arild lilleboe

Introduction

As a dividend growth investor, I constantly seek new income-producing investments to increase my income stream. As the market is down in 2022, I am trying to find more attractive investment opportunities. Sometimes I add to my existing position, while I start new positions on other occasions to gain exposure to new sectors and markets.

One way to gain diversification is exposure to foreign companies. Equinor (NYSE:EQNR) is the leading Norwegian energy company. While European companies do not tend to be reliable dividend payers, their growth is usually consistent over the long term. Therefore, long-term dividend growth investors may consider European exposure.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Equinor ASA, an energy company, engages in the exploration, production, transportation, refining, and marketing of petroleum and petroleum-derived products, and other forms of energy in Norway and internationally. It operates through Exploration & Production Norway, Exploration & Production International, Exploration & Production USA, Marketing, Midstream & Processing, Renewables, and Other segments.

Fundamentals

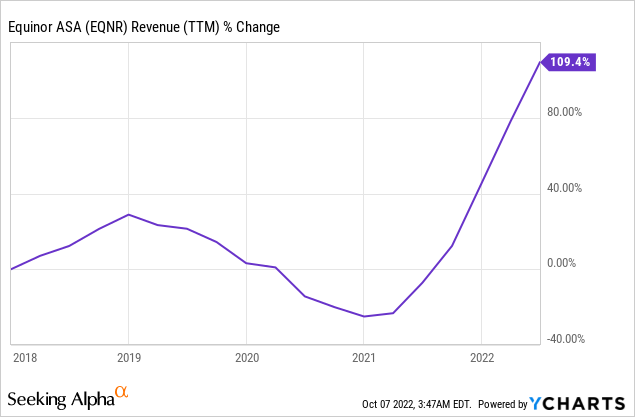

Over the last five years, the revenues of Equinor have increased by almost 110%. More than doubling sales in five years is the result of the cyclicality of the oil market. As the graph below shows, there is exceptionally high volatility as companies in the market are price takers, and demand is volatile. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Equinor’s sales to decline at an annual rate of ~10% in the medium term, as oil and gas prices will stabilize.

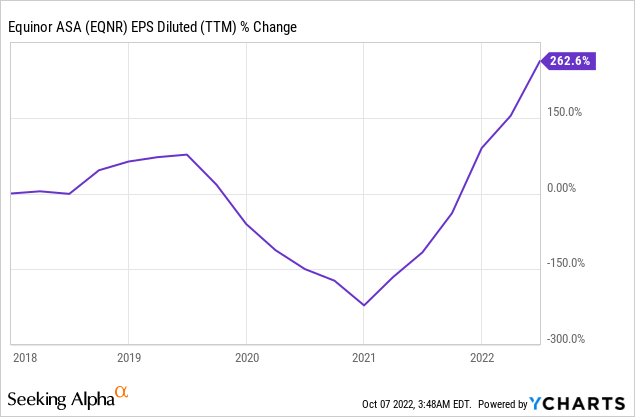

The EPS (earnings per share) has increased even faster. In the last five years, the EPS grew by over 260%, which means it more than tripled. The EPS grew much faster as the company enjoyed increased sales and lower expenses as it improved its margins significantly. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Equinor’s EPS to decline at an annual rate of ~13% in the medium term, as oil and gas prices will stabilize.

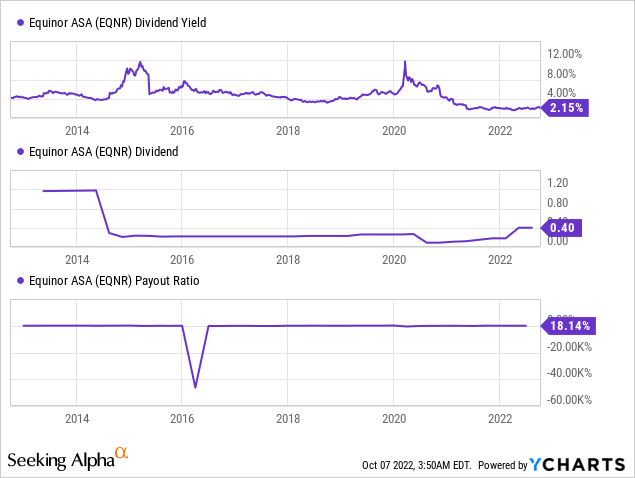

Like many of its European peers, the company doesn’t have a long-term history of annual dividend increases. Following the decline in the stock price in 2014, the company slashed its dividend. Since then, the dividend has been growing in the long-term, but not annually. The current policy is maintaining a safe dividend payout with additional special dividends. The annual dividend stands at $0.2 quarterly, and the company also paid a special dividend of $0.5 for Q2 and $0.2 for Q1. Therefore, the dividends for 2022 will be the highest ever.

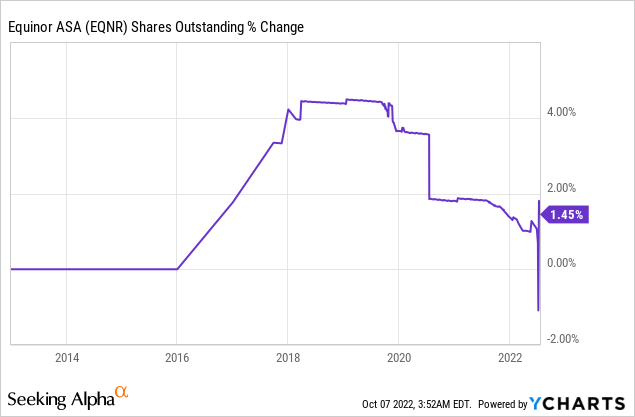

Many companies return capital to shareholders via buybacks in addition to dividends. Over the last decade, Equinor didn’t execute any meaningful buyback programs. At the same time, the company also maintained a stable share count. In its Q2 earnings report, the company announced that it increased its buyback plan from $5B to $6B. I don’t expect significant buybacks, as 67% of the shares are held by the government which may not want to increase its ownership.

