andresr

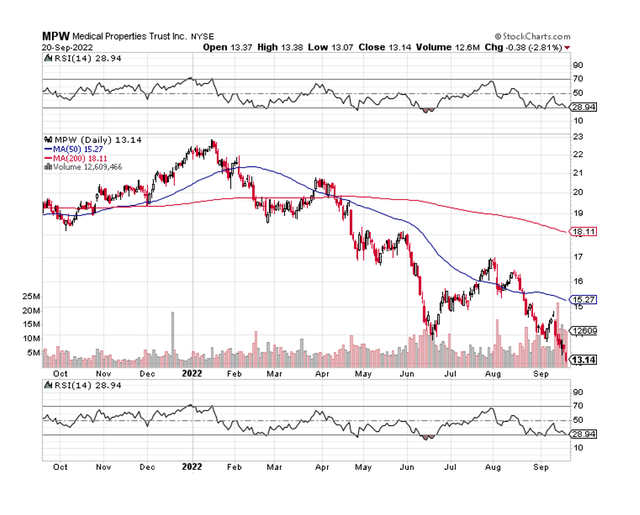

Medical Properties Trust Inc. (NYSE:MPW) fell to a new 52-week low yesterday as a result of a broader market rout, and the stock of the healthcare-focused real estate investment trust is grotesquely undervalued based on expected funds from operations.

I believe that the recent stock price decline has little to no justification and that it represents an excellent buying opportunity for income investors with a long-term mindset.

Due to a very conservative payout ratio, the dividend is very safe, and stock price weakness has pushed the dividend yield close to 9%.

I’m going all-in right now because of the high margin of safety reflected in an MPW investment at this time.

MPW Stock Price Weakness Is Totally Undeserved

The only explanation I can think of for the recent stock price decline in Medical Properties Trust is general market weakness in light of the market’s expectation of a large interest rate hike.

Stocks have been extremely volatile in September, owing to widespread concern about interest rates. The central bank is expected to raise its key interest rate by 75 basis points, marking the third 75-basis-point increase since June. The central bank is becoming more aggressive in its efforts to rein in spiraling inflation, but higher interest rates are typically viewed as a drag on the stock market.

Regardless, the market’s weakness has pushed Medical Properties Trust’s shares to a new low yesterday, creating an irresistible buying opportunity in my opinion for two reasons:

- Medical Properties Trust has an ultra-safe dividend.

- The stock is irrationally cheap at less than 8x 2022 FFO.

Since nothing in Medical Properties Trust’s business has changed in the last month, and the company has made no recent announcements, I see the current pullback as a Strong Buy opportunity that investors should not pass up.

Medical Properties Trust, as I previously stated, is a highly diversified healthcare real estate investment trust with a large and growing real estate portfolio.

The trust is primarily focused on General Acute Care Hospitals in the United States, but it also has international exposure, particularly in Europe, where Medical Properties Trust has real estate investments in the United Kingdom, Switzerland, Germany, and Spain.

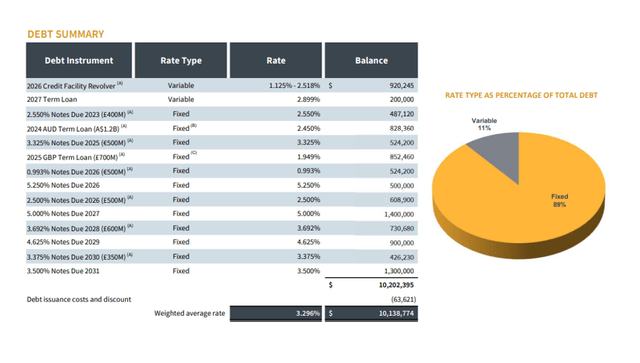

Furthermore, the majority (89%) of the trust’s debt is fixed rate, implying that the company faces little interest rate risk even if the central bank raises interest rates significantly in the future.

Debt Summary (Medical Properties Trust)

Yes, The Trust Covers Its Dividend

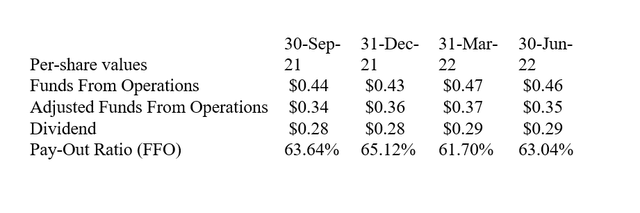

Income investors should keep in mind that Medical Properties Trust covers its dividend with adjusted funds from operations and has a payout ratio in the low to mid 60s, which contributes to the $0.29 per share quarterly dividend being very safe. The trust’s dividend, in my opinion, is sustainable and will not be jeopardized even if interest rates continue to rise.

Dividend And Pay-Out Ratio (Author Created Table Using Trust Financials)

Medical Properties Trust’s Valuation Makes No Sense As Well

The real estate investment trust has not reduced its guidance or reported anything that suggests the trust’s stock should trade lower.

According to the most recent earnings report for 2Q-22, Medical Properties Trust expects to earn $1.78 to 1.82 per share in funds from operations in 2022, translating into a very low (and very attractive) 7.3x FFO multiple at the current stock price of $13.14.

Why Medical Properties Could See A Lower Valuation

I don’t see how higher interest rates affect Medical Properties Trust’s core business of providing healthcare facilities to its tenants.

The international diversification of Medical Properties Trust also helps to improve the REIT’s positioning, making it less reliant on the U.S. healthcare market, while the trust’s relatively low presence of variable rate debt protects it from the impact of higher borrowing costs.

Having said that, the market may temporarily avoid real estate investment trusts due to concerns about rising interest rates for the corporate sector as a whole.

My Conclusion

Medical Properties Trust hit a new 52-week low yesterday, and the pullback represents a Strong Buy opportunity in my opinion.

Medical Properties Trust’s business continued to perform well in the second quarter, and the payout ratio is so low (in the low to mid 60s) that investors don’t have to be concerned about factors like dividend sustainability or rising interest rates.

I believe the valuation based on funds from operations reflects a very high margin of safety.

With a nearly 9% (covered) dividend yield, MPW represents exceptional value right now, which is why I am going all-in at 52-week lows.

Be the first to comment