MarsBars

There are some stocks, like the late great comic Rodney Dangerfield, that just get no respect. That’s not necessarily a bad thing, however, as this opens up opportunities for value investors to pick them up on the cheap. As experienced investors know, stock investing isn’t a popularity contest, and some of the biggest gains are had when good-paying stocks are bought when the market isn’t paying attention.

This brings me to LXP Industrial Trust (NYSE:LXP), which has and still is undergoing a major portfolio transition. This article highlights why LXP appears to be undervalued and is an attractive income stock, so let’s get started.

Why LXP?

LXP Industrial Trust is a REIT that was once called Lexington Property Trust. Over the recent years, LXP has undergone a major portfolio transition away from office buildings and towards industrial properties. At present, industrial properties, which consists of warehouse and distribution facilities make up 90.4% of LXP’s annual base rent, while office properties make up the rest.

The industrial side of LXP’s portfolio appears to be rather healthy, and includes 110 properties covering 53 million square feet. The majority of them (77%) are located in the Top 25 MSAs in the U.S., and 92% are in the Top 50 MSAs. This segment also carries a reasonably long weighted average lease term of 6.7 years, and is seeing strong demand with a 99.3% leased rate.

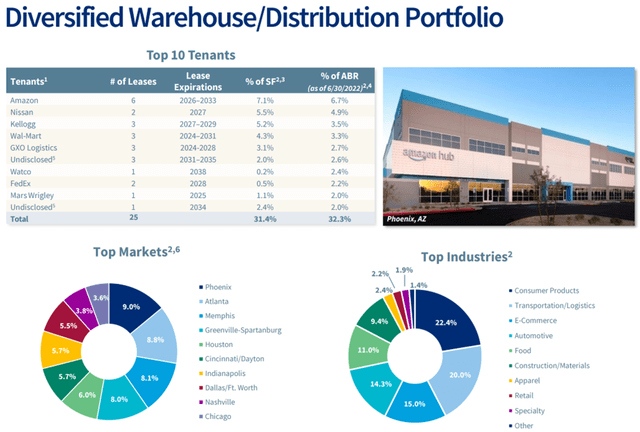

The portfolio is also rather young, with an average age of just 8.9 years. This results in higher marketability to new tenants should an existing one move out. Moreover, LXP counts large and well-known companies as its top tenants. As shown below, Amazon (AMZN), Nissan (OTCPK:NSANY), Kellogg (K), and Walmart (WMT) represent LXP’s top 4 tenants, representing 18% of portfolio ABR.

LXP Portfolio Mix (Investor Presentation)

Meanwhile, LXP is seeing healthy demand, with a 99% occupancy rate as noted earlier, and it was able to raise base rents by 21% on new and extension leases during the second quarter. Moreover, LXP continues to recycle capital away from office properties and towards industrial facilities. This includes disposing of 6 properties for an aggregate amount of $147 million during Q2 and subsequent months, while commencing development and acquiring 3 properties and a 60 acre parcel of developable land in Atlanta and Indianapolis.

Factors that could pressure the share price include ongoing transformation efforts, in which higher cap rate office properties are traded for lower cap rate industrial facilities. As such, FFO per share growth could be muted in the near-term, but higher rent growth and tenant stability positions LXP well for the long-term. Moreover, LXP caries a net debt to Adjusted EBITDA of 6.8x, which I view as being reasonable, considering the development projects currently underway that could drive the leverage ratio down once they are stabilized.

Meanwhile, LXP pays an attractive 4.8% dividend yield, which is well-protected by a 46% payout ratio. It’s worth noting that LXP reset its dividend back in 2019, which was earlier in the portfolio transformation. This put LXP on solid financial footing with plenty of retained capital to fund its transition.

I see value in the stock at the current price of $10.15 with a forward P/FFO of 15.4, sitting well below that of its larger industrial REIT peers that have P/FFO ratios well above 20x. Management also seems to think that the stock is cheap, as it repurchased 7.9 million shares since the start of the year, representing a 2.8% reduction in the share count.

LXP recently announced a Board-approved authorization to repurchase another 10 million shares. At the current valuation, LXP is getting a 6.5% earnings yield on every repurchased share, sitting higher than the cap rate on new acquisitions. Lastly, sell side analysts have an average price target of $12.63, translating to a potential one-year 29% total return including dividends.

Investor Takeaway

LXP is a quality and under the radar company that’s quickly transitioning into a pure-play Industrial REIT. It maintains strong portfolio fundamentals with relatively newer properties and has an attractive development pipeline. The stock pays a very well covered 4.8% dividend yield that should be raised again next year, and trades well below its larger industrial peers. I see value in the stock for solid income and potentially strong capital gains.

Be the first to comment