xiao zhou/iStock via Getty Images

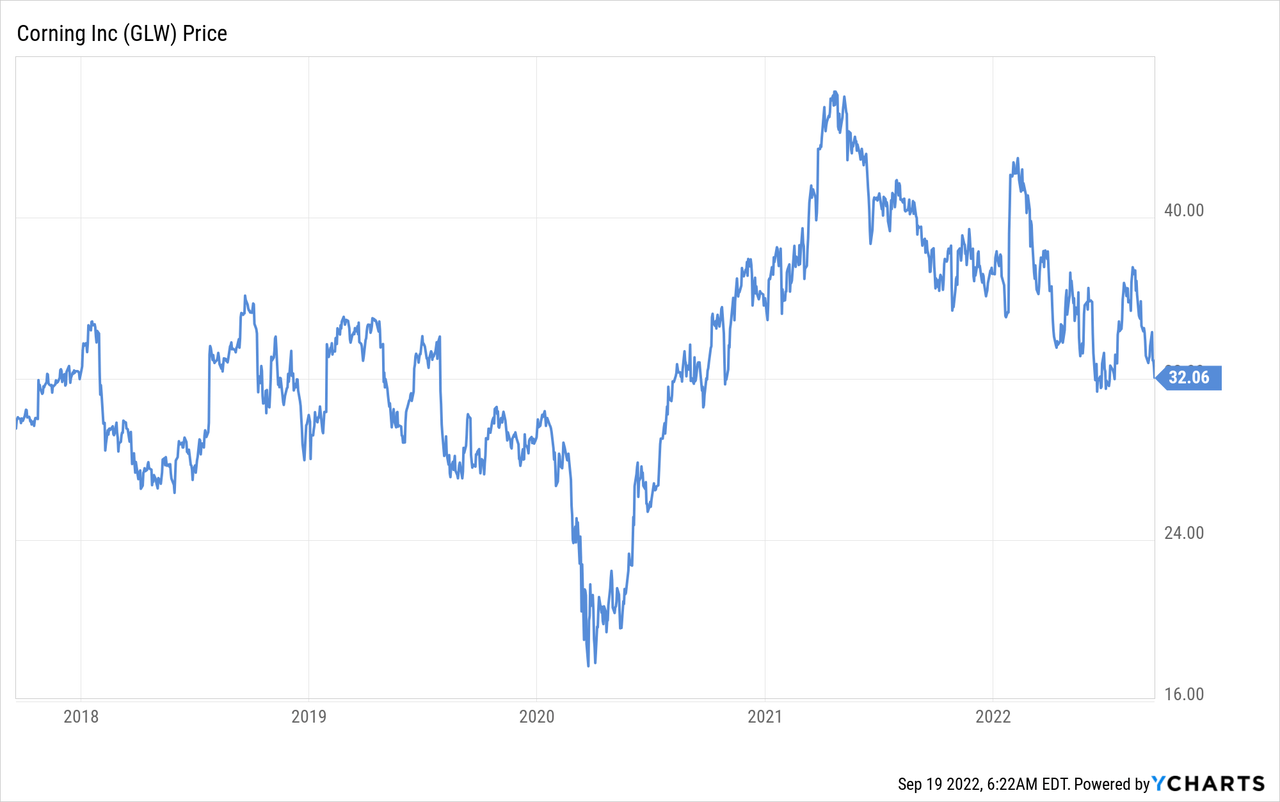

Corning (NYSE:GLW) is executing very well, yet its share price fails to reflect any of the progress the company is making. Shares are trading in the low $30s, the same price they were at almost five years ago! As we’ll see in this analysis, the company is a much bigger and more profitable company compared to the Corning of five years ago, and the fact that shares have gone basically nowhere means that the valuation has compressed and that today shares are trading with an extremely compelling valuation.

To give a quick example, in the first half of this year the company added approximately $700 million in revenue, up about 10% y/y, and first half EPS grew even faster, up 14% from $0.97 to $1.11. The company also generated robust first half free cash flow of $611 million. Yet shares are trading lower this year compared to last year. Admittedly the market is down, but the strong performance of Corning means investors can buy a bargain today.

There are some segments that are performing particularly well. For instance, in the second-quarter optical communications was the biggest growth driver, increasing 10% sequentially and 22% y/y to $1.3 billion. The combination of private network and public infrastructure investments will create double-digit market growth for passive optics over the next few years and Corning is well-positioned to capture this growth. The company is increasing capacity for both cable and fiber. At the end of August, Corning announced that it’ll be expanding manufacturing capacity for optical cable by building a new plant in Arizona. Corning also announced the opening of a new optical fiber manufacturing facility in Poland, which will significantly increase its ability to support the growing demand for broadband in the European Union.

The rest of the businesses are performing in line with expectations, perhaps with the exception of display technologies. In August, panel maker output declined from already low levels due to rolling power outages in China. In any case the company is working to stabilize returns for the business, maintaining favorable pricing, and continues to be an industry leader with leadership and cost advantages in new technologies. Hemlock Semiconductor, which manufactures ultra-pure polysilicon for the semiconductor and solar industries, is also performing exceptionally well. It is turning on idle capacity and secured multi-year take-or-pay commitments for solar, and expects demand to continue growing. The mobile consumer electronics segment is outperforming in a down market, with customers adopting Corning innovations for new product launches expected this year. An example of how this business is outperforming is that while smartphone sales worldwide were down 11% y/y, Corning sales were basically unchanged from the previous year. That’s because Corning introduced some really exceptional products, particularly for flagship phones, which were less impacted than other categories.

Financials

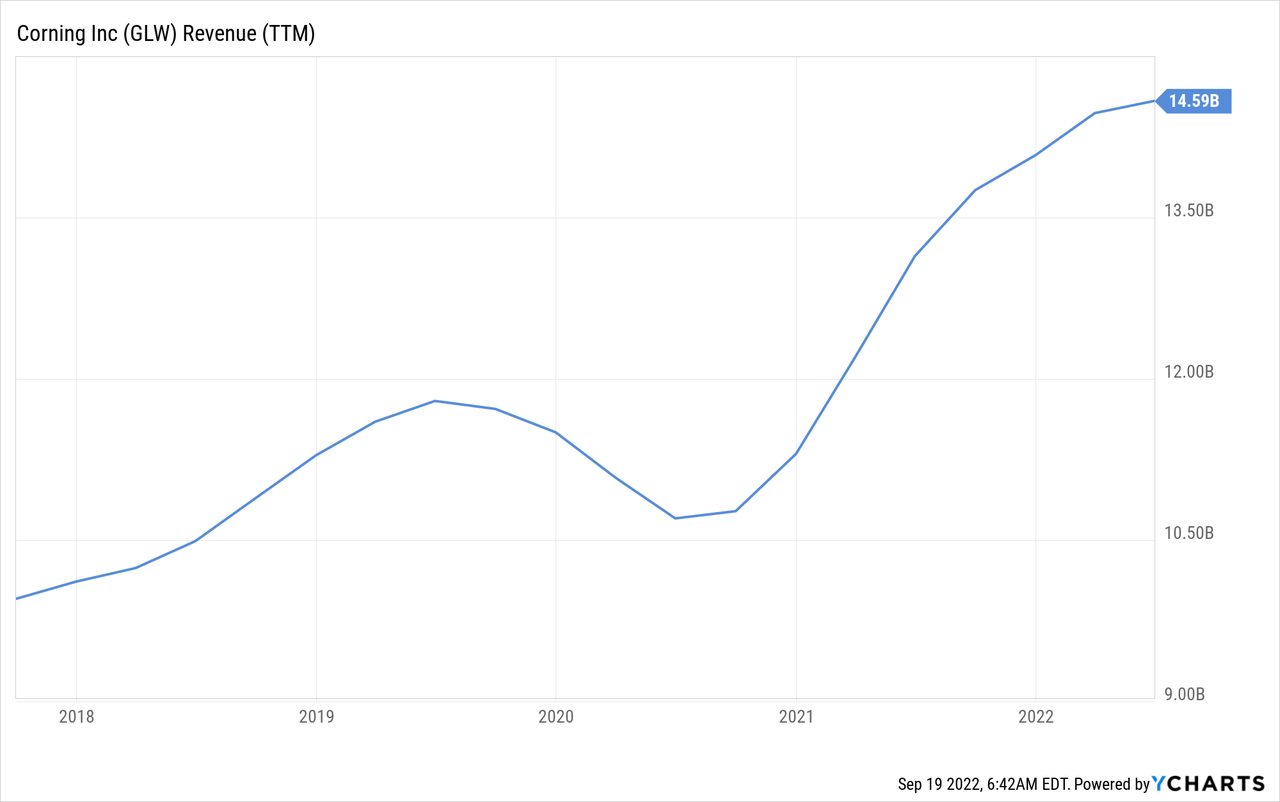

In the last five years revenue has grown from less than $10 billion to more than $14 billion, and that is despite Covid and the recent macro-economic weakness.

