Khanchit Khirisutchalual

In my never-ending search for capital appreciation in my two personal portfolios that I manage, I try to uncover opportunities in growth stocks that are undervalued and have strong earnings growth with real, or at least potential catalysts for future expansion. Often these stocks are small and under the radar and/or are misunderstood by the market and not followed closely enough for the value to yet be recognized.

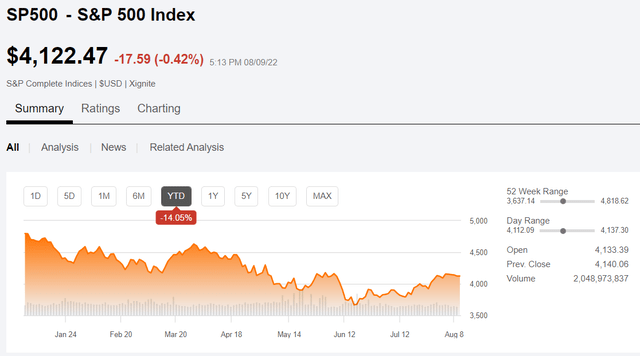

After suffering a plunge of more than 20% in the first 6 months of 2022, the worst half year since 1970, the S&P 500 index started to turn the corner in July. Many small to medium size (in terms of market cap) growth companies have been even more hammered by the bearish market sentiment, inflation, fears of recession, rising rates, and so on. But now in early August, signs of a recovery or turnaround in market sentiment are starting to show some green shoots. Thus, I am bargain hunting and like a kid in a candy shop, trying to identify the tastiest treats.

My success rate is pretty good, meaning that I have mostly picked more winners than losers over the past few years that I have been actively trading. The losers are better described as “learners” because I always learn something from a bad investment. It might be just bad timing, or I may have misjudged the future business prospects based on glossy investor presentations. But I try to learn what I can from both winners and learners in my portfolio.

What Recovery?

As I write this article in the second week of August, the S&P 500 ended the day at 4,122, down -14% YTD. The low of 3,666 was reached on June 16 and the index has mostly risen since then. Some signs of either a recovery or a bear rally are taking place, depending on who to believe.

One market strategist from JP Morgan offers 10 reasons to be bullish on stocks right now.

Inflation remains frustratingly elevated. Recession talk still dominates Wall Street despite a surprisingly strong July jobs report. And second quarter earnings season has been anything but great. But all that’s not stopping top JP Morgan strategist Mislav Matejka from being bullish on stocks.

“We believe that risk reward for equities is not all bad as we move into year-end,” Matejka said in a new note to clients on Monday. “In fact, we argued that we have entered the phase where the weak dataflow can be seen as good, leading to a [Fed] policy pivot, and the activity slowdown might prove to be less deep than feared.”

Being an optimist has served me well in my career and in life in general, so I like to hedge my bets based more on the positive aspects of investing, but with an awareness of the risk involved. Given that there are signs of a trend reversal in the broader market, and more signs of positive earnings beats from select growth companies that I follow in the technology sector (especially chip stocks), I have been looking for some growth opportunities in other market sectors for diversification.

In the following sections I will briefly describe the company and the growth prospects for each company’s stock that I believe is ripe for picking. These are just some options to consider for further research, not necessarily a buy recommendation.

Three Growth Stocks to Consider

I selected three stocks that are not information technology companies but may be utilizing technology to support growth in their respective industries. For example, AerSale (ASLE), a company that sells commercial aircraft, parts, and engines, is now getting ready to introduce a new technology for pilots using 3D synthetic vision with multispectral ClearVision called AerAware.

ASLE – Aerospace and Defense

- Market cap = $936M

- FWD P/E = 21

- Short interest = 3%

- Q2 Non-GAAP EPS of $0.56 beats by $0.38

- Q2 Revenue of $139.6M (+51.9% Y/Y) beats by $28.6M

AerSale Corporation provides aftermarket commercial aircraft, engines, and its parts to passenger and cargo airlines, leasing companies, original equipment manufacturers, and government and defense contractors, as well as maintenance, repair, and overhaul (MRO) service providers worldwide. It operates in two segments, Asset Management Solutions and Technical Operations (TechOps).

What I especially like about ASLE is the new AerAware heads-up display technology that they are developing along with their partner Universal Avionics, an Elbit Systems (ESLT) subsidiary and they are very close to commercializing it.

From the Q2 earnings call, CEO Nicolas Finazzo had this to say:

AerAware heads-up display (AerSale website)

Regarding AerAware, I’m pleased to announce that together with our partner Universal Avionics an Elbit Systems subsidiary, we’ve completed the software validation process. This represents more than two years of engineering and development effort. And we’re very excited to reach this important milestone. As we’re nearing the commercialization phase of AerAware, we’ve stepped up our marketing efforts with airline operators and have received favorable feedback across the board. We’ve been hearing positive reviews about the system following our many demonstration flights, with pilots frequently noting that AerAware’s advanced technology is “Decades ahead of anything existing today”. The visual clarity of our enhanced Flight Vision System provides a strong advantage compared to older technology head up displays that were developed over two decades ago.

Universal Avionics was recently awarded a contract from AerSale to supply Enhanced Flight Vision Systems for Boeing aircraft. It would appear to be a strong indication that commercial acceptance of AerAware is not far off. This comment from SA member hokieincanecountry summarizes how this news helps AerSale to bring AerAware closer to commercial status:

What ASLE is applying to the FAA for is approval of its Supplemental Type Certificate (called an STC). With such an approval, this would represent that the United States of America federal government has given technical approval as long as the installations on the candidate aircraft are performed using the ASLE license and technical data and using qualified personnel to install the ASLE-supplied kits.

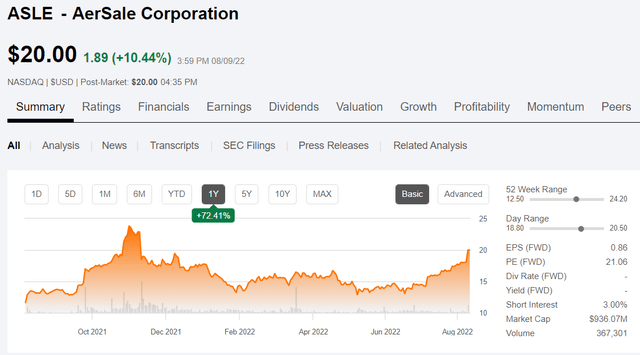

ASLE is up 72% over the past year, and has yet to recognize any revenues from AerAware, which is likely to be a catalyst for further explosive growth.

AerSale 1-year chart (Seeking Alpha)

At a closing price of $20 on 8/9/22, I would be looking to buy some shares but be prepared for volatility given the current concerns about inflation, recession, etc. The biggest risk to consider is if the airline industry suddenly slows down again due to another global pandemic, war, or whatever other black swan event may come along next.

Next up is an environmental cleanup and facilities services company, Heritage-Crystal Clean (HCCI).

HCCI – Environmental and Facilities Services

- Market cap = $846M

- FWD P/E = 10.9

- Short interest = 2.5%

- Q2 Non-GAAP EPS of $0.97 beats by $0.46

- Q2 Revenue of $156M (+33.5% Y/Y) beats by $17.2M

Heritage-Crystal Clean, Inc., through its subsidiary, Heritage-Crystal Clean, LLC, provides parts cleaning, hazardous and non-hazardous waste, and used oil collection services to small and mid-sized customers in the industrial and vehicle maintenance sectors in the United States and Canada. It operates through two segments, Environmental Services and Oil Business.

HCCI completed an IPO in 2008 and serves a diverse base of customers in the US and Ontario Canada. The stock is up 20% over the past 1 year and +8.3% YTD.

HCCI 1-year chart (Seeking Alpha)

The oil business has been robust in 2022 and during the 2nd quarter they reported record high revenues according to President and CEO, Brian Recatto:

During the second quarter of fiscal 2022 oil business revenue was a record high for a 12-week quarter at $64.8 million, an increase of $20.2 million or 45.3% compared to $44.6 million in the second quarter of fiscal 2021.

Then again, Environmental Services also resulted in a record high in the quarter:

In the environmental services segment, revenue for the second quarter of 2022 was $91.9 million compared to $72.7 million for the same quarter of 2021. This represents a record high for a 12-week quarter and an increase of $19.2 million or 26.4%.

The recent announcement of the acquisition of Patriot Environmental, which has not been finalized yet, should add revenues and further grow the bottom line once complete.

“The acquisition of Patriot will fortify our presence in the Western U.S. and enhance our nationwide service. With the addition of Patriot’s two wastewater treatment facilities, we will have ten wastewater treatment facilities throughout our network.” said President and CEO Brian Recatto.

Even without the Patriot revenues the Q2 report included all-time record EBITDA for one quarter. From the earnings call:

- EBITDA of $35.9 million was an all-time record and up 37% compared to $26.2 million in the year ago quarter, and our adjusted EBITDA of $39.9 million in the second quarter was also a record.

At the current price HCCI is close to its 52-week high so it could retreat some before moving upward again. Longer term this is a buy, but I would Hold shares at the current price.

As the population in the US (and worldwide) grows older and require more advanced and specialized medical care for improved quality of life, one company has made great progress. That company is Lantheus Holdings (LNTH).

LNTH – Health Care Supplies

- Market cap = $5.44B

- FWD P/E = 21.9

- Short interest = 3.8%

- Q2 Non-GAAP EPS of $0.89 beats by $0.19

- Q2 Revenue of $223.7M (+121% Y/Y) beats by $19.2M

Lantheus Holdings, Inc. develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in the diagnosis and treatment of heart, cancer, and other diseases worldwide.

In October 2019 Lantheus announced that they were acquiring Progenics Pharmaceuticals. Prior to that, Lantheus was primarily a medical imaging company, and still is. But now the combination of companies has created a broad portfolio of products including:

PYLARIFY® (Piflufolastat F18), a PSMA PET imaging agent for the detection of suspected recurrent or metastatic prostate cancer; PYLARIFY AI™, an artificial intelligence platform that assists in the evaluation of PSMA PET images; DEFINITY® Vial for (Perflutren Lipid Microsphere) Injectable Suspension, an ultrasound enhancing agent for patients with suboptimal echocardiograms; TechneLite® (Technetium Tc99m Generator), a technetium-based generator that provides the essential medical isotope used in nuclear medicine procedures; and AZEDRA® (Iobenguane I 131) for the treatment of certain rare neuroendocrine tumors.

In April 2022, the stock jumped after the Q1 report showed that revenues had increased by more than 125% YOY, mainly due to sales of Pylarify.

“We are excited by our recent strategic collaborations for PYLARIFY and PYLARIFY AI and continue to assess longer-term revenue opportunities through strategic transactions and internal development to drive shareholder value.”

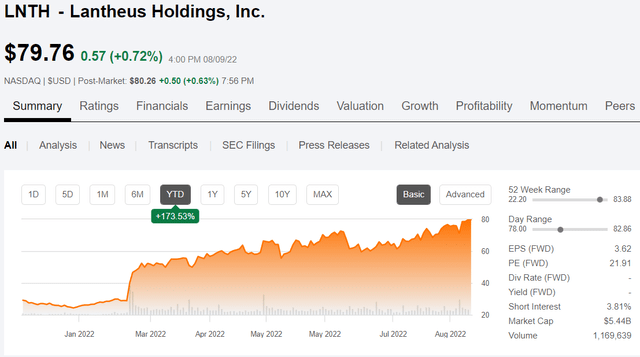

The stock chart for LNTH shows a gain of more than 200% in the past 1-year period and YTD shares have risen by 173.5%, most of that since February after reporting Q4 2021 earnings with 37% YOY revenue growth.

LNTH YTD stock chart (Seeking Alpha)

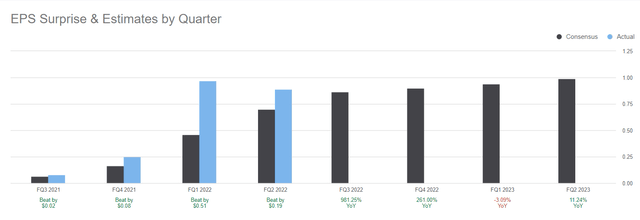

As the revenue and earnings growth both continue to increase each quarter, the stock continues to rise and still remains a good value at just over 20 forward P/E. The prospects for continued earnings growth are very good and this chart illustrates nicely the growth potential expected in the coming quarters.

LNTH EPS Estimates and Surprises (Seeking Alpha)

Guidance for the second half of 2022 was confirmed in the Q2 earnings call by CFO Bob Marshall as he outlined the growth targets for Q3 and full year 2022:

We forecast revenue to be in the range of $220 million to $230 million for the third quarter of 2022, an increase of approximately 116% and 125% over the third quarter of 2021. With regard to PYLARIFY, we now model at $480 million to $500 million with expanding PMF coverage and user uptake. Therefore, we now forecast full year revenue to be in the range of $885 million to $905 million from the prior range of $800 million to $835 million. We now expect adjusted EPS to be in the range of $3.50 to $3.60 per share versus the prior range of $2.90 to $3.15.

I rate LNTH a Strong Buy given the record results in 2022 and updated guidance.

These are 3 quick picks of quality growth stocks that have outperformed in 2022 and look poised to continue to outperform in the 2nd half of the year. I would love to hear your thoughts or comments on any of these companies as I have just started to investigate them for my own investment choices.

There are many other good prospects for growth-oriented investors, and I have discussed some of them in previous articles. These are a few that I am very impressed with currently and I intend to start a position (or add to my position in HCCI, which I already own) in the next several days or weeks depending on what the overall market does.

Be the first to comment