Courtney Hale

Booz Allen Hamilton (NYSE:BAH) is a company most of you are probably familiar with if you follow my articles at all. My stance on this company has been almost universally positive, considering this business a solid investment with a great upside for any investor with an eye for quality.

This stance has been vindicated in the recent few months, with the company appreciating significantly.

It’s time, therefore to update my thesis for the company

Booz Allen Hamilton – An Update

As mentioned in some of my initial articles on Booz Allen Hamilton, the company is a 100+ year business founded in Chicago. Its specialization in the defense industry goes back to World War II and back when BAH helped the U.S Navy prepare for the second world war, but the company wasn’t IPO’ed until 2010.

An initial large stake owner was Carlyle Group (CG), but they divested their stake back in 2016.

So, the question many people ask is why should they be investing in Booz Allen, beyond the fact that the company has a 100+ year history as an industry leader? Well, there are a few arguments for this.

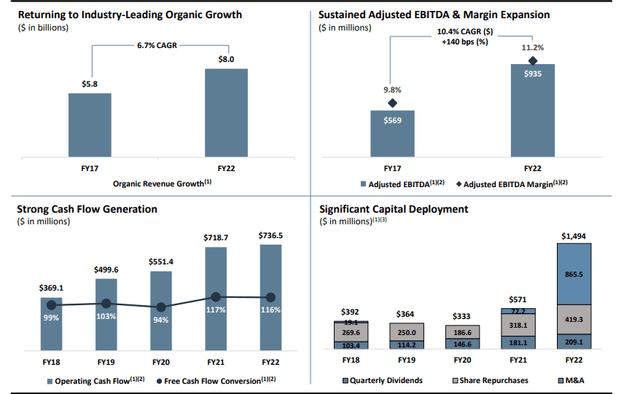

Booz Allen has impressive organic growth history with impressive EPS growth, as well as a large backlog. It’s a fundamentally sound business with a history of being able to generate through-cyclical, impressive operational cash flows. The company has been able to deliver consistent shareholder returns over time and has also been able to grow its dividend at a decent pace.

Furthermore, while the company is already impressive in size, the company operates in addressable markets of truly large sizes, which means that the company has plenty of customers, contracts, and markets to sell to. BAH operates in markets that are characterized by through-cyclic fundamentals, which is always an appealing thing to invest in.

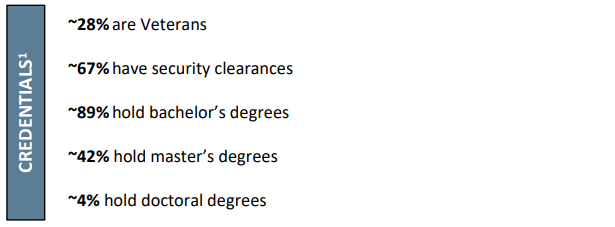

The company now employs 29,300 people in 25 countries, found in over 1,000 locations. These are mostly highly-trained or experienced individuals.

Booz Allen iR (Booz Allen IR)

The company has a very broad customer base, with most of the company’s customers being in the defense sector. Most of these customers are therefore the Air Force, Space Force, NASA, and Army, with another 19% from Military intelligence agencies and U.S intelligence agencies.

Only 34% of annual revenues come from non-military-related, Civil, and global commercial businesses, including 3% from global commercial businesses. This sort of mix is something I find extremely appealing. That’s part of why I find the company so appealing, and why I’ve invested a decent amount of cash in the company.

The appeal is apparent when we look at the company’s year-over-year trends. Take a look at how this company has managed throughout one of the most difficult situations in the last 20-40 years.

Company capital has been deployed in dividends, M&As (like Synthetaic AI, Reveal Technology Inc, and Latent AI), significant amounts of buybacks, and normalized CapEx. Booz Allen outperforms the defense service sector, of which it is a part. The company also outperforms the Russel 1000, and the S&P Software and Services Industry Index, where the company has averaged a 5-year RoR of 170%, and 3-year returns of nearly 60%.

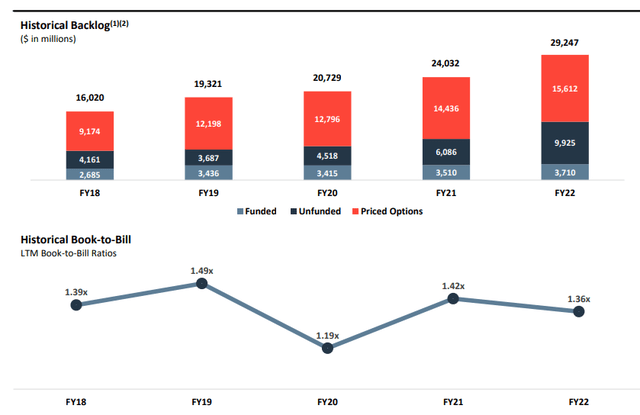

The company is also not going anywhere in terms of performance. Why? Because the order backlog is well-filled, the company continues to have a high book-to-bill of over 1.35x.

The company has a non-standard fiscal and has already reported 1Q23 results, which saw revenue increases of 13.1% and EBITDA up 6.1%. The company has plenty of arguments for why you should invest, based on its 2023-2025 expectations. It expects EBITDA to grow to around, or above $1.3B, with organic revenue growth of 5-8%. There are plenty of M&As on the radar, and the company seeks to maintain its double-digit EBITDA margin. For 2023, the company expects results at or about the same in terms of EPS.

The company has obviously seen potential upside from Ukraine – BAH is delivering critical capabilities and insights. While the company obviously can’t get into specifics, it showcases just what exactly BAH works with. There haven’t been any FY22 shortcomings with regard to the multi-year thesis. A company like Booz Allen will, as opposed to others, be a beneficiary of a more volatile global environment, including a more volatile domestic environment, in terms of security.

Financials and fundamentals continue to be fine for the company. BAH is facing labor and headcount issues, with continued recruitment troubles. Specifically, the company isn’t finding the right people for the right jobs. The Q-o-Q headcount isn’t growing all that much even yet. We should keep an eye on BAH hiring, given the degree the company relies heavily on its specialized way. The company doesn’t admit to real trouble here, but admits it’s a tight labor market, and also admits they’ve had some important staff departures. BAH is working on a very aggressive referral program, increasing its non-traditional hiring sources. The company is growing its pipeline of candidates – and BAH does remain optimistic, but says clearly that it remains a tight labor market.

However – demand indicators are positive.

Despite market volatility, the company is seeing signals of good demand, even if there are slight indicators of program slippage – but still a good sales season for the full year. Given that most of the company’s sales are government, there’s good visibility on sales, with a win rate of over 90% for recompetes, and 60% for new work. Speaking as someone with experience in the public sector, those are superb numbers – really beyond believable, for anyone but an absolute market leader.

I believe BAH will be one of the better investments to make until 2025 based on its fundamentals and appeal – provided that you get the company at an appealing price – and nothing that I have seen in the latest report does anything to change that. The company’s challenges, in fact, were stated prior to the Ukraine war – which means that any challenges or drawdowns discussed in late January are unlikely to be exactly in the same position as of today.

Let’s look at an updated valuation.

Booz Allen – The Updated Valuation

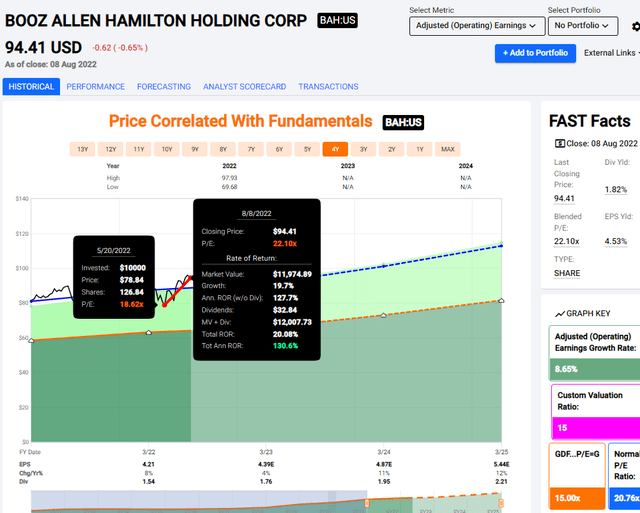

The company has a well-established trend of trading at an 18-21x P/E premium, which we consider to be valid. Ideally, we’d want to buy the company at a valuation close to where I bought shares, at around to below 18x. At 18x, if bought back in May, you would already have made returns of around 20% – which in this market environment is not a bad thing at all.

However, that return comes at a price. The yield is now below 2%, the company trades at above 22x, and that’s a multiple we don’t really want to be paying for BAH. Why?

Because at this valuation, historical multiples show us an upside of no higher than 8.75% annually, or below 10% until 2025. That’s a no-go for me. I want a 9-10% annual RoR, at the very least.

So, that’s the reason I’m shifting my stance to a “HOLD” here – and why I’ll be waiting with more buying of the company’s shares until we once again get a cheaper price. It’s pretty simple and mathematical for me here. Either the company has a conservative forecast for meeting my demands, or it does not. The result is a very binary stance, resulting in either a “BUY” or a “HOLD”. In this case, BAH skirts this border and now is above where I would view it as attractive.

From S&P Global, we still see an upside for the company. Based on EPS and backorder growth and potential, 11 analysts still consider the company at an average of around $103.8/share, which gives us an upside of 10%. Sounds pretty good – until you realize that this has the company trading at not far from 24x P/E, which is a massive premium for his business. 7 out of 11 analysts gave the company a “BUY” or an “outperform”.

I take a different stance, and consider that there are superior alternatives for investing here.

In my last article, I said this about the company.

S&P Global has a target range for BAH of between $80 on the low end and $109 on the high end, with an average of $94/share, denoting an upside of over 10%. 8 out of 11 investors have a “BUY” or “Outperform” rating on the company.

(Source: BAH article)

Realize that analysts are pretty quick in shifting their targets. I usually am not. My targets for the companies I write about are written for the long-term, and short, temporary impacts do not affect them as much as they seem to affect other analysts.

I won’t be selling BAH here. It’s not time for rotation. The company is too good, as I see it – and we’re not as expensive as would justify this. I wouldn’t start considering rotation until around $110-$115/share. This would imply an above-25% RoR, and I could buy the company back when they drop back down.

If you’re looking for a government-centric consulting and contracting business, or what’s known as the world’s most profitable spying company, then this is a decent time to invest in it. It’s not too expensive, there’s a good upside, and the company just reiterated and delivered on guidance.

Fundamentals are good, the order book is filled, and macro calls for the company to continue its work, with volatile geopolitical situations acting like a positive backdrop for a further demand, which has been confirmed by the number of contract wins, the order book, and the continued demand implied by the company.

Thesis

Unlike many of my colleagues, my M.O. continues to be investing in conservative businesses – of which BAH is one because I’m a value investor with a fundamental focus on quality. I would rather buy a slightly undervalued Booz Allen Hamilton than a massively, supposedly undervalued growth “quality” business.

It might be tiresome to hear the same thing from me over and over again – but as my art teacher says, repetition is the mother of skill.

Find quality. Invest in quality. Hold quality.

Repeat.

Don’t let yourself be discouraged by, or lured by supposed triple-digit short-term returns in speculative, risky investments. There is a reason many of these investments are crashing, many of them moving 10-20% in a single day.

They’re not safe – and you deserve better than that – as do I – and that’s why I seek this.

Here are my criteria and how the company fulfills them. (bolded)

This company is overall qualitative. This company is fundamentally safe/conservative & well-run. This company pays a well-covered dividend. This company is currently cheap. This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment