Kunakorn Rassadornyindee/iStock via Getty Images

Investment Thesis

We ventured outside of our typical investment jurisdiction to look at Repsol (OTCQX:REPYY). What we discovered was an undervalued energy company with substantial profit generating assets, advanced in its decarbonisation transformation, and committed to shareholder returns – essentially the elusive ESG investment opportunity we had long been searching for.

The Company

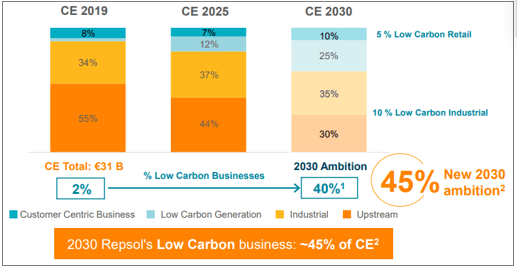

Spain-based Repsol is a vertically integrated energy producer with substantial cross-sectional representation across the value chain. The company splits its operations into 4 segments: Upstream (Oil and Gas), Industrial (includes refining), Customer-Centric (includes retail), and Low-Carbon generation. Currently the Upstream and Industrial businesses drive the majority of overall profits, but the company is building towards larger contributions by the renewables business.

Repsol is positioning to diversify away from traditional fossil fuels, and aiming to have the low carbon business contribute 40% by 2030 (Repsol ESG Day presentation)

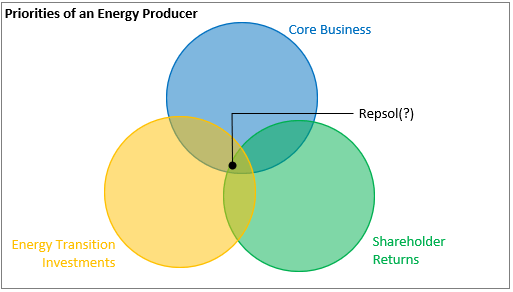

In our experience energy companies generally find themselves balancing 3 main objectives: efficiently monetising core operations, steadfastly transitioning towards decarbonisation, and prioritising shareholder returns. More often than not we see companies sacrifice on one (sometimes two) of these goals to achieve successful outcomes on the other(s). Repsol is the first company we’ve encountered that we feel is satisfactorily managing all three priorities simultaneously.

A visualisation of the key priorities energy producers face in current times. We feel that Repsol comes close to satisfactorily delivering on all three fronts. (Woodforde Investments)

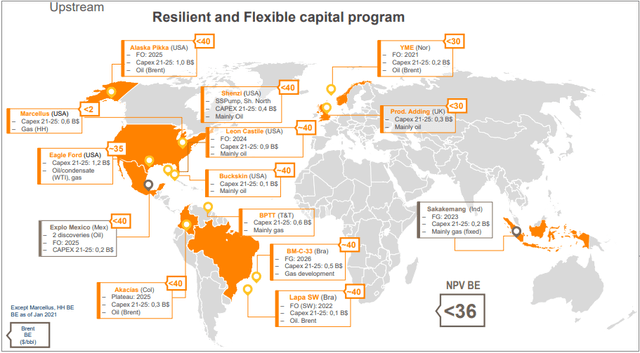

Firstly, similar to industry peers its core business is performing well, benefitting from higher energy prices in 2022. The fact that Repsol also operates refineries allowed it to capitalise on higher refining margins due to a global capacity squeeze. We like this diversified approach to profit generation as it gives the company more earnings stability than a pureplay E&P company which is more exposed to energy spot prices. On an ongoing basis, break-even for the upstream business is $40/barrel, with the company expecting most of the capex to keep these sites operating to be self-funded.

Repsol’s core (upstream) sites. With low break-evens, these operations will generate sufficient cash to self-fund capex, whilst still allowing for excess to be invested in low carbon initiatives or returned to shareholders (Repsol ESG Day presentation)

The company is also unlocking value in its business through a series of stake sales of various assets. In particular, the sale of a 25% stake in the Upstream business for $4.8bn caught our attention. Considering Repsol’s current market cap of EUR18bn, the transaction represented greater than a quarter of the entire company‘s valuation. This was a first hint of an undervalued opportunity in our view.

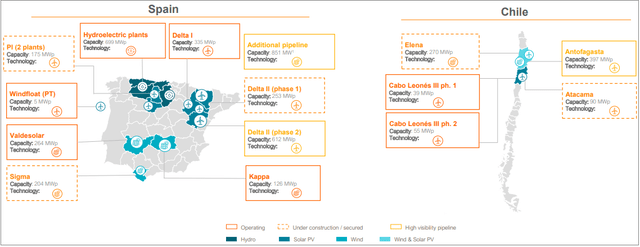

Secondly, we were particularly impressed by the direction of travel and amount of progress made in the low-carbon space. With many of its projects currently operating, and more in the pipeline, we think that Repsol is ahead of the curve relative to many other rivals. We feel this head-start will build up valuable know-how and a path to durable profitability earlier than the pack, and that will prove a competitive advantage in the long run.

