Tjanze/E+ via Getty Images

Thesis

TINA is now a moniker of the past excesses, while TARA has arrived. With the violent rise in yields in 2022, risk-free assets like Treasuries now offer significant returns. The Schwab Strategic Trust – Schwab Short-Term U.S. Treasury ETF (NYSEARCA:SCHO) is a vehicle that invests in short dated Treasuries. The fund follows the Bloomberg US Treasury 1-3 Year Index, and currently exhibits a sub-2 year duration:

Date (Fund Fact Sheet) Duration (Fund Fact Sheet)

There are several ways to gain access to the Treasuries and T-Bills markets, each one with its upside and downside. Let us first discuss each instrument and their general meaning and formation:

-

T-Bills or Treasury Bills are short-term United States government obligations that have a maturity of one year or less and are backed by the full faith of the US Treasury.

-

Treasury Notes are longer-dated (more than one year) United States government obligations.

-

Treasury / T-Bills ETFs are investment vehicles publicly traded on an exchange that have an asset manager who actively chooses the underlying collateral (Treasuries / T-Bills) and receives a management fee for services rendered, fee which is paid from the yield generated by the underlying collateral and thus ultimately the investors in the ETF.

For retail investors, ETFs represent the easiest way to gain exposure to certain sectors due to the ease of buying and selling as well as the lack of active management on the investor’s side. SCHO falls into this category.

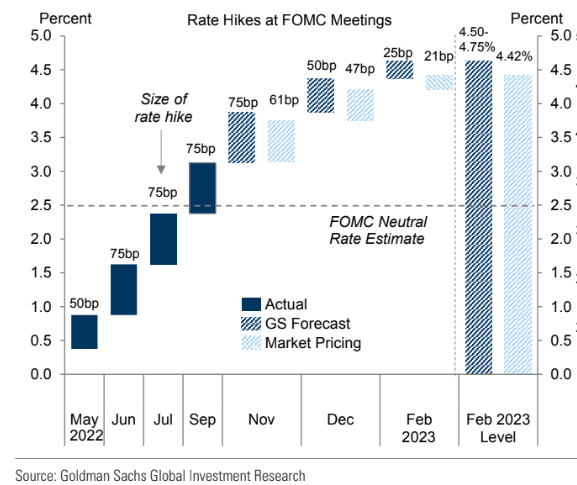

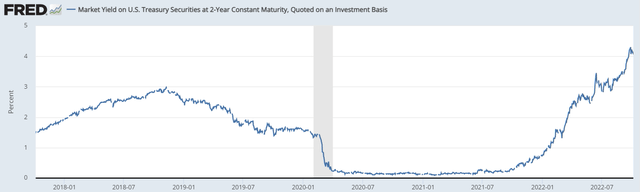

The vehicle is down year to date due to its duration profile, but we think the move is close to being exhausted for 2-year notes, with a 4.5% target in sight:

Fed Funds Projections (Goldman Sachs)

While the above table details the Goldman Sachs projections for Federal Funds, usually the front end of the Treasury curve tends to follow quite closely the Fed Funds, especially in today’s environment where the Fed is talking about “higher for longer”.

With the negative impact of duration and rate hikes now dissipating, SCHO is becoming a bone fide cash parking vehicle. Investors looking to ride out the storm in cash like instruments can now choose SCHO and get a yield that is closing in 4%.

We believe we are in the midst of a bear market that has not yet run its course. 2022 has been an excruciatingly tough year with the market playing “hide-and-seek” with the Fed. On one end the market is looking for a pivot on the back of deteriorating fundamental metrics, while the Fed is adamant about doing what it takes to tame inflation. Violently rising rates coupled with an economic slowdown does not result in an economic expansion, but a contraction. The best trade for 2022 would have been to sit in cash since January in short duration vehicles. Hindsight is always “20/20” but cash is no longer “trash” and is yielding now close to 4%.

Performance

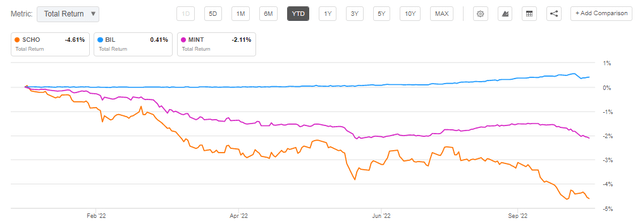

SCHO has a negative performance in 2022:

YTD Total Return (Seeking Alpha)

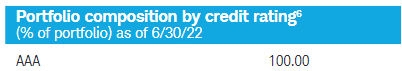

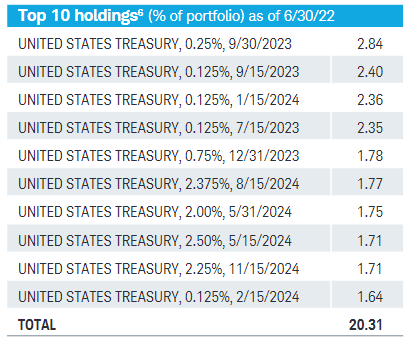

This is entirely due to its duration profile since the fund has no credit risk (all underlying securities are AAA rated U.S. Treasuries). Let us have a closer look at the performance and decompose it:

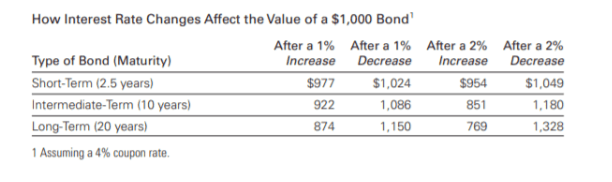

Bond Sensitivity (Vanguard)

We can see from the above table that short-term bond funds expose a decrease of -2.3% when rates rise by 1%. 2-year yields are up more than 300 bps year to date:

This translates into an expected price move for the fund of -2.3% x 3, which equates -6.9%. When we factor in the dividend yield received by the shareholders in 2022 we get to the total return figure of -4.6%. Duration under any form, even with no credit risk, can bite quite hard when rates rise as violently as we have seen them this year.

Holdings

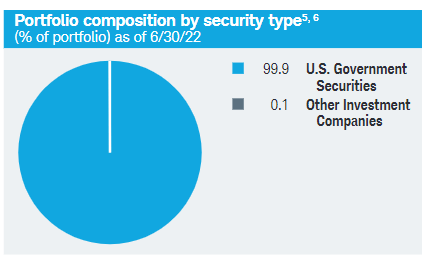

The fund holds solely credit risk free securities:

Holdings (Fund Fact Sheet) Ratings (Fund Fact Sheet)

The top holdings are reflective of that composition:

Top Holdings (Fund Fact Sheet)

Although the granularity is not that important for a treasuries fund (i.e. concentration issues are not really a factor), we can observe that the fund does not have positions exceeding 3% of the fund in any of the underlying securities.

Concentration is not an issue in this fund because the ultimate obligor for the entire portfolio is the U.S. Government. It is interesting to note that due to the massive overspending by the government, the U.S. debt has now exceeded $31 trillion.

Conclusion

SCHO is a treasuries fund that currently has a 2-year duration. Negatively affected by the more than 300 bps increase in 2-year yields this year the fund is down -4.6% YTD on a total return basis. We feel the rise in yields is almost behind us, with a 4.5% target for this point in the curve in our opinion. With a raging bear market, and equity returns which have turned deeply negative, we feel SCHO is a good vehicle to now park cash and actually get a dividend yield.

Be the first to comment