Kameleon007

Fixed-income markets in the US reverted to their traditional role of delivering upside support when the rest of the portfolio tanks. It’s too soon to say if this is a return to form for bonds for an extended period, but with more rate hikes expected, there’s still plenty of room for debate.

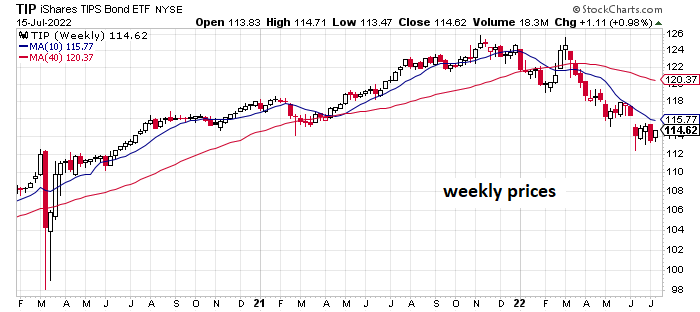

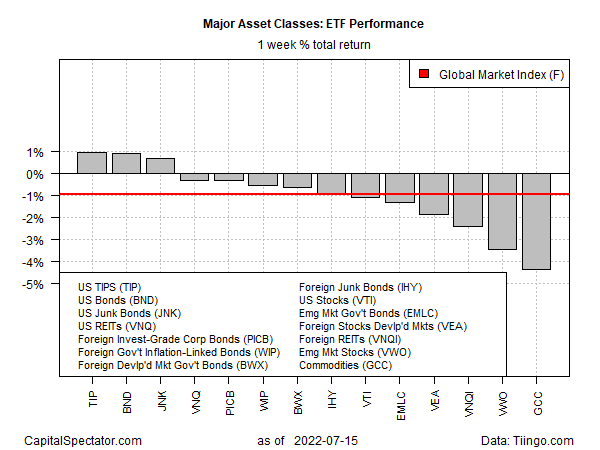

Meanwhile, the iShares TIPS Bond ETF (TIP) posted the strongest gain – 1.0% – in last week’s trading through Friday, July 15, based on a set of ETFs representing the major asset classes.

Vanguard Total US Bond Market (BND) was the second-best performer last week. US junk bonds (JNK) also rallied. Otherwise, the rest of the major asset classes lost ground.

Despite the bounce in bonds, fixed income appears to be churning in a range and so it’s unclear if a sustained rally is starting. But for investors nursing wounds in multi-asset class strategies this year, the potential for higher (or even stable) bond prices is a welcome change of pace after watching bonds and stocks slide throughout most of the year to date.

Despite the latest pop, “Investors should be careful with bonds,” says David Bianco, Chief Investment Officer for the Americas at DWS Group. “Look for inflation-protected bonds, hold on to cash and then look for real assets, whether it’d be stocks or real estate or utilities.” In addition, investors are “better off for now” in short-duration debt because the bond market hasn’t fully priced in the risk of higher interest rates, he adds.

The Global Market Index (GMI.F) lost ground last week, falling 1.0%. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETFs and represents a useful index comparison for portfolio strategies overall.

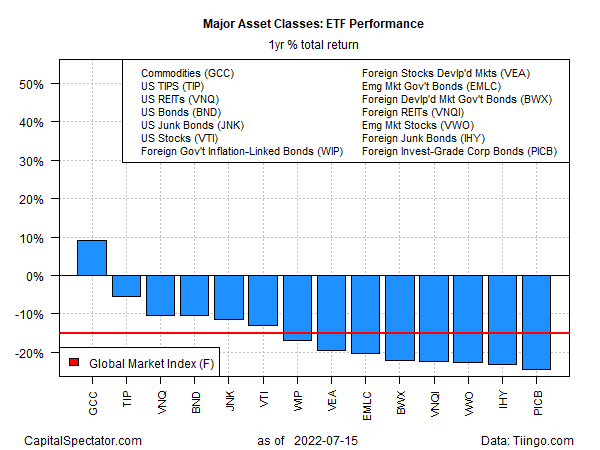

Commodities remain the only winner for the one-year window for the major asset classes. But while WisdomTree Commodity (GCC) is leading the field over the past 12 months, the ETF’s edge is fading fast, thanks to a sharp decline over the past month-plus.

Otherwise, all the major asset classes are posting losses for one-year results. The deepest shade of red ink: foreign corporate bonds (PICB), which has shed nearly 25% over the past 12 months.

GMI.F is also deep in the red for the one-year period, posting a 15.1% loss.

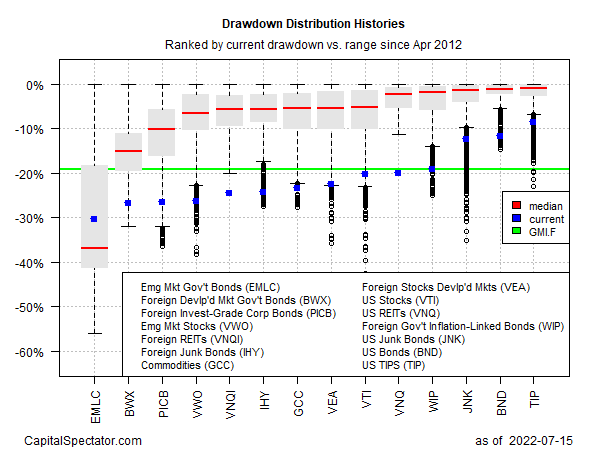

Profiling the ETFs listed above via drawdown shows that nearly all the funds are posting peak-to-trough declines of -10% or deeper – most are underwater by at least -20%. The exception: a relatively mild -8.5% drawdown for iShares TIPS Bond (TIP).

The deepest drawdown for the major asset classes: emerging markets bonds (EMLC), which is down more than 30% from its previous peak.

GMI.F’s current drawdown: -19.1%.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment