carlosgaw/E+ via Getty Images

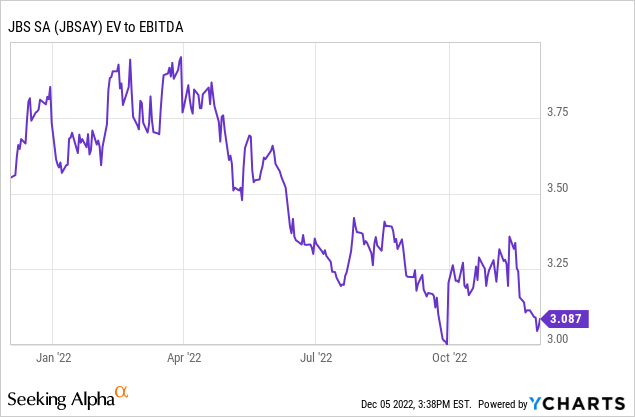

Global proteins leader JBS SA (OTCQX:JBSAY) continues to deliver strong FCF generation, but the market has mostly focused on the YoY declines in North American beef and the prospect of more headwinds in the coming quarters. This view largely ignores JBS’ diversified revenue base, with a significant portion of revenues also coming from Brazil and exports to key growth markets like China, which remain poised for recovery. As we head into a period of macro weakness next year, JBS’ exposure to the resilient food category should allow it to outperform through the crisis as well. With the stock currently trading at an undemanding ~3x EV/EBITDA, the valuation case is compelling.

Diversification Pays Off

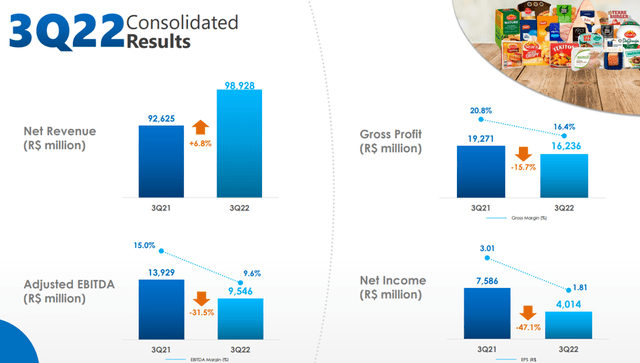

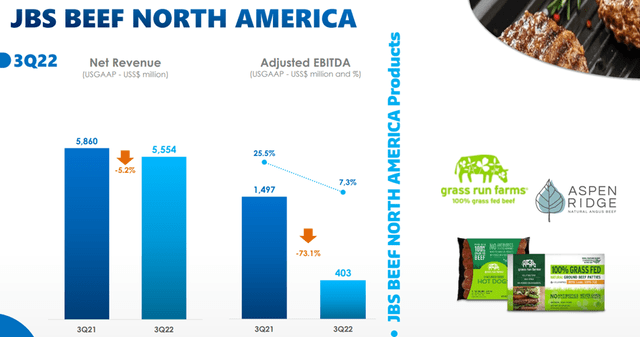

JBS’ Q3 highlighted once again the importance of its geographic and product diversification in navigating the inflationary headwinds globally and mitigating the risk of consumers switching proteins in response. On the one hand, the deterioration in US Beef came in at a faster pace than expected, with core GAAP EBITDA margins contracting by ~400bps QoQ to 7.3% (vs. Marfrig’s (OTCPK:MRRTY) North America margin contraction of ~130bps QoQ). Australia also disappointed, with its GAAP margins suffering a ~280bps QoQ deterioration. Yet, this was offset by favorable YoY trends in Seara and Pilgrim’s Pride (PPC), resulting in solid adj. EBITDA of BRL9.5bn at a 9.6% margin (~5.4%pts contraction YoY). JBS also reported record revenue of BRL98.9bn (+6.8% YoY), with lower net financial expenses supporting strong free cash flow generation as well.