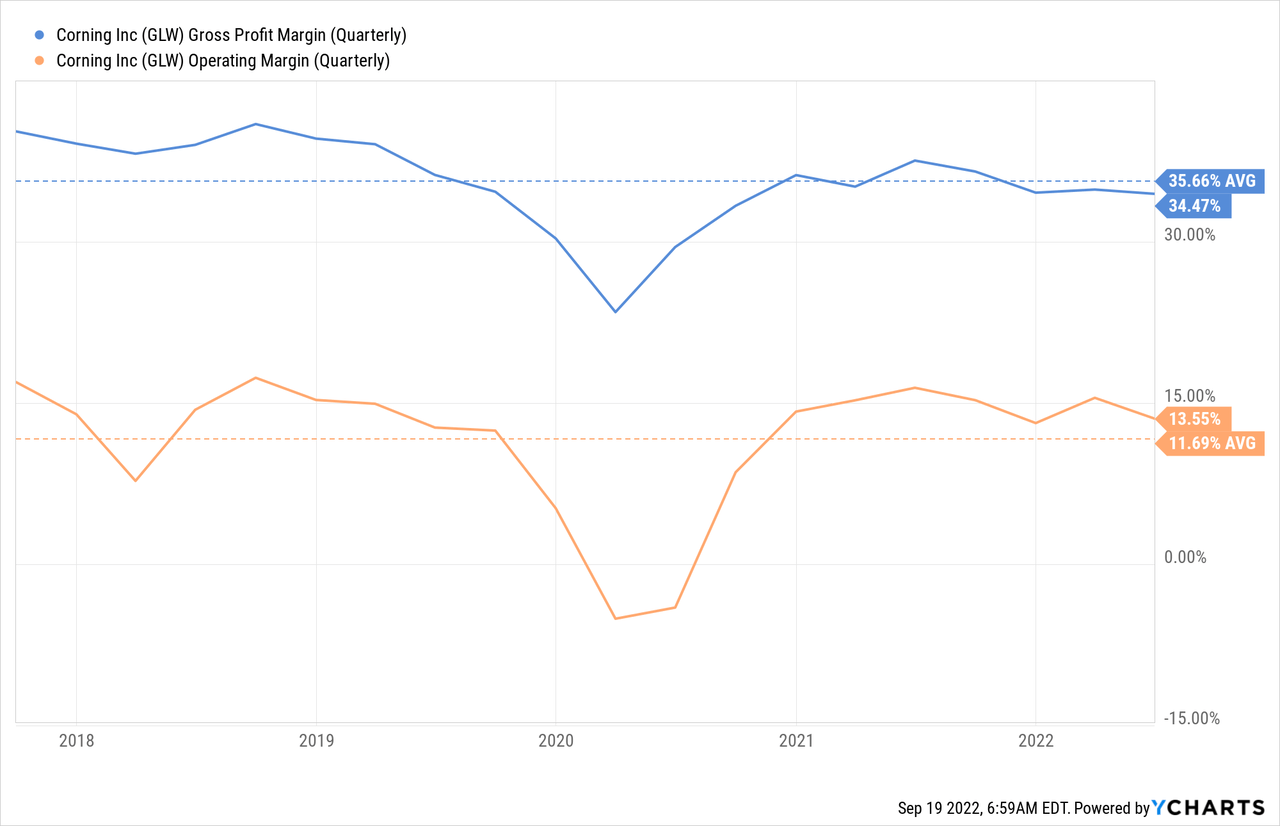

Admittedly, there has not been much in the form of operating leverage resulting from the increased revenue. Gross profit margins are a little below the five-year average, and operating margins have not improved much in the last five years either. This is probably one of the key areas where the company has to make some progress to force the share price higher. If revenue keeps growing and margins improve, we believe that will put enormous pressure for the shares to move to the upside.