Valuation

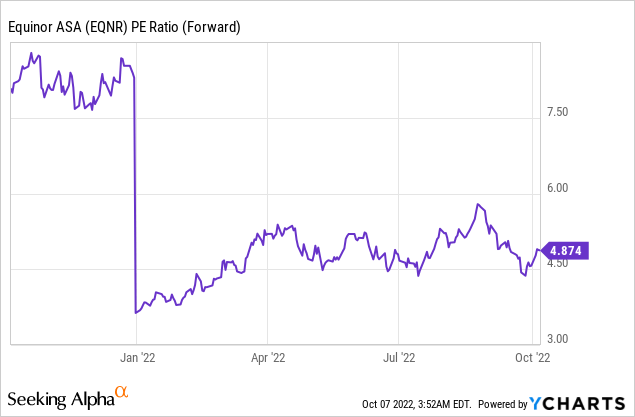

The P/E (price to earnings) ratio of Equinor stands at 4.9 when considering the 2022 EPS forecast. This is an extremely low valuation, implying that investors don’t believe the current profitability is sustainable. I tend to agree that the current energy market crisis will not persist in the long term. However, I think the current valuation offers an adequate margin of safety.

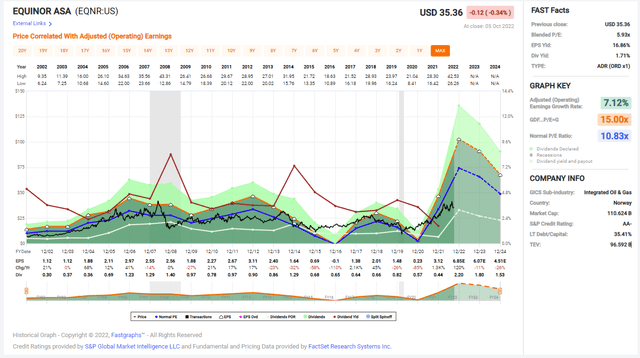

The graph below from Fastgraphs emphasizes how attractively valued Equinor is at the moment. The analysts do not expect the company to maintain the current EPS, but even under their assumptions, Equinor is attractive. The company trades less than eight times when using 2024 forecasted EPS, which is still significantly lower than the average valuation, which stands at 11.

To conclude, Equinor is an excellent company with significant government ownership. This ownership means that the company is run conservatively, as its goal is to bring prosperity in the long term to the Norwegian people. The company offers investors solid fundamentals with sales and EPS growth over time, leading to higher dividend payments. In addition, the company offers an attractive valuation.

Opportunities

Gas prices in Europe are on the rise. The Russians are weaponizing their energy market to hurt the Europeans for assisting Ukraine in war. Norway is another significant gas exporter, and European nations seek additional Norwegian gas. Therefore, we will see higher volumes at higher prices as more countries attempt to replace Russian gas.

In the long term, the company will profit from its exposure to renewable energy. Equinor has renewable energy projects in Europe – Germany, Norway, Poland, the UK – and the United States. Equinor will be well-positioned to capitalize on the trend as the world shifts toward green energy. It is an important long-term trend that will help the company grow and replace the sales from its fossil fuels.

European exposure is another essential growth prospect in the long term. Europe is suffering from a severe energy crisis that will persist in the short term. In my opinion, European countries will not agree to rely on Russian energy in the future. They seek solutions, and as they suffer, it may be the time to start investing in the European economy and energy market. Equinor can support both short-term needs with its oil and gas and long-term needs with its renewable projects.

Risks

The fact that the Norwegian government owns Equinor may be a risk for investors. The Norwegian government cares for the Norwegian people and aims to maximize their prosperity. I believe they are not concerned with the well-being of foreign investors. Therefore, investors should consider that the majority shareholder may influence investment decisions and strategic moves.

The risk of recession is also relevant in the short term. Recession will lower the energy demand. However, as Europe struggles to replace Russian energy, this is a limited risk. A more critical risk is the shift towards renewables. While Equinor is a leader in the renewable segment, it is still a tiny portion of its sales, and it will take time for the company to replace its oil and gas sales with renewables or even get close to it.

An unreliable dividend may also be a risk for some income investors, especially those who need the income at the moment. The company’s dividend policy aims to show increases over time, but it may not be annual increases. The special dividend cannot be relied on, as it results from excessive profits. Therefore, investors who need a reliable ever-growing stream of dividends may find Equinor less attractive and suitable.

Conclusions

There is no doubt that Equinor may be an interesting play for investors seeking exposure to Europe and markets outside the United States. It is a very reliable company that shows consistent growth and improvement and rewards its shareholders while it does it. The current valuation leaves investors with a significant margin of safety.

The company combines short-term and long-term prospects to drive the share price forward. In the short term, it will capitalize on oil and gas prices. In the long term, it will capitalize on its ability to offer a portfolio of renewable energy solutions. Therefore, while the risks are there, I believe that investors may find Equinor suitable for their portfolios and needs.

Be the first to comment