AerialPerspective Works

In this digital age, it becomes increasingly important to be able to put “data in motion” and make proper decisions based on real-time data. This is why Confluent (NASDAQ:CFLT) stands out and is known as one of the best data processing platforms in the world.

The long-term outlook for CFLT may still be good, but as of this writing, the risk outweighs the potential reward, especially considering the unfavorable outlook for its top line and earnings per share for the fiscal year 2022.

Company Overview

Confluent is one of the world’s top providers of platforms for real-time data processing. Apache Kafka is an open-source event streaming platform made by the founders of CFLT. It lets users connect and process data in real-time, which speeds up the process of making good decisions. It has become popular and now about 75% of the FORTUNE 500 companies and 80% of the FORTUNE 100 companies use it. According to the management, about 34% of Fortune 500 companies are already using Confluent Kafka. CFLT now has 4,120 customers, up 46% from the 2,830 customers it had in Q2 of ’21.

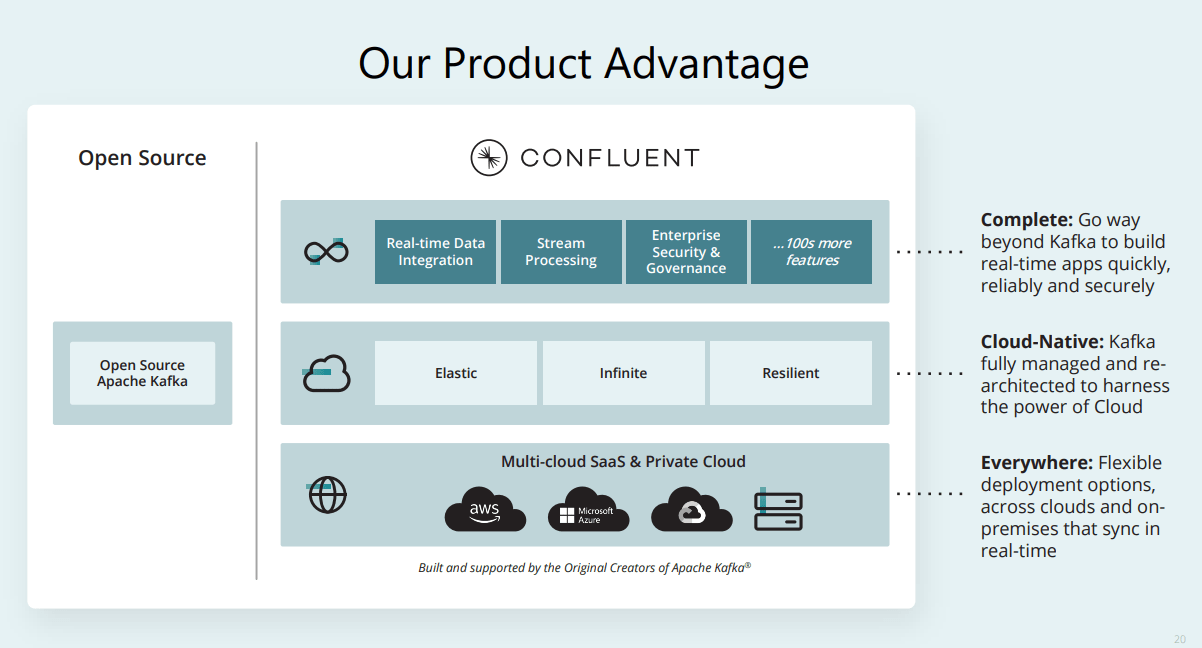

CFLT: Competitive Advantage (Source: Investor Presentation)

CFLT stands out from its competitors because it offers a more scalable, easier to set up, and cost-effective service. In fact, G2 named CFLT as a leader in the event stream processing industry and gathered positive reviews. This led to a solid dollar-based net retention rate of over 130% for the fifth quarter in a row. This suggests that a strong moat is starting to form.