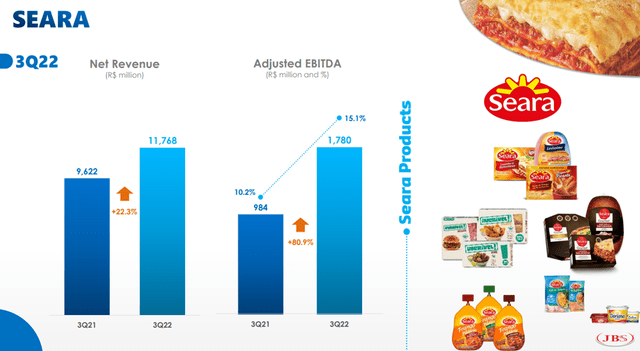

Seara the Highlight

The main highlight in recent quarters has been JBS’ food processing subsidiary Seara – in Q3, revenue grew by 22% YoY to BRL11.8bn, while the EBITDA margin expanded ~490bps to 15.1%. Of note, Seara has been outperforming its industry peers as well, coming in well above peer BRF (BRFS), which posted a 9.8% EBITDA margin for the period.

One key reason for the outperformance is Seara’s pricing power, which has allowed it to increase its average price by ~20% without sacrificing volume growth (+2%). Going forward, Seara’s margin momentum should continue as commodity supply eases and key inputs like corn and soy costs decrease. Thus, JBS management’s decision to ramp up capex to expand Seara’s volume capacity by +20% makes sense. Additional improvements to existing production to drive better efficiency, along with more value add from the company’s innovation efforts, should drive incremental savings down the line.

Silver Linings for the Beef Segment

Concerns about the near-term outlook for the US Beef division are warranted – in the Q3 release, JBS cited challenging conditions in the region amid supply-side issues related to future animal availability and labor, as well as lower wholesale prices. Yet, signs of normalizing US beef industry margins are emerging, supporting the case for a higher trough margin this cycle than in the past. For one, domestic demand in the US remains constructive on the back of a strong labor market and higher wage growth. Additionally, JBS’ focus on value-added programs could protect margins in a prolonged downturn – JBS’ Aspen Ridge brand, for instance, grants it access to differentiated cattle quality.

Even overseas, signs of a demand recovery are promising. For instance, the recent easing of China’s ‘COVID-zero’ policy bodes well for disposable income and consumer purchase patterns going forward. Over the long run, a growing middle class also provides structural demand support for proteins, so I see the current downturn in beef as a transitory issue that will eventually pass.

Progressing Toward an NYSE Listing

For now, JBS’ planned share listing on the NYSE remains a work in progress. Management did reiterate on its latest earnings call that it still intends to list via a structure that “unlocks great value for shareholders” – this represents a key step to adding developed market investors to its registry down the line. Getting there won’t be straightforward. For one, US market conditions are not favorable amid the accelerated Fed rate hikes. Another hurdle is on the ESG front, as supply chain transparency, particularly around the sourcing of cattle, has been a persistent issue. Governance improvements, for instance, regarding the independence of its Board, are also on the table. Net, the benefits of successfully implementing the proposed ESG improvements outweigh the costs, in my view. Attracting ESG flows should not only benefit the valuation but also lower the cost of capital, paving the way for new strategic growth opportunities.

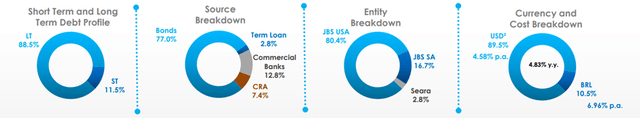

In the meantime, management has taken positive steps on balance sheet liability management by restructuring the debt stack and lowering the average cost of debt. Most of the BRL-denominated debt has been moved into hard currencies, though, which does introduce FX risk. Yet, the de-levered balance sheet should provide some offset – net debt/EBIDTA remains on track to stay well below the 2x threshold by year-end. As feed-related working capital also falls in line with commodity prices in the coming quarters, the incremental free cash generation should help to accelerate the debt paydown.

A Cheaply Priced Protein Play

JBS’ geographic and product diversification continues to pay off nicely, as deterioration in some regions (e.g., North America Beef) was offset by the YoY EBITDA improvements in Seara and PPC. Some degree of caution is perhaps warranted given the prospect of more margin headwinds in the USA divisions in the coming quarters, but the stock seems to have overly discounted the pessimism at the current ~3x EV/EBITDA valuation. Fundamentally, JBS remains positioned to sustain a decent level of margins for beef and poultry in the US, while capacity expansion at Seara could unlock more earnings upside. With leverage also manageable and an NYSE listing catalyst on the horizon, I think the JBS investment case makes a lot of sense at these levels.

Be the first to comment