AUDINDesign

The Consumer Price Index (CPI) report that was released on November 10, brought hopes that inflation might be peaking and this good news caused the stock market to surge. However, it’s way too early to get excited because even if inflation is moderating, it’s still extremely high and the Federal Reserve appears poised to maintain their hawkish stance for the foreseeable future. I think investors should be increasingly less concerned about inflation and more concerned about the economic damage that high interest rates are starting to do to the housing market. This will impact just about everything in the economy in the coming months.

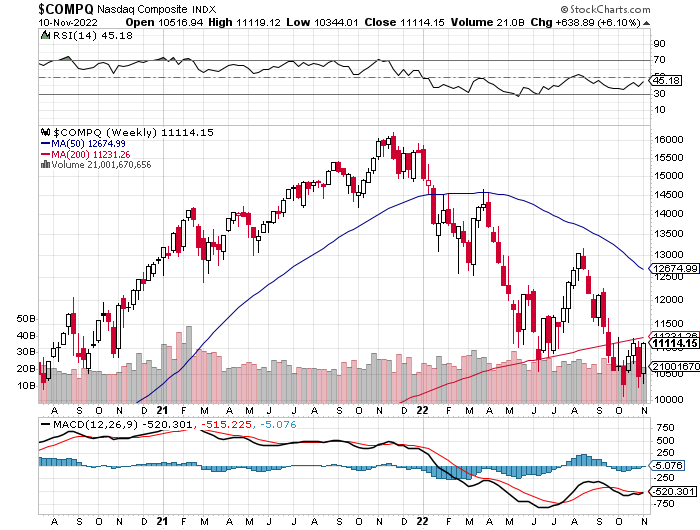

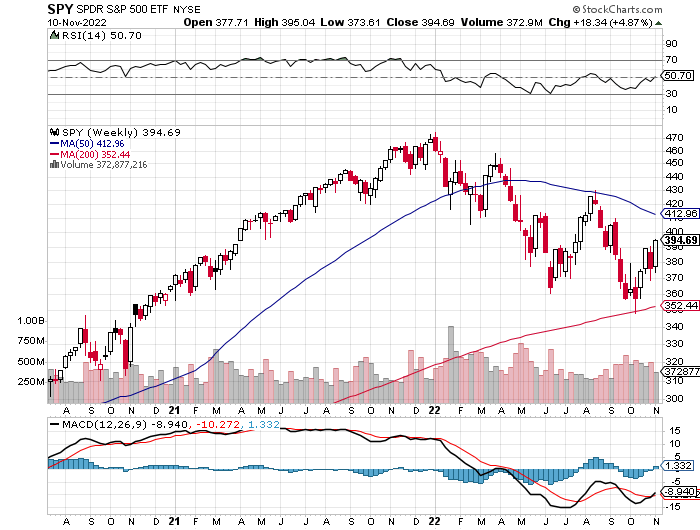

Around this time last year, the stock market started a major descent, which has continued. This decline in equities has been caused by the increasingly rapid pace of interest rate hikes by the Federal Reserve. Just about everyone who has a retirement or other account that is invested in stocks has seen a big drop in the value of their portfolio. The S&P 500 (SPY) has dropped about 25% from all-time highs and the NASDAQ Composite (COMP.IND) is down around 35%. Stocks typically have rapid corrections when compared to other assets like real estate and yet the drawdown in stocks has lasted for a year and the end of this correction still might be a way off. If stocks are taking this long to find a bottom, it could mean that the real estate market could be poised to suffer a major correction that could drag out for a much longer time period than just a year.

StockCharts.com

StockCharts.com

In the early part of 2022, 30-year mortgage rates were around 3%, home prices were still rising and overbidding was very common. However, all of this has come to a screeching halt due to the Fed’s policy, which has caused mortgage rates to recently surge to about 7.3%. This record-setting jump in mortgage rates has no historical precedent, so we are in uncharted waters. When it comes to real estate, we have only just begun paying the price for the easy money policies that the Federal Reserve implemented during the pandemic. The stock market has led the declines and now the housing market is poised to be the next victim of the rapid policy changes from the Federal Reserve. Let’s take a closer look at this dynamic and how it will impact the economy in 2023:

Many Assets That Surged During The Pandemic Have Returned To Pre-Pandemic Levels, Home Prices Will Do The Same

Many stocks and other assets surged during the pandemic. This was fueled by a surge in demand for certain things, as well as by sheer speculation caused by easy money. This all appears temporary in nature and simply fueled by stimulus payments and easy money policies by the Federal Reserve (both of which are a thing of the past). Certain tech stocks that were extreme pandemic winners like Teladoc Health (TDOC) or Zoom Video (ZM) had amazing gains. For example, Teladoc Health was trading around $27 per share in 2018, and surged above $300 per share during the pandemic, but it lost all those gains and now trades back to around the $27 level it held in 2018. The Zoom Video story is similar and it traded around $70 per share in 2020, then went to nearly $600 during the pandemic. It is now back down to pre-pandemic levels of just over $70 per share. Many mega-cap tech stocks have also recently made a round-trip back to pre-pandemic levels. This list includes Amazon (AMZN), and Meta Platforms (META), and it even looks like Alphabet (GOOGL) could be next to return to pre-pandemic levels, since it is not far from $70 at this point. Many cryptocurrencies have given up all the gains or are now very close to making a complete round trip.

