unomat/iStock via Getty Images

Shares of urothelial cancer specialist UroGen Pharma (NASDAQ:URGN) have lost nearly two-thirds of their value over the past three years. 2022 performance is slightly negative at -12%.

Playing devil’s advocate, the market could be worried about cash balance and burn rate as the company aims to end 2022 with $100M on the balance sheet versus a quarterly net loss of $25M (one year runway). Additionally, this cash is product of loan facility with Pharmakon Advisors and my guess is we can expect a secondary offering in Q1 2023 or so.

Despite these concerns, from a Core Biotech perspective, this one caught my attention given growing sales for Jelmyto (up 41% in Q3 to $16.1M with peak potential of up to $300M in LG-UTUC), pivotal data coming in 2023 for UGN-102 in LG-IR-NMIBC ($500M opportunity) and optionality via RTGel (can carry molecules of all sizes to reside in target space for extended period of time).

I look forward to presenting my thoughts on this interesting commercial-stage idea to readers, including pathway to value creation and suggestions on how to manage key risk factors to thesis.

Chart

FinViz

Figure 1: URGN weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see share price rise to high twenties in early 2021 as Jelmyto achieved $11.8M in first seven months of commercialization out of the gate. Additionally, in March that year RTW Investments provided a vote of confidence via $75M non-dilutive funding in exchange for tiered cash payments on net product sales of both Jelmyto and UGN-102 from high to low single digits (to be terminated after RTW receives $300M in total payments). Anyway, from there share price steadily declined to mid-single digits as sales growth failed to impress including November’s steep decline on Q3 earnings miss. Recently, share price rose to low teens but pulled back to high single digits (perhaps on balance sheet concerns hinted at in Q3 report). My initial take is that investors interested in this name can enter a small pilot position, but should wait for further clarity on the balance sheet (financing overhang to be cleared) before adding more exposure.

Overview

Founded in 2004 with headquarters in New York (195 employees), UroGen Pharma currently sports enterprise value of ~$200M and Q3 cash position of $95M providing them operational runway for just over 3 quarters.

September’s presentation at Ladenburg Thalmann provides an excellent overview of operations, with management noting that the company’s origins came from a urologist running into a chemist in a cocktail party. The urologist asked how they can get drugs into the urinary tract and keep them there (particularly relevant to bladder cancer and urothelial carcinoma as bladder is designed to void thus leading to limited dwell time for therapies delivered to the bladder including chemo). The chemist responded he had something for that, now known as RTGEL (reverse thermal hydrogel technology) which is a mixture of polymers that are liquid when cooled and when warmed turn into a soft gel that slowly disintegrates within a warm wet cavity in the body (transmitting drug to target over extended period of time). Starting with Jelmyto, UroGen has brought a product to market useful in urology and the pipeline consists of additional drug candidates that look to improve on these results and address other indications of high unmet need.

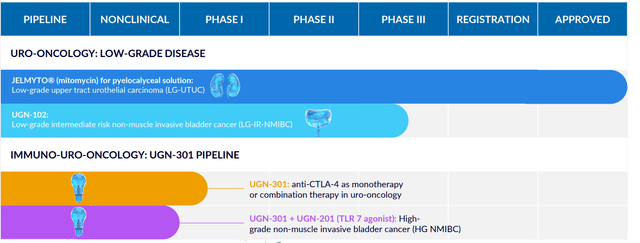

Corporate Slides

Figure 2: Pipeline (Source: corporate presentation)

Urothelial cancer is a relatively common malignancy, with more attention paid to metastatic disease given approval of checkpoint inhibitor therapy. SeaGen’s antibody drug conjugate Padcev is approved for patients with locally advanced or metastatic disease as well. UroGen is NOT competing for these patients, but instead is focused on different groups of people, underserved populations with recurrent bladder cancer who are treated by repetitive surgery (standard of care for these older patients with average age of 74).

