Justin Sullivan/Getty Images News

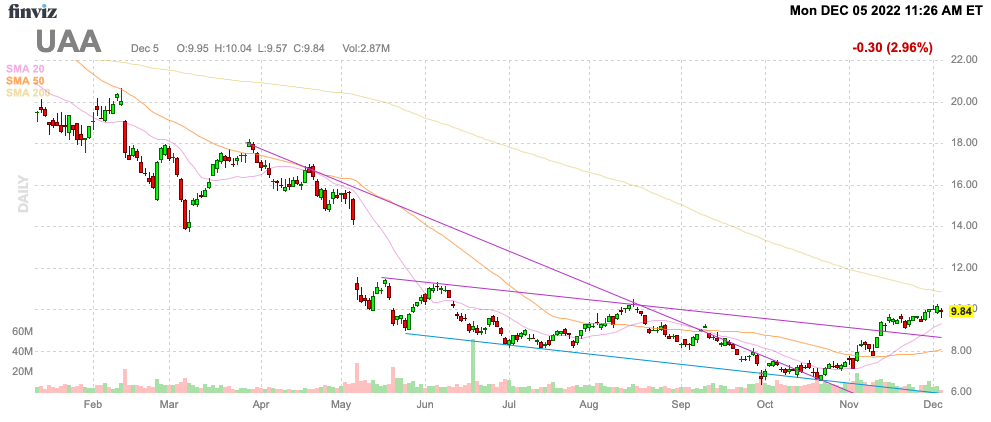

In no surprise to most investors actually following the Under Armour (NYSE:UA, NYSE:UAA) story, the stock has rallied after dipping to dirt cheap levels in October. A lot of retail stocks have rebounded in the last couple of months, but the market didn’t appreciate the insanely cheap valuation of a company still forecasting growth for 2022. My investment thesis remains very Bullish on Under Armour trading below $10.

Source: FinViz

Limping Into 2023

About a month ago, Under Armour cut the FY23 revenue growth rate to the low single-digit percentage level after original expectations of currency-neutral 7% to 9% growth. The cut wasn’t too shocking with the stock trading at multi-year lows and investors not even expecting much if any growth, not growth that could’ve actually approached 10%. Remember, the athletic apparel company correctly cut shipments last year leaving inventory flat to down from prior year’s levels despite higher sales now.

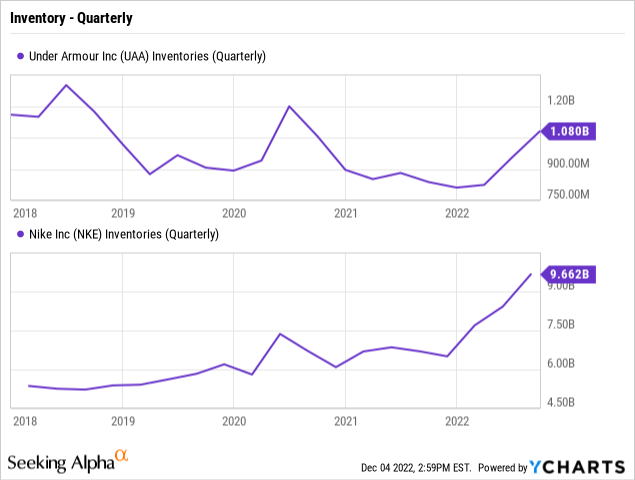

With Under Armour still trading at $10, any growth here is a positive. Remember, the big issue with growth and gross margins is highly related to peer Nike (NKE) having far too much inventory for the holidays. The athletic footwear leader reported FQ1’23 sales grew 4%, but margins were similarly impacted due to the heavy promotional environment.

Nike has annual revenue of $50 billion while Under Armour hopes to top $6 billion in FY24. The small player will always struggle to drive the market when the industry giant decides to flood the market with excess inventory.

Nike ended the September quarter with an inventory balance of $9.7 billion at ~50% above the similar levels in 2019 heading into the holidays. Under Armour actually has lower inventory now than all the way back in 2018 at just $1.1 billion now.

While Under Armour is limping into 2023 with inventories that are possibly too lean, the company should be poised for an excellent FY24. The supply chain is now mostly caught up and shipping costs should normalize in the next few months.

The athletic apparel company guided to FY23 gross margin impacts of 375 to 425 basis points. Under Armour should quickly recapture the peak margins next year at over 50% from FY21.

The company was creating a margin gap with Nike and quickly returning to the premium sector. Before the market slowed and margins were pressured, Under Armour earned an EPS of $0.85 for 2021.

Analysts are far too conservative here with EPS forecasts for FY24 at only $0.64 and a meager leap to $0.72 in FY25. Investors shouldn’t assume Under Armour fails to more than recover over 2 years after the Covid crisis is over.

Investors should look towards this more normalized business model as follows:

- Revenue (10% growth) = $6,435M

- Gross Profits @ 51% = $3,282M

- OpEx @ 40% = $2,574M

- Operating Income = $708M

- Taxes @ 30% = $212M

- EPS = $496M/480M shares = $1.03

As Under Armour returns to record revenues net year, the company will produce a strong EPS with the higher gross margins. Note, the company is full of innovation now with the new SlipSpeed footwear line released back around the FQ3’23 earnings report. In addition, Under Armour under the new CEO is moving into more lifestyle clothing to expand the market opportunity for the company. The SlipSpeed shoes cost $150 highlighting the shift to more premium items.

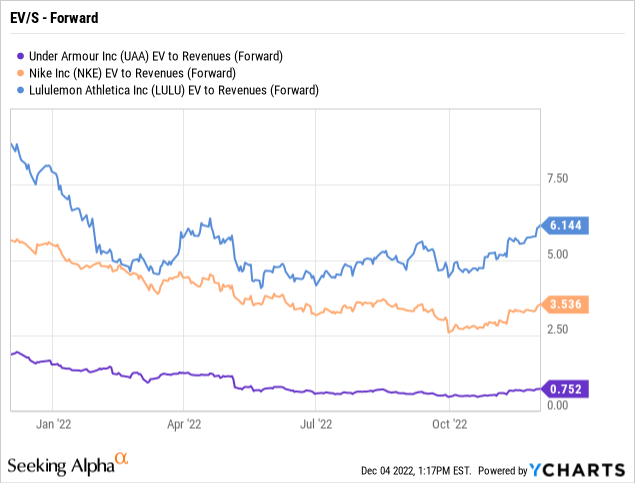

The stock remains dirt cheap compared to sector peers with Nike still trading at 3.5x sales targets while Under Armour has a throw away valuation of 0.75x forward sales. Lululemon Athletica (LULU) trades at 6.1x sales targets in a prime example of where Under Armour can land in the future with a focus on premium gear with higher gross margins.

Only a few years ago in FY19, Lululemon had gross margins of just 56% with operating margins of 22% due to constrained spending on operating expenses. The yoga clothing firm has a smaller product selection contributing to the larger margins on lower revenues at the time.

Under Armour does need a larger revenue base to produce these impressive operating margins. The company was headed in that direction before Covid normalization and costs impacted margins.

Takeaway

The key investor takeaway is that Under Armour isn’t accurately priced for the margin story unfolding hidden by Covid. As the inventory correction at Nike ends and the promotions normalize, Under Armour has a $1+ EPS story to build on going forward.

Investors should’ve already loaded up on the stock far below $10, but Under Amour remains cheap at $10 today.

Be the first to comment