We Are

SPDR Portfolio S&P 500 High Dividend ETF (NYSEARCA:SPYD) has outperformed the S&P 500 index in the last twelve months, thanks to its portfolio diversification and focus on high-yielding stocks from energy, utilities, and financial sectors. While this ETF has outperformed so far in 2022, it does not seem suitable for long-term dividend investing. A lack of consistency in dividend payments, soft price appreciation in bull markets, and a portfolio centered around high-yielding but low-quality dividend stocks all contribute to skepticism about its ability to generate solid long-term returns.

SPYD Might be an Option for Bear Markets

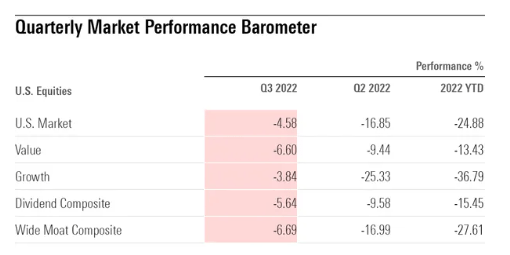

Stock Market Performance (Morningstar.com)

In bear markets and high volatility periods, dividend-focused stocks and ETFs have historically outperformed broader markets. As of the end of September, dividend-paying stocks and ETFs have once again outperformed the broader market in 2022’s bear market, shedding around 15% against a 25% drop for the S&P 500 and a 36% drop for growth stocks.

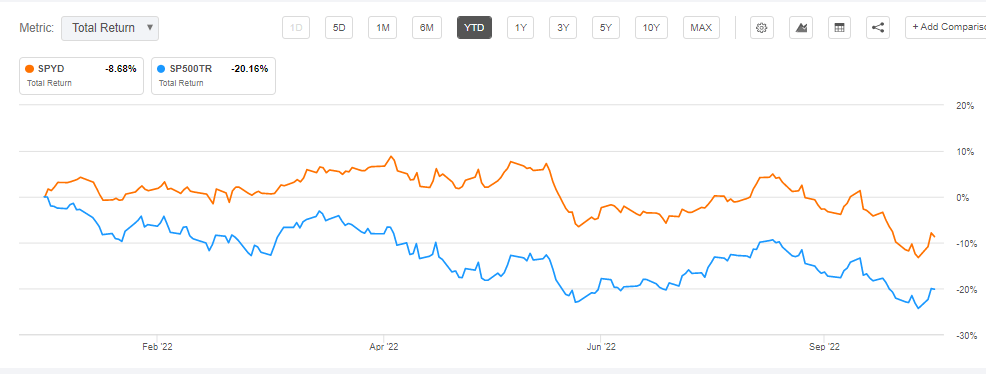

SPYD’s Total Return (Seeking Alpha)

Additionally, high-yielding dividend stocks and ETFs have provided more protection against market volatility. So far in 2022, SPYD, which tracks S&P 500 High Dividend Index and holds stakes in 80 high-yielding S&P 500 companies, has lost 11.9%, less than half what the S&P 500 has lost. In addition, the fund’s high dividend yield contributed to reducing the impact of the blow. A dividend yield of over 4.5% trimmed year-to-date losses to just under 8%, compared to a negative 20% total return from the S&P 500. Its performance is attributed to its focus on 80 large-cap high dividend-yielding companies from all eleven S&P 500 sectors, with a strong emphasis on financials, utilities, energy, and healthcare. Generally, this ETF could be a good choice for defensive investors who want to receive dividends without losing their initial investment, particularly in high volatility periods.

But SPYD Lacks Long-Term Dividend Investing Characteristics

When it comes to generating lofty returns over the long term while taking a lower risk, dividend investing has been one of the most popular investment strategies over the decades. The combination of steady dividend growth and healthy price appreciation helps dividend stocks generate solid returns in the long run. In the case of SPYD, the ETF offers a high yield but falls short on dividend growth and price return, two key characteristics dividend investors look for in long-term investing.

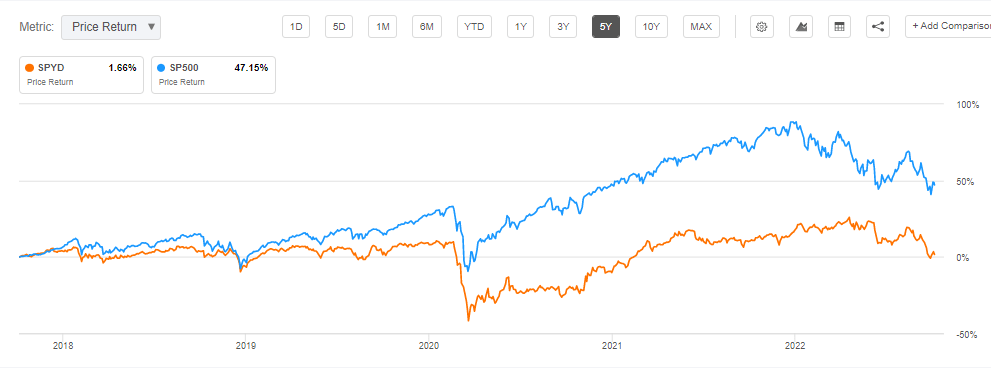

SPYD’s Price Return (Seeking Alpha)

SPYD has returned only 1.6% over the last five years compared to a price return of around 47% from the S&P 500. Although it outperformed the S&P 500 index so far in 2022 for the first time since its inception, it still lacks the ability to generate lofty returns in long term. This is due to SPYD’s portfolio concentration, which is ideal during bear market scenarios, but not during bullish markets. Bear markets are short-lived when compared to bull markets. Historically, an average bear market lasted 289 days or about 9.6 months. Meanwhile, a bull market typically lasts 991 days, which is 2.7 years. Based on the average bear market length of 289 days, this bear market has almost reached the historical average. The current bear market began on January 3rd, 2022 when the index started sliding from an all-time high.

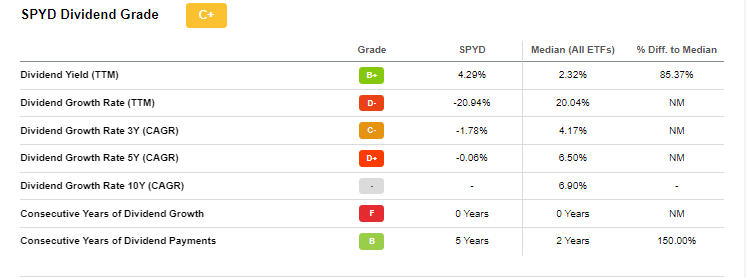

SPYD’s Dividend History and Quant Grade (Seeking Alpha)

Dividend growth is another factor negatively affecting its returns. SPYD has cut its dividends three times since its launch in 2015, earning a C plus quant grade on the dividend factor. Dividend growth has been negative for the last three years and negative for the last five years. There is little hope for dividend growth in the future as high-interest rates are likely to adversely impact its stake in the financial, real estate, materials, industrial, communication, and technology sectors. Furthermore, the fund’s large number of securities doesn’t focus on dividend growth, while only a few belong to the dividend aristocrats list. For instance, its stock holding such as NWL Newell Brands Inc. (NWL) has not increased its dividend since 2018. Similarly, Darden Restaurant (DRI), Iron Mountain Inc. (IRM), FirstEnergy Corp. (FE), PNC Financial Services Group Inc. (PNC), and many others received low dividend consistency grades based on Seeking Alpha’s quantitative analysis system.

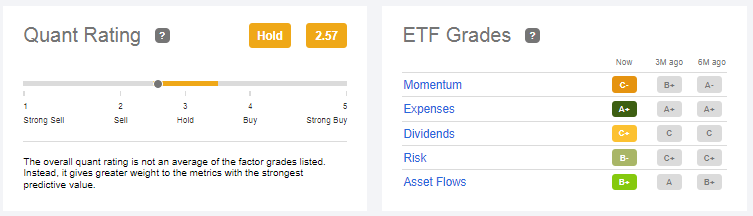

Quant Ratings

SPYD’s Quant Ratings (Seeking Alpha)

Based on Seeking Alpha’s quant system, SPYD has a hold rating with a quant score of 2.57. The low grades on momentum and dividend factors hint at lower total returns in the future. On the positive side, the ETF gained an A-plus grade on the expense factor due to its low gross expense ratio of just 0.07%. SPYD is ranked 374th out of 507 ETFs in its asset class and 90th out of 96 in the sub-asset class according to Seeking Alpha quant data.

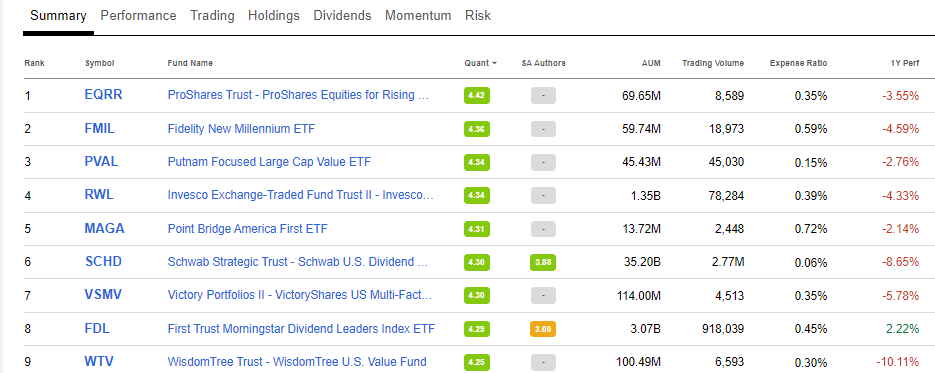

Alternative Options

Seeking Alpha Quant ratings for SPYD’s sub-asset class)

For dividend investors, there are plenty of options that offer lower volatility along with steady growth in total returns over time. According to Seeking Alpha quant data, ProShares Trust – ProShares Equities for Rising Rates ETF (EQRR), Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF (SCHD), and First Trust Morningstar Dividend Leaders Index ETF (FDL) are among the top-rated dividend-focused ETFs to buy for the long-term. In the last three years, ProShares Trust – ProShares Equities for Rising Rates ETF has generated a price return of around 29% and a total return of around 37%. Similarly, Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF has also been outperforming the S&P 500 index both in price and total returns.

In Conclusion

SPYD ETF provides above 4.5% dividend yield, but it hasn’t been able to translate this yield into substantial long-term returns because of low price appreciation and lack of dividend growth potential. Although it provided a cushion against market volatility in 2022, the ETF has failed to generate solid total returns for investors in the past five years. In addition, the ETF’s focus on low-beta sectors and stakes in low-quality dividend stocks make it an unattractive long-term dividend investment. In my opinion, a dividend-focused ETF with a low yield but steady dividend growth and price appreciation potential is a better investment.

Be the first to comment