Going back to the start, mitomycin is a generic drug currently used off-label as an adjuvant chemotherapy for the treatment of low-grade NMIBC after trans-urethral resection of bladder tumor (TURBT). In other words, while not FDA-approved, physicians are permitted to utilize it as standard of care for this indication as part of their medical practice. In reality, adjuvant chemo is used in only 15% to 30% of eligible population. One reason is that mitomycin is administered via water-based solution which has short dwell time in the bladder limited to first voiding. It also causes temporary irritation of the urinary tract including need to urinate frequently and urgently (does not sound pleasant). In the upper urinary tract, dwell time is limited to five minutes as urine flows and no active retention by the patient is feasible. Many in vitro studies have shown that increased dwell time in the bladder results in increased time to recurrence for urothelial cancer (likely due to increased cell killing versus aqueous solutions).

Jelmyto is essentially the company’s novel sustained-release RTGel-based formulation of mitomycin developed for the treatment of low-grade UTUC (upper tract urothelial carcinoma). When used as a chemoablation treatment, it potentially spares patients from repeated tumor resection procedures and reduces need for upper urinary tract surgeries including kidney removal (sounds like a definite value add to me). As for specifics of this indication, UTUC accounts for 5% to 10% of all new cases of urothelial cancer, which together with recurrent cases results in US annual incidence of up to 7,000 cases. Prior to Jelmyto approval in April 2020, there were no drugs approved and current standard of care is radical nephroureterectomy (RNU) which is a complete kidney and upper urinary tract removal (sounds horrible!). Recent advances in resection instrument technology allow physicians in some cases to use endoscopic tumor resection (sparing the kidneys) followed by adjuvant mitomycin treatment. However again, as mentioned prior, anatomy of the upper urinary tract leads to high recurrence rates with patients undergoing multiple endoscopic resection procedures (increases probability of complications such as perforation). In the end, 70% to 80% of patients ultimately undergo RNU. Jelmyto was granted Breakthrough Therapy Designation and phase 3 OLYMPUS results showed complete response rate of 58% (41 of 71 patients) with 23 of 41 patients remaining in CR at the 12-month time point.

Corporate Slides

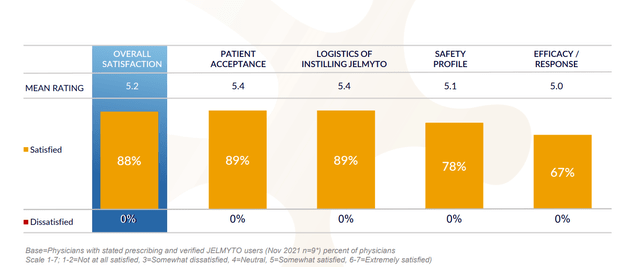

Figure 3: High satisfaction across key attributes for Jelmyto (Source: corporate presentation)

Permanent J-code took effect in January 2021, but launching in the midst of pandemic was difficult and only presently are doctors emerging from restrictions more salesforce experiencing more engagement, doc visits, in-person scientific meetings, etc. Launch is progressing and more people are using the drug and doctors are creating a way to best serve their patients, mixing and matching Jelmyto with standard of care endoscopic therapy (whether precedes or follows). The key takeaway is that Jelmyto is becoming part of the armamentarium and this is reflected in independent groups of physicians publishing papers on how they use it (including via nephrostomy tube in the back to kidney, in the clinic versus a surgical center). As for market opportunity, management estimates target population at 15,000 people across new diagnoses and patients with recurrent disease. They’ve guided for $70M to $80M in revenues this year but did $30M in the first half of the year (increasingly likely they don’t meet guidance and stock could react negatively).

Corporate Slides

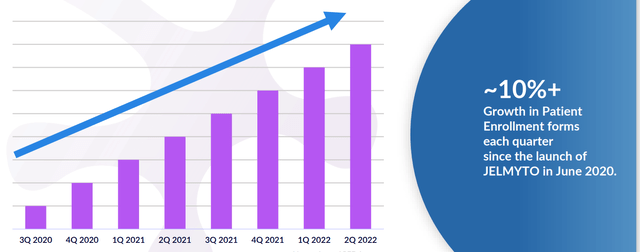

Figure 4: Patient enrollment forms as an early indicator of demand (Source: corporate presentation)

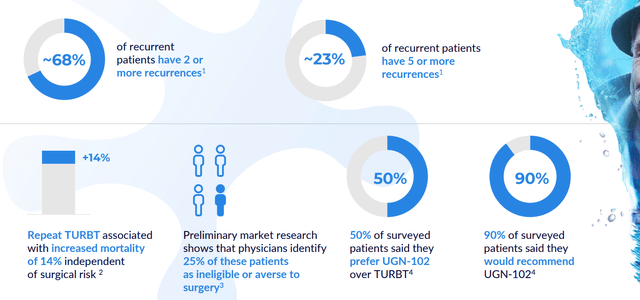

Moving on to UGN-102, this sustained-release formulation of mitomycin is intended for the treatment of low-grade intermediate risk NMIBC. Phase 2b OPTIMA II study reported 65% complete response rate 3 months after start of therapy. Of patients achieving CR, 95%, 73% and 61% remained disease-free at six, nine, and 12 months after treatment initiation, respectively. Probability of durable response 9 months post CR was estimated to be 72.5% by Kaplan-Meier analysis. The indication they are pursuing reflects a large market opportunity, with 80,000 low-grade intermediate risk NMIBC patients in the US. Phase 3 ATLAS study was initiated in December 2020 and ran until November 2021, comparing UGN-102 to standard of care TURBT procedure. Dialogue with the FDA determined that this was not feasible (comparing a drug to surgery) and so a new phase 3 (ENVISION) was initiated evaluating UGN-102 with single-arm design (similar to prior OPTIMA study). Planned primary endpoint is complete response rate at 3 months and key secondary endpoint will be durability over time in patients achieving CR. Completion of enrollment (220 patients across 90 sites) is expected by year end 2022 with NDA submission in 2024 assuming data is positive. ATLAS phase 3 data from the stopped study will be shared in 2023 as well (provides at the least additional safety data and additive insights to the potential of this treatment). Interestingly enough, the company also initiated a phase 3b study with the objective of showing UGN-102 can be administered at home by qualified home health professional (avoid need for repeated visits to healthcare setting, convenience would be a major win in terms of uptake in my opinion).

corporate slides

Figure 5: UGN-102 could become the first therapeutic available for LG-IR-NMIBC patients (Source: corporate presentation)

On the Ladenburg call, management also highlighted the aforementioned 65% CR rate in phase 2 with durability in excess of 70% in a year. ATLAS study was indeed problematic because historically drugs are not forced to be compared to surgical procedures. Design was cumbersome and although the study was stopped, they continue to accumulate data on these individuals and will share it in 2023 (could prove helpful directionally even though they can’t do statistical comparisons as the trial was underpowered). In contrast to Jelmyto opportunity, there are 80,000 bladder cancer patients relevant for therapy with UGN-102 and again this is a large, underserved market where these older people are treated primarily with repetitive surgery. Prevalence is significant with many people cycling through therapies and per KOL interviews, this 80,000 annual patient population could be on the low side.

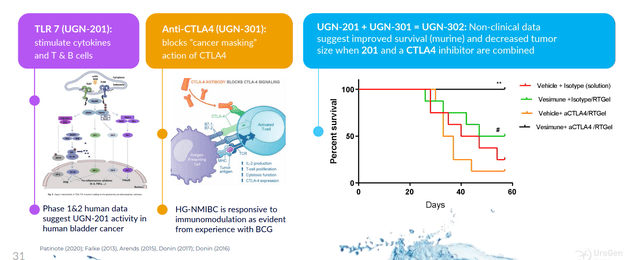

Moving on to the rest of the pipeline, this provides investors optionality as the beauty of this platform with RTGel is getting drug to target while sidestepping side effects. They can leverage doctor familiarity with the paradigm, as all urologists are familiar with intravesical therapy and the uniqueness here is the ability to carry molecules of all sizes to reside in the target space for an extended period of time. They can put a lot of different kinds of things in this and even expand to other areas outside urology (other warm wet parts of the body). UGN-301 (anti-CTLA-4 antibody zalifrelimab licensed in from Agenus) is the subject of combination therapy with multiple agents including TLR 7 agonist. High-grade NMIBC could be an attractive opportunity here (over 18,000 annual US patients who are unresponsive to standard of care BCG).

corporate slides

Figure 6: Encouraging activity for novel agonist/antagonist immunotherapy combination (Source: corporate presentation)

Other Information

For the third quarter of 2022, the company reported cash and equivalents of $95.9M as contrasted to net loss of $25.8M. Keep in mind this cash position includes the first $75M tranche of the up to $100M term loan facility with Pharmakon Advisors (closed in March). Accumulated deficit of $467M since inception is on the high side in regards to stewardship of company’s resources.