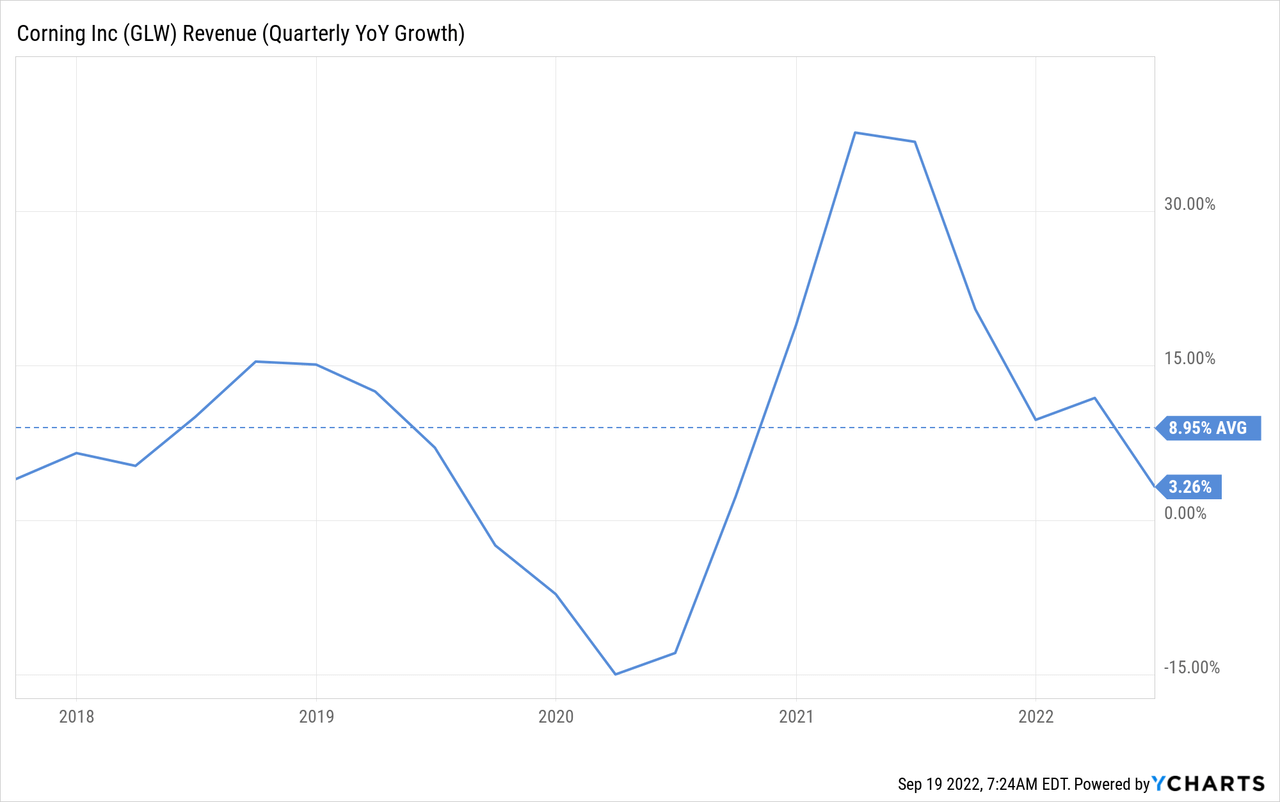

Growth

In the last five years quarterly revenue has grown y/y at an average of ~9%, that is very good considering all the challenges that have been present during this period, including Covid and the recent macro-economic headwinds and supply-chain disruptions.

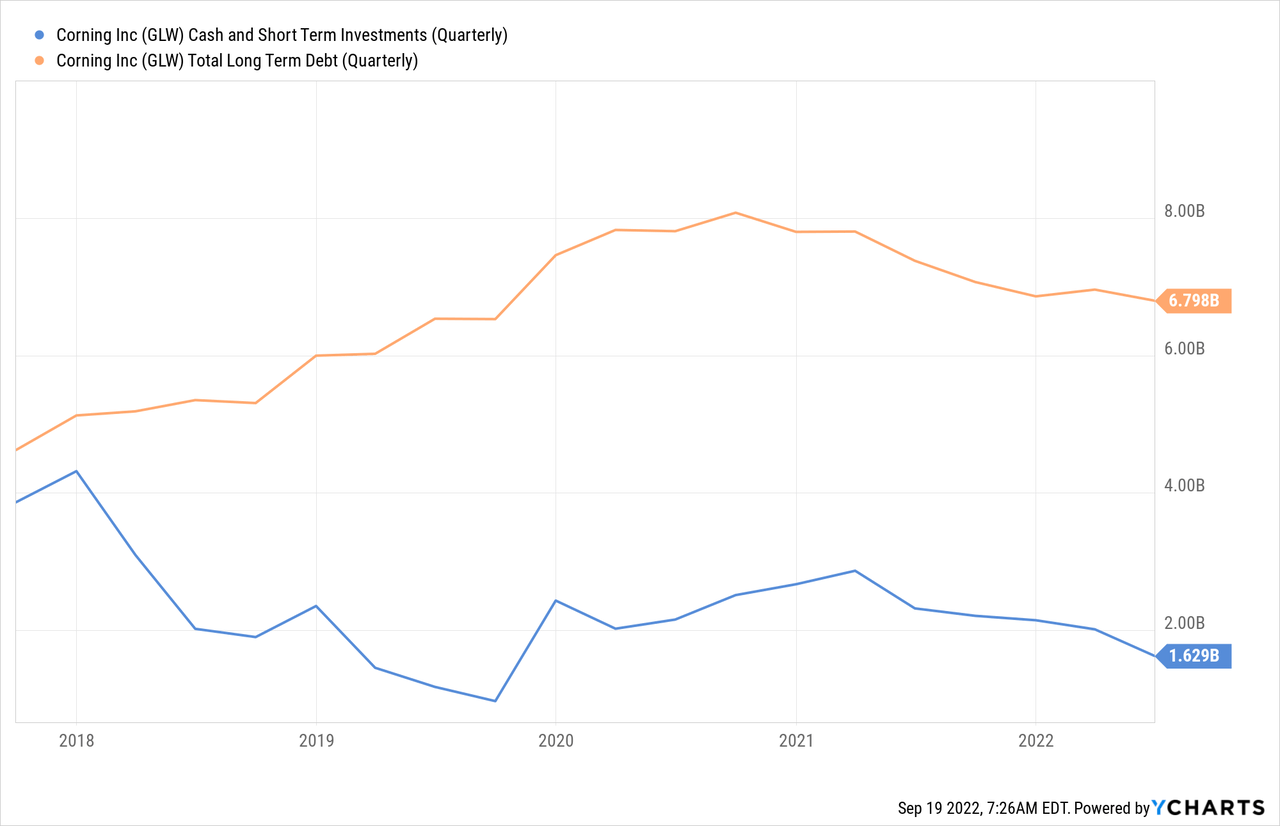

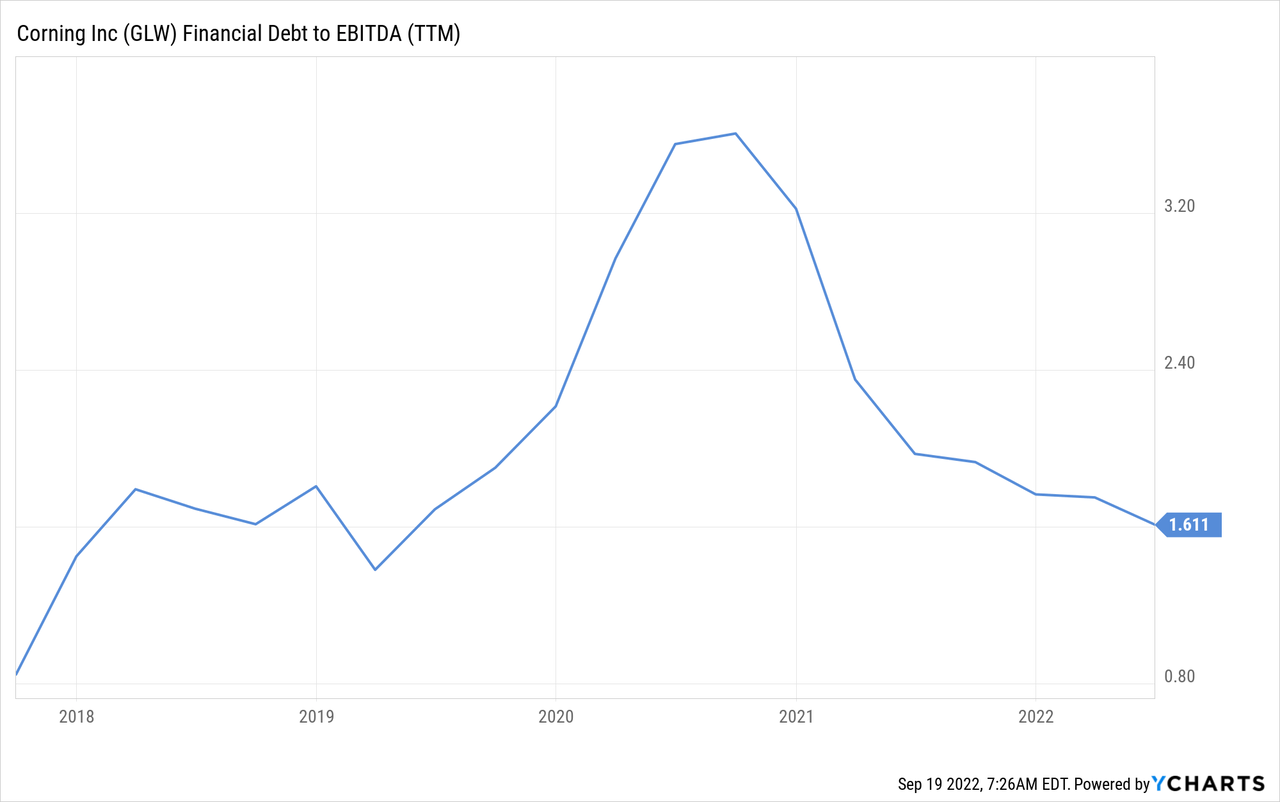

Balance Sheet

Unfortunately, something else that has grown during this period is the amount of long-term debt. Although it has been declining for the last two years, it is still currently significantly higher than it was five years ago and the amount of cash and short-term investments has decreased as well.

Despite all of this, leverage remains quite reasonable with a debt to EBITDA ratio of only ~1.6x. For the time being we are not overly worried about the balance sheet strength, and trust that management will work to reduce leverage further.

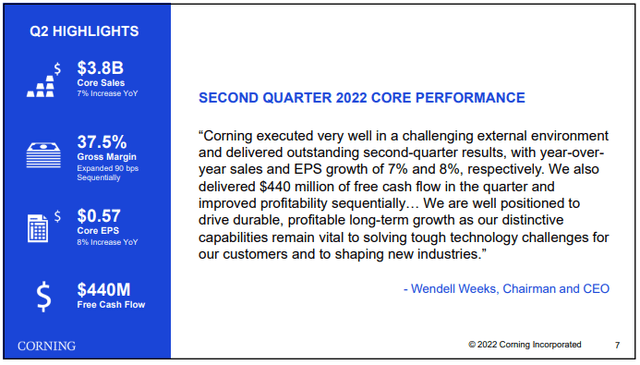

Q2 2022 Results

For its most recent quarterly results, Corning reported excellent numbers. With sales increasing ~7% and EPS ~8%, while delivering $440 million in free cash flow.

Corning Investor Presentation

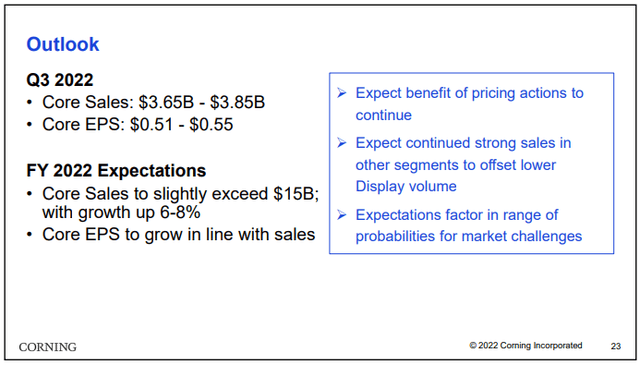

Guidance for Q3

Guidance for Q3 was pretty decent too, and Corning is expecting the benefit of pricing actions to continue. For the complete fiscal year 2022, expectations are for sales growth in the range of 6 to 8%, and EPS growth to be about the same as sales growth. Given the economic environment we believe these are very healthy numbers.