Another value-adding catalyst is its recent innovation of Stream Designer, which makes real-time projects simple and easy to use. Management says Stream Designer is the first visual interface to speed up real-time applications’ development, improve monitoring, and make developers more productive.

Boost developer productivity: Instead of spending days or months managing individual components on open source Kafka, developers can build pipelines with the complete Kafka ecosystem accessible in one visual interface. They can build, iterate and test before deploying into production in a modular fashion, keeping with popular agile development methodologies. There’s no longer a need to work across multiple discrete components, like Kafka Streams and Kafka Connect, that each require their own boilerplate code.

Unlock a unified end-to-end view: After building a pipeline, the next challenge is maintaining and updating it over its lifecycle as business requirements change and tech stacks evolve. Stream Designer provides a unified, end-to-end view to easily observe, edit, and manage pipelines and keep them up to date.

Accelerate development of real-time applications: Pipelines built on Stream Designer can be exported as SQL source code for sharing with other teams, deploying to another environment, or fitting into existing CI/CD workflows. Stream Designer allows multiple users to edit and work on the same pipeline live, enabling seamless collaboration and knowledge transfer. Source: Confluent

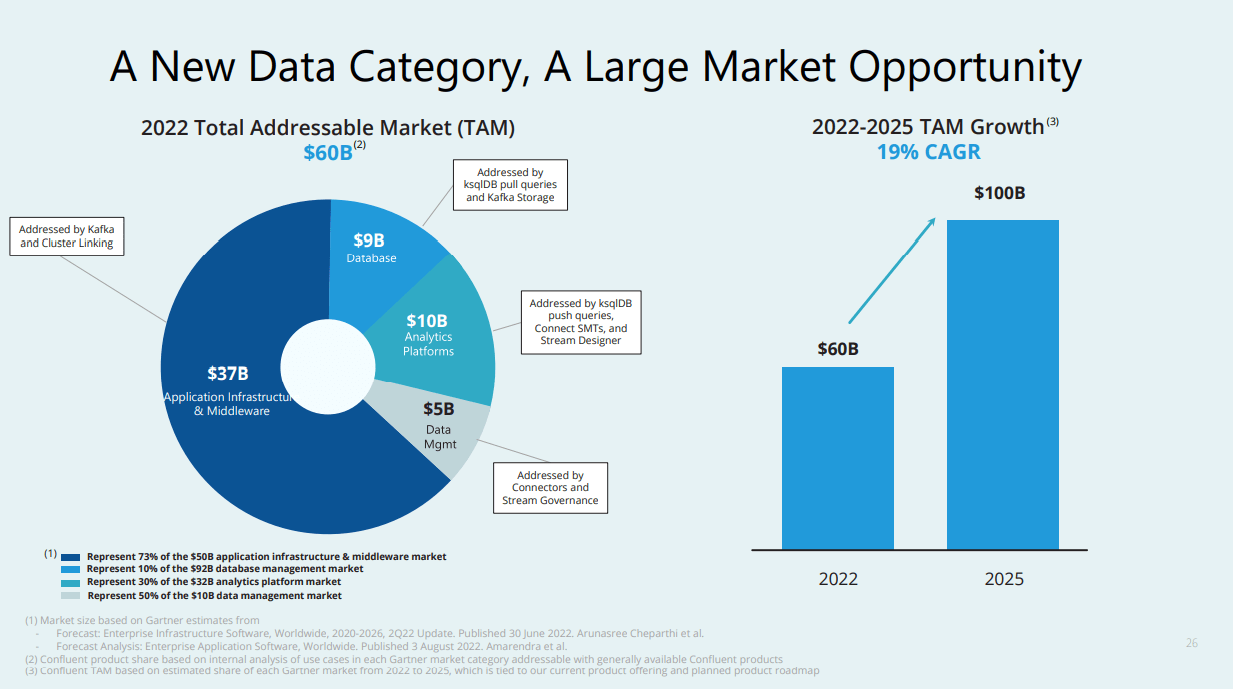

CFLT: Growing TAM (Source: Investor Presentation)

Its growing total addressable market identified by the management makes it attractive on a long-term basis. According to management, TAM will continue to grow to approximately $100 billion by 2025, implying a solid 19% CAGR from 2022 to 2025. However, looking at the CFLT’s current performance, we can see a slowing growth performance, thus making it unattractive.

