blackdovfx

The iShares Expanded Tech-Software Sector ETF (BATS:IGV) is a US tech ETF that is not value weighted, and ends up being focused in a relatively non-consensus direction towards enterprise oriented tech companies. While many of these companies are in fascinating markets that have secular growth potential, that hasn’t stopped tech from becoming a market pariah, and the corporate facing business models are even worse for what we believe is coming. With this ETF being even more expectation exposed than the broader value weighted tech bucked of the Invesco QQQ ETF (QQQ) that follows the NASDAQ listed stocks, we think prospects aren’t promising.

IGV Breakdown

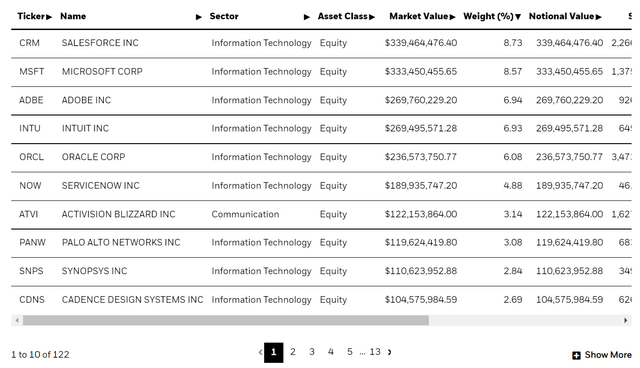

The IGV is not that small of an ETF. It has a little over 100 holdings, but some command a fair bit of weight.

Holdings (iShares.com)

The first couple are around 7-8% allocations, and they show the non-consensus exposures of this tech. Rather than being value-weighted like other tech ETFs, featuring some FANG names, Apple (AAPL) and Amazon (AMZN) at the very top due to their megacap status, the first is Salesforce (CRM), followed by the admittedly massive Microsoft (MSFT), but then more specific tech companies like Adobe (ADBE), Intuit (INTU) and Oracle (ORCL). Specific companies with a limited scope in the semiconductor value chain like Cadence (CDNS) are high on the stack at almost 3% allocation. While all large-cap, they aren’t the usual suspects, and are certainly not put in the typical order.

What these companies have in common besides being slightly lower in the large-cap tech bracket than the usual megacap suspects, is that they are mostly corporate facing businesses. Why is this important? Because consumer facing businesses have already taken their lumps, while corporate spending still buoys the fundamentals of tech companies that are enterprise facing. Where the Fed is trying to employ Phillips Curve logic to bring down inflation, i.e. getting people unemployed again by raising rates till it hurts enough, at some point corporate budgets will face a reckoning as some turns in the unemployment-lower consumption spiral take place. The fundamentals of these companies have been strong, but must decline in the coming cycle.

Conclusions

This ETF doesn’t feature the most mature tech businesses which have reached an echelon of their own but are beginning to acquire smaller multiples. The P/E of this ETF is beyond 40x, which means that expectations remain important. With a grim outlook causing expectations to fall on top of fundamentals on a latent basis, there’s more space for these companies to fall, and the COVID-19 spending spree may make the overstatement of trailing fundamentals even worse.

The ETF has fallen in line with the QQQ, but the exceptional positioning of companies like Apple and Amazon may inure a more value weighted ETF in terms of fundamental risk compared to the stocks in the IGV, so a parity in their decline may be a sign of excessive optimism around the IGV. We think it should be avoided as most parts of the market.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment