anatoliy_gleb

XPRO Shapes Up Well

Expro Group Holdings (NYSE:XPRO) provides well construction services, including drilling, tubular running services, cementing, and well management services in the US and internationally. The company will benefit from increased brownfield activity like intervention & integrity and well-flow management businesses in 2H 2022 and 2023. To gain market share, it has recently introduced technologically efficient solutions like CoilHose and Octopoda. Sales will also receive a boost from higher demand for high-end, well-construction equipment and subsea test trees. At the operating profit margin level, Frank’s International acquisition’s cost and revenue synergies look to exceed the previous expectations.

The stock is reasonably valued versus its peers at the current level. However, a higher activity level led to higher working capital requirements, which drained XPRO’s cash flow from operations. Nonetheless, the company’s balance sheet is free from debt, which, therefore, puts it at an advantage over its peers. I suggest investors buy the stock expecting improved returns in the coming quarters.

Explaining The Outlook

In 2H 2022 and 2023, XPRO’s management sees increasing demand and a supply glut in the oilfield services equipment industry. Higher offshore and international activity following higher production in brownfield and newfield operations will drive the demand. Exploration and development activity will mainly rise in North and South America, Norway, India, and Sub-Saharan Africa.

As energy price strengthens in the medium term, it anticipates improved requirements for high-end, well-construction equipment and subsea test trees. Drilling, well construction, and well completion activity account for 65% of its total business. Increased brownfield activity will see growth in intervention & integrity and well-flow management businesses. These operations, together, comprise 35% of XPRO’s business.

Technologies And International Contracts

Recently, XPRO developed two new technologies – CoilHose Light Well Circulation and Octopoda, which helped gain market share. These are well-intervention integrity solutions. CoilHose provides a lower-cost alternative to coiled tubing systems. Octopoda was deployed in the Congo to investigate and remediate sustained casing pressure and other well annulus problems.

The offshore market has undergone a significant change in outlook, with ~60% of XPRO’s new customer commitments likely to come from offshore. The company’s contract wins, and extensions totaled ~$300 million. In North and Latin America, it has been a premier casing and tubular running services provider. In Brazil, it completed a first casing project and eight simultaneous TRS deepwater completions in the Gulf of Mexico. In Europe and Sub-Saharan Africa, they secured new business in Q2, including a four-year well flow management contract in the Norwegian continental shelf. In September, it completed the plug and abandonment of the indigenous gas wells in Ireland. It has also developed a digital technology that can help drilling operators cut CO2 emissions significantly.

Synergies To Lower Costs

In October 2021, Expro Group completed the acquisition of Frank’s International in a business combination and created Expro Group Holdings. It targeted cost and revenue synergies between $80 million and $100 million post-merger. By Q2 2022, it identified areas by which it can achieve the $55 million in annualized cost savings target, which would be a quarter earlier than initially expected.

The company will complete the cost savings by consolidating facilities and the supply chain. It may also exceed its earlier EBITDA target of $10 million to $30 million through expanded customer relationships, operating footprint, increased time on the rig, and extended field life. By Q2, it consolidated operations in Azerbaijan, Canada, Malaysia, India, and Texas.

Analyzing The Q2 Drivers

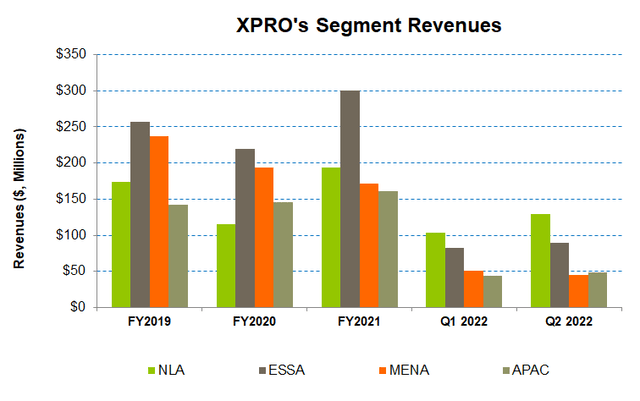

From Q2 2022 to Q2 2022, the company’s revenue increased by 12%. Geographically, the North and Latin America (or NLA) division registered the highest growth (25% up) during this period, while the Middle East and North Africa (or MENA) saw a decline in revenues (11% down). The company’s adjusted EBITDA increased 39% sequentially due to a favorable activity mix and rapid realization of merger-related synergies. However, lower well flow management equipment sales in Saudi Arabia and UAE mitigated some of the topline growth.

