Gary Kavanagh/E+ via Getty Images

Overview

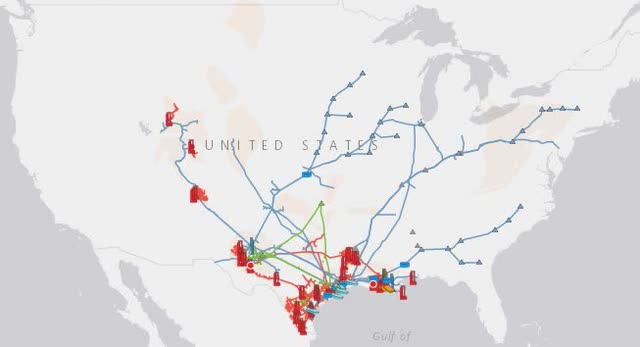

Enterprise Products Partners (NYSE:EPD) is one of the largest pipelines in the US, with a more than 50,000-mile footprint covering the United States from Wyoming to New York. Revenue in the last 12 months exceeded $55 billion.

This article will look at EDP’s dividend history, what the future dividend policy may be, and compare it to other competitors’ dividends.

Note: I use the words “dividend” and “distribution” interchangeably.

EPD Stock’s Key Metrics

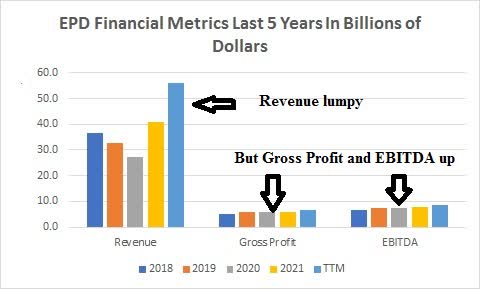

When you look at EPD’s Revenue, Gross Profit, and EBITDA over the last five years, you see some incongruous numbers.

But fear not, the number actually shows the quality of management at EPD.

Seeking Alpha and author

Looking at revenue we see a steep drop from 2018 through 2020 then a quick rise for the last two years. That was because of management’s wise decisions to divest some properties and reinvest in others. The most recent acquisition was Navitas Midstream in January 2022.

The key point to remember is even though revenue was down some years both gross profit and EBITDA went up, thus allowing the dividend to go up too.

What Is EPD’s Dividend Yield?

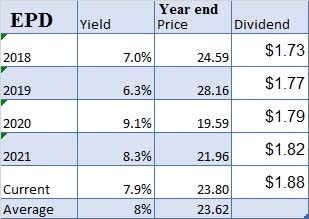

Currently, EPD’s price and dividend yield are sitting right about where the 5-year average sits. What is noticeable is the share price is down 15% from 2019 even though the dividend itself has gone up every year.

This could imply that EPD is currently underpriced.

Author

Is The Dividend Safe?

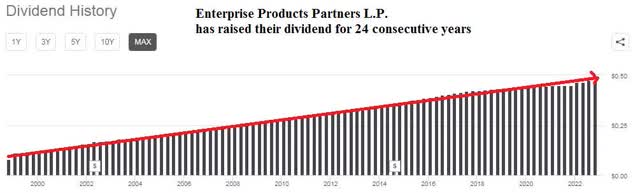

One of the things EPD is known for is its steady year-after-year increase in its dividend rate. It has raised its distribution for 24 consecutive years.

It is also buying back shares, which further supports the dividend because the same dollar amount of distribution will be spread over fewer shares.

This year will be the 24th consecutive year of distribution growth. Enterprise repurchased approximately $95 million of its common units in the open market during the third quarter of 2022 and has repurchased a total of $130 million of common units in 2022. Source: Enterprise Products Partners

That is an enviable record that few other companies can match.

With increasing gross profit and EBITDA, I think it is safe to say, EPD’s dividend is not only safe but most likely will grow over the foreseeable future.

Randy Fowler, Co-CEO:

Our first priority is supporting and growing distributions to investors.

and

Jeremy, I think you’ll continue to see us sort of all the above and try to do a combination of distribution growth and buybacks, where it makes sense, again, opportunistically.

Source: EDP

So dividend/distribution growth and share buybacks are both priorities of management, a good sign if you are looking for increased dividend payout going forward.

And even with the increased distribution and share buybacks, the percent of cash flow spent on those two items was only 56% of distributable cash flow. So plenty of room for increased distributions and buybacks in the future.

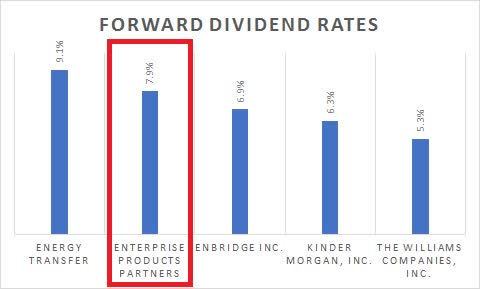

How Does The Dividend Compare To Competitor Dividends?

Comparing EPD to its pipeline competitors shows EPD behind only Energy Transfer (ET), but with their huge cash flow and management commitment to increasing distributions and buying back shares, it should be considered top tier for this group.

Seeking Alpha and author

Is EPD Stock A Buy, Sell, Or Hold?

Considering its 24-year history of raising the distribution, its conservative management, and its commitment to raising distributions, EPD looks to be a stellar choice for long-term dividend-seeking investors.

The only fly in the ointment is the long-term downtrend in the share price since 2014. On a price return basis (not including dividends), the shares are down 37%.

However on a Total Return basis, including distributions, EPD is up over 24% a rather modest return for eight years.

All in all, EPD is a Buy for long-term dividend-seeking investors.

Be the first to comment