Sundry Photography

The valuations of some beaten-down tech stocks this year just don’t make sense. Too many high-profile names have made too rapid of a transition from market darling to penalty-box stock, least of all DocuSign (NASDAQ:DOCU).

During the pandemic, DocuSign was all the rage. Revenue was growing north of >40% y/y, and the conversion of the workforce to remote work only reinforced the need for companies to facilitate electronic agreements. And really, none of these macro drivers have changed: just the fact that at a much larger scale, DocuSign is clearly experiencing natural deceleration. But add that on top of failing market sentiment for tech stocks, and you have a recipe for disaster.

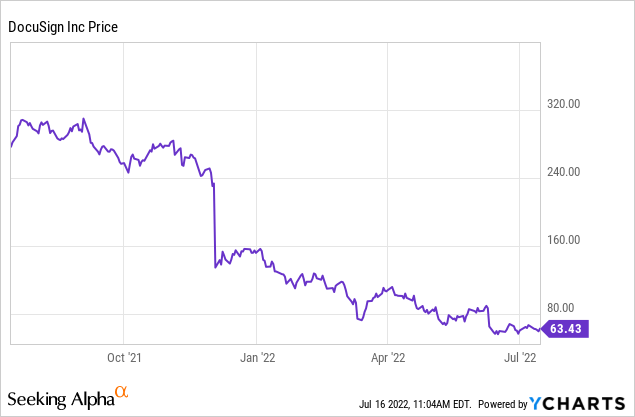

Year to date, DocuSign has lost 60% of its market value; and over the past year, that loss is closer to 80%. The stock is now trading at lows not seen since 2019, having wiped out all of the gains it has made since the pandemic (despite the fact that the business has expanded generously since then). Should that make sense? It certainly doesn’t to me – and in my view, it’s a great time for investors to re-assess the bullish case on this stock.

In light of DocuSign’s dramatic year to date fall, and the fact that the company’s technology remains a market leader, I am upgrading my view on DocuSign to very bullish. There’s a lot of value here that is currently not getting captured.

In my view, here are the top drivers of the bullish thesis for DocuSign:

- Clear leader in a mission-critical technology product. Despite the fact that pandemic tailwinds are “over” for DocuSign, remote work has only shown us how reliant we are on digital to facilitate basically everything. Today, many swaths of industry remain stuck in legacy processes; and giant sectors like real estate and healthcare remain ripe for technology disruption. In other words, DocuSign still benefits from a huge greenfield market for its electronic agreements products.

- Customer diversification. DocuSign is a truly “horizontal” software product that is applicable to customers of any industry, without any functional changes needed to its product. At the time of its IPO in 2018, DocuSign had only ~400k customers; today, that number has tripled to more than 1.2 million, reflecting the strength of DocuSign’s go-to-market expansion.

- High gross margin profile. DocuSign has 80%+ pro forma gross margins, among the highest in the enterprise software sector and allowing for significant operating leverage at scale.

- Profitable on a pro forma and free cash flow basis. Even as growth is slowing, DocuSign is still able to impress with high-teens pro forma operating margins and rich free cash flows – which is a major booster in this very risk-averse market environment.

The biggest draw for DocuSign right now: it’s incredibly cheap, with losses extending after the company’s CEO Dan Springer resigned in mid-June. At current share prices near $63, DocuSign trades at a market cap of $12.68 billion. After we net off the $1.06 billion of cash and $719.6 million of debt on the company’s most recent balance sheet, the company’s resulting enterprise value is $12.34 billion.

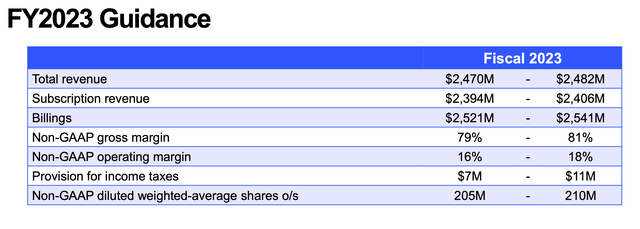

Meanwhile, as shown in the chart below, the company has guided to $2.47-$2.482 billion in revenue for the current year, representing ~18% y/y revenue growth:

DocuSign outlook (DocuSign Q1 earnings deck)

Against this outlook, DocuSign trades at just 5.0x EV/FY23 revenue. Yes, the company’s growth rate has been sliced down (to the mid-20s this quarter, and expected to flatten to the teens through the year) – but its valuation is also much less than in the past, when it had traded at a mid-teens revenue multiple. To me, that is fair compensation for the natural deceleration it is experiencing.

The bottom line here: DocuSign is still expanding, albeit at a slower pace than in the past, which investors should accept alongside the stock’s much lower price tag. And especially as DocuSign remains a hugely profitable company with rich gross margins, this is a golden opportunity to buy this stock on the cheap.

