Matteo Colombo/DigitalVision via Getty Images

“Singapore is the happiest place in Asia.” – Dan Buettner

If you’ve kept track of developments in The Lead-Lag Report, you’d note that I’ve been recently highlighting how emerging markets have been doing relatively well compared to the domestic markets. However, the outperformance has hardly been broad-based, and has largely been driven by Chinese equities which are up by 17% over the past month; in fact, a couple of weeks back, I had put out a tweet postulating Chinese equities as an ideal meltup proxy.

This is of course largely a corollary of the end of strict lockdowns there, but the Chinese economy has a lot of catching up to do. Businesses still have ample backlogs to clear, and ports still remain overburdened. You would think a lot of this would unwind in H1-22.

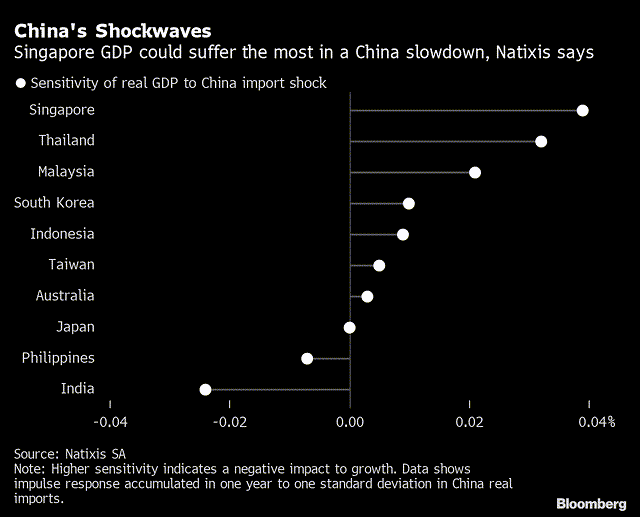

One economy that looks well-poised to benefit from a Chinese recovery is Singapore. China is one of the country’s largest trade partners and is also one of those partners with which it enjoys a trade surplus. Official data points to SGD21bn of exports towards China alone, with imports of SGD19bn. A few months back, when China was deep in the throes of a lockdown, it was estimated that the Singaporean economy could feel the most pronounced hit due to strong linkages with the former.

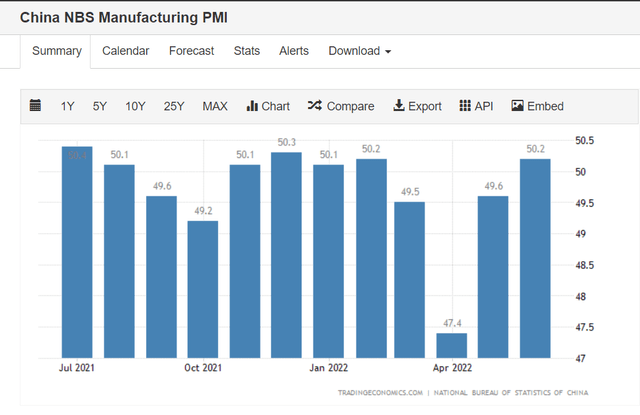

Much of what Singapore exports are items like core machinery, ancillary machinery equipment, etc. These are segments that could get a real fillip as Chinese manufacturing conditions normalize. In fact you’d be interested to know that after three months of weakness, the official Chinese manufacturing index recently expanded in June and looks like it could have further upside potential in the months ahead.

Nonetheless, if this is a theme that appeals to you, you may consider looking at the iShares MSCI Singapore Capped ETF (NYSEARCA:EWS) which is incidentally one of the oldest EM-themed products around, having begun its listing journey in 1996! EWS it must be noted is a relatively small portfolio of only 20 stocks.

Structurally, Singapore has a lot going for it. As noted in The Lead-Lag Report, it is one of the most innovative regions in the world and falls only behind South Korea in that regard.