Corning Investor Presentation

Valuation

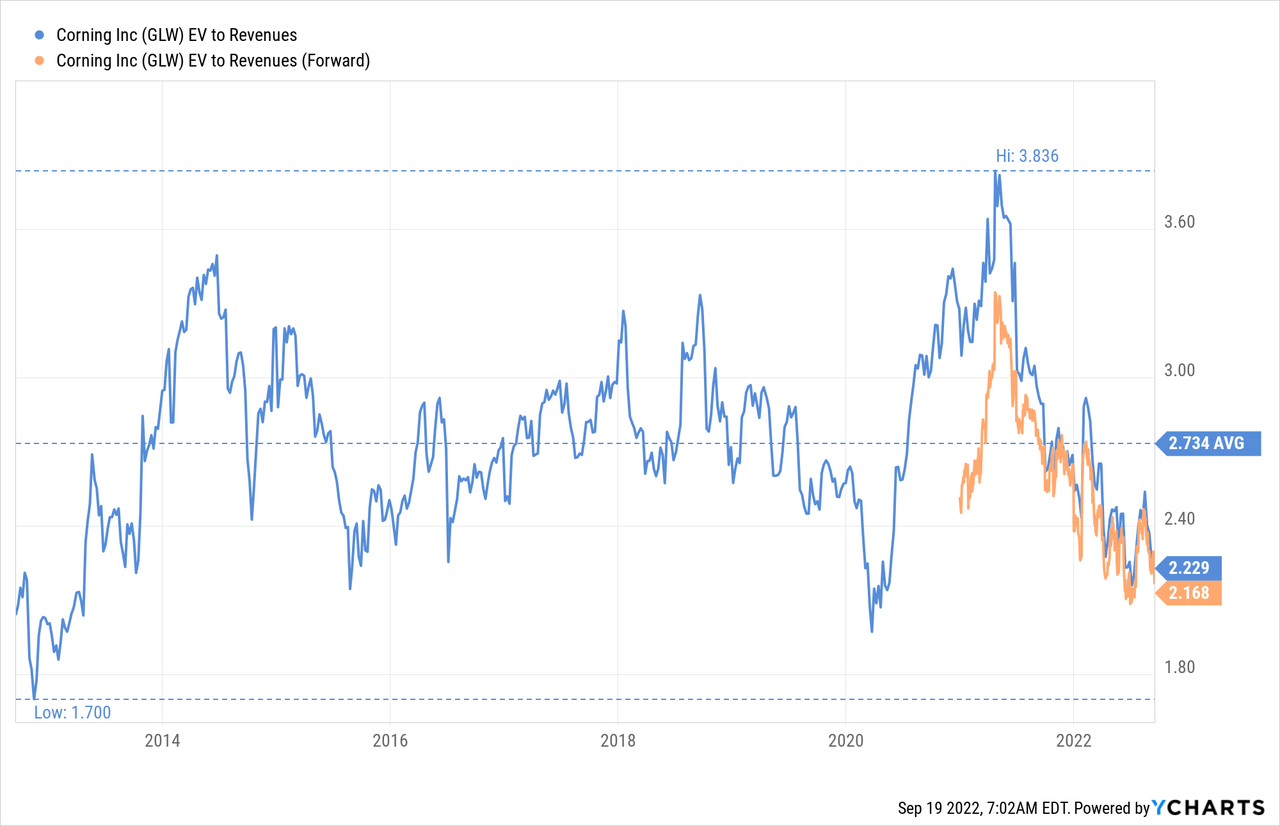

Corning has rarely been this cheap, at least in the last ten years, with an EV/Revenues multiple of ~2.22x, significantly lower than the ten-year average of ~2.73x.