Q1 Download

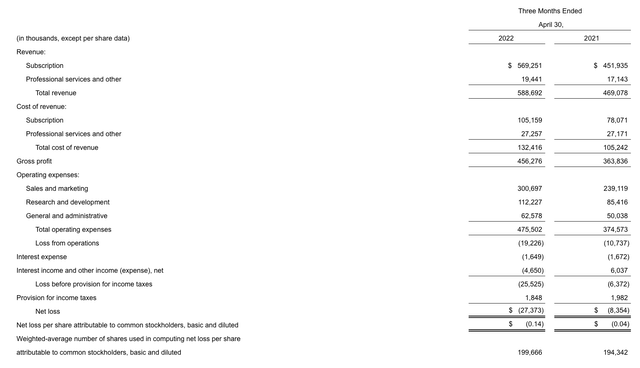

Let’s now discuss DocuSign’s latest Q1 results in greater detail. The Q1 earnings summary is shown below:

DocuSign Q1 results (DocuSign Q1 earnings deck)

DocuSign’s revenue grew at a 25% y/y pace to $588.7 million in the quarter, beating Wall Street’s expectations of $581.9 million (+24% y/y).

Now, I’ll admit, DocuSign’s Q1 was far from a perfect quarter, and several metrics did fall off the tracks. First, billings growth in the quarter was just 16% y/y to $613.6 million. While the company still did build up deferred revenue, the nine-point gap between billings growth and revenue growth does indicate that the company’s revenue growth will continue to decelerate, in keeping with DocuSign’s 18% y/y growth outlook for the year.

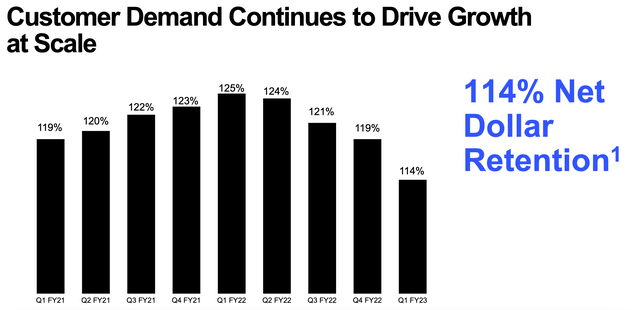

Second: dollar-based net retention also weakened in the quarter. The company hit an all-time low of 114%, five points lower than 119% in Q4. Now, a 114% net retention rate (indicating that the average customer upgrades their relationship and spend by 14% in the following year) still compares well against many other SaaS companies, but the downward trend is difficult to swallow.

DocuSign net retention rate (DocuSign Q1 earnings deck)

Here are some helpful comments from CFO Cynthia Gaylor’s prepared remarks on the Q1 earnings call. She noted that the company is experiencing some macro headwinds, but that it is belt-tightening in response to that:

As we’ve indicated, we are confident in our long-term opportunity and in our ability to add new customers and power their digital transformation across the Agreement Cloud with DocuSign. However, we are not immune to the macro challenges with our customers and peer space.

As Dan discussed, we are focused on that, which is within our control, innovation across our product portfolio and improving our go-to-market execution. While we have made considerable progress bringing in leaders with significant experience at scale, it’s important to recognize that meaningful traction and better visibility will take multiple quarters.

We have operating leverage in our business model and are committed to balancing growth with profitability, while also exercising expense discipline. We remain on track to reach our long-term target operating margins. We will continue to make thoughtful and disciplined investments across the company, with a particular focus on our highest priorities, which will drive our growth and success over time.

Specifically, in fiscal 2023, we are moderating our expenses and managing our hiring plans at a more measured pace, appropriately aligning our investments with the current climate and our growth. These elements have been incorporated in the current outlook.”

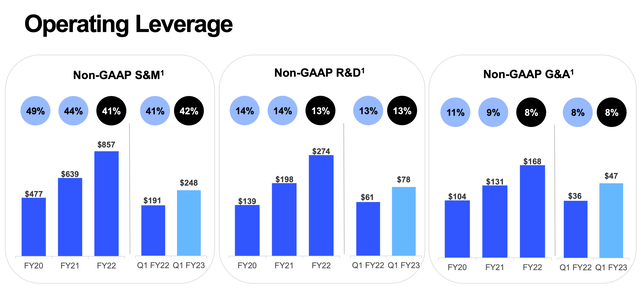

Unlike many other tech companies that have seen operating expenses shoot up in the wake of revived sales travel and higher compensation costs, the three major categories of DocuSign’s operating expenses still remained roughly flat on a percentage of revenue basis year over year:

DocuSign opex (DocuSign Q1 earnings deck)

DocuSign also still expanded its pro forma operating income by 10% y/y to $102.2 million, though pro forma operating margins of 17% fell by three points relative to 20% in the year-ago Q1. We note that DocuSign is very close to breakeven operating margins on a GAAP basis, at just -3% this quarter. Note as well that free cash flow expanded 42% y/y to $174.6 million in the quarter, representing a 30% FCF margin.

Key Takeaways

There is understandably quite a bit of doom-and-gloom around DocuSign right now, specifically with slowing billings growth and an unclear leadership transition. Yet at the same time, DocuSign’s 5x forward revenue multiple is too enticing to ignore. I would take the trade-off of some short-term pain to invest in DocuSign for the long term at these prices.

Be the first to comment