lei liu/iStock via Getty Images

I have been writing a lot about the strong dollar and what it can do for the United States.

Well, there is another side to the story… the problems of a weak currency.

Nicholas Macpherson, a former permanent secretary of the Treasury in the U.K., writes that “The British Should Stop Being So Relaxed About The Weak Pound.”

Mr. Macpherson writes that a fall in the value of a currency can lead to a drop in living standards.

And,

“Faced with a drop in living standards, and debt interest eating into resources better spent on NHS and education, the British people may begin to reflect on the consequences of devaluation.”

Maybe a drop in living standards and a rising burden of debt interest on the country is not a free lunch.

“Maybe it’s time to embrace sound money.”

A Falling Value To The Currency

Devaluation of the currency does good things for a country in the short run.

However, over the longer run, devaluation costs a country economic growth and competitive ability with the world.

“Britain’s addiction to consumption over investment and its chronic productivity problems meant that balance of payment difficulties tended to emerge for any given exchange rate.”

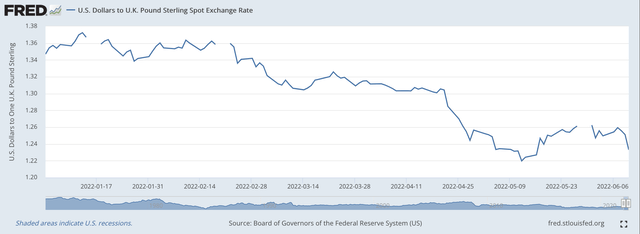

In the recent past, since its January peak, the pound is 10 percent weaker than the U.S. dollar. The pound is 3 percent weaker than the Euro.

U.S. Dollar relative to the British Pound (Federal Reserve)

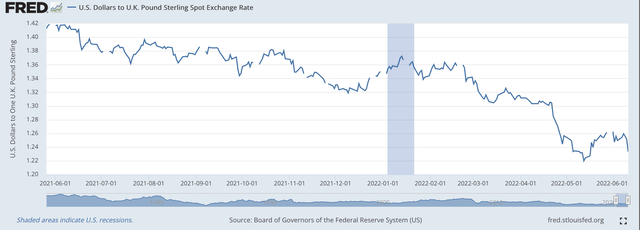

Since late May 2021, the value of the British pound has fallen even further.

U.S. dollar relative to the British pound (Federal Reserve)

So, the British have been facing a weaker pound since relatively early in 2021.

So, the pressure is building up.

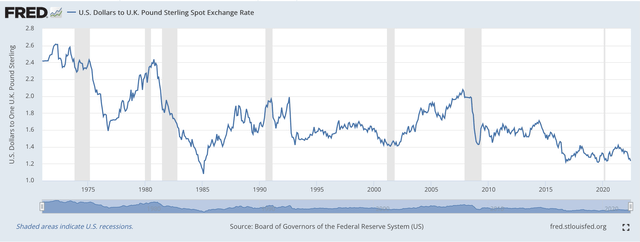

But, taking even a longer look at the relationship, it appears as if the British have worked behind a falling value of the pound for most of the time since early 1972, when world currencies went off the gold standard and began to float.

U.S. Dollar relative to the British Pound (Federal Reserve)

In fact, the British have tried to live off of a weak pound for a long, long time.

And, this is a major reason, I believe, that Great Britain is doing so poorly in trade against the United States, and trade against the rest of the world.

The pathway, as Mr. Macpherson describes it:

“Governments would resist devaluation in pursuit of credibility, arguing that this time was different.”

“But, sooner or later the dam would burst, with successive devaluations….”

And, then Mr. Macpherson goes on.

“From a politicians’ point of view a downward drift in sterling is the perfect policy instrument.”

“It allows the economy to adjust after a period when the country has been living beyond its means.”

“But, it carries a cost and one which has potentially increased with time.”

And, the United States must keep this lesson in mind as it goes forward.

The Easy Way Out

Pushing for a weak currency helps the economy grow, but only in the short run.

Politicians can use and misuse fiscal and monetary policies to weaken the value of their currency in the short run.

Economic growth increases.

But, only for the short run.

This is like a drug overdose. The initial high goes away.

And, another high is needed to extend it.

Undisciplined policies give the politicians what they want in the short run, but….

I believe the history of the British pound since 1972 highlights this story.

To repeat Mr. Macpherson:

“Britain’s addiction to consumption over investment and its chronic productivity problems meant that balance of payments difficulties tended to emerge for any given exchange rate.”

And, this is where the Chinese come into the picture again.

The Chinese are noted for focusing on the longer run. They think in terms of decades.

Here we see British politicians focusing on the shorter run… focusing on the next election.

The United States must avoid this tendency. And, if recent history is any evidence of this, it seems as if the U.S. is avoiding this trap at the present time.

Moving Forward

The United States seemed to be moving in this direction following the 2020 presidential election.

It seemed as if the Biden administration was building a fiscal program that would follow some of the same lines that the British government had been following.

As of this time, it appears that this strategy is not going to be enacted and with the Federal Reserve fighting the battle against inflation, it seems as if the United States government is on the right path to maintain a strong U.S. dollar and support the place of the U.S. dollar in the world.

This is especially important given the efforts the Chinese have made and will make to build up the Chinese Yuan as one of the major currencies of the world, if not “THE” major currency.

Mr. Macpherson cites the fact that Bank of America has claimed that British sterling has become “an emerging market currency.”

What a fall for what was once the prime example of the greatest global currency in the world.

The United States really needs to take this lesson seriously.

Be the first to comment