Nordroden

Dear readers,

The time has come to update my thesis on the company Gerdau S.A. (NYSE:GGB), a business in the steel sector. In my previous article on the company, I called the company a relatively risky play given some of the credit rating deficiencies as well as some of the geographical risks and macro.

As I’ve mentioned before, investing in companies in Brazil is always a bit of a risk due to currency and potentially volatile markets – though it’s equally dangerous to completely overplay these risks and ignore the market and individual company valuations entirely, as some investors want to do.

Revisiting Gerdau

When looking at Gerdau, it’s important to remember positives as well as challenges. There are plenty of positives that make Gerdau a convincing play if you’re prepared to consider the risks.

This is an investment-graded Brazilian steel producer with expansive international operations and 40-50 years’ worth of experience. Whatever challenges the modern world and its market can think to throw at individual companies – Gerdau has seen and experienced them firsthand, especially being in a relatively volatile geography such as Brazil.

Being a family-controlled company also brings with it some of the upsides – as well as downsides of such a venture, including a lack of shareholder control, but a highly vested interest in things like the dividend.

Still, commodities such as steel, as with other commodities like aluminum, copper, and other metals, are bound to have certain upsides in the market environment we’re now clearly entering. These investments tend to hold their levels far better than some other sectors, given the relative pricing power of the companies.

Some basics first – as I mentioned in my first article on the company, steel as a sector has a high correlation to population and industrial growth, which is why the market for it has been very lucrative for the past two decades or so. China has seen explosive demand due to its bubble in Real estate, and while China may be on its way down, there is still a high continued demand for steel. Gerdau also produces within one of the most appealing steel geographies in the world, with Brazil being the 9th-largest producer worldwide of steel. This also isn’t an easy sector to be in, which is why we’ve seen such a degree of consolidation over the past 20-40 years.

Steel in other parts of the world hasn’t seen great trends, on a company-wide level. Companies that exemplify this include Mad Men-known Bethlehem Steel Corporation, Trico Steel Co, National Steel Corporation, LTV Corporation, and others, many of which were folded into ArcelorMittal (MT). Only the largest and most efficient producers, or producers found in low-cost regions end up remaining in this sector.

Of course, this is actually a potential positive for Gerdau, together with the current macro. This is because Gerdau can produce cheaper than most of its peers, and given the current trends, it’s unlikely that this will change in the near term. This has granted the company some positives over the past few quarters, and its transformational journey is ongoing.

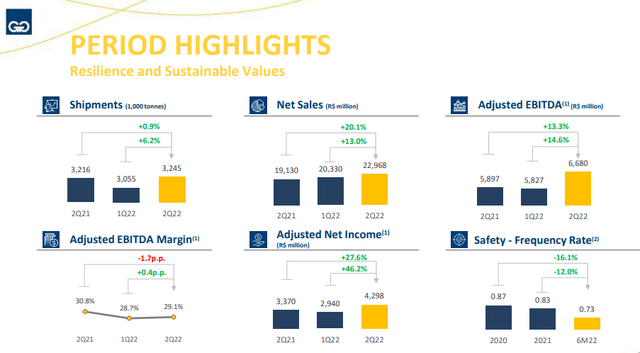

2Q22 results are in – and these results are good despite current issues. While higher Brazil inflation and worldwide macro heighten the risks. The company is seeing a slowdown in China due to COVID-19 restrictions. There was also a pricing decline with trends in Turkish rebar, raw materials, as well as scrap and pig iron prices. These prices have essentially corrected somewhat.

Still, shipments, sales, EBITDA, net income, and margins are all up.

The company recorded the best quarter in history for the company’s NA division, meaning 42% of consolidated EBITDA. The company saw very healthy dynamics in industrial and infrastructure trends as well as construction, with leading indicators pointing to even stronger growth thanks in part to accelerated infrastructure spend. This doesn’t take away from the logistical and labor challenges the company is seeing, but it’s still projecting a very strong steel demand, with a large order backlog. The US infrastructure bill should start seeing its first effects by the end of 2022, or early 2023.

