Philippe Turpin/Photononstop via Getty Images

Investment Thesis

GoodRx’s (NASDAQ:GDRX) highly shorted shares soared 50% after-hours as the market is positively surprised by the company‘s near-term improved outlook.

GoodRx is a telemedicine platform that provides patients with access to cheap medication as patients search for the cheapest prescription medicines on its platform.

Looking beyond Q3 and into its Q4 2022 results, GoodRx believes that it will see a significant improvement in the trajectory of its business as it has now solved a material issue with a large grocery partner.

With the stock down so significantly in the past 6 months as investors feared the worst, I believe that investors paying 5x this year’s revenues for this business will be positively rewarded.

Revenue Growth Rates Loose Steam, But

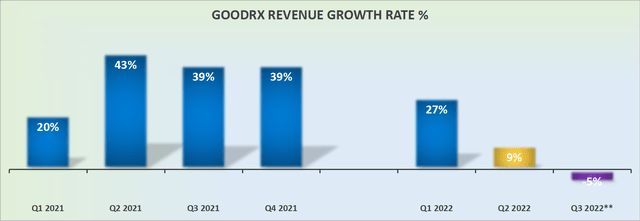

GoodRx’s revenue growth rates

GoodRx reports 9% y/y growth. This is clearly a substantial deceleration from the 27% y/y revenue growth rate posted in Q1, not to mention a very dramatic deceleration from the 43% y/y revenue growth rates posted in Q2 of last year.

Yet GoodRx’s shares soared. Why?

GoodRx’s Guidance Positively Surprises

GoodRx notes in its guidance that it now believes that it has resolved its grocery issue. GoodRx contends that the grocery issue was only partially impacting its Q2 2022 revenue growth rates, but that its full impact will be felt in its Q3 2022 revenues.

GoodRx estimates that its grocery issue will impact its Q3 revenues by approximately $37 million at the midpoint.

Hence this means that if this issue were to be resolved, its revenues would have been approximately $222 million at the midpoint.

That implies that not only GoodRx’s Q3 revenues would have massively beat analyst revenue consensus estimates of $201 million by approximately 10%, which would have been a massive positive surprise for this highly shorted stock, but there’s more.

Perhaps more importantly, this would have put its revenue growth rates at closer to 14%.

This means that rather than GoodRx’s current revenue growth rates pointing to a negative 9% y/y, its growth rates would actually be at 14% — a dramatic change.

Moreover, this would be a notable reversal in the company’s fortune, as GoodRx would see its revenue growth rates accelerate from Q2 2022, as well as crucially, the company would return to reporting stable growth rates.

Further Details About this Turn of Fortune

Throughout the earnings call, GoodRx makes the argument that its network retailers outside of this one key grocer that had been lost had seen strong enough growth to offset in large parts the loss volumes from this one grocer.

GDRX Q2 2022

Indeed, as you can see above, monthly active consumers ended the quarter largely flat y/y. This is despite the tough comparables with the same period a year ago when monthly active consumers were up 36% y/y (excluding RxSaver).

GoodRx is Fairly Cash Flow Generative

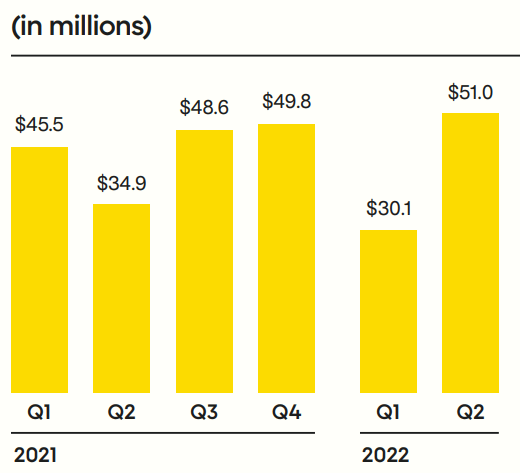

The graphic below comes from GoodRx’s Q2 2022 shareholder letter.

GDRX Q2 2022

For Q2 2022 GoodRx’s cash flows reached $51 million. This figure is higher than any of the previous 5 quarters.

That being said, this improved cash flow profile was nearly entirely driven through improvements in working capital, including accrued expenses, accounts payable, and prepaid expenses, and the collection of accounts receivable.

Given that GoodRx’s Q3 2022 EBITDA margin is expected to reach approximately 20%, despite including the loss of its grocery revenues, I believe that it’s reasonable to assume that GoodRx’s Q4 2022 exit rate could see GoodRx’s cash flows from operations returning to approximately $200 million annualized.

GDRX Stock Valuation – 5x Sales, Clearly Attractive

If we were to presume that GoodRx’s grocery issue is fully solved by Q4 2022, that would probably see Q4 2022’s revenues reach $260 million. Technically, this would put GoodRx’s revenue growth rates exiting Q4 at somewhere around 15% to 20% y/y revenue growth rates.

While this is far from an exciting growth profile, particularly when compared with its growth profile for 2021, nevertheless this is a dramatic improvement from what investors have become accustomed to over the past couple of quarters.

By my very rough estimates, this puts this profitable company on a 5x sales multiple. Note, this multiple includes GoodRx’s 50% jump premarket.

Investment Risk

My whole investment thesis is contingent on prescription volumes returning in full to the grocer after Q3 2022.

There is no guarantee that patients will return to using GoodRx to shop for their prescriptions with this key grocer.

Also, my thesis is contingent on GoodRx’s revenue growth rates returning to approximately 15% to 20% CAGR starting in 2023.

However, there is no guarantee that other large Pharmacy Benefit Managers (“PBMs“) will not also reconsider visiting their contractual arrangement with GoodRx.

Given GoodRx’s revenue concentration amongst its three largest PBM partners, that would have a significant detrimental impact on its revenue growth rates.

The Bottom Line

GoodRx is a company that has had a meaningful change of fortune. The company is no longer having to focus on stemming its lost revenue, but can now focus on improving its profitability profile.

Altogether, I believe that paying 5x this year’s revenues makes for an attractive valuation. What’s more, as we come to a close in 2022, soon investors will turn their focus to 2023.

By that point, investors today paying approximately $5 billion for GoodRx will be getting the company on a forward 4x sales multiple. This strikes me as an attractive valuation.

From a cash flow perspective, GoodRx is likely to end this year reporting approximately $200 million of cash flows. If the business indeed stabilizes, it’s very likely that GoodRx could see approximately $230 million of cash flows in 2023.

This would put GoodRx priced at 22x which is a fair multiple, given that this figure is very likely to err on the side of caution. Furthermore, GoodRx will more likely work to improve its cash flow profile, if indeed its growth opportunities have been exhausted.

Simply put, including the 50% jump premarket, the stock is still down more than 60% from previous highs. I believe that a lot of negativity is still priced in at this valuation.

Be the first to comment