The company’s trailing top line of $488 million, which produced a slower year-over-year growth of 12% compared to its 64% in the prior fiscal year, supports my view on CFLT. On top of this, the management forecasts that CFLT’s top line for the current fiscal year will be around $567 to $571 million, or a median annual growth rate of just 47% YoY below its 2-year average of 61%.

Profitability Remains At Risk

Despite its expanding TAM and market-leading portfolio, CFLT is unable to convert this competitive advantage into profits. In fact, its Q2 operating loss was -$117.30 million, a decrease from the -$86 million and -$27.5 million losses recorded in Q2 ’21 and Q2 ’20, respectively.

This quarter, CFLT’s operating margin improved to -84.15% from -97.40% during the same period last year, while its Non-GAAP operating margin improved from -41.70% in Q2 ’21 and -37.84% in Q2 ’20 to -33.50% this quarter. The management anticipated a continued improvement to -33% in Q3 ’22 but remained in negative territory with -35% to -34% for this FY22.

I believe CFLT’s management is not taking care of its shareholders very well. This is true considering its rising stock-based compensation of $234 million, up from its three-year average of $105.83 million and its deteriorating bottom line of -$440.7 million, which is down from -$342.8 million in ’21 and -$229.8 million in ’20.

Additionally, the management’s unattractive Non-GAAP earnings per share outlook continues to post some concern which is to be around -$0.73 to -$0.69 in ’22. This is unattractive compared to its -$0.19 recorded in ’21 and -$0.21 in ’20.

Not Attractive Compared To Its Peers

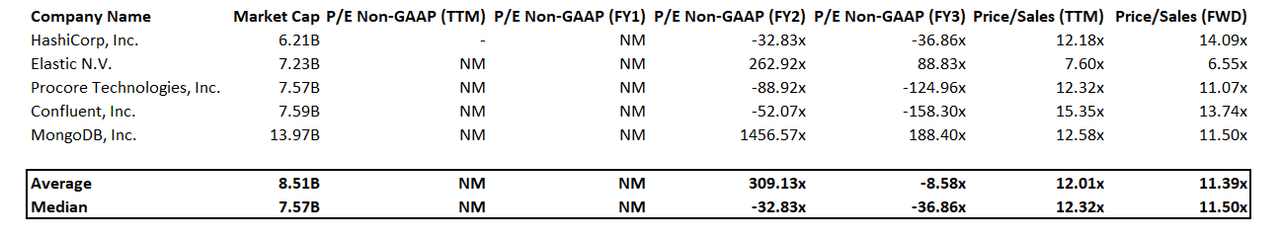

CFLT: Relative Valuation (Source: Data from Seeking Alpha. Prepared by InvestOhTrader)

HashiCorp, Inc. (HCP), Elastic N.V. (ESTC), Procore Technologies, Inc. (PCOR), MongoDB, Inc. (MDB)

CFLT’s bottom line remains under pressure compared to its peers ESTC and MDB, which are expected to start generating positive Non-GAAP P/E of 262.92x and 1,456.57x in FY24, respectively.

Its trailing P/S ratio of 15.35x, which is trading at a premium compared to its peer group’s median of 12.32x, makes CFLT unattractive compared to its peers.

