franckreporter

Palantir (NYSE:PLTR) is one of the few tech companies that continues to show a double-digit revenue growth rate in the current turbulent macroeconomic environment, and yet its shares have been aggressively depreciating since the start of the year. While some of this is due to the overall market selloff, it seems that the market nevertheless doesn’t fully understand Palantir’s potential and its ability to generate greater shareholder value in the long term, which resulted in the company’s stock trading in the oversold territory. Therefore, as investors await the results, now is a good time to analyze what we should expect from the upcoming report and what kind of catalysts could help the shares to rebound in this environment.

Decent Q2 Results And A Declining Share Price

Back in August, Palantir released a mixed Q2 earnings report in which it beat the revenue estimates, slightly missed the earnings forecast, and reported a conservative outlook for the year. The revenues themselves were $473.01 million, up 25.9% Y/Y, and the number of clients increased to 304 in comparison to 169 from a year ago, and back in August in one of my bullish articles about the company, I explained why the results weren’t as bad as some might thought they were.

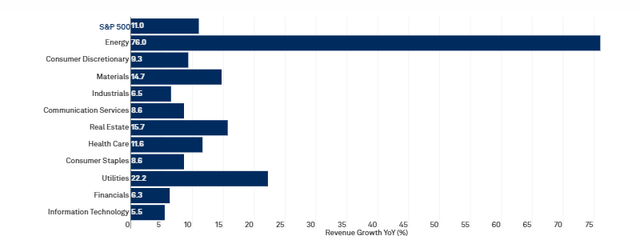

At the same time, Q2 was the fifth consecutive quarter in which the stock-based compensation has been decreasing, while the insider selling nearly ceased to exist after the options of Palantir’s CEO Alex Karp, which were granted to him a decade ago, expired in December of 2021. What’s also important to note is that as Palantir managed to generate an aggressive double-digit revenue growth rate, the overall revenue growth rate of the companies from the S&P 500 index was only 11% Y/Y, while the growth rate of companies from the information technology within the index increased only by 5.5% Y/Y.

Q2 Revenue Growth Rate Of Companies From The S&P 500 Index (S&P Global)

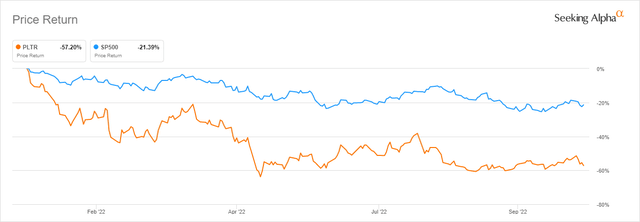

However, despite such a decent performance in comparison to others, Palantir’s stock still depreciated, and currently, it continues to trade below the S&P 500 index since the beginning of this year.

Price Return Of Palantir’s Stock In Comparison To The S&P 500 Index (Seeking Alpha)

Here’s What Investors Should Expect Going Forward

Going forward, there are nevertheless reasons to be optimistic, as the company has several catalysts, which could help the company’s stock to rebound. First of all, while the growth of Palantir’s revenues in the government segment decelerated, as they were only up 13% Y/Y, there’s an indication that that is going to change in the foreseeable future.

As the Russo-Ukrainian war continues to challenge the alliance of western countries, while China once again has been named as a top threat to U.S. interests in the latest National Defense Strategy report, it becomes obvious that the defense spending is more than likely going to increase no matter who controls the Congress or the White House. For 2023, the U.S. defense spending could be in the range of $850 billion to $857 billion, and there are already forecasts, which show that we could see annual defense spending top $1 trillion in the following years.

This is a positive development for Palantir, as the company has been actively working with Pentagon on different software projects, and recently it was awarded the highest accreditation from the Department of Defense, which makes it possible for the contractors to use Palantir’s platforms to store and transfer a top-secret data. The only other two companies in the world with similar accreditation are Amazon (AMZN) and Microsoft (MSFT). In addition, in recent months we’ve already seen an increase in contracts that were awarded to Palantir by various federal agencies along with the branches of the Department of Defense. This is a sign that Palantir’s software solutions would continue to be in high demand due to a favorable geopolitical environment for the company along with a higher defense budget that would be needed to be spent.

In addition to the defense sector, Palantir has also been actively increasing its exposure to the healthcare sector. Just recently, its contract with the FDA, under which the company would be responsible for monitoring food chain disruptions, has been expanded, while at the same time Palantir is also bidding for the 5-year £360 million software contract that’s expected to be awarded by the United Kingdom’s National Health Service. In the past, Palantir has already worked with the NHS on the Covid-19 response in the UK, and the lobbying efforts to receive a new contract are already underway.

