aluxum

Thesis

MongoDB (NASDAQ:MDB) has a compelling growth story. They have been a share taker in an expanding market. The move from on-premise to the cloud also appears to have benefited them. As companies move to public cloud providers they re-asses which technologies they are using. MDB has been able to expand both its revenue per user and its number of paying customers with its cross-cloud Atlas MongoDB platform.

However, to justify the stock’s current price the company will need to see large revenue growth for the next 5-10 years and begin to show positive operating leverage.

MDB could justify the current price with 5-10 years of continued strong performance. But, any slowdown in the revenue growth will likely lead to a large sell-off. At the current stock price, this feels like the opposite of a good bet, heads I win a little, tails I lose a lot.

The product

I’m a software engineer by trade. I’m familiar with MDB’s main product and have always been impressed with it. It offers an easy to use highly resilient and adaptable database offering. Having worked with MySQL server and Microsoft SQL server quite a bit I’m not surprised that they are losing share to competitors.

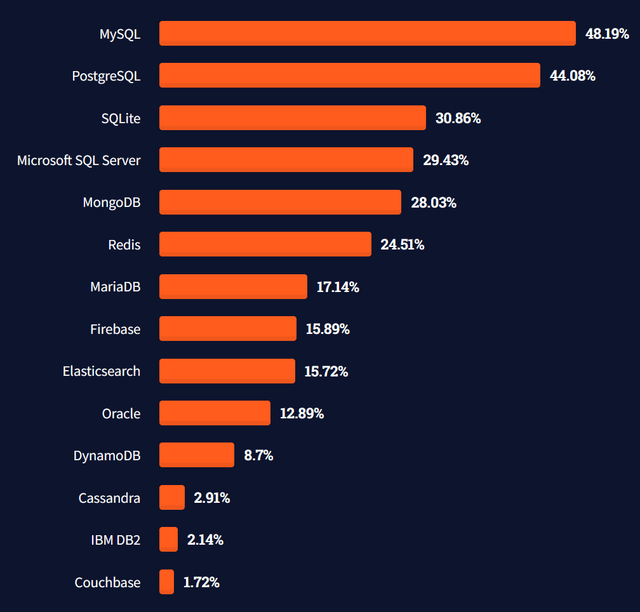

In the most recent stack overflow survey of what software developers are working on MongoDB was the fifth most popular option with 28.0%. This is up from 26.7% in 2020 and 26.0% in 2019.

Stack overflow survey of professional developers (Stack Overflow)

Databases should have high switching costs. Databases represent the core of most technology businesses and companies don’t want to have to go through the costly and risky process of changing the database. This is evident from MySQL’s continued usage rates. MySQL has been popular since the mid-2000s, which is quite a long time for a technology product.

Potential challenges to the growth story

The problem with being in a high-growth industry is that it attracts a lot of competition. MDB’s biggest competitors are cloud providers. Amazon (AMZN), Microsoft (MSFT), and Google (GOOG) all offer their own No SQL databases. This leaves MDB in a precarious position. They are building their future platform on top of these cloud providers, but the cloud providers themselves are competition. Cloud providers often provide professional services to help new customers architect their systems on the cloud. These professional services will influence the technical decisions made when moving customers to the cloud such as what database to use.

Cloud providers will also be able to offer their native No SQL DBs at a lower price point since they don’t need to markup the base cloud hosting fees to make a profit. For example, if we look at a 2 GB minimum spec Dynamo DB on AWS it costs ~$63 a year a 2 GB minimum spec Mongo DB instance costs about ~$684 a year. The two databases’ specs aren’t directly comparable, but DynamoDB is undoubtedly cheaper.

MDB wants to dominate the entire database industry. Aiming to replace all database use cases with their NoSQL database. I worry that they may end up being a jack of all trades, master of none. When I used Mongo DB in the past the biggest things that impressed me were the ease of use and reliability provided. Unfortunately, when a technical offering adds more functionality it often ends up becoming harder to use and less reliable.

Insiders and the company itself are selling shares

Over the past year, insiders have sold $375M worth of MDB stock and there hasn’t been any buying. Insider selling doesn’t always mean the stock is overvalued, but rapid selling like this usually indicates that a stock is not undervalued.

The company also priced an issuance of shares at $365 per share in mid-2021. There was no impending debt payment or capital requirement that necessitated MDB to make this issuance. They had 975 Million in cash and short-term investments on their balance sheet at the time. Companies do not want to dilute their shareholders for a price they feel is less than their stock is worth.

MDB seems to be focused on growth at any cost

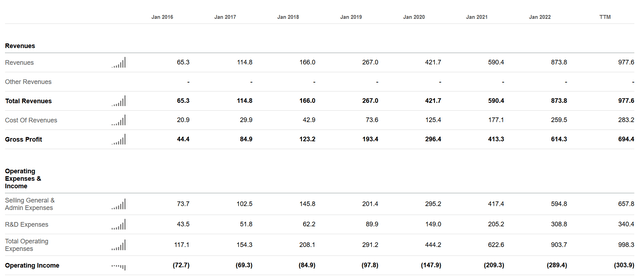

While MDB’s revenues and gross profits have been growing rapidly their sales and R&D spending have been growing even faster.

MDB income statement (Seeking Alpha)

MDB is a growth company so it can be forgiven for being unprofitable in the short run. The more concerning thing to me is that management doesn’t seem to have a long-term vision for how or when the company becomes profitable. It’s not clear to me that the investment in growth and sales headcount will end up paying off.

The company gives a lot of clarity on its year-long and quarterly guidance but doesn’t seem to give much guidance in terms of its long-term financial plans. I’d much rather see guidance around how their additional investment in headcount will help fuel their growth going forward and when/if they will hit an inflection point to profitability.

Valuation

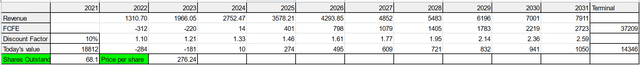

Given the company’s great revenue growth, I’ve modeled them to increase revenue by 50% in 2022 and 2023 then slowly decline their revenue growth rate from 2023-2027. I then give them a 13% revenue growth rate from 2027-2031.

The company has communicated continuing to spend in the short term. So I’ve modeled them being cash flow negative in 2022 and 2023 before slowly increasing their free cash flow margin to 35% of revenue in 2031. This implies that their spending on R&D and SG&A will continue to grow but at a much slower rate than revenue in the future. I do count stock based compensation against their free cash flow. Even though it is a non cash expense it is a real cost to shareholders.

I usually try to be conservative when projecting cash flows. I’ve been a little less conservative than usual in my projections here since I’m issuing a sell recommendation.

MDB Discounted Cashflow (Author’s work)

As always my discount cash flow model is meant much more as a rough guide of how I would value the company rather than a definitive price target. Using a discounted cash flow analysis on a company like MDB is especially hard since its future cash flows are hard to predict.

Final thoughts

I don’t own any MDB. But if I did, I would sell. Does this mean that I’m shorting or buying puts on MDB? No, while I find the current price speculative it’s not the kind of stock I would consider shorting. I do see a road to profitability here. I usually will only go short on a stock if I think it is fraudulent or there is a near-term catalyst for a price correction.

MDB is a company I’d love to own, just not at the current price. If it cost less than $100 a share, I’d take a much closer look. Not that I expect the price to drop to $100, but you never know with Mr. Market.

Be the first to comment