JHVEPhoto/iStock Editorial via Getty Images

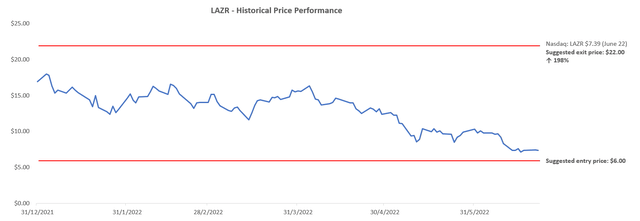

More than 80% of Luminar’s (NASDAQ:LAZR) market value has evaporated since it peaked above $40 per share following the merger with Gores Metropoulos SPAC in December 2020. Now trading at just a little more than $7.50 apiece, the stock has plunged more than 50% on a year-to-date basis, underperforming the broader market amidst a risk-off environment for equities, although still not as bad as others within its peer group (VLDR: -70%+ YTD; OUST: -60%+ YTD).

The dire macroeconomic outlook, clouded by record inflation and tightening monetary policies that risk an imminent recession have caused investors to shun growth stocks, given their real returns are the furthest out. Meanwhile, companies that have gone public over the last two years through a reverse SPAC merger, like Luminar, are also facing increasing regulatory scrutiny, which has further deterred investors’ confidence. The headwinds have together amplified pains for Luminar’s market performance this year, with little respite in sight.

As one of the leading LIDAR developers in the industry, with its technology designed for a wide range of applications from passenger vehicles to commercial trucks, Luminar remains well-positioned for significant growth opportunities in the long-run from a fundamental perspective. Yet, a consistent positive track record that demonstrates the viability of Luminar’s technology is still lacking, which is especially important under the current macro environment in order to restore investors’ confidence in the company’s long-term growth outlook.

We believe a key near-term catalyst for the stock would include mass deployment of Luminar’s technology across major connected vehicle markets in order to drive brand traction and awareness. This includes the upcoming launch and production of the Luminar-equipped Polestar 3 SUV (GGPI) by the Volvo-backed, Swedish premium electric vehicle (“EV”) maker in late 2022/early 2023. But for now, volatility will remain the theme given the stock’s classification as a high-risk, duration investment, especially as investors digest potential impacts of a looming global recession.

Why Has Luminar Stock Dropped So Low?

Growth stocks that are still in development and/or early ramp-up phase, like Luminar, have been dealt the worst blow amidst this year’s broad-market selloff. Investor angst is rising as the Federal Reserve amps up the hawk on monetary policy tightening plans to quell inflation, a manner that could inadvertently awaken a violent economic downturn. Luminar also faces industry- and company-specific headwinds, spanning a broad-based automotive slowdown due to supply constraints, a regulatory crackdown on SPAC mergers, and lackluster fundamental performance, which have added pressure on the stock’s performance this year despite management’s share buyback efforts.

Macro Challenges. With the latest inflation print coming in at 8.6% – a new 40-year record high – the Fed has made it a priority to suppress rising consumer price pressure. More aggressive rate hikes are now on the FOMC’s agenda, as demonstrated through the latest rate hike decision of 75-bps. In Fed Chair Jerome Powell’s latest appearance before the Senate Banking Committee, his stance on whether a recession is near has shifted from “no sign” of such risks given the strong American labour market and pandemic-era savings, to now a “possibility” in a matter of just a week.

The increasingly dire macroeconomic backdrop has caused investors to hasten their rotation away from risky assets like growth stocks such as Luminar, given their nature as duration-characterized assets with cash flows being the furthest away from realization. Aggressive rate hikes risk erosion of future valuations, while also pushing up borrowing costs that could stifle expansion plans for growth companies. The combination of rising price pressures and ongoing supply chain constraints that have been exacerbated by protracted pandemic disruptions and Russia’s invasion of Ukraine is now also adding further complication to the broader auto industry’s outlook. This has accordingly amplified risks of a direct impact on Luminar’s near-term growth realization trajectory.

SPAC Turmoil. The hype for SPAC mergers have also undoubtedly faded this year, making it a double whammy for Luminar alongside broad-based macroeconomic headwinds. In addition to faltering valuations across growth stocks due to mounting macroeconomic challenges, investors have also been deterred from investments related to de-SPAC transactions. A series of federal investigations for fraud and misleading disclosures related to SPAC mergers have triggered massive losses within the cohort this year. Once considered market darlings, investors are now approaching upstarts, such as Luminar, that have gone public via SPAC mergers with extra caution.

Guidance Misses. Actual fundamental performances that have fallen short of pre-merger estimates have left a sour taste in the mouths of investors as well, a fault that Luminar has been guilty of this year after it missed first quarter revenue estimates by a whopping 18% (1Q22 actual sales: $6.86 million vs. 1Q22 consensus revenue estimate: $8.36 million). The stock fell as much as 10% overnight after releasing its first quarter results in early May, a common response observed over the past two earnings seasons this year where any hint of extended weakness had been enough to send investors on a selling spree.

What is Luminar’s Long-Term Outlook?

Despite the near-term macro and industry-specific challenges, Luminar benefits from a first-mover advantage in the nascent market for LIDAR technology. Demand for automotive LIDAR hardware and accompanying software is slated to become one of the fastest-growing markets within the decade, with anticipated growth at an accelerated compounded annual growth rate (“CAGR”) of more than 30% through to 2030.

1. Supportive Regulatory Environment

Much of the LIDAR industry’s growth will be driven by increasing demands from regulatory bodies for advanced driver-assistance system (“ADAS”) adoption to ensure greater vehicle safety.

Growing acceptance of ADAS by regulators and drivers in recent years have foreshadowed the eventual adoption of full autonomous driving. With global economies like the EU requiring key ADAS features in all new vehicles beginning mid-2022, and the NHTSA recommending similar on the grounds of enhanced road safety, a future where cars will take over ultimate control from human drivers is near, making LIDAR technology more important than ever before. This is further corroborated by the field’s technological readiness, which has accelerated in recent years with more autonomous driving companies graduating from the development phase to the on-road testing phase – to date, more than 1,400 driverless vehicles have been deployed in the U.S. alone through pilot testing programs.

Given Luminar has already garnered experience through the development and sales of its legacy Hydra LIDAR system alongside OEM partners, and is now ramping up series production of its newest Iris LIDAR system, the company is well-positioned to capitalize on the fast-expanding addressable market. Luminar’s Iris LIDAR sensor is currently one of the best in class, offering long-range detection of objects that are more than 250 meters away, with high resolution to support application across passenger vehicles, commercial vehicles, and robotaxis. The sensors have also been designed to offer optimal scalability for customers, while meeting commercial viability for automotive applications through level 5 autonomy, which does not require any human intervention once approved by regulators.

2. Comprehensive Application / Use Case

With Luminar’s LIDAR system designed to enable autonomy across a wide range of use cases, spanning passenger vehicles, commercial vehicles, robotaxis, and other adjacent applications (e.g. aerospace/defense, construction/mining, agricultural), the company benefits from optimized exposure to a rapidly accelerating addressable market.

Robotaxis and Passenger Vehicle Application: Heightening demand for convenient access to safe and reliable shared mobility to enable a fuel-efficient economy for public transportation will also bolster demand for Luminar’s LIDAR systems to enable autonomous driving technology implementation into robotaxi fleets. The global robotaxi market is expected to grow into a $40 billion opportunity by the end of the decade, representing a 10-year CAGR of more than 67% as more reliability is placed on the emerging technology for improved road safety and fuel efficiency.

Studies have shown that autonomous vehicles can ease congestion by regulating their driving speed and accordingly the speed of surrounding vehicles while enabling greater fuel efficiency by moving in a controlled pace to reduce fuel burn. This makes an attractive adoption point for autonomous driving technology in passenger fleets as decarbonization remains a priority in the political agendas of leading economies. For instance, the European Commission has tightened the region’s passenger vehicle emissions standards to 95g of CO2 permitted per kilometre travelled in order to meet its “Fit for 55” emissions reduction target. Meanwhile, the U.S. has recently pledged to reduce greenhouse gas pollution by at least 50% to 52% from 2005 levels by 2030.

And on the safety front, human error currently accounts for more than 90% of passenger vehicle accidents in the U.S. alone. However, ADAS-equipped passenger vehicles have proven to enhance road safety and effectively reduce road casualties in recent years, underscoring the imminent replacement of manual driving with technology to eliminate accidents caused by human error in the long-run.

Meanwhile, self-driving technology is also expected to garner demand from passenger vehicle owners. From an economic standpoint, the emerging technology will allow car owners to capitalize on vehicle downtime by offering their cars up for autonomous ride-hailing services and lower overall TOCs.

Commercial Vehicle Application: Increasing preference for transportation efficiency and accessibility has fuelled demand for autonomous driving technology, underscoring the increasing importance of LIDAR systems. Within the commercial segment, rising logistics and fulfilment needs, paired with a protracted labour shortage have increased urgency for automating trucks and last-mile delivery vans.