As for Palantir’s commercial business, it’s safe to say that despite the turbulent macroeconomic environment, the demand for the company’s solutions is higher than ever, as in Q2 its commercial revenues increased by 46% Y/Y. A lot of this growth could be attributed to the company’s Apollo platform, which has all the chances to continue to help Palantir generate double-digit returns, as last year it became a standalone product and managed to accelerate the onboarding of new customers. On top of that, despite the ongoing macroeconomic uncertainty, recent reports from research firms suggest that the data analytics market would continue to grow at a CAGR of 30.7% and be worth $346.24 billion by the end of the current decade, which indicates that the demand for Palantir’s commercial offerings is unlikely to decline anytime soon.

Considering all of this, it’s safe to say that Palantir is more than likely to continue to aggressively grow its revenues in Q3 and beyond. Back in August, Palantir’s management estimated that the business would generate $474 million to $475 million in revenues during Q3, which implies a Y/Y growth of ~20%. Since the blended revenue growth rate for Q3 of companies from the S&P 500 index so far is 10.5% Y/Y, while the blended growth rate for the companies from the information technology sector, in particular, is currently only 5.7% Y/Y, it’s safe to assume that Palantir would once again outperform its peers in terms of growth.

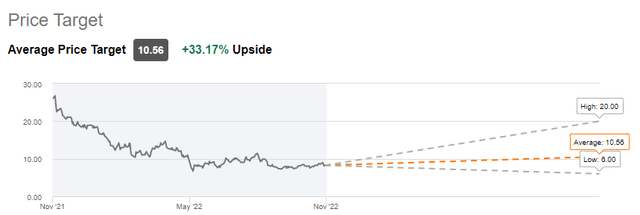

On top of that, with no debt, $2.4 billion in cash, and a remaining deal value of $3.5 billion at the end of Q2, it’s safe to say that Palantir continues to be an attractive stock to own at this stage. To figure out the exact upside that the company offers, I’ve made two DCF models in recent months, which showed that in the base case and an optimistic case Palantir’s fair value is $10.03 per share and $12.08 per share, respectively. At the same time, the consensus on the street is that Palantir’s fair value is $10.56 per share. While I plan to update my models after the Q3 results come out, the good news is that even now all of the scenarios show that Palantir’s stock offers a significant upside from the current market levels. In case of a successful Q3 results, we could see the stock rallying closer to those levels.

Palantir’s Consensus Price Target (Seeking Alpha)

Risks

As the Federal Reserve continues to engage in a quantitative tightening and increases interest rates to tame inflation, there’s a risk that in the short-term Palantir’s growth could be slower than initially thought. While last year Palantir’s goal was to grow its annual revenues by 30% or higher through 2025, the worsening macroeconomic environment forced the management to decrease its goals for this year. As a result, currently, the company expects to generate only ~$1.9 billion in revenues this year, which implies an annual growth of only ~23%. Considering this, there’s always a possibility that despite all of the long-term catalysts, the company could once again announce a conservative outlook, which would prevent the stock from rallying in the short term until the macroeconomic headwinds disappear.

In addition, back in September, Alex Karp already was predicting that the current turbulent environment would take a portion of companies out of business. While Palantir itself is safe in that regard, its equity stakes in other businesses are nevertheless at risk. While earlier this year Palantir stopped investing in other businesses, its investments from the previous years generated a loss of $174.7 million in the first 6 months of 2022. This is a problem for the company since, despite its efforts to decrease the stock-based compensations, such losses prevent Palantir from improving its overall bottom-line performance, which makes its shares unattractive for some investors. In case of further significant losses from equity stakes in other businesses, there’s a risk that Palantir’s stock could continue to trade at the current distressed levels until the macroeconomic situation improves as well.

The Bottom Line

The major upside for Palantir is the fact that there’s an indication that its revenues would continue to grow at a double-digit rate, which implies that its business has everything it needs to continue to aggressively expand in the current environment despite all the risks. Add to this the fact that the stock-based compensations continue to decrease while the insider selling almost ceased to exist and it becomes obvious that once the macroeconomic picture improves Palantir’s shares could begin to appreciate at an aggressive rate. As for now, if successful, the upcoming Q3 report has all the chances to start rebuilding investor confidence and help the stock to finally rebound after months of trading in the distressed territory.

Be the first to comment