da-kuk/E+ via Getty Images

After carefully reviewing Nano-X Imaging Ltd. (NASDAQ:NNOX)’s history and controversies, I still struggle to justify the current valuation, despite it being down 90% from the peak. Despite easing downside momentum on the stock, I would recommend investors stay on the sidelines until the company can de-risk its story.

Introduction

I am approaching Nano-X Imaging Ltd. as a potential bottom fishing candidate. It has certainly been a rollercoaster ride for investors. Nano-X IPO’ed in August of 2020, and quickly tripled in value from its IPO price within weeks. However, there was a short attack shortly after from Citron and Muddy Waters broadly claiming that the company is built on vaporware and is “Theranos 2.0”.

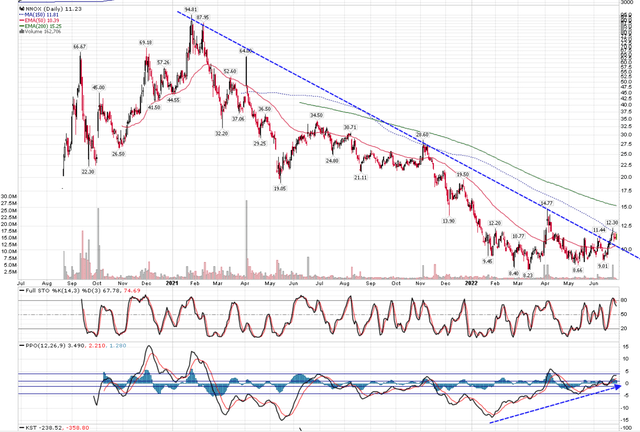

Figure 1 – NNOX shows interesting chart pattern (author created with price chart from stockcharts.com)

While the company did not rebuke the short reports directly, it did schedule a live demonstration of its technology shortly after at the 2020 Radiology Society of North America (RSNA) conference in December. The successful demonstration of the prototype helped restore investor confidence somewhat and the stock price traded as high as $95 in early 2021, giving the company a market cap of almost $5 billion.

Unfortunately, that was the high for NNOX’s stock price, as repeated FDA delays and the stock market correction helped crater the stock to a low of $8 recently. Since reaching $8 in March, the stock price is attempting to form a sustainable bottom, breaking the 2 year downtrend and challenging the 150 day moving average, with positive divergence in the MACD indicator.

With this interesting technical backdrop, I want to revisit the company to see if it has made any progress fundamentally to justify a change in investor sentiment and/or successfully rebutted analyst critiques.

Delays, Delays, And More Delays

One of the biggest issues I have with the Nano-X story is its long history of delays. When Nano-X IPO’d, it initially planned to submit and obtain FDA clearance for its multiple-source Nanox.ARC X-Ray device by the fourth quarter of 2020:

“We will continue to optimize and develop further features of the Nanox.ARC, and plan to submit an additional 510(K) application under the Third Party Review Program with respect to the multiple-source Nanox.ARC during the fourth quarter of 2020, which, if cleared, will be our commercial imaging system.”

-Quote from F-1 filed during IPO

As the fourth quarter of 2020 came and went without FDA clearance even for its single-source Nanox.ARC, the company pushed back the commercial launch to Q1 2022:

“We first demonstrated a working prototype of the Nanox.ARC in February 2020 and, if cleared by the FDA and authorized by similar regulatory agencies in other jurisdictions, we are targeting shipment of 1,000 Nanox Systems by the end of the first quarter of 2022, with the goal to finalize deployment of the initial 15,000 Nanox Systems by the end of 2024.”

- Quote from F1 filed during secondary offering of shares in February, 2021

Finally, in April of 2021, Nano-X did finally receive FDA clearance for its single-source Nanox Cart X-Ray System, almost a year after it initially submitted its 510 (K) application. However, with the Q1/2021 results that were released on May 11, 2021, the company further pushed out the commercialization date to sometime in 2022, blaming a shortage of high-power ceramic tubes:

“As a result, while the Company does not expect to meet its previously announced milestone of shipment of 1,000 multi-source Nanox units by the first quarter of 2022, the Company believes that it will be able to gain ground during the year to reach the shipment milestone of 1,000 multi-source Nanox units during 2022, and possibly more, if the multi-source Nanox.ARC is cleared by the FDA and authorized by other similar regulatory agencies.”

