Thierry Hebbelinck/iStock Editorial via Getty Images

Published on the Value Lab 12/4/22

It’s tough to know what to think of markets right now. There are very real inflation factors coming from the supply side, and rates are rising which may not help inflation and would then also hit disposable income. There’s also the question about the goods cycle, which has been elevated at the expense of services, potentially turning around as rates hike, which would be good for inflation but hurt portfolios with commodity price exposure. Things are polarising right now, either rate hikes will work and turn the goods market around as well as inflation, or they won’t and we’re going to have much smaller pocketbooks. This is the view that we are developing, and therefore are looking for positions that are agnostic to either outcome. We think Proximus (OTCPK:BGAOF)(OTCPK:BGAOY) and telcos like them fit the bill.

The Economic Angle

It is unsure what will happen. Real rates are of course quite low right now, but goods are running into shortages and prices are getting really high, so the economic impact is definitely negative. When rates hike and cool down the economy, the question is whether supply shortages will unwind. Perhaps lower money velocity will even slow down plans for firms to expand capacity, and inflation from the supply side might last longer than expected. Certainly, mortgage payments will go up, corporate leverage will become more expensive and the turnover of goods should decrease. If inflation isn’t combated, then we have a very serious economic issue that will leak into employment, a.k.a stagflation. If inflation is combated, then good exposures should fall regardless.

That’s why we are reducing our exposure to commodities that have benefited highly in the pandemic environment, and are either taking industrial exposures with little commodity risks, or we are pivoting to companies that have a clear value proposition, are defensive in every economical eventuality, and already trade at a very low price. We think Proximus hits each of these criteria perfectly.

Share Price

Proximus Stock Price (Google Finance)

One thing is for sure, Proximus has not been an outperformer. We think there are a couple of key reasons for this. The first is the CAPEX burden. Proximus will be financing a fiber rollout for the next five years, and the CAPEX burden is probably going to be very substantial, maybe around 3 billion EUR, which is already more than 50% of the current market cap. Fiber rollouts have been a major source of pain for Telco investors across markets. BT Group (OTCPK:BTGOF) had the issue of needing to finance a fiber rollout which meant they couldn’t sustain their all important dividend at a time when their investors needed some payout assurances. Proximus is hanging onto its dividend for now, which leads us to the second reason we think Proximus is being shunned: the dividend is not sustainable.

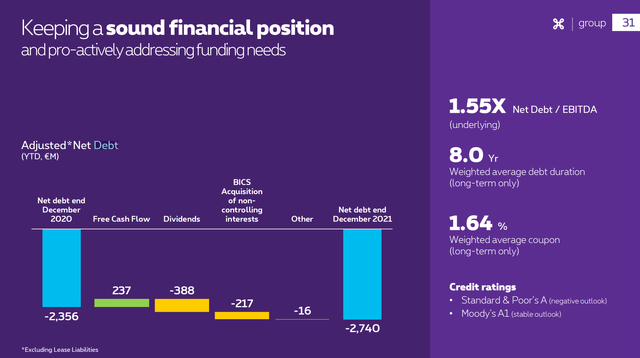

Clearly it isn’t sustainable because net debt is having to rise in order to meet the dividend payments. Free cash flow, on account of the elevated CAPEX, is not able to cover dividend payments at all. In fact the payout ratios are really elevated on FCF at 163%.

Debt Load (Q4 2021 Pres Proximus)

Investors are probably forecasting major dividend cuts or dividend cancellation at some point over the next five years while the fiber rollout is being financed and are pre-empting the hit by selling the stock. However, at this point we don’t think the price can go much lower and has bottomed out despite having no rebound momentum.

Defensive Markets

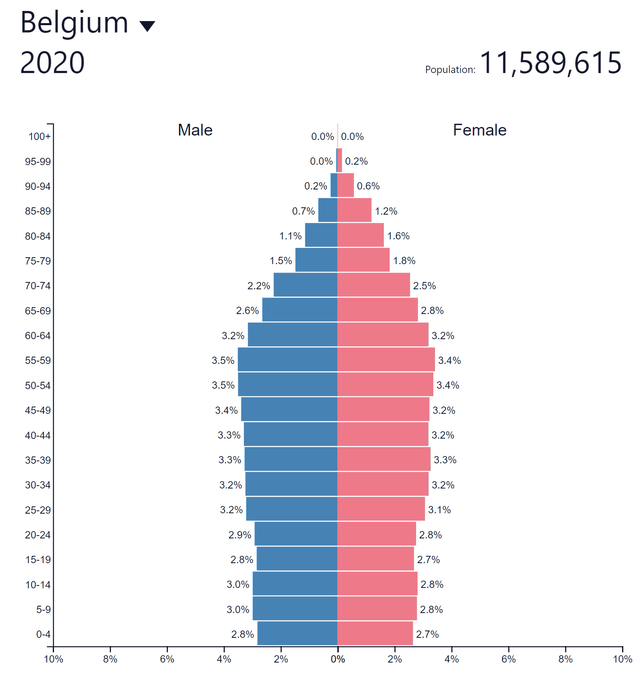

While the dividend is not sustainable, the markets are very defensive. Firstly, on a demographic front, Belgium is not the worst we’ve seen in Europe. In fact, the population pyramid looks pretty reasonable, with no extreme drop off in the younger populations to support future demographic support of phone plan customers. Moreover, households will be supported by the demographic trends for fixed line internet customers.

Population Pyramid Belgium (populationpyramid.net)

But ahead of the demographic support for the businesses, they are defensive in what they provide as well. Phone plans and fixed line internet are not services that one would quickly cut off in order to save money. First of all, unlike a utility bill, these bills are relatively fixed and not very large, especially because there is a sort of implicit expectation by regulators in European countries that goods that are of extreme public importance like internet won’t become in the least prohibitively expensive. Moreover, with work from home being exercised by both employees and businesses, it is an essential resource for both looking and engaging in employment. It is also the source of much of the media and entertainment people consume, so it’s going nowhere.

Conclusions

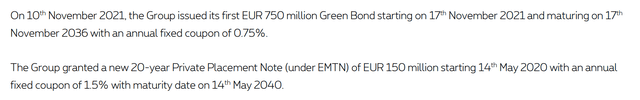

There’s more to consider about Proximus. Its debt costs are extraordinarily low at 1.64% on fixed coupon debt.

Proximus Debt (Annual Report 2021)

The debt matures in a while, so the interest expenses should be mostly unaffected by the rate hikes that are coming over the next couple of quarters.

The multiple is also very low thanks to the IPO of Telesign where the valuation acts as an offset to net debt as a non-operating asset. Since it is not yet profitable, it is not contributing to the comprehensive EBITDA. Telesign has a value of 1.3 billion EUR which offsets almost half of the CAPEX burdens introduced by the fiber rollout. Adjusting the multiple for the incoming CAPEX burden, debt and the offset from Telesign, the multiple becomes around 5.6x, which is low in absolute terms, and marginally lower than peers that trade at multiples towards 7x.

While a cut of the dividend could be a hit to the stock price, the already low multiple and defensive businesses make it a place where we’d be willing to park our money at this point. We rate Proximus a buy.

Be the first to comment