Research and development expenses rose slightly to $13.1M, while SG&A fell slightly to $19.1M. Non-cash financing expense related to aforementioned obligation to RTW investments was $4.8M for Q3, while interest expense on loan facility was $2.7M. To my eyes, it’s clear the company will need a dilutive secondary offering in the next quarter or two in order to comfortably extend runway out for another year.

On the bright side, Jelmyto revenue rose 41% to $16.1M versus $11.4M for Q3 2021. There were 930 activated sites and repeat accounts as of November 1st versus 893 on August 1st. Additionally, the FDA authorized an extension of the in-use period for Jelmyto admixture from 8 hours to 96 hours following reconstitution (will help expand access and give urologists greater flexibility). Another tailwind would be recent retrospective analysis published in British Journal of Urology showing that 59% (17 of 32) of patients who received Jelmyto via antegrade administration had no evidence of disease at the primary disease evaluation and did not recur at a median follow up of 13 months. Importantly, ureteral stenosis (scarring) occurred in just 9% of treated patients and this method of administration does not require general anesthesia.

As for the pipeline, UGN-102 phase 3 ENVISION study is expected to be fully enrolled (220 patients) and completed at the end of November. UGN-301 (CTLA-4) continues to enroll high-grade NMIBC patients in phase 1 study and will evaluate combination with other immunomodulators such as TLR7 agonist UGN-201.

On the Q3 conference call, management touches on the enhanced ease of use for Jelmyto due to FDA change on end-use period extension (provides opportunity for physicians used to doing surgeries in the morning, because they might not have been able to get a mixed dose until the afternoon). This change will give them greater flexibility to confirm the dose is there the day before. There has been an immediate effect as reflected in accounts getting the product the day before and now administering in the morning whereas this was not possible a month ago. Previous full year revenue guidance was $70M to $80M and management makes it clear they are not likely to reach that number. Going forward, it seems like each hurdle to uptake removed could provide a tailwind (going from 8 hour stability to 96 hours, convenience of administration via nephrostomy tube so physicians don’t have to go to OR or a surgery center, etc).

As for timing of 102 readout, they need minimum of 12 month follow up post CR (complete response) for all patients before they can go to the FDA, so that won’t happen until after the end of 2023. As for UGN-103, they want to keep enrolling patients and have enough monotherapy data to go on before proceeding with combination studies (should occur next year).

Interestingly enough, last secondary offering in 2019 netted $162M in net proceeds (almost equal to current market capitalization) at price point of $41/share (share price has fallen by 80% since then). I continue to think one final, highly dilutive offering will allow them to get to a point of gaining critical momentum via accelerating Jelmyto sales followed by the crucial UGN-102 readout.

Speaking of which, here are a few nuggets from the KOL webinar on UGN-102 and the role it could play in addressing high unmet need in LG-IR-NMIBC:

- Standard of care in urothelial cancers is invasive and radical surgery, making it challenging for physicians to treat given anatomical barriers and inability for medicines to dwell long enough in the cavity to have a meaningful impact. Patients go through repetitive, risky surgeries and often lose kidney or other organs (and increased risk of morbidity in elderly patients).

- UGN-102 is intended for low-grade intermediate-risk NMIBC and delivers mitomycin similar to Jelmyto. If approved, 102 would be the only primary intravesical chemo ablative treatment and 96% of urologists surveyed stated they would use UGN-102 within 2 years after approval.