- Quote from Q1/2021 earnings release

Moreover, the 510 (K) application for the multi-source Nanox.ARC appears to be mired with delays again. The company initially filed the 510 (K) in June 2021, but withdrew the submission in January of this year and replaced it with a Q-Submission instead (Q-submissions are requests for feedback and meetings). As can be imagined, the timeline to commercialization is pushed back even further, as the Nano-X still needs to clear the Q-Submission before resubmitting the 510 (K).

“Right now, we don’t say more than what we are seeing right now in the press release and in the earnings. The only thing I’m saying is that the fact that we have changed our way to communicate with the FDA to an on-day dialogue with a Q sub, we are waiting for the green light to the FDA for the approval of the Q sub and then it will be submitted, okay?

We have provided in the last few months all the information that we requested. Following the last 2 sessions that we had with the FDA, they have asked for a lot of supplemental information. We have actually shared this information with the FDA. And right now, we are waiting for the okay.”

- Erez Meltzer, CEO, on Q1/2022 earnings call

So essentially, a FDA clearance on the multi-source Nanox.ARC is 2 years late, based on the original IPO timeline, with no clarity on if/when it will be received.

Is The Technology Truly Disruptive?

One good article that looked at the competitive landscape was written by Looking for Diogenes, who pointed out that an Australian competitor, Micro-X, filed a 510 (K) submission for their Rover Mobile X-Ray machine on June 11, 2020 and received clearance on July 20, 2020, so a much faster turnaround than what Nano-X has experienced.

What I find interesting is that Nano-X appears to be the only company focused on a MEMs (Micro-Electromechanical Systems) solution while most of the recent literature appears focused on CNT (Carbon Nano-tube) technology. In fact, Micro-X, the company mentioned above, uses CNT to power their mobile X-Ray machines. It is quite odd for a groundbreaking technology to not have scholarly articles written about it.

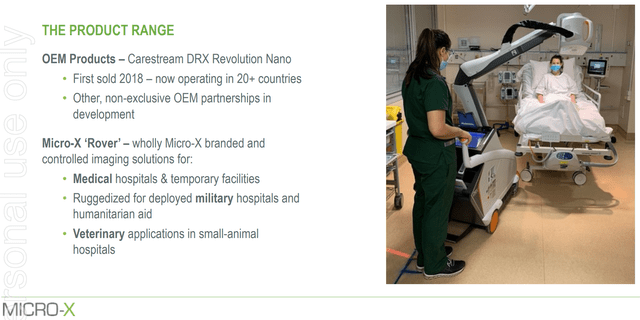

On an incidental note, in Diogenes’ article, he mentioned a third competitor, Carestream with a mobile X-Ray system on the market. In fact, upon closer due diligence, Micro-X appears to be the manufacturer of the Carestream Nano.

Figure 2 – Micro-X is OEM manufacturer for Carestream mentioned in prior articles (Micro-X investor presentation)

Without more information or disclosure, investors simply cannot make an educated assessment of Nano-X’s technology.

Short-Seller Controversy

As we mentioned in the introduction, Nano-X was targeted by short sellers Citron and Muddy Waters shortly after it went public. Although I have no love for these dedicated short sellers, I do know one thing from my years running a hedge fund: when there’s smoke, there’s usually fire. It’s rare for these short-sellers to target well run companies, as they can easily be sued for slander and stock manipulation.

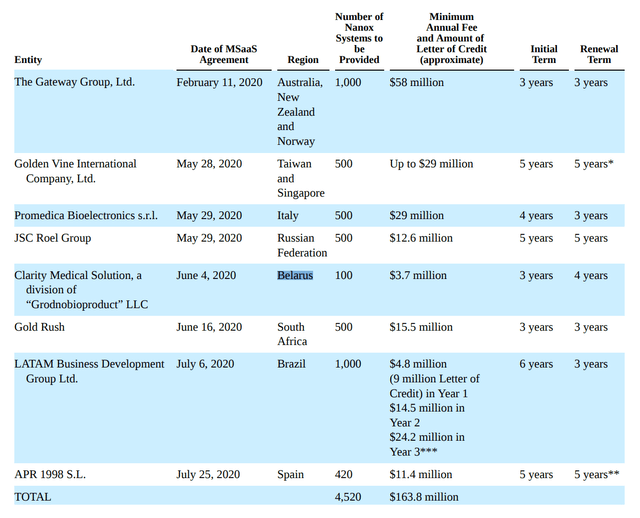

One common theme between the two short reports is that they took issue with Nano-X’s pre-order book. Nano-X claimed to have over 5,000 machines pre-ordered all across the world pending regulatory approval.

FIgure 3 – NNOX’s pre-order book (Nano-X F1 Filing)

However, even a cursory due diligence on some of these customers would raise serious red flags. For example, shortly after the IPO, Nano-X press released that it had entered into a 7-year agreement with SPI Medical S.A. de C.V (Mexico) for 630 Nanox Systems across Mexico and Guatemala. However, a Google search of SPI Medical returns a very rudimentary “Hello World” webpage. Another customer, The Gateway Group of Australia, distributes consumer products and soft drinks. Hardly the required experience to distribute medical imaging equipment. The list goes on.

On this controversial topic, I have to agree with the short sellers’ analysis. How do legitimate medical imaging companies place orders for X-Ray and CT machines without FDA approval, clinical trials, and side-by-side comparisons of images, etc.? And if these were not legitimate customers, why heavily promote them in Nano-X presentations and marketing materials?

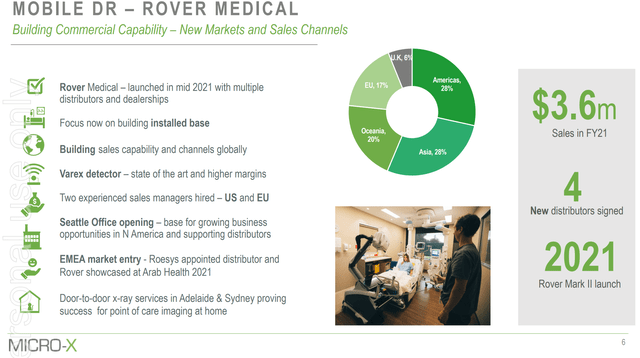

And bringing the story back to Micro-X, the Australian firm with an existing mobile X-Ray machine that began selling in 2018, Micro-X has only seen $3.6 million (Figure 4) in revenues for FY2021. After 3 years on the market, a competing X-Ray machine has only achieved $3.6 million in revenue! The explanation I can think of is that the sales cycle for X-Ray machines is much longer than that assumed in the Nano-X presentation materials.

Figure 4 – Micro-X only saw $3.6 million in revenues for its mobile X-Ray machines (Micro-X investor presentation)

Valuation Still Too Rich

Even though Nano-X has come down significantly from its peak, at a recent stock price of $11, it still sports a hefty market value of $570 million. I find this too rich, for a company that has yet to generate any significant revenues (its revenues for 2021 was $1.3 million). As we are halfway through 2022, it is highly unlikely that Nano-X will receive FDA clearance for its Nanox.ARC multi-source device and record any product revenues in 2022. Consensus revenues for 2023 is $34 million for Market Cap / Revenues of 16.7x, but this assumes FDA clearance and startup production sometime the next year.

Significant Cash Burn

Finally, looking at the company’s Q1/22’s cash burn of $15 million versus its $139 million in cash and investments, I estimate Nano-X has the financial wherewithal to stay in operations for another two years. But note that assumes “business as-is”. The company to-date, has never mentioned the cost to build a Nanox.ARX machine or the capital that is required.

Presumably, if NNOX gets regulatory approval, it will need to acquire tens of millions in materials and inventory in order to produce the actual machines. It just spent over $10 million to build a “MEMs” chip plant in Korea, what about an actual manufacturing facility? Will existing capital be sufficient to fund that expansion or will shareholders face additional dilution? Current investors should not be surprised by a large equity issuance if and when Nano-X does receive regulatory clearance.

Conclusion

Due to the red flags I have highlighted above, I would not recommend buying shares today, even if the potential market opportunity looks enticing. There are simply too many unknowns at this point in terms of timing, technology, and customers. At the same time, I would not short the stock at current levels, as a lot of the froth has been taken out of the stock, with it falling from $95 to $8. I could see a scenario where the company does receive a 510 (K) clearance for its multi-source Nanox.ARC machine and the stock doubling or tripling overnight.

In fact, I would be more than happy to be proven wrong and would reconsider the stock at two or three times the current valuation if there is FDA clearance for the Nanox.ARC machines and Nano-X can successfully ramp up production.

Be the first to comment