With booming e-commerce adoption having accelerated by at least five years over the last two years spurred by pandemic-driven habits, the current shortage of last-mile delivery vehicle drivers in the U.S. alone is expected to rise from 80,000 to more than 160,000 by the end of the decade. Logistics challenges have also added additional pressure to already-congested ports, which now see average wait times of more than 20 days compared to about two days at pre-pandemic levels. The critical role of logistics and last-mile delivery in the increasingly digitized post-pandemic era is now spurring urgency to the commercialization of self-driving technology within the commercial vehicle sector, which can single-handedly alleviate all of the above-mentioned bottlenecks.

The global autonomous commercial vehicle market is expected to triple in size over the next five years, with further acceleration in the latter half of the decade, representing a 10-year CAGR of more than 25.2%. Much of the autonomous commercial vehicle segment’s growth will be underpinned by lower total ownership costs (“TOCs”) by as much as 40% for fleet operators, while driving greater efficiency and reliability in delivery services to support accelerating e-commerce adoption. This cost efficiency is also corroborated by Luminar’s goal of bringing down the target input costs, or “bill of materials” (“BOM”), on its LIDAR sensors from less than $500 per unit to less than $100 per unit in the long-run through economies of scale.

Eliminating the need for truck drivers can also ensure prolonged operations of trucks to boost daily delivery capacities and effectively alleviate logistics challenges like congestion. More importantly, automating trucks is expected to “mitigate human error” and reduce related accidents caused by exhausted drivers on long-haul routes and aggressive delivery schedules – a core driving vision of Luminar’s business.

Vertical Integration: Luminar’s gradual progress towards vertical integration of its design and component manufacturing capabilities mark significant milestones towards realizing its target BOM of less than $100 per LIDAR sensor in the long-run, which will be critical to enabling future mass market adoption and deployment.

In addition to the acquisition of Open Photonics and Black Forest Engineering in 2017 and 2018, respectively, Luminar has also acquired OptoGration and Freedom Photonics over the last 12 months. The acquisitions have brought together all critical components of Luminar’s lidar systems in-house, spanning receivers, ASICs (application-specific integrated circuits), InGaAs (Indium Gallium Arsenide), laser chip technology, and LIDAR technology engineering expertise in-house.

- Open Photonics: Open Photonics specializes in the development of photonics solutions, the foundational technology of LIDAR systems that allow the “detection and manipulation” of light to generate data on road conditions. Luminar acquired Open Photonics in 2017, which marked one of the company’s earliest significant consolidations to bolster its LIDAR technology development capacity in-house.

- Black Forest Engineering: Luminar acquired Black Forest Engineering in 2018, which now supplies “custom signal processing chips” used in its LIDAR systems.

- OptoGration: The company was acquired by Luminar in August 2021, and extends Luminar’s supply of critical receiver chips and InGaAs – a “photodetector semiconductor chip used to convert optical power into an electrical current – used in its LIDAR systems.

- Freedom Photonics: The acquisition of Freedom Photonics closed in April 2022. The consolidation of the company allows Luminar direct access to core diode laser technologies used in its LIDAR systems.

While Luminar designs and supplies most of the critical components to its LIDAR systems in-house, it outsources assembly – the most capital-intensive part of the business – to industry manufacturing leaders Celestica (CLS) and Fabrinet (FN). The strategy has allowed Luminar to operate a “capital light” business model to enable significant cost-efficiencies, while maintaining quality control and supply management of key components in-house. Luminar has also recently forged an agreement with Celestica to expand production capacity, underscoring the LIDAR maker’s positive progress on ramping up series productions.

Full Stack Turnkey Solution

Luminar has also become an attractive option for OEMs looking to incorporate LIDAR systems into their respective ADAS / autonomous driving technologies. In addition to its core hardware offering, the Iris sensors, Luminar also offers complementary software to provide OEM partners with a “turn-key autonomous solution to accelerate widespread adoption at series production”:

- Perception Software: Luminar works alongside its OEM partners to ensure its LIDAR systems deliver “full vehicle system capabilities”. This requires configuration of the company’s proprietary perception software used in transforming data gathered by the LIDAR (e.g. object range, speed detection, real-time mapping, etc.) into actionable information for the vehicle.