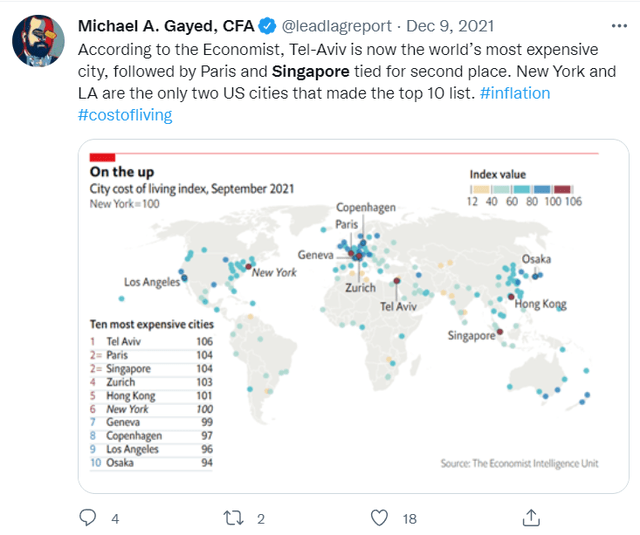

When you have such a strong innovative culture flowing through the economy, this inevitably only translates into higher standards of living; a recent cost of living survey puts it in the top-10 list, although a separate survey by The Economist and shared on the timeline of The Lead-Lag Report puts it in the top-5 list.

I recognize that in a world plagued by high inflationary thresholds, publicizing economies with elevated cost of living standards is hardly comforting, but do note that the populace here too remains well compensated. Recruitment agencies in Singapore believe that salaries in the tech and finance space of Singapore could rise by anything between 15 and 30% over the next two years, significantly higher than the current 10-15% levels, which in itself is quite impressive.

At the other side of the equation, it’s also encouraging to note that the Singaporean authorities are doing their bit to reduce levels of inequality. Last month, authorities levied an additional 35% stamp duty for buyers whose homes are transferred into a trust. People who resort to this route are typically the super-rich and I think it could be useful in curbing some of the excesses witnessed, whilst redirecting it to other avenues in the economy.

Speaking of Singapore’s real estate, there are other positive developments to note particularly for Singapore-based REITs. Recent reports show that these companies are benefitting from better lease terms as the WFH movement dims and people start returning to offices. The retail and travel sectors too are expected to pick up in H2-2022 as Singapore has some of the most liberal policies to attract international visitors from around Southeast Asia. For the uninitiated, relatively high vaccination rates and booster take-ups have provided Singapore with the right foundation to be a little less cautious than some of its other regional peers. They’ve also put in place a Vaccinated Travel Framework which should help the professional services sector to be more accessible to international clients.

Conclusion

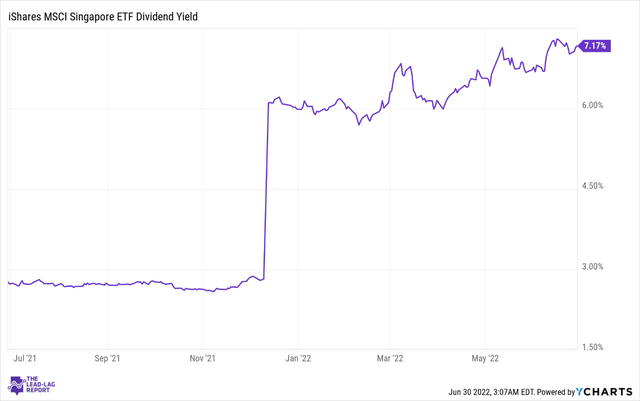

Whilst you have a largely promising outlook, investors will have to deal with the fact that Singaporean equities don’t come cheap. Just for some context, do consider that EWS trades at a forward P/E multiple of 14.09x, which is a lot pricier than the corresponding forward multiple of the iShares MSCI Emerging Markets ETF (EEM) which trades at only 11.6x. However, to ameliorate the high valuation effect, you also have an exceptionally sturdy dividend yield position, currently at over 7% and well over the historical average of 4%. EEM on the other hand only offers you a yield of 2.7%.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment