Alexander Farnsworth/iStock Editorial via Getty Images

Introduction

As interest rates are increasing, I almost feel like a kid in a candy shop when I look at bonds and preferred shares. While I’m definitely underwater on earlier purchases, I’m not too worried as I have a long-term investment horizon and as I’m in a position to continue to move disposable cash to my investment accounts on a monthly basis. So rather than being disappointed with some (unrealized) capital losses on the preferreds I started to buy too early, I’m happy to be able to buy quality fixed income at prices I didn’t expect to see this year. In this article, I’ll have a closer look at the Q-Series of the Wells Fargo (NYSE:WFC) preferred shares. Those Q-shares are currently offering a 6.45% yield but will become a floating security next year. And at the current 3 month SOFR rate, I’m expecting a yield closer to 8% which would be pretty good.

A quick look at the 9M 2022 results

I won’t spend too much time on discussing the Q3 and 9M 2022 results as there are plenty of good authors here on Seeking Alpha providing good coverage on WFC’s earnings. Ian Bezek did a good job I his article and I’d like to refer you to his most recent update.

While I will focus on the preferred shares, it’s obviously also important to see how profitable the underlying company is and how well covered the preferred dividends are. So it does make sense to have a look at Wells Fargo’s most recent performance.

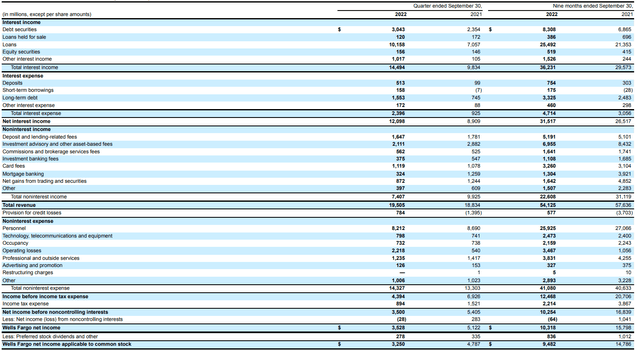

The bank reported a total interest income of $14.5B compared to just $9.8B in the same quarter of last year. And while the interest expenses increased by over 150% to $2.4B, the net interest income increased by just under 36% to $12.1B. A very strong result. On top of that, WFC recorded a $7.4B non-interest income and $14.3B in non-interest expenses.

Wells Fargo Investor Relations

This resulted in Wells Fargo reporting a pre-tax and pre loan loss provision income of just under $5.12B. Approximately $784M was put aside to cover future loan losses and this resulted in a pre-tax income of $4.4B and a net income of $3.53B after taking the net income attributable to non-controlling interests into consideration. And as you can see above, the total amount of preferred dividends that had to be paid out by Wells Fargo was $278M resulting in a net income of $3.25B attributable to the common shareholders of Wells. The EPS of $0.86 was pretty strong but I cared more about the preferred dividend coverage level of in excess of 1,200% (even including the loan loss provision). As I’m mainly focusing on the preferred shares, I care more about that metric than I care about how cheap Wells Fargo’s common shares are.

The Q-Series of the preferred shares are resetting next year

In this article I will mainly focus on the Q-Series of the preferred shares issued by Wells Fargo because of two reasons: Not only is there an attractive current yield, I also think the possibility of seeing these preferred shares being called by Wells Fargo is quite real.

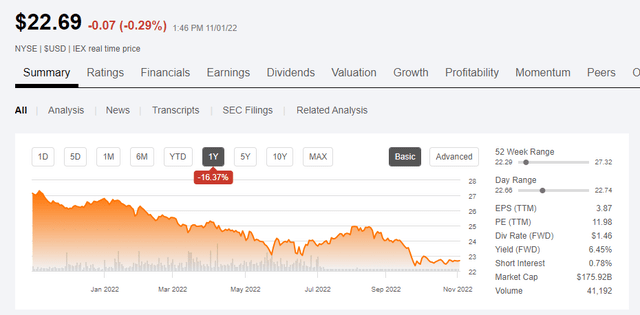

The Q-Series of the preferred shares are trading with (WFC.PQ) as their ticker symbol and are currently getting close to the end of the 10 year period with a fixed preferred dividend of $1.4625 per share per year. This represents a 5.85% preferred dividend yield and based on the current share price of $22.69 while writing this article the yield has increased to 6.45%.

Seeking Alpha

While a 6.45% yield is already quite alright (but not a “must buy now” type of yield), I think 2023 could be very interesting. These preferred shares were issued in July 2013 with a first call date in September 2023. At that first call date, these preferred shares will also see their fixed dividend starting to float based on the 3 month LIBOR +309 base points. The LIBOR will no longer applicable so I’m looking at the 3 month SOFR and the 3 month SOFR rate currently stands at approximately 4.13% (but will obviously fluctuate by quite a bit between now and September 2023).

This means that based on the current 3 month SOFR, the preferred dividend will reset to 4.13% + 3.09% = 7.22%. Based on the principal value of $25 per preferred share this would represent a quarterly preferred dividend of $0.45125 or $1.805 per year. That sounds great but based on the current share price the yield would increase to 7.95% if the 3 month SOFR is still at the current rate when the preferred dividend gets reset.

Investment thesis

The fix-to-float preferred shares issued by Wells Fargo actually offer excellent possibility to speculate on the 3 month SOFR. I like the Q-Series of the preferred shares but if you want more safety the R-Series trading as (WFC.PR) have a similar set up with the main difference being the current dividend payments of $1.65625 per year which will reset in March 2024 at 3 month LIBOR [SOFR] + 369 base points. That’s a higher current yield and a higher yield upon the reset, but these preferred shares also are trading at a 10% premium compared to the Q-Series. The higher reset ratio also makes it likelier WFC will call the R-Series first as the reset will push the cost of capital on that specific preferred share to almost 8%.

It’s still too soon to know for sure, but these fix-to-float preferred shares could be promising to speculate on the short-term interest rates.

Be the first to comment