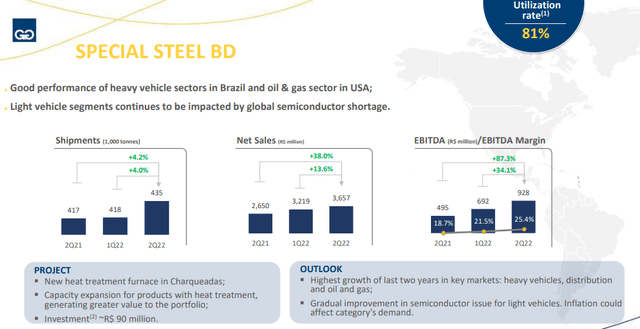

The special steel segment is seeing some impressive growth as well.

Brazil saw impressive trends as well, with increasing trends and good outlook. Volumes are at stable levels, and the company expects continued upside from residential and energy sectors, with plenty of demand from the infrastructure sector.

South America ex-Brazil meanwhile had the best quarter in history and expects continued upside from both Argentina and Uruguay, with continued stability and demand from Peru as well. The company managed over R$3B of FCF in the quarter, or a 14% net sales margin for the quarter. This is also the 9th consecutive quarter of positive FCF, with the 2nd lowest financial cycle for 2Q in the last 10 years.

This also puts the leverage at 0.18X, which is the lowest leverage ratio ever recorded by Gerdau.

The company has an average debt term of 8 years, with a 7.6% average weighted cost. This might sound high from an EU/NA perspective, but it’s not that high for the context the company operates in.

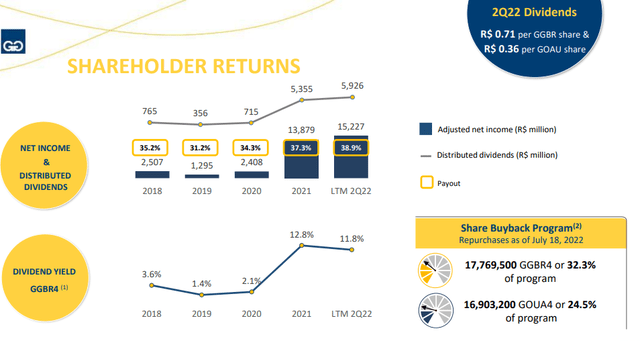

The company is also in an excellent position to continue its generous dividend policy, coupled with excellent shareholder buybacks.

All this puts the company in a superb position.

I highlighted in my previous article that the company is currently in a part of the cycle where it is performing with a very high RoIC, meaning that most of the other corresponding key variables are also positive. I do go into some fundamental risks in my original piece…

- The iron/steel market is inherently volatile, best expressed by viewing this company’s earnings and sales over time.

- The Brazilian Real (R$) is not exactly known as the most universally stable currency, and over 50% of company earnings come from Brazil. The company’s FX exposure is massive. Nor is Brazil inherently known as the most geopolitically stable region, with plenty of ups and downs.

- While the company’s current debt level seems low thanks to high earnings, actual total debt is relatively high. With a high cost of capital and a historically low ROCE compared to a relatively high WACC of well over 9% at this point, the company has had a hard time, outside of this crisis, really driving shareholder returns. This is a problem, and not a small one.

(Source: Seeking Alpha article, Gerdau)

I will continue to argue that some of these risks have grown smaller as the company has been granted ample elbow room to address its actual debt with the advantage of massive earnings – enough to make share buybacks.

I will also go on record saying it’s difficult to say when exactly the problematic macro situation, characterized by high demand and inflation, is likely to wind down or to end – but that the company is appealing here – and the appeal at this point, with the company’s recent quarterly, is getting even higher.

Since my last article on Gerdau, the company has dropped close to 15%. That brings the valuation to the following situation.

Valuation for Gerdau

This does not take away from an extremely volatile earnings history, but the fact is that over the past 20 years, the company has clearly outperformed broader markets, coming in at an over 12% annualized RoR. What’s even better, the company shows no indication of being grossly overvalued as they did prior to the 2007-2009 financial crisis.

Gerdau is, in fact, extremely undervalued at this juncture. The current valuation has the market putting Gerdau at no more than a 3x P/E, which is ridiculous for this company.

There is the matter of the company’s earnings being elevated for 2022 still, but I don’t see the company being worth this little. After a 15% drop-off, Gerdau has become incredibly appealing, now trading below $5/share. I actually shared this in my last article – that the company becomes a “BUY” at $5/share, and I’m now backing this stance with cash injections.

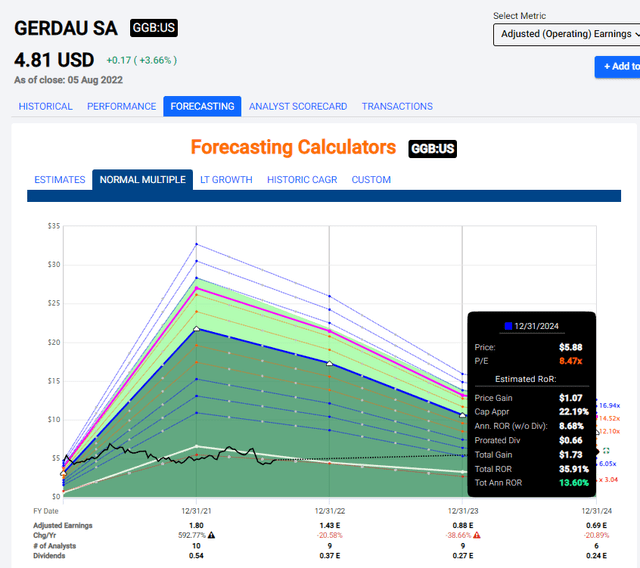

Gerdau upside (F.A.S.T. Graphs)

I put the company at the lowest possible 20-year average of 12x P/E, then dial this down to 8.5x P/E, which is still lower than most peers in the entire industry. The upside here is 36% until 2024, even in the face of double-digit actual declines.

This is a perfect example of a SOTP/NAV valuation being an argument for investing. 5 out of 6 analysts have this company at a current “BUY” or “Outperform” recommendation, and I finally believe the price to be low enough for me to start taking more of an active role in the shareholding of this business.

Gerdau will be my second South American holding. I intend to start small – then build up size step-by-step, as I don’t see this company moving massively in either direction quickly.

There is no doubt that Gerdau is a well-established company in several markets. There is also no doubt that Gerdau trades to significantly cheaper multiples on virtually every basis compared to peers at this time, with some exceptions.

My previous points made about the peers remain – all of them are tendentially better capitalized than Gerdau is, and any investment into Gerdau needs to deal with the fact that 50% of the company’s EBITDA in fact comes from Brazil, which again isn’t exactly stable geography by any means.

There are safer alternatives out there – I still believe and see that. However, given the shift in macro, we’re seeing, I’m now willing to pay tangible book value for the company, which means that I might be willing to start to look at Gerdau at around or below $5/share, which is a fairly significant bump from my recent price target for the company of around $3/share.

That’s why the company is now a “BUY” for me. My stance on the company is now a “BUY”.

Thesis

My thesis for Gerdau here is the following:

- While Gerdau has some appeal from a fundamental point of view, active in good geographies with growth potential, the company still needs to prove consistent returns above the cost of capital and debt. For the time being, this is being achieved thanks to outsized demands due to recovery.

- I view Gerdau as a “BUY” here, but the valuation targets have improved significantly. If you bought the company during the crash – congratulations, you have excellent returns and can enjoy your yield.

- The price target is below $5/share when tangible book value hits a 1X ratio. Until then, I’m at a “HOLD”. That means I’m still at a “HOLD” now, but it’s far closer to a “BUY” than it was before.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Thank you for reading.

Be the first to comment