mg7/iStock via Getty Images

Investment thesis

Marine Products Corporation (NYSE:MPX) has a robust and debt-free balance sheet. Its cash position has improved in recent quarters, as well as inventories and account receivables despite the coronavirus pandemic crisis and the subsequent headwinds related to rising production costs, labor shortages, and supply chain issues. Both gross profit and EBITDA margins are at maximums, as well as net sales, and the reason is that the company has aggressively increased the price of its products and thus managed to pass on the increase in production costs to customers.

Despite this, the share price declined by ~54% since October 2018 even if there are no real problems in sight for now. What I believe we do have now are two major risks that were not considered with the same intensity before. First, the increase in the price of the company’s boats, which is at around 33% on average, could result in a reduction in demand in the medium term. And second, fears of a recession deep enough to hit the middle and upper classes enough to reduce demand for the company’s products seem to be growing as days go by. Still, these factors seem to be priced in the share price as the PS ratio is abnormally low while margins remain high and the dividend yield is significantly higher than usual.

A brief overview of the company

Marine Products is a manufacturer of fiberglass powerboats in the sportboat, sport fishing, and jet boat markets through the Chaparral and Robalo brands. Its manufacturing facilities are located in Nashville, Georgia. It has a total of five manufacturing facilities in which manufactures interiors, designs new models, creates fiberglass hulls and decks, and assembles various end products.

Marine Products (2021 Annual report)

The business was founded in 1965 (Chaparral was founded in 1965 and Robalo was founded in 1969), but Marine Products is the result of a spin-off from RPC, Inc. (RES) in 2001 and its market cap currently stands at ~$361 million, employing around 880 workers. The company is what many investors could call a boring company as the last major movement took place in 2013 when it announced the introduction of a new line of jet boats. Capital expenditures are also very low. In this sense, the company is treated as a cash cow since it distributes almost all its profits among the shareholders through dividends and share buybacks without making great efforts to expand its business to new areas. Still, its sales have increased significantly over the last few years thanks to the constant updates of its products and increased prices.

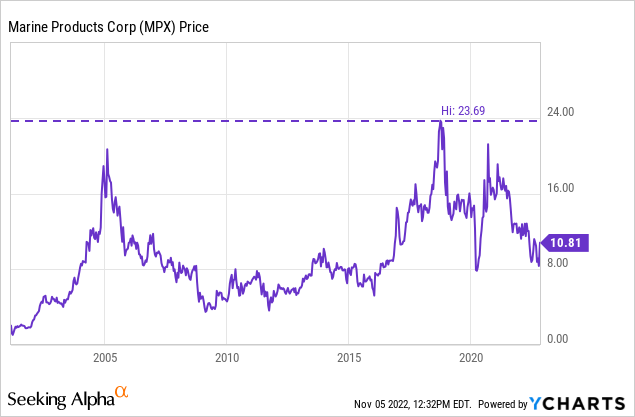

Currently, shares are trading at $10.81, which represents a 54.37% decline from all-time highs of $23.69 in October 2018. Such a sharp drop deserves the attention of those investors interested in obtaining a good value for their investments, especially dividend growth investors as the current dividend yield is abnormally high compared to the past while performance remains optimal.

Net sales are at record highs

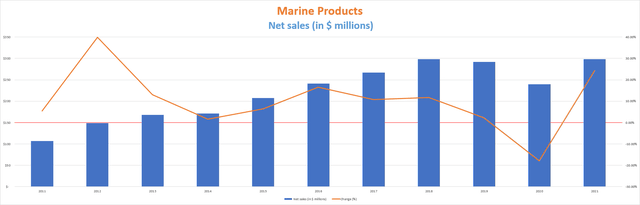

The company sells its products through 206 domestic and 92 international independent authorized dealers. Over the past decade, the company has achieved a steady increase in net sales, although they declined by 17.91% in 2020 as a consequence of the coronavirus pandemic crisis as the company had to suspend operations in its Nashville, Georgia production facility on March 30, 2020. Still, net sales increased by 24.26% in 2021 thanks to the reopening of the American economy.

Marine Products net sales (10-K filings)

Things are getting even better in 2022. During the first quarter, net sales declined by 2.25% year over year but increased by 42.45% in the second quarter and by 31.93% in the third quarter. In this sense, trailing twelve months’ net sales of $349 million represents the maximum reached by the company in its entire history. This is the result of an average increase of 33% year over year in the price of the company’s boats to offset higher costs of raw materials and components. As for volumes, they remained flat in the third quarter of 2022 compared to the same quarter of 2021. In the coming quarters, it is expected that net sales will remain high as dealer inventory levels stand at historic lows. This increase in sales along with a declining share price has caused a sharp decline in the price-to-sales ratio.