I think home prices (which surged during the pandemic), are likely to follow all these other examples, and give up the crazy pandemic gains. The pandemic and the Fed completely distorted stock prices and home values, and this is now being unwound. According to Black Knight, home prices in the 50 largest US markets surged anywhere from 19% to 66% during the pandemic. Data from Black Knight shows that prices have been falling for three straight months. I think home price declines are poised to accelerate in 2023, for a couple of reasons. First of all, the bubble has burst and home buyers are no longer playing the overbidding games, and real estate is no longer being viewed as a guaranteed money maker. Secondly, interest rates have surged from 3% to well over 7% in just a few months and the current 30-year mortgage rate of about 7.3% is a level that has not been seen since 2007. That means interest rates are much higher today than they were just before the pandemic hit. This alone is enough reason for home prices to go back to where they were before the pandemic hit, and possibly even lower. The third reason why home prices will likely return back to pre-pandemic values and possibly even below, is because there are clear signs of a recession looming today which did not exist in early 2020. If interest rates and economic concerns are much higher today than they were in early 2020 (just before the pandemic hit), then it seems like there is strong potential for home prices to not only lose the pandemic-fueled gains, but even go below the levels held in 2020.

People have seen the value of their stocks drop for the past year, as well as their crypto assets, and now home prices are declining. This downward pressure could snowball in the coming months as the economy goes towards a recession. We will soon see more people lose their jobs and even people who still have good jobs will cut back on spending. If you think there is no way that home prices could give back the 19% to 66% pandemic gains and revert to pre-pandemic levels, just remember that the idea that many major tech stocks would give back all the huge pandemic gains seemed just as unlikely, and yet here we are. It’s worth noting that the losses in tech stocks could be just the beginning for the stock market since a number of analysts and investors believe that the S&P 500 Index is heading back to pre-pandemic levels as well. That would mean this index could decline another 15% or so to around the 3,000 level.

The Housing Market Is Now Frozen And Many Home Sellers Are In The Denial Stage

Big interest rate hikes have caused mortgage rates to go to over 7% in just the past few months. The rapid move in these rate hikes puts us in uncharted waters and it has frozen the housing market almost overnight. Anyone who already owns a house wants to keep their 3% mortgage rate, so they don’t want to sell. Potential buyers are sidelined as well, because they don’t want to pay sky-high prices with a 7% mortgage rate. This means there is a standstill and activity has dried up. It seems that the stock market is not yet fully pricing in how negative this could be for the economy in 2023 and beyond. The housing market was a huge contributor to the economy for the past few years and to the “wealth effect”.

Each time a house is bought, there is economic activity generated for so many companies which includes movers, furniture stores, lawyers, real estate agents, title companies, hardware, television, and appliance stores, etc. The freezing of the housing market has only happened recently and there is a lag time for it to trickle through the rest of the economy. That’s why the real impact of the now frozen housing market won’t start to really be felt or seen in quarterly financial reports until 2023. It seems that many home sellers are still in the denial stage, unable or unwilling to sell for less than the crazy high peak bubble prices that they saw their neighbor get just months ago. But, this denial could get replaced fairly soon with the fear that if they don’t lower their home prices now, they will get even less for the home in the future. That dynamic could cause an increase in inventory in 2023, and fuel more competition and price drops.

The Macro Environment Is Deteriorating Rapidly

It looks as if some prescient business leaders can see where the economy is heading and that a recession is likely coming. A number of high-profile business leaders have been recently showing deep concern for the economy. This group of business luminaries includes Jamie Dimon of JPMorgan Chase (JPM), Elon Musk, and David Solomon, the CEO of Goldman Sachs (GS), warning of a recession, or making bleak forecasts. The most recent warning comes from Jeff Bezos, the founder of Amazon (AMZN), who said that it is time to “batten down the hatches”. We haven’t seen warnings like this from top business leaders in many years, so it makes sense to take note.

There Is Opportunity

While you might think I am totally bearish, I do see opportunities in all of this. The market and the economy may not have hit rock-bottom levels yet, however, some stocks may have already bottomed out, or might be close to it in the next month or two. With so many stocks at or near 52-week lows, we are likely seeing significant tax-loss selling pressure as we head into year end. Buying stocks at the end of the year that are probably being punished by tax-loss selling is one of my favorite strategies. That’s because these types of stocks can rebound sharply when tax-loss selling fades into the New Year. I always write about my favorite tax-loss stocks to buy in the final weeks of the year, and I will do so again very soon. I also think that even though the market and the economy might now bottom out until sometime in 2023, it could make sense for long-term investors to start averaging into high quality mega-cap tech stocks right now, but very slowly. Stocks like Alphabet (GOOGL), which has an excellent balance sheet and very favorable long-term growth prospects are worth buying in stages right now, even though it can go lower.

In Conclusion

It makes sense to be very cautious now. The Fed is currently unwinding its zero interest rate policy experiment. This could easily create a hard landing, which has historically been the case when the Fed raises rates. The drying up of housing activity could really start to show up in 2023, and impact so many businesses directly and indirectly. It makes sense to be very disciplined right now and keep high levels of cash as more and more assets decline back to the levels they held before the pandemic. Stocks like Alphabet are already close to pre-pandemic levels, so I am buying a little and I plan to become more aggressive as a buyer, if the market indexes continue to drop back to pre-pandemic levels, which could take place in 2023.

Be the first to comment