- Core Sensor Software: Core sensor software is built into Luminar’s LIDAR systems, and further configured to capture OEM requirements for vehicle integration and control. Core sensor software is primarily responsible for “enriching sensor data stream before perception processing”, with core features such as “automatic sensor discovery to expedite system start-up time, extrinsic calibration to automate multi-LIDAR geometrical alignment, and horizon tracking to automate region-of-interest scanning”.

- Sentinel: Sentinel, introduced in March 2021, represents Luminar’s full-stack hardware-software offering that combines Iris sensors with its proprietary perception and core sensor software. Two key aspects of the technology are “Highway Autonomy” and “Proactive Safety” to enable safe and convenient autonomous driving/ADAS capabilities on highways, as well as proactive “accident avoidance” monitoring at all times. Sentinel is currently on track for beta release by the end of the year to existing customers including Volvo and SAIC, with continued updates delivered over-the-air.

Demand for autonomous driving software expected to grow at a CAGR of 36% over the next five years and into a $60 billion opportunity by the next decade, which makes strong tailwinds for Luminar. The ability to offer hardware-software turnkey solutions for OEM partners’ autonomous needs accordingly maximizes Luminar’s addressable market, and bolsters the company’s reach into emerging growth opportunities stemming from a variety of use cases that range from passenger vehicles and robotaxi fleets, to commercial vehicle operators.

Luminar’s Fundamental Outlook

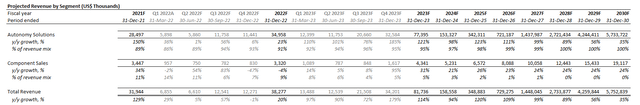

Based on Luminar’s pre-merger Investor Presentation, the company had predicted revenue growth at a five-year CAGR of more than 100% from $26 million in 2021 to $837 million by mid-decade. The assumption was consistent with its $1.3 billion order book at the time, which has since expanded to more than $2.1 billion as of 2021 year-end, as well as expectations of ramping up series production to scale by 2025.

While the company has handily exceeded 2021 revenue projections with actual sales of close to $32 million, and is on track to surpassing its 2022 growth target with projected sales of approximately $40 million, the steep climb towards $837 million by mid-decade from here on out will prove more difficult. This is primarily due to uncertainties pertaining to OEM launch timelines, despite contract wins that have already been added to its multi-billion-dollar order book, as well as production capacity constraints that will take time to come online and ramp up to scale. But over the longer-term, consistent with management’s assumption for at least “3% to 4% market penetration” by 2030, which we view as probable considering the viability of Luminar’s existing technology and continued ramp up of series production, the company is expected to achieve annual revenues exceeding $5 billion.

Our base case forecast takes a comparatively conservative approach, and projects Luminar’s revenue to total $38.3 billion by the end of 2022, and further expand at a four-year CAGR of 74% towards $348.9 million by mid-decade. The assumption applied is consistent with Luminar’s historical growth trends, as well as its near-term production outlook considering the ongoing development of Sentinel and its manufacturing capacity build-out, as well as the protracted realization timeline on contract wins from OEM partners, such as Nissan (OTCPK:NSANY / OTCPK:NSANF), which could take until the latter half of the decade for full ramp up.

Luminar Revenue Forecast (Author)

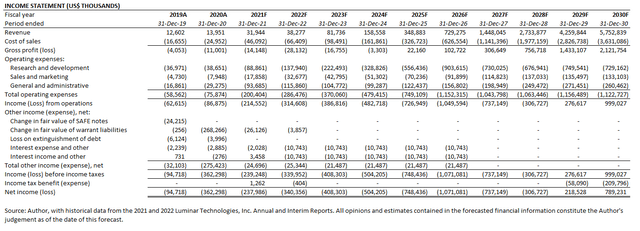

The burgeoning research and development costs pertaining to Luminar’s technology stack in the near-term, paired with employee stock-based compensation arrangements that are expected to remain elevated until mass market deployment is also expected to push profitability out to 2028. This is consistent with management’s guidance for continued operating losses due to investments into series production, as well as historical gross profit margins in recent quarters that have already fallen off pre-merger projections.

Luminar Financial Projections (Author)

Luminar_-_Forecasted_Financial_Information.pdf

Is Luminar Stock Price at a Bottom?

