Pgiam/iStock via Getty Images

Last year, I recommended purchasing Sabine Royalty Trust (NYSE:SBR) for its attractive yield and its expected recovery from the pandemic. After a 30% rally of the stock, I recommended taking profits, as I considered the trust risky from a long-term perspective. A few months after my second article, Russia invaded Ukraine and the prices of oil and gas skyrocketed to 13-year highs. As a result, Sabine Royalty Trust has nearly doubled since my second article. On the one hand, my timing was wrong but no one could have ever predicted the invasion of Russia in Ukraine. On the other hand, investors should now realize that this cyclical trust is risky around its all-time highs.

Business overview

Sabine Royalty Trust is an oil and gas trust, with a 40-year history. It has royalty and mineral interests in oil and gas properties in Florida, Louisiana, Mississippi, Oklahoma, New Mexico, and Texas. A key characteristic of the trust is the absence of capital expenses. This means that the trust only distributes the royalties it receives from oil and gas output (minus general and administrative expenses) to its unit holders.

Just like all the other oil and gas trusts, Sabine Royalty Trust was hurt by the coronavirus crisis and the resultant collapse of the price of oil in 2020. However, Sabine Royalty Trust proved more resilient than other trusts. To be sure, it reduced its annual distribution by 25% in 2020 whereas Permian Basin Royalty Trust (PBT) reduced its annual distribution by 43% in that year.

Even better, Sabine Royalty Trust is thriving right now. Thanks to the global distribution of vaccines, the energy market has recovered from the pandemic. In addition, due to the sanctions imposed by the U.S. and Europe on Russia for its invasion in Ukraine, the global oil and gas markets have tightened to the extreme. Before the sanctions, Russia was producing 10% of global oil output and about one-third of the natural gas consumed in Europe. Consequently, the sanctions have led the prices of oil and gas to skyrocket to 13-year highs this year.

As Sabine Royalty Trust is a pure upstream player, without any downstream segments, it is extremely sensitive to the cycles of the prices of oil and gas. As a result, the prevailing commodity prices are ideal for the trust. To provide a perspective, in the first nine months of this year, the trust has offered total distributions per unit of $5.99. These distributions exceed the annual distributions of the trust in more than a decade. Given also the current prices of oil and gas, Sabine Royalty Trust is likely to offer a total annual distribution of $8.00-$8.50 in 2022. Such a level, which will be a new all-time high for the trust, will be approximately double the previous 10-year high of $4.03, which was achieved in 2013 and 2014.

The sanctions of western countries on Russia are not likely to loosen anytime soon and hence some investors will view Sabine Royalty Trust as attractive now that it is thriving. Based on its distributions in the first nine months of the year, the stock is offering an annualized distribution yield of 10.2%, which is certainly enticing, especially given that most investors are struggling to protect their portfolios from the eroding effect of 40-year high inflation.

However, it is critical to always remember the dramatic cyclicality of the prices of oil and gas. Most countries are under extreme pressure right now due to the multi-year high prices of oil and gas and thus they are exhausting their means to diversify away from oil and gas. As a result, there is a record number of renewable energy projects that are in their development phase right now. When all these projects come online, in 2-5 years, they will replace fossil fuels in the energy mix to a great extent and hence they will cause a plunge in the prices of oil and gas.

It is also important to note that the market is always a forward-looking mechanism. This means that the prices of oil and gas are likely to reflect the above development before it takes place, i.e., before all these projects begin to produce clean energy. Moreover, experience has proved the highly cyclical nature of the oil and gas industry. Whenever the prices of oil and gas have rallied to multi-year highs, a dramatic plunge has ensued, as excessive prices have always taken their toll on demand. Some investors may think that this time is different but such a notion is a highly risky investing strategy.

Investors should also note that the price of oil has declined significantly off its peak of $130 in February, shortly after the invasion of Russia in Ukraine, and has lately fallen below its level just before the onset of the Ukrainian crisis. This is a markedly strong bearish signal, which essentially means that the impact of the war in Ukraine on the global oil market has already been absorbed via lower consumption and the aforementioned shift away from fossil fuels. For instance, many countries have revived their coal mines in order to shift away from oil and gas. Overall, the oil price seems to have peaked and is likely to enter its next downcycle at some point in the future.

Distribution

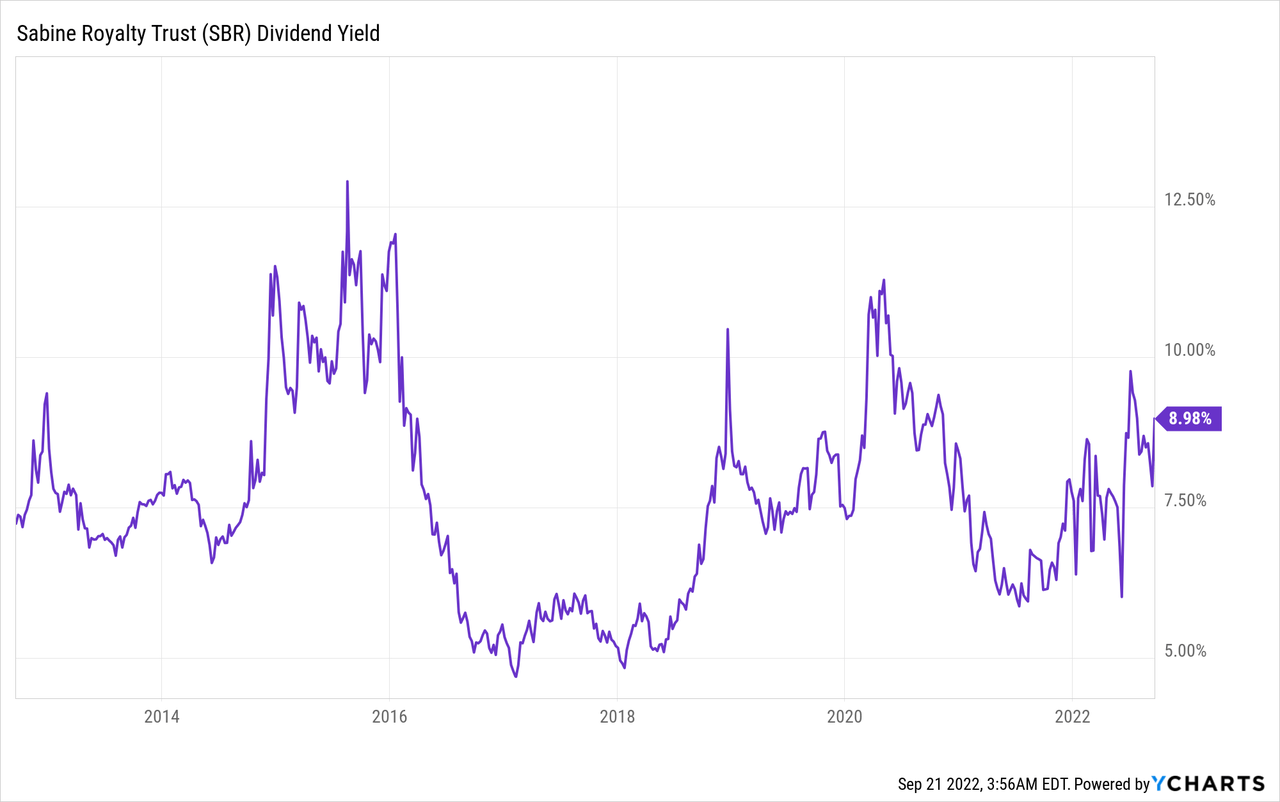

Sabine Royalty Trust has always offered high distribution yields to its unit holders.

As mentioned above, based on its distributions in the first nine months of the year, the stock is offering an annualized yield of 10.2%. This is an undoubtedly attractive yield for income-oriented investors.

However, the distributions of all the oil and gas trusts, including Sabine Royalty Trust, are extremely volatile, depending on the prevailing prices of oil and gas. Whenever the next downturn in the global energy market shows up, Sabine Royalty Trust will greatly reduce its distributions, just as it has done in all the previous downturns. For instance, in 2014-2016, when the price of oil plunged due to the boom in shale oil production, Sabine Royalty Trust reduced its annual distribution by 53% in total, from $4.10 in 2014 to $1.93 in 2016. Whenever the trust faces its next downturn and reduces its distribution significantly, its stock price will follow suit.

Final thoughts

As per the wise words of legendary investor Peter Lynch, the fastest way to lose 50% of invested capital is to invest in a cyclical stock near the peak of its cycle. At that point, the company thrives and its stock looks exceptionally cheap thanks to its high yield. Sabine Royalty Trust is thriving right now thanks to the multi-year high prices of oil and gas, which have resulted from the sanctions of western countries on Russia. The trust is likely to keep thriving in the short run and it is impossible to predict when the next downturn in the energy market will show up. However, as experience has shown, a downturn will inevitably show up at some point, especially given the numerous clean energy projects running right now. Whenever the next downturn shows up, Sabine Royalty Trust will have significant downside risk of its current nearly all-time high level.

Be the first to comment