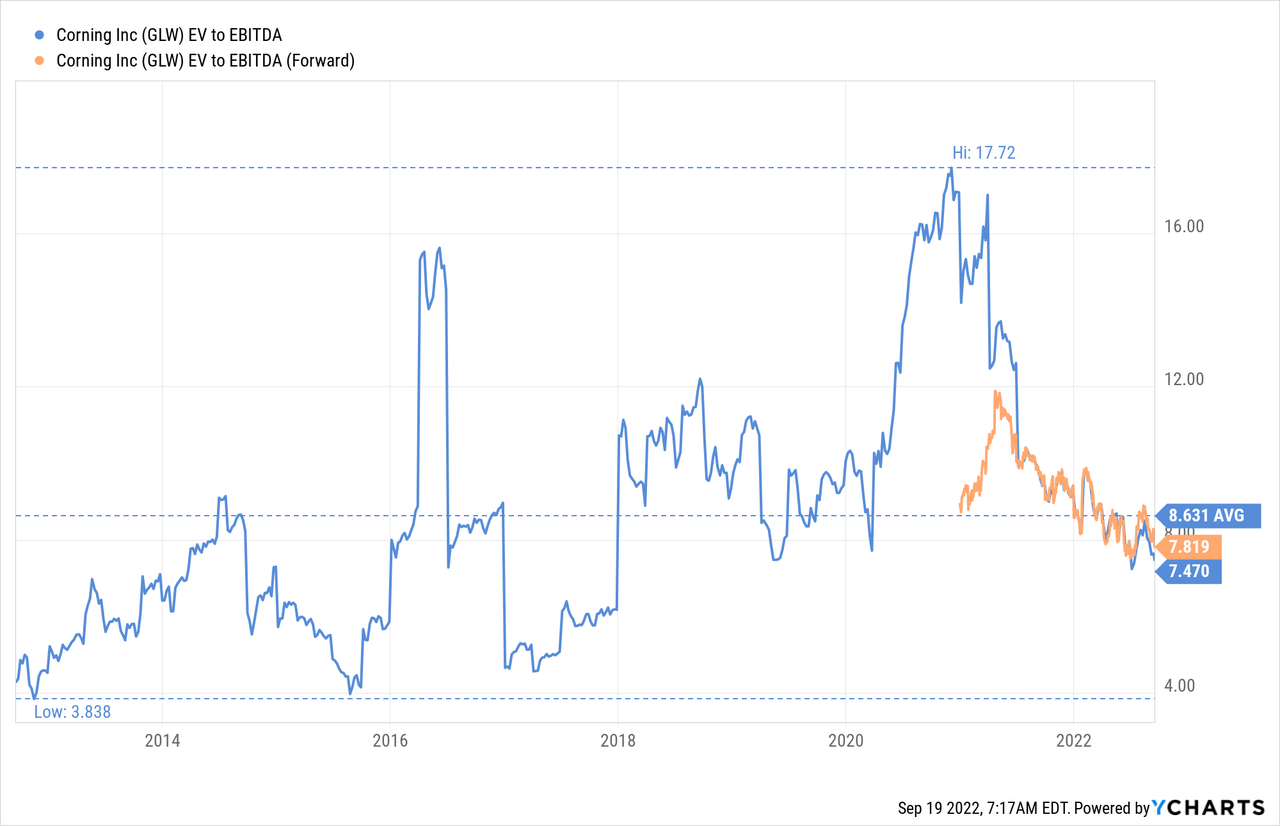

The EV/EBITDA multiple is also below the ten-year average of ~8.6x, currently at 7.4x. We consider this multiple very cheap on an absolute basis too. Especially for a technology company like Corning.

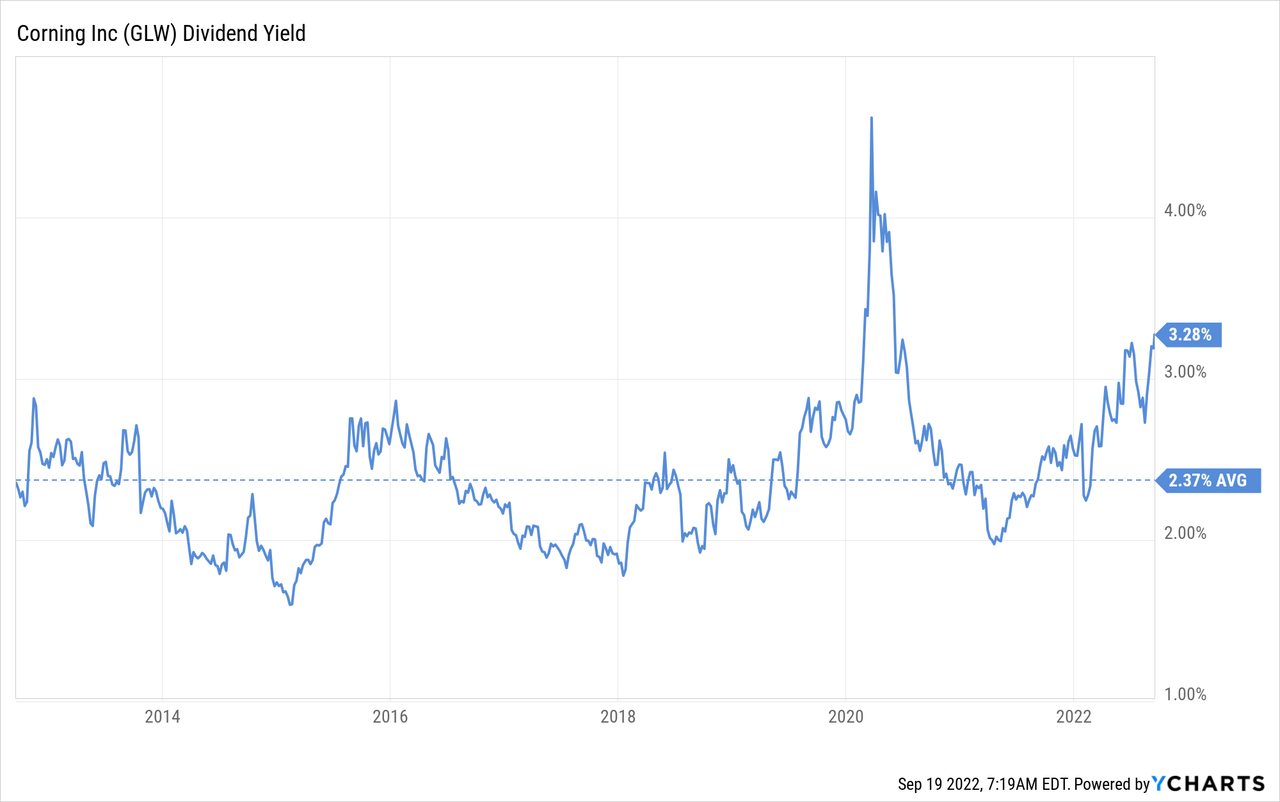

Another sign that shares have gotten too cheap is the above average dividend yield. Shares are currently yielding almost 50% more than the 10-year average of ~2.3%. Except for the brief period around the worst of the Covid crash, shares have not had a higher dividend yield than the recent ~3.3%.

Risks

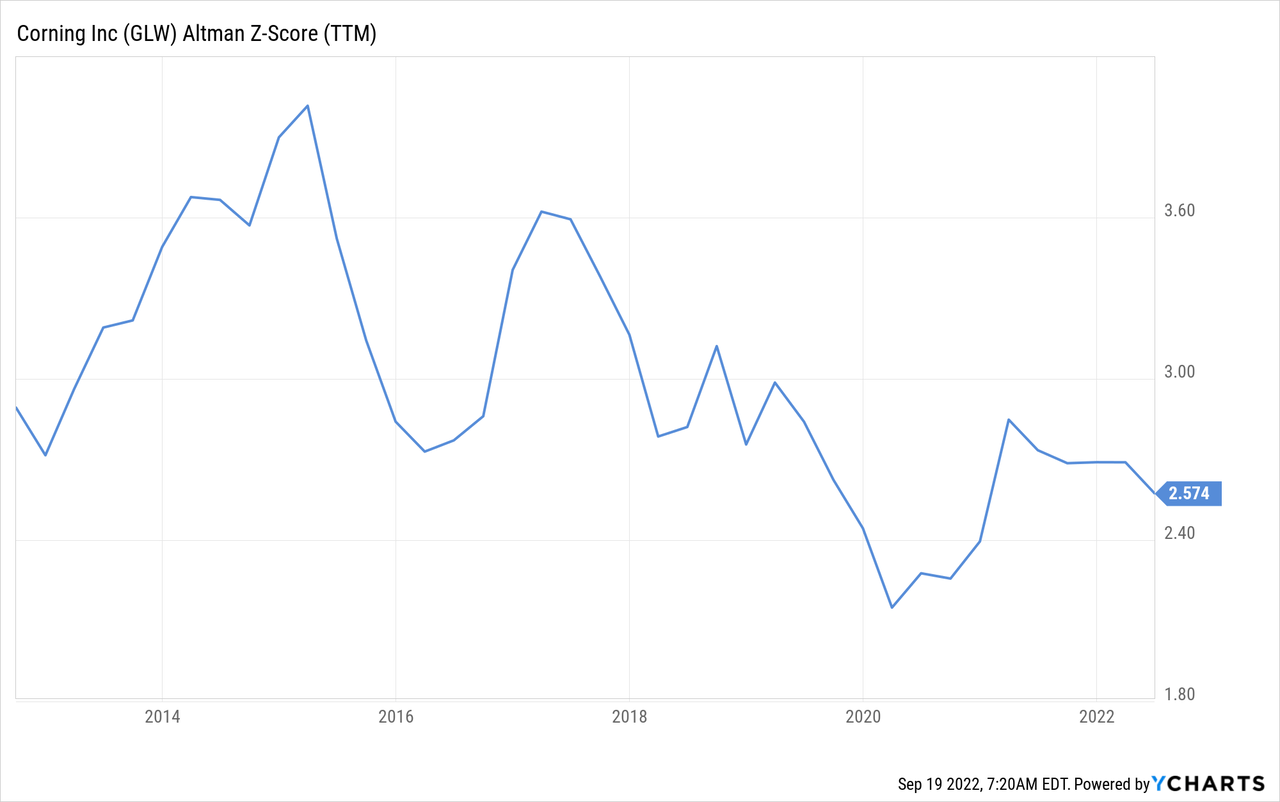

While Corning is solidly profitable, and the balance sheet is in decent shape, its Altman Z-score remains below the 3.0 threshold. We hope that as the company’s profitability improves and it deleverages some more, that it will once again find itself with a score above 3.0.

Additionally, Corning remains a company with high sensitivity to economic conditions, as many of its products have discretionary end markets, such as cars and mobile phones.

Conclusion

We believe Corning shares are trading at a very attractive valuation, and after almost five years of going nowhere, the valuation has compressed enough that they resemble a coiled spring. We believe improved margins could serve as a catalyst for shares to move higher. In any case, we do find it ridiculous that the share price is basically the same as it was five years ago, despite the enormous progress the company has made. Revenues are much higher, and growth prospects for divisions such as optical communications are extremely positive. In other words, we believe Corning shares are currently offering enormous value.

Be the first to comment