- Phase 3 OLYMPUS study for Jelmyto in a similar cancer showed 58% CR rate and 82% duration of response. UGN-102 in phase 2 showed 55% CR rate and 72.5% duration of response (tells us they work similar to each other and molecular profiling shows LG-UTUC and LG-IR-NMIBC are very similar). There are synergies from commercial standpoint as 95% prescriber base is the same for Jelmyto and UGN-102. As for distinct differences, the ratio of medicines and volume are different for 102. Administration for 102 is much simpler versus Jelmyto, as it’s not manipulating upper tract (simpler administration) and can be done in the clinic by doctor or even a nurse or extender. Market for bladder cancer is much bigger (10x) than upper tract ($3B across all patients, with 80k patients in the US alone of which 60k are recurrent).

- TURBT is used to manage bladder tumors initially whether low or high grade. TURBT is insertion of metal tube into the bladder through the urethra, with instrument used to resect the tumor. This needs to be done under anesthesia and there is a hot electrified loop at the end of the instrument used to shave the bladder down. Older and sicker patients have to go to operating room for the procedure. TURBT is commonly associated with risk of complications including pain and urinary symptoms as well as risk of bleeding. Also, there’s risk of infection as well as injury to bladder during procedure itself. These patients require lifelong surveillance and frequently require treatment over and again (up to 60% have recurrence within a year and up to 80% have recurrence within 5 years).

- Focusing on intermediate risk NMIBC patients (the group of interest), they have propensity to recur within 1 year or have larger tumors over 3cm which are low grade. Unmet needs are providing them with additional treatment options besides repeated surgeries as well as reducing chance they will recur.

- As for Q&A, they highlight that 102 would be a great option for older patients with recurrences (very common patient population physicians are used to dealing with). Surgeon states that TURBT is an operation none of them really wants to perform in this patient population (elderly, lots of medical complications). Vast majority of physicians are employed, not in their own primary practice, and urologist says it’s more efficient economically to treat these patients in the office (will become more true as healthcare system continues to evolve). A relevant point is that all urologists are very familiar with intravesical therapy (giving BCG) and 102 is significantly easier to deliver than Jelmyto (issue there was how to best instill it and ultimately nephrostomy tube ended up being the best way for patients with upper tract disease). 102 does not even require the physician to be there for instillation (can all be done by nursing, patient in and out in 20 minutes).

As for institutional investors of note, RTW Investments owns roughly 857,000 shares and Opaleye Management has a smaller stake at 397,000 shares. Major holders like BlackRock and Wildcat Capital Management have been reducing their stakes (perhaps not a good sign). Insider sales over the past year do not inspire confidence, although CEO Liz Barrett owns ~300,000 shares and Arie Belldegrun (Israeli-American urologic oncologist) owns over 400,000 shares. The latter seems to add credibility given his background in the space and Belldegrun is also known as founder and CEO of Kite Pharma which was sold to Gilead in 2017 for $11.9B.

As for leadership, President and CEO Liz Barrett joined in 2019 and her experience adds to my comfort level (prior served as CEO of Novartis oncology and before that Global President of Oncology at Pfizer). Chief Commercial Officer Jeff Bova served prior as VP of Oncology Sales at Bayer Healthcare and also led highly successful launch of Xofigo in prostate cancer. I touched on Arie Belldegrun above, but did not mention he is Chairman of the Board of Directors. Interestingly enough, a second heavy hitter from Kite is also on the board (Cynthia Butitta, who was Kite’s Chief Operating Officer). Ran Nussbaum (Managing Partner and co-founder of Pontifax Group) has served as director at UroGen since 2013.

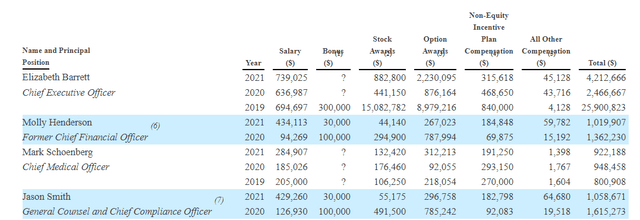

Moving on to executive compensation, cash portion of salary seems on the high side for CEO at over $700k (a small-cap company trying to conserve cash should pay much lower in my humble opinion). To be fair, that number for others on leadership lineup looks more than reasonable, as does level of option awards and non-equity incentives.

Proxy Filing

Figure 7: Executive Compensation Table (Source: corporate presentation)

Moving onto useful nuggets from members of the ROTY community, DSJ.2018 stated the following back in March:

URGN is cheap and they have a nice little commercial launch going: reported Q4 revenue of $16.2M for Jelmyto and provided a revenue projection of $80M for 2022. New patient enrollments are growing sharply and Q4 revenues were up 43% versus Q3. Jelmyto is attractive and gaining traction as the only effective and non-surgical option in bladder cancer, specifically Low-grade Upper Tract Urothelial Cancer (UTUC). Jelmyto is instilled as a chilled liquid once weekly for 6 weeks with a Uroject 12 Syringe Lever and a 5- or 7-French ureteral catheter or nephrostomy tube. It’s a no brainer versus having a kidney removed and has the potential to become the SOC in Low-grade Upper Tract Urothelial Cancer, a market in the US which includes 6,000-8,000 individuals. Molecular profiling shows that LG-NMIBC and LG-UTUC are similar diseases at a genetic mutational driver level and UGN-102’s data has been great thus far.

On the other hand, EquityMan highlighted a potential red flag in that Jelmyto revenues are not close to covering costs for UGN-102 development and noted the company is burning too much cash.

On Biotwitter, “must follow” Dough referenced an analyst note from Matt Kaplan which pointed out that use of in-office nephrostomy tube (antegrade) administration of Jelmyto had increased from 40% to 50% of instillations over the past 3 months. Such a tailwind could potentially influence sales acceleration for Jelmyto in coming quarters (or years for that matter).

As for IP, Jelmyto has Orphan Drug exclusivity through April 2027 and composition of matter patent through 2031. For UGN-102, issued patents are set to expire between 2024 and 2037 and overall IP portfolio consists of 40 granted patents worldwide as well as over 45 pending applications covering methods, systems and compositions for treating cancer locally as well as via intravesical means (expirations 2031 to 2041).

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), Allergan/AbbVie agreement serves as a warning and example that not all collaborations work out. Agreement was inked in 2016 and the two parties worked on products containing RTGel and Botox for treating overactive bladder (phase 2 study failed its primary endpoint in 2020 and from there agreement was terminated in 2021 as they did not find other worthy applications for combination with RTGel). For Agenus agreement, this was inked in 2019 for rights to zalifrelimab for treating high-grade NMIBC and UroGen paid $10M upfront (also on the hook for up to $115M in milestone payments and royalties on net sales in 14% to 20% range).

Final Thoughts

To conclude, my concerns on UroGen’s balance sheet (cash position roughly equal to debt with operational runway of ~1 year) coupled with how far out the UGN-102 pivotal readout is (1H 24) have kept me on the sidelines for the present. However, I do appreciate market opportunity for both Jelmyto in LG-UTUC and UGN-102 in NMIBC given current standard of care of repetitive, invasive surgeries involving potential complications (seems quite unappealing to my eyes). I also am a fan of optionality for RTGel and other molecules it could carry (I hope they ink a deal with Agenus for differentiated CTLA-4 drug botensilimab).

Jelmyto sales are already growing +40% year over year and I expect that could accelerate as administration via nephrostomy tube becomes more widely accepted (greater convenience). On the con side, I think the company needs one more highly dilutive secondary offering to get them to the pivotal phase 3 readout.

Given the above, for readers who are interested in the story and have done their due diligence, URGN is a Buy at a current levels (sub $9). A prudent entry strategy could be to purchase a small pilot position, then wait for financing overhang to be cleared via secondary offering before adding more exposure on dips.

From a Core Biotech perspective (emphasis on next 3 to 5 years), I would like to enter the stock at some point in 2023. However, in the interest of risk management and prudence, I will wait until financing overhang is cleared to make my initial purchase.

Key risks include weak balance sheet with outsized debt load relative to current market capitalization (could lead to highly dilutive financing in the near term), competition in indications targeted (including standard of care surgeries like TURBT or RNU), slowing sales for Jelmyto and binary risk in regard to UGN-102 pivotal readout (not to mention setbacks to projected timelines). Continued reliance on third party subcontractors and suppliers could be a cause for concern as well (leading to difficulties in regard to compliance with cGMP or quality system regulation or supply issues disrupting clinical studies or product launch).

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Be the first to comment