selvanegra

MiNK Therapeutics (NASDAQ:INKT) is a clinical stage biotechnology company that was spun off from Agenus (AGEN), as a preclinical company, in October 2021. Its therapies are being developed using iNKT cells, or invariant natural killer T cells. MiNK believes the properties of these cells should make them a superior therapy to treat certain disease conditions including certain solid cancers. In 2022 it moved two potential therapies, in a total of three disease indications, into Phase 1 clinical trials. It has several other therapies in preclinical development. Because it is a long road to FDA approval for commercial sales of the therapies, with many possible points of failure along the way, putting a specific value on the stock is guesswork. My guess is that this biotechnology platform will be immensely valuable by the end of the decade. Along the way the stock will typically go up when good data is released and down when poor or failing data is released. Here I will give an update on the data generated so far, with its implications.

iNKT background brief

iNKTs combine the killing features of natural killer cells with the durable memory response of T cells. iNKT cells, as generated by humans, are believed to be effective in treating solid tumor cancers. MiNK is engineering these cells to be better targeted for specific cancers and other disease indications. The iNKTs are drawn from healthy doners, multiplied and perhaps engineered, and administered to patients. So far, they appear to be safe to administer, not triggering the cytokine release syndrome that can be a problem with CAR-T therapies. They kill diseased cells by activating proinflammatory immunity, yet tend to prevent damaging hyperactivation. As cancer therapies they have an ability to turn cold tumors hot; the current generation of cancer immunology antibodies do not work on cold tumors.

Data presented at SITC in November

At SITC (Society for Immunotherapy of Cancer annual meeting) in November MiNK Therapeutics presented clinical, first-in-humans data on agenT-797, which was acquired from Agenus during the spin off. Patients were previously refractory to treatment with Keytruda or Opdivo. As a monotherapy, against solid tumors, it showed a 27% reduction of tumors or disease stabilization. In combination with pembrolizumab (Keytruda) or nivolumab (Opdivo), it showed a 66% reduction, which is better than expected for the standard-of-care immunotherapies it was combined with, especially for previously refractory patients.

In a separate trial agent-797 showed an improved survival benefit of 70% versus 10% in patients with ARDS (acute respiratory distress syndrome) who were on respiratory bypass. ARDS can be caused by Covid, flu, and other respiratory diseases.

In both trials safety was very good, with no signs of lymphodepletion, cytokine release syndrome, or neurotoxicity. Preclinical data was also released for other pipeline therapies. See the MiNK SITC press release for details. It is also worth looking at the MiNK R&D Day slideshow.

Cash and Cash Flow

At the end of Q3 2022 MiNK had only $24 million in cash after using $5.6 million cash for operations in the quarter. Clearly it will need to raise a lot more cash to get its therapies to FDA approval and commercial income. Typically, that means either licensing one or more therapies or diluting current investors by issuing more stock. Licensing also means giving up a substantial share of potential future revenue. This need to find cash to keep going should be taken into account when valuing the company.

Valuation

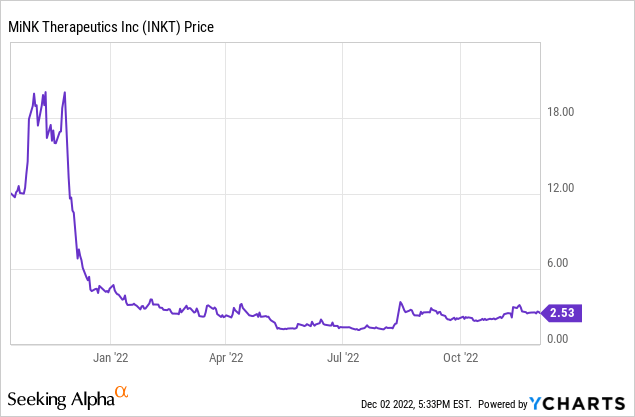

MiNK Therapeutics closed on Friday, December 2, 2022, at $2.52 per share. That equates to a market capitalization of about $80 million. It compares to a 52-week low of $1.09 and a 52-week high of $9.94. When it had its IPO, it quickly climbed to $20 per share on November 22, 2021. There are currently 33.8 million shares outstanding. Volatility has been the rule, which is not surprising for an obscure company that had no clinical data until recently.

Given what we know from the science of iNKT cells, and the early data, I think the company has a good likelihood of becoming a winner, for those who have enough patience. What cannot be predicted is the exact timing, nor any particular future market capitalization or stock price. I believe physicians should be excited by the Phase 1 results presented at SITC. The clinical results reduce the risk for investors, but Phase 2 studies with positive data would result in much greater risk reduction. My main problem with the current stock price is the low market capitalization of $120 million. Conducting Phase 2 trials is more expensive than Phase 1 trials, and Phase 3 trials are more expensive still. To raise another $120 million for operations at the current price would require substantially diluting current investors. If the stock went back to $20 per share, dilution to raise money would not present a problem for me. I think $10 per share is a more reasonable goal, given the risks of failures in later trials and of dilution.

Also note that Agenus retains much of the MiNK stock, and Agenus itself had $218 million in cash at the end of Q3. I think accumulating MiNK Therapeutics over time and tracking the data readouts could be very rewarding for investors who have an appetite for some risk. There is no rush, given the current risk-averse market.

Be the first to comment