Repsol’s portfolio of renewable assets and pipeline projects (Repsol ESG Day presentation)

Lastly, we looked at the shareholder return program of the company. Its current dividend payout yields 5% at current stock prices, and accompanied with a stock buyback program the amounts returned to shareholders equate to around 30% of operating cash flow. Relative to peers this is in the lower range, but nonetheless understandable when much of the current cash generation is going into capex for both existing operations and future investments.

However, because of the stock’s valuation (P/B of 0.7; trailing P/E of 5x), its plan to buyback 150m shares represents 10% of outstanding issuances. This reflects exceptional value in our opinion, and another signal to us of an undervalued stock.

Valuation

A skeptical mind would think that the trailing 12-month (Jul 21 – Jun 22) earnings of EUR3.8bn is perhaps distorted by elevated oil and natural gas prices, and refining margins seen since the start of the Ukraine conflict in late-February. Indeed, if we just annualised Q2 22’s operating income we would arrive at a mouth-watering P/E of 2.2x! However, Repsol also took an impairment charge of EUR1bn during this period which largely offset the windfall gains.

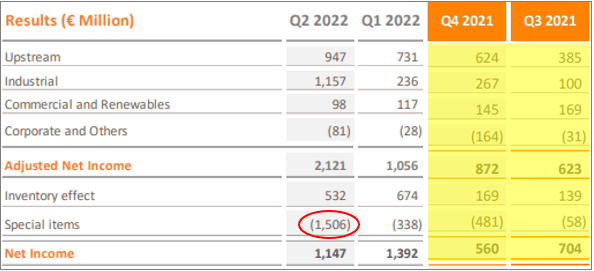

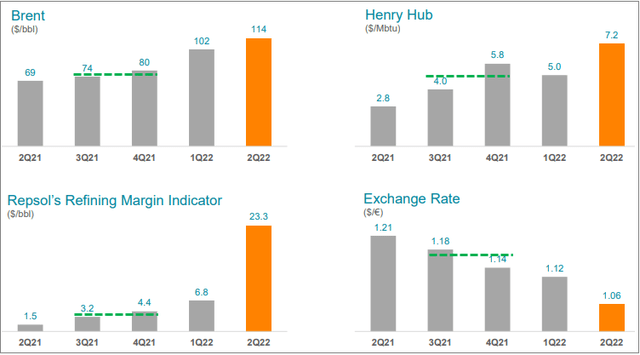

Strong trailing 12-month earnings were skewed by Q2 results, but also included a significant impairment charge on legacy refineries (circled red). Instead, we look back to H2 2021 earnings (highlighted yellow) to build a valuations base case. (Repsol financial reports) A collection of key data points which underlines the company’s earnings. Note that current levels remain favourable compared to H2 2021 (green lines), which acts as an upside to our base case. (Repsol financial reports)

We look back to H2 2021 to find more normalised energy prices and refining margins, and gauge that if future prices broadly average out at similar levels, the corresponding P/E would be 7.5x. This value could be viewed as an upper bound if an investor subscribes to the opinion that underinvestment has resulted in structural change to supply dynamics resulting in stickier energy prices.

We see even further upside to this base case when factoring in the positive effects of buybacks. All in all, the result is a stock we think is deep within an attractive valuation window.

Trust in Management

As an aside, we were intrigued about the nature of the impairment charge, with the introduction of the REPowerEU plan to decrease Europe’s dependence on Russian fossil fuels triggering a reassessment by Repsol of demand assumptions and the lifespan of legacy refineries. To our mind this reflected an intent to demonstrate integrity – through the proactive financial prudence shown in reported numbers, but also an implicit irrevocable commitment to decarbonisation. Although we can’t validate that the accuracy of the amount impaired, we appreciate the transparency this communication signals, and think it builds towards a fostering of trust in management.

Conclusion

At this present time, with continued energy security concerns and the multitude of macroeconomic headwinds, there is risk of weak demand and soft commodity prices again inflicting financial pain on Repsol as it did in 2020. We think the low P/E multiple is a reflection that these negative scenarios are priced into the stock. However, with an eye on a carbon-free future, when we look past these near-term cyclical concerns we see an undervalued business.

Indeed, this conviction is validated by the price received for the Upstream business stake sale, as well as the substantial number of stocks the company is able to buy back via its capital return program.

We therefore sense we’ve finally found an ideal ESG-themed investment: a committed company and management, a core business that provides strong cash flows to support future investments, renewable initiatives with certainty around viability and durability, and a commitment to shareholder returns, all at an enticing valuation.

(EURUSD = 1 assumed in analysis)

Be the first to comment