Lim Weixiang – Zeitgeist Photos

Thesis

CSW Industrials, Inc. (NASDAQ:CSWI) has had strong growth in sales, rising by almost 25% in the last quarter compared to the year prior, and due to cost efficiencies and an outpacing of sales growth, operating Margin has improved to above 18% thanks to 35% growth in operating income. Despite this robust performance, the share price remains down on the year and is discounted to peers on several comparable valuation methodologies, indicating that there is around 10% or more upside. On the other hand, this upside is not high enough to give the stock a buy rating, so we recommend holding until we see further improvements or a larger discount to a fair valuation.

Intro

CSWI is a diversified industrial company with a focus on mechanical products for HVAC/R, plumbing products, building safety solutions, as well as specialty lubricants and sealants. The end markets are building products, plumbing, energy, rail, mining, and general industrial companies. The group has factories across the US, Canada, and Vietnam, but sells globally.

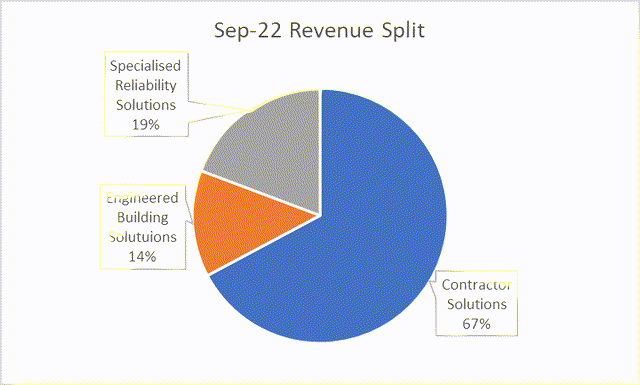

The group is split into three business segments, led by Contractor Solutions, which accounts for two-thirds of the business, followed by Specialized Reliability Solutions and Engineered Building Solutions (revenue split by division illustrated above).

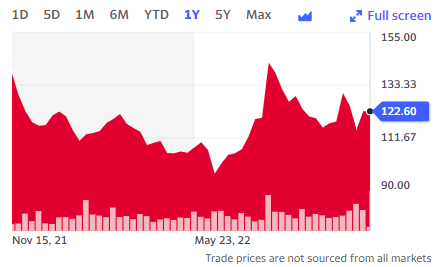

The company has been outperforming the market over the past year, albeit still down from its 52-week high. CSWI is down around 10% on the year, somewhat more stable than the 20% market decline overall. The stock currently sits at around $122 USD a share.

Yahoo Finance

Financial Analysis

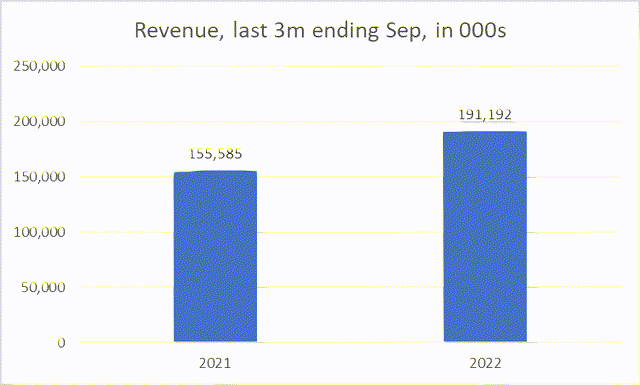

The group’s revenues grew in the last quarter (3 months ending September 2022) by 23%, reaching just under $200m for the period. The growth was driven by a number of factors, one being the acquisitions of Shoemaker, CG, and ACG, which contributed around 7% of the growth, but the majority of growth was organic sales, which grew around 16% which was primarily driven by pricing initiatives.

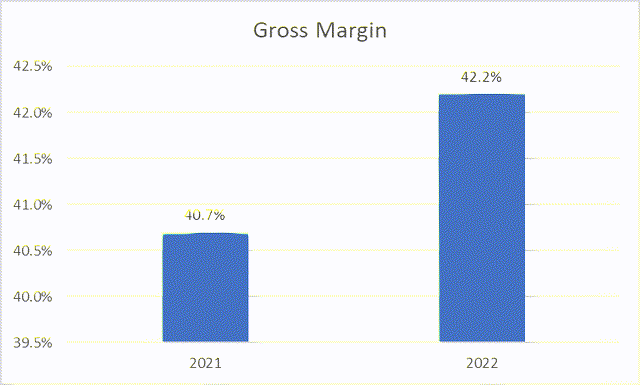

This improvement in revenue (due to price) led to an improvement in gross profit margin for the group, which grew by almost $20m, from 40.7% to 42.2.% for the latest quarter.

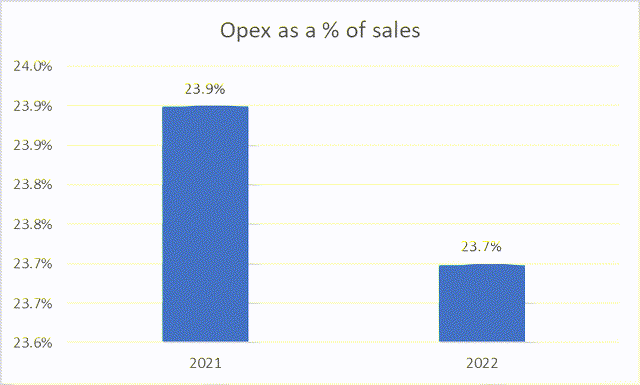

As inflation is almost at double digits right now, and the company has made several acquisitions, you would expect operating costs to be substantially high for the period, given all these factors. When in reality operating expenses as a % of revenue decreased slightly, showing an improvement in costs despite the slight rise. Operating expenses as a % of sales improved from 23.9% in 2021 to 23.7% in 2022, for the current period.

This indicates that the company has had recent success as top-line growth has outpaced expenses, even though we are in an environment of significant disruption in the supply chain as well as unprecedented inflation.

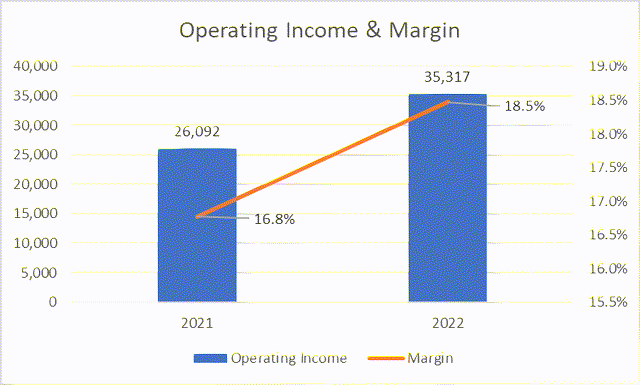

These improvements have led to a strong increase of 35% in operating income for the period, resulting in an improvement in operating margin from 16.8% to 18.5%.

The improvement was driven by large increases in revenue for the contractor solutions segment, as that division has the highest margins, at around 25% operating margin, compared to the two other segments with margins below 15%.

Valuation

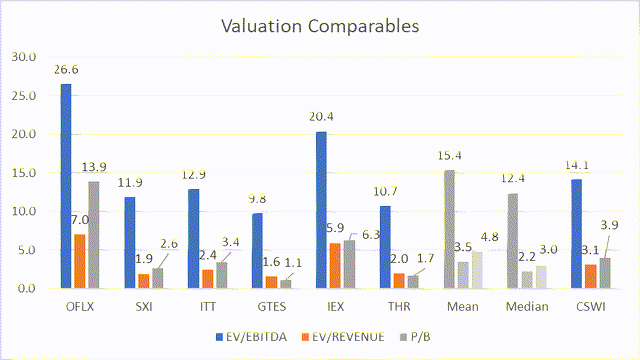

If we collate a set of industrial manufacturing peers and compare them using different valuation methodologies, CSWI looks slightly undervalued.

Comparing EV/EBITDA, EV/Sales, and P/B, CSWI is discounted by between 5% and 20%, depending on which valuation you prefer. Therefore, using these numbers alone, CSWI has a potential upside of around 10% give or take.

Risks

- One risk to the potential upside is if operating expenses start outpacing growth in revenue. Given that revenue growth has been so high lately, there is a chance of a taper if demand decreases, especially if one of the new acquisitions begins to suffer or does not work out. Operating expenses are already almost a quarter of total sales, so a small increase in operating expenses, due to items such as wage inflation, will lead to a few points decrease in the bottom line.

- Furthermore, the cost of revenue or gross margin may take a hit. The effects of inflation may have yet to hit the business as there is always a lag, and if there are any supply chain disruptions then this would emphasize it; if gross margin were to fall, again, this would lead to a decrease in operating margin.

Conclusion

CSWI has had a great year so far, with top-line growth of around 25% driven by both strong organic growth and key acquisitions made in the past year. This growth has led to an improvement in both gross margin and operating margin (which was also improved due to an improvement in SG&A as a % of sales, so cost efficiencies have been made), leading to an overall improvement in operating income by around 35%.

However, despite the strong performance, the company’s share price has not improved over the past year. While it has not followed the overall market with a large decline, it is still down 10% from the previous year, while earnings have improved 35%. This has led to an undervaluation of the company, as on all methodology, whether it is EV/EBITDA or P/B, CSWI is clearly trading under peers and has a potential upside of around 10% or more in our view.

On the other hand, this is not enough to make a strong case for investment, given the limited upside. The upside could be higher if the company continues to make improvements and sales continue to outpace expenses, but we are entering a period of unprecedented inflation and supply chain disruption, so this growth may not continue at the same pace. Therefore we recommend holding until we see further improvements down the line.

Be the first to comment