Luminar Valuation Analysis (Author)

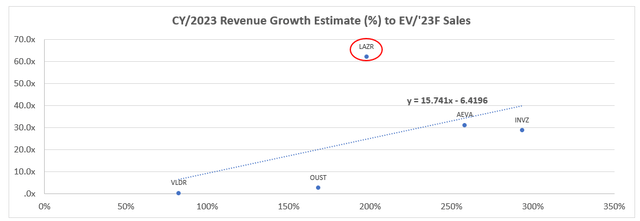

From a valuation perspective, we believe the stock will be subjected to further volatility over coming months that could cause its price performance to trend lower. Luminar is currently one of the most expensive LIDAR stocks on the market on a relative basis to its peers:

Luminar Peer Comp (Author)

Considering the duration-characterized nature of Luminar’s business, which has its realization timeline on profitability and positive operating cash flows being further out in the decade, its lofty valuation could be subject to further pressure in the near-term based on the current market climate.

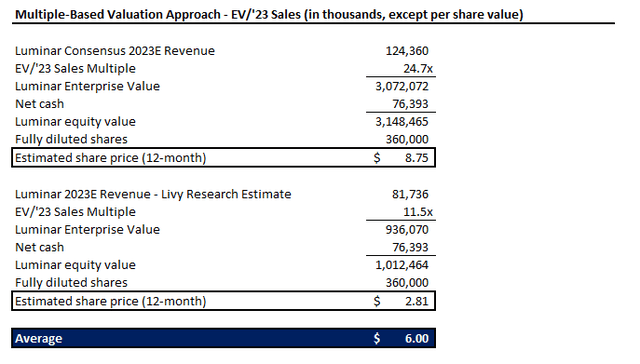

Based on the consensus CY/2023 revenue growth estimate of about 198% for Luminar, the stock should trade closer to an EV/’23 sales ratio of 24.7x (currently ~60x). This would price the stock at about $8.75 apiece, which represents upside of 18% based on its last traded share price of $7.39 on June 22. However, applying our more conservative CY/2023 revenue growth estimate of about 114%, the stock is expected to trade closer to an EV/’23 sales multiple of 11.5x, which would yield a price of $2.81 apiece. Taking the average of the two range book-ends, the stock could likely fall through $6 apiece amidst continued market volatility.

Luminar Valuation Analysis (Author)

However, the Luminar stock exhibits characteristics of a profitable long-term investment considering the fast-expanding demand environment for LIDAR systems, buoyed by safety and convenience requirements of next-generation connected vehicles. Its multi-billion-dollar and growing order book, backed by a “land and expand” strategy underpinned by contract wins with reputable auto OEMs like Nissan, Volvo and Mercedes-Benz (OTCPK:DDAIF / OTCPK:DMLRY), implies significant growth opportunities in the latter half of the decade when autonomous mobility adoption gains momentum.

For now, perfect execution on existing near-term performance obligations landed, such as the launch of Luminar’s LIDAR systems in the upcoming Polestar 3 electric SUV, will be critical to extrapolating its longer-term expansion capabilities. Accordingly, we expect the upcoming launch and start of productions of the Luminar-equipped Polestar 3 SUV to be a key catalyst on watch for the stock.

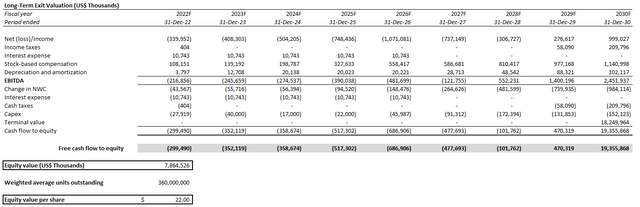

Based on a 10-year discounted cash flow (“DCF”) analysis performed in conjunction with our base case fundamental forecast for Luminar, we believe the stock exhibits potential to reach more than $20 apiece in the long-run. The analysis applies a 7.4x exit multiple based on a terminal perpetual growth rate of about 3% to reflect Luminar’s continued penetration into the autonomous mobility market that is expected to accelerate past 2030. An 8.9% WACC is applied to discount the projected cash flows over the forecast period, which is determined based on Luminar’s current risk profile and capital structure.

Luminar Valuation Analysis (Author)

Is LAZR a Buy, Sell, or Hold?

Luminar remains a uniquely positioned business to capitalize on emerging autonomous mobility opportunities with its first-mover advantage in advanced auto LIDAR systems. While its long-term fundamental and valuation prospects are attractive, the current market climate spells further volatility ahead for the stock.

Luminar’s business is still in early stages of growth right now, and its lack of tangible results, such as mass market deployment, certainly heightens the risk of the investment, subjecting it to further price pressures in the near-term as market grapples with a looming economic downturn. For now, we view Luminar as one to put on the watchlist as a long-term investment given its proven technological viability, reputable contract wins, as well as early progress in series production ramp-up, but do not recommend an entry at current levels.

Be the first to comment