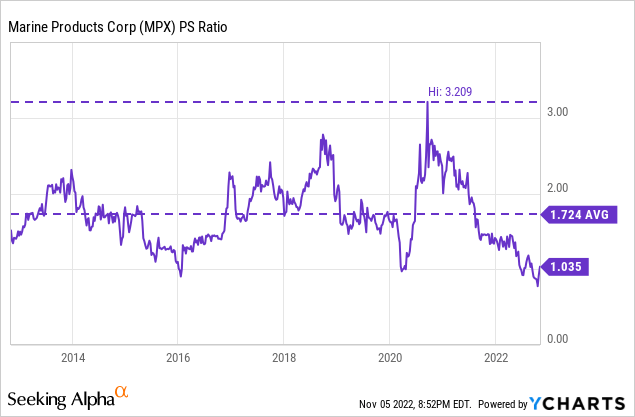

Currently, the PS ratio stands at 1.035, which means the company generates net sales of $0.97 for each dollar held in shares by investors, annually. This ratio is significantly lower than the average ratio of 1.724 during the past decade and much lower than the peak of 3.209 reached in September 2020. Considering that profit margins remain high, I believe this represents a good opportunity to achieve good returns in the long term for investors interested in buying shares of the company and holding them for the dividend.

Margins are very healthy

Since the coronavirus pandemic crisis, operations suffered shortages of engines, resins, and fiberglass, which are used for the manufacturing process of the company’s boats, and this has made it difficult to meet demand while working capital requirements have increased. The company also uses copper and steel for the manufacturing process, and therefore, profit margins are linked in part to the price of both materials.

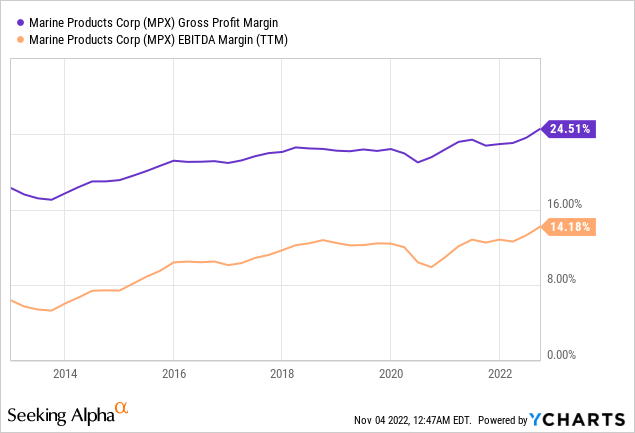

Gross profit margin increased to 24.99% during the third quarter of 2022 (from 21% in the same quarter of 2021) and this has allowed a gross profit of $25 million, which was 56% higher than in the same quarter of 2021, as a result. This margin is higher than the current trailing twelve months’ gross profit margin of 25.51%. SG&A of $10.3 million was also 34% higher year over year due to higher incentive compensation, sales commissions, and warranty expenses as a consequence of higher product prices. EBITDA margin of 15.15% in the third quarter was also significantly higher than the current trailing twelve months of 14.18% and marks the highest level of the last decade, enabling an EBITDA generation of $15.2 million. In this sense, the company is generating generous profits that are strengthening the balance sheet, which was already robust prior to these results.

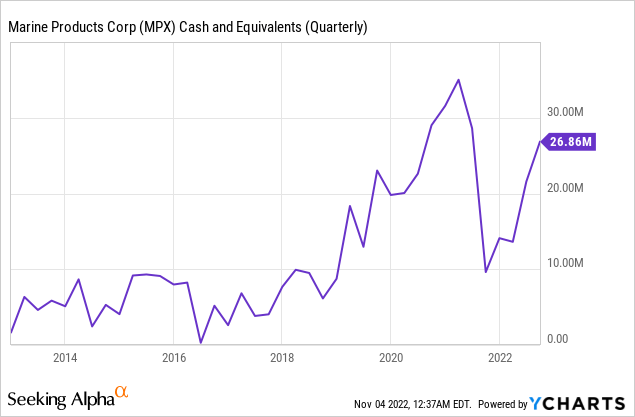

The cash position is very strong

The company enjoys a debt-free balance sheet, which places it in a highly advantageous position. This is so because a balance sheet without debt reduces the risk of bankruptcy to virtually zero. In addition, there are no interest expenses to meet each year, so the company can retain all of the cash generated through its operations in order to expand its business or, as usual, distribute it among shareholders. Furthermore, it currently holds $26.86 million of cash on hand, which is $12.8 million higher than in the third quarter of 2021, thanks to increasing sales and profit margins.

In this sense, the company has managed to significantly increase its cash on hand over the last decade since it used to be below $10 million before 2019, which demonstrates the viability of its operations and its ability to convert sales into actual cash.

The dividend is safe and the yield is at very high levels

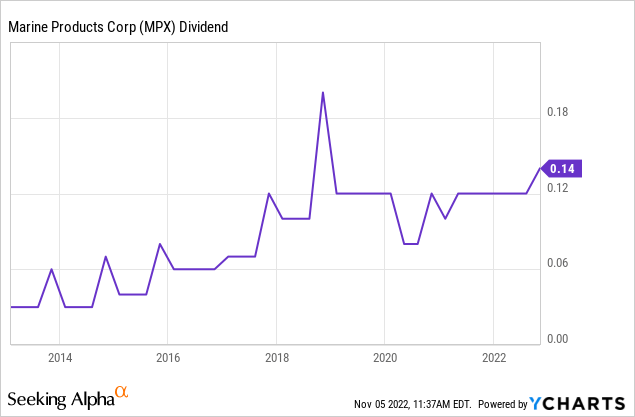

The company has increased the quarterly dividend payout at a very generous rate since 2013 from $0.03 to $0.14. The last raise took place in October 2022 when the management announced a 17% raise to the current $0.14 per share, which represents an annual dividend payout of $0.56. Almost every year, the company pays special dividends with the remaining cash.

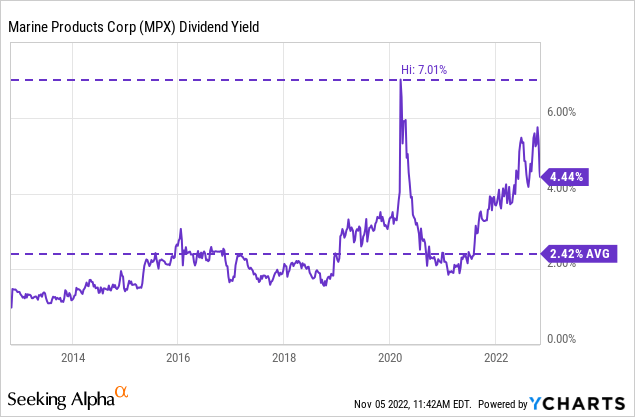

The latest dividend payout increases took place despite the share price decline of 54.37% since October 2018, and this has left a dividend yield of 4.44%, which is 83.47% higher than the average of the past decade despite the 7.01% spike during the worst days of the coronavirus pandemic crisis. Still, considering the most recent dividend raise, the expected dividend yield on cost is actually 5.18% without taking into account potential future special dividends.

This is one of the main signs that suggest that Marine Products could be offering a good buying opportunity for those dividend growth investors with a portfolio focused on the long term. But to determine if this is really the case, it is very important to assess whether the current dividend is really sustainable with the company’s current capacity to generate cash from operations. Therefore, below I present a table where I have calculated what percentage of the cash from operations is used for the payment of dividends each year and then I will assess the situation for the coming quarters because the current dividend yield, which is higher than usual, reflects a delicate situation that, if is successfully navigated by the company, would leave us with a very advantageous dividend yield on cost.

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Cash from operations (in millions) | $10.94 | $10.56 | $16.04 | $15.84 | $29.64 | $22.78 | $33.92 | $29.87 | $0.46 |

| Dividends paid (in millions) | $5.71 | $6.10 | $7.64 | $9.20 | $11.50 | $17.25 | $19.76 | $13.55 | $15.63 |

| Cash payout ratio | 52.16% | 57.26% | 47.61% | 58.10% | 38.81% | 75.75% | 58.25% | 45.36% | 3,419.91% |

As we can see in the table above, the company has historically paid around half of the cash generated through operations in form of dividends, including in 2020. The problem came in 2021 when the company reported an unusually low cash from operations of $0.46 million despite good profit margins, which left a cash payout ratio of 3,419.91%. In fact, the abnormally low cash from operations was the result of an increase of $31 million in inventories. In the same period, accounts payables increased by $0.7 million while accounts receivables decreased by $0.8 million. Certainly, these were not bad numbers because the company accumulated inventories instead of cash, and this caused a sharp drop in cash and equivalents, which was partially recovered in recent quarters.

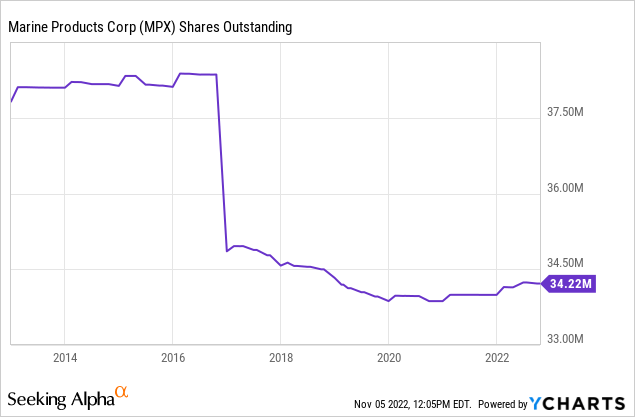

During the three quarters that ended September 2022, the company generated cash from operations of $4.5 million in the first quarter, $12.6 million in the second quarter, and $10 million in the third quarter. This is a total of $27.1 million pending the fourth quarter results (that is, during only three quarters). In the same period, inventories increased by $9.5 million and account receivables by $9.1 million, offsetting the increase of $7.8 million in accounts payables. Considering there are 34.22 million shares outstanding, it is expected that the annual dividend expense to cover the dividend will be around $19 million, with which the current cash from operations is more than enough to cover the current dividend and generate surpluses even after covering the usual capital expenditures of ~$2 million per year, and this should allow for future special dividends.

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Special dividends per share | $0.03 | $0.04 | $0.04 | $0.00 | $0.05 | $0.10 | $0.10 | $0.04 | $0.00 |

Since 2013, the company has usually paid a special dividend at the end of each year but refused to pay it for only two years. In 2016, the company made an aggressive share repurchase instead of issuing a special dividend, and in 2021, the management decided to preserve cash due to low cash from operations. As inventories are at record high levels while dealers’ inventories are low, I expect further increases in cash from operations that will soon be distributed among investors through a special dividend, further regular dividend raises, or new share repurchases.

Share repurchases increase investors’ positions passively

Prior to the coronavirus pandemic crisis, the company used to repurchase its own shares in order to successfully reduce the total number of outstanding shares. This makes each share represent a larger portion of the company over time, improving thus per-share metrics (and allowing for future dividend raises as there are fewer shares for the dividend distribution). The last share repurchase took place in the fourth quarter of 2019 when the company bought back 88,983 shares. Prior to that, it was a common practice that helped the company reduce the number of shares outstanding year after year, including 3.5 million shares in 2016 for $33.74 million.

As a consequence of the coronavirus pandemic crisis in 2020 and the headwinds that have resulted from it, as well as the current conflict between Russia and Ukraine, the management seems to be more inclined to preserve cash in order to maintain a healthy balance sheet, because although operations have not been significantly affected thanks to pricing actions, there are growing fears of the arrival of a recession that could be deeper than the current macroeconomic situation. For this reason, share repurchases have been paused. Also, demand could decline as a result of the increased price of the company’s products.

Still, investors can expect further share buybacks in the future and as soon as the current macroeconomic landscape improves, which will make their positions grow over the years.

Risks worth mentioning

Personally, I consider the company’s risk profile to be very low as its profit margins are very high while its debt is non-existent.

- The most immediate risk facing the company is the possibility of a deep recession affecting the consumer habits of the American population, especially the middle and upper classes. If such an event had an impact on demand for the company’s products, it has a lot of room to maneuver: there is a dividend to cut, a share repurchase habit to continue pausing, and, in the worst case, a debt to take. But it is important to note that such measures would have a significant impact on shareholders’ returns.

- Also, investors should consider that increasing the price of a company’s products by ~33% is not something so simple as it can have a direct impact on customer demand. Included in the share price reduction is the risk of falling volumes as a result of the first mentioned risk added to this risk.

- And finally, around 95% of the company’s sales take place within the United States. This means that the company has very limited geographic diversification, and therefore, its operations depend on the situation of the American economy. On the other hand, it also means that there is a wide international market in which to expand, although it is not something that an investor should expect at present.

Conclusion

The Marine products’ balance sheet remains in excellent condition. In addition, profit margins have improved in times as difficult as the current ones marked by current inflationary pressures. In the short term, the company’s inventories are high while dealer inventories are at very low levels, and this suggests that sales will continue to be at least flat in the coming quarters.

The problem is the aggressive increase in the price of its products at a time of economic uncertainty marked by fears of a coming recession, which increases the risk of declining demand in the medium term, but we must not forget that the balance sheet is prepared to withstand the blow of declining demand because, in addition to not having debt, it has a dividend to cut. Furthermore, the business has its roots in 1965 and has shown its viability over the years.

That is why I consider that the current dividend yield on cost of ~5.18% as a consequence of the current share price decline represents a great opportunity for dividend growth investors with a long-term vision since Marine Products is destined to be a true wealth generator in the long run at the current share price.

Be the first to comment