On top of that, its support costs decreased by three percentage points relative to Q1 2022. Overall, it realized $30 million of annualized support cost savings through Q2. The management believes it can reduce support costs to about 20% of revenue from 22% now following net pricing gains and incremental cost synergies.

Cash Flows And Liquidity

In 1H 2022, XPRO’s cash flow from operations (or CFO) turned negative compared to a positive CFO a year ago. Despite a significant rise in revenues in the past year until 1H 2022, the higher working capital requirement (higher receivables AND inventory) and higher tax, merger, integration, and severance payments led to the CFO’s deterioration. Although capex decreased, free cash flow (or FCF) remained negative in 1H 2022. The company expects to generate positive FCF in 2022, and much of the improvement in cash flows is weighted towards 2H 2022.

As of June 30, XPRO’s debt was nil. This gives it an advantage over some of its peers’, NOV Inc (NOV), RPC Inc (RES), TechnipFMC (FTI) averages. Its liquidity was $309 million on June 30. As of June 30, shares worth $37.0 million (10% of its common stock) remained authorized for repurchases. It is authorized to acquire up to $50.0 million through November 2023.

What Does The Relative Valuation Imply?

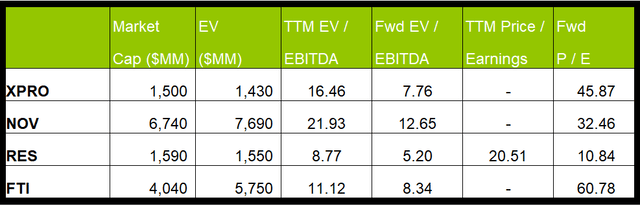

XPRO’s current EV/EBITDA multiple (16.5x) to the forward EV/EBITDA multiple (7.8x) contraction is steeper than its peers’ (NOV, RES, FTI) average fall, implying a higher EBITDA growth. This, in turn, typically reflects in a higher EV/EBITDA multiple. The stock’s current multiple is higher than its peers (13.9x). I think the stock is reasonably valued versus its peers at the current level.

Target Price And Analyst Rating

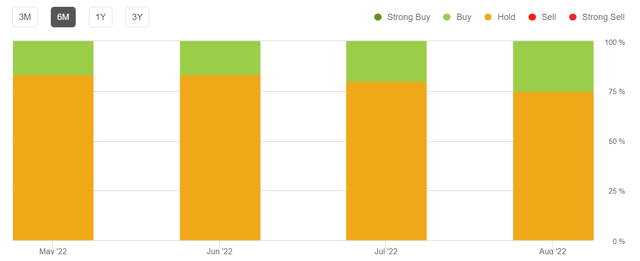

During the past 90- days, a Wall-street analyst rated XPRO a “Buy.” Three analysts rated it a “Hold,” while none recommended a “Sell.” The consensus target price is $16.25, which yields 10.75% returns at the current price.

What’s The Take On XPRO?

In 2022 and 2023, a vast part of the energy-producing world, including North and South America, Norway, India, and Sub-Saharan Africa, will see increased activity, thus leading to a higher demand for high-end, well-construction equipment and subsea test trees. With a growing backlog, most of its new customer commitments are likely to come from offshore. The company’s previous acquisition of Frank’s has led to high cost and revenue synergies, which will help expand the operating profit margin.

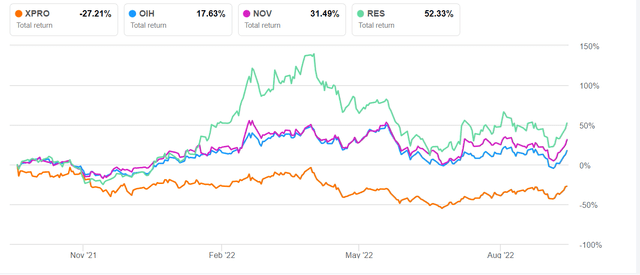

However, lower sales of well-flow management equipment in some parts of the Middle East were concerning in Q2. Negative cash flows were also a concern. So, the VanEck Vectors Oil Services ETF (OIH) significantly outperformed the previous year’s stock. With relative valuation placing the stock at a reasonable place, I think returns from buying the stock will improve.

Be the first to comment