Trading Below IPO Price

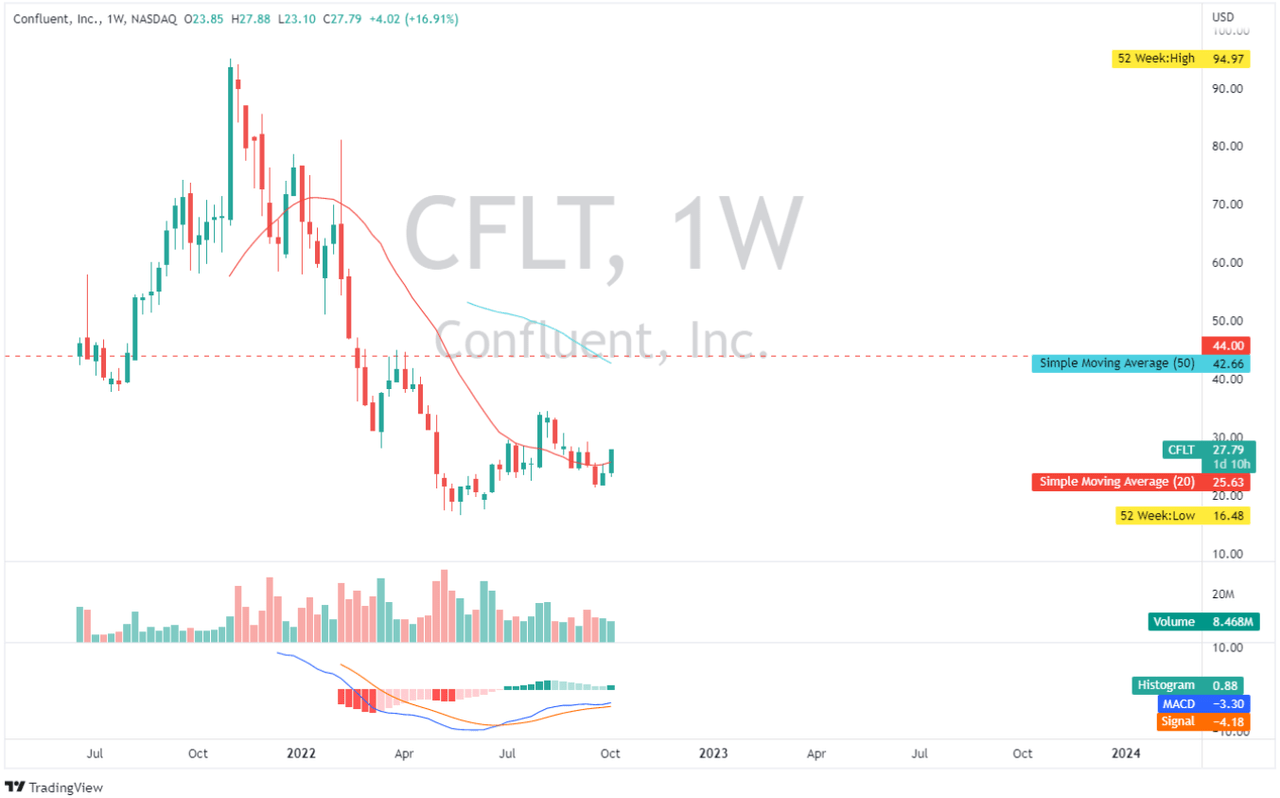

CFLT: Weekly Chart (Source: TradingView.com)

CFLT is currently trading below its IPO price, with no sign of a positive bottom line within the next three years. Looking at its weekly chart, the price broke out from its 20-day simple moving average, which may induce its price to challenge its prior IPO price. However, I believe $30 and $40 will act as a strong resistance zone to monitor. A potential bearish crossover from its MACD may serve as another bearish confluence which investors and traders should monitor.

Final Key Takeaways

In addition to the concerns mentioned about profitability, CFLT has issues with its growing long-term debt, as evidenced by its debt-to-equity ratio of 1.40x, which is unappealing compared to the previous year’s ratio of 1.32x. As a result, the company’s interest expense obligation has increased to $2.1 million, up from $0.2 million in ’21. To sum it up, I believe CFLT is still not a good investment, even though it is now trading below its IPO level.

Thank you for reading and good luck!

Be the first to comment