on external events.

Rate hikes and the S&P500 (Bloomberg)

Another important consideration are the 401(k) accounts in the U.S., which are meant to ensure the spending needs in retirement. The falling stock prices, alongside inflation, are a double hit on those savings, since the nominal amount of money in the account is shrinking, while the purchasing power is also evaporating. Retirees and soon-to-be retirees are definitely not happy with this development and could unleash their anger on the ballot.

The likely path forward

Based on all of the above reasons, I think that political pressure will prevail over pure economic theory and central banks will be forced to reverse the course. There are early signs of pivoting from a few days ago when the BoE had to intervene in the bond market in order to “restore market functioning in long-dated government bonds.” It’s not surprising that the first major central bank that began to tighten blinked also first.

Granted, the proposed tax cuts in the UK, without corresponding reduction in expenses, likely increased the uncertainty on the bond market. But, at the end of the day the BoE signaled that it’s ready to step in to prevent major turmoil. And such market turbulences are on the horizon when rates are being raised in economies with ballooning debt, addicted to “cheap” money.

A return to rate cuts and quantitative easing will likely depress bond yields across the spectrum again, which could naturally turn investors to other assets such as equity for higher returns. And expectations about increase in corporate profits are not a must, but simple multiple expansion, just like in 2020, could do the job as well.

Why VT?

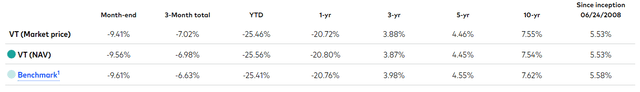

The Vanguard Total World Stock ETF offers a diversified, market cap weighted exposure to the global stock market. Pretty much every investor knows about the benefits of diversification. With VT an individual could be as diversified as he can get with a single product. It’s constructed to track the FTSE Global All Cap Index and has done so quite successfully with median tracking difference of just -0.08%, according to data from ETF.com. The portfolio has quite a large exposure to the U.S. – 60.5%, but this is understandable given the sheer size of the U.S. stock market, compared to the rest.

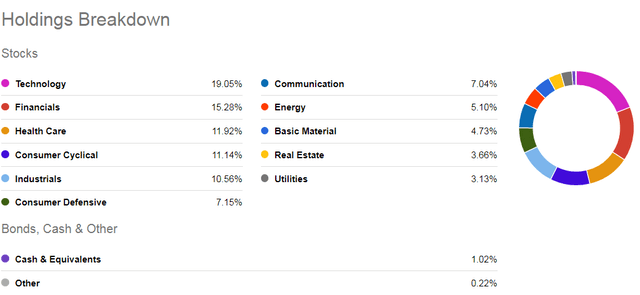

Sector exposure of VT (Seeking Alpha)

The diversification across sectors looks compelling and the fund has a very low expense ratio of just 0.07%, due to its self-rebalancing nature and large assets under management (“AUM”). For comparison, the expense ratio of MSCI ACWI ETF is 0.33% – almost 5 times as much.

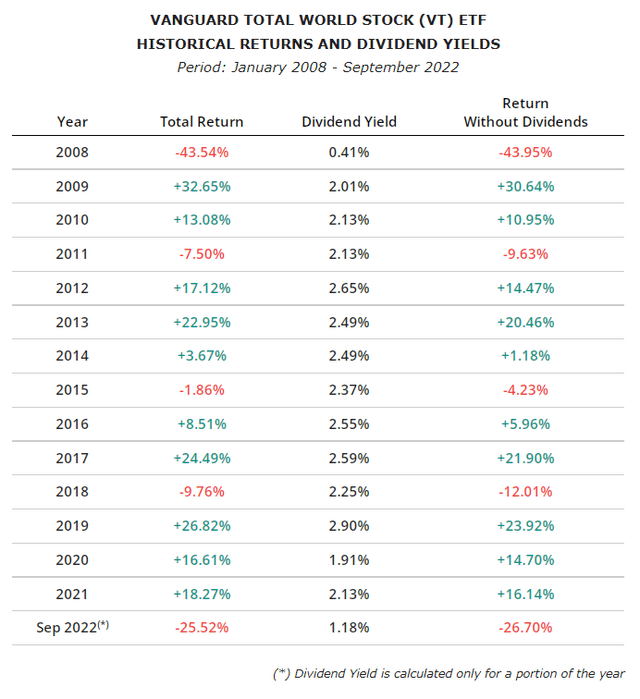

Since its inception, VT has achieved CAGR of 5.53%, which is above the average annual inflation rate in the U.S. from 2008 to today of 2.32%. The performance was also impacted by the exceptionally bad year that stocks are having in 2022 as VT’s YTD return is -25.46%. This has led to the price dropping below the pre-pandemic levels from the beginning of 2020. On the flipside, since the inception of the fund, there has never been an occasion of two consecutive red years. The ETF is distributing dividends on a quarterly basis, and the dividend yield is around 2.6% on a TTM basis.

VT’s annual returns (lazyportfolioetf.com)

Who should avoid VT?

If for some reason an investor doesn’t want to have tax events throughout the year, then VT is definitely not viable. Others may not like the high exposure to the U.S., which would probably make ETFs, specifically excluding the U.S. a more appropriate choice. Conversely, there are many funds that focus entirely on the U.S. and have brought higher historical returns. High-risk profile investors would probably find the CAGR since inception of 5.53% not satisfactory, but this product could have a place even in high-risk portfolio for diversification benefits. And lastly, anyone who believes that we’re headed towards a prolonged period of higher interest rates and could time a better entry point would probably be better off staying on the sidelines for a while.

Conclusion

The central banks have scared off a lot of market participants with the rapid rate hikes, which has led to equities tanking. That being said, I think that the tightening cycle may be coming to an end rather sooner, due to increased political pressure. Such a scenario could lead to equities to lift-off. VT, representing the global stock market would be a natural beneficiary of such a situation. The ETF is self-rebalancing, has a very low expense ratio and pays quarterly dividends, which makes it a good option for passive investors who want to achieve maximum diversification